$200 Million Tariff Burden: How It Affected Colgate (CL)'s Latest Financial Results

Table of Contents

Deconstructing the $200 Million Tariff Impact on Colgate's Revenue

The $200 million figure represents a significant portion of Colgate's overall revenue, stemming primarily from tariffs imposed on various products across different global regions. These tariffs, enacted as part of various trade disputes, specifically affected:

- Oral Care Products: Tariffs on toothbrushes, toothpaste, and other oral hygiene products in key markets like [Insert specific region/country examples, e.g., the European Union or China] significantly reduced sales volume.

- Personal Care Products: Similarly, tariffs impacted sales of soaps, shampoos, and other personal care items in these same regions, contributing to the overall revenue decline.

- Specific Product Lines: [Mention any specific Colgate product lines heavily impacted by tariffs and quantify the impact if possible with sales figures or percentages]

The direct impact on Colgate's revenue is substantial. [Insert data showing the decrease in revenue. For example: "The company reported a X% decrease in revenue, directly attributable to the $200 million in tariffs."]. This revenue decline wasn't uniformly distributed across product segments. [Insert a chart or graph visually representing the revenue decline across different product segments – oral care, personal care, etc. Label axes clearly and cite the source of the data]. This data clearly illustrates the significant financial strain placed on Colgate due to these trade policies. Keywords such as Colgate revenue, tariff impact, revenue decline, product segments, and financial performance are crucial for understanding the scope of the problem.

Colgate's Profitability Under Pressure: Margin Squeeze and Cost-Cutting Measures

The tariff burden didn't just impact revenue; it also significantly squeezed Colgate's profit margins. The company experienced a decline in both its gross profit margin and operating margin. [Insert specific data on the decrease in gross profit margin and operating margin, citing the source]. This margin squeeze forced Colgate to implement several cost-cutting measures, including:

- Price Increases: Colgate raised prices on some products to offset the increased costs associated with tariffs.

- Efficiency Improvements: The company focused on streamlining its manufacturing processes and supply chain to improve operational efficiency.

- Supply Chain Adjustments: Colgate explored alternative sourcing options and supply chain diversification to mitigate the impact of future tariffs.

The effectiveness of these measures is debatable. While some cost-cutting initiatives helped offset the impact, the overall effect on profitability remains negative. The long-term implications of these strategies are still unfolding, and their sustainability will depend on various factors, including the future trajectory of trade policies. Keywords like Colgate profit margin, cost-cutting, gross profit, operating margin, profitability, and supply chain are vital for understanding this aspect.

Investor Response and Stock Performance: Analyzing Market Reaction to Tariff News

The news of the $200 million tariff burden had a noticeable impact on Colgate's stock price (CL). [Insert a graph illustrating Colgate's stock performance around the time of the tariff announcement and the subsequent financial report release. Clearly label the axes and cite data sources]. Initially, the market reacted negatively, reflecting investor concern about the company's financial outlook. [Describe investor sentiment—were there sell-offs? Did analyst ratings change? Cite news articles or analyst reports to support your points]. However, [describe any subsequent market reaction—did the stock recover? Why or why not?]. The long-term outlook for Colgate's stock remains intertwined with the resolution of trade disputes and the company's success in adapting to the changing global trade landscape. Keywords such as Colgate stock, stock price, investor sentiment, market reaction, stock performance, and analyst ratings are crucial to this section.

Strategic Adjustments: How Colgate (CL) Is Adapting to the Changing Trade Landscape

In response to the challenges posed by tariffs, Colgate is actively implementing strategic adjustments to mitigate the impact of future trade barriers. These strategies include:

- Supply Chain Diversification: Colgate is actively exploring new sourcing options and manufacturing locations to reduce its dependence on regions subject to tariffs.

- Market Diversification: The company is expanding its presence in new markets to reduce reliance on any single region.

- Product Innovation: Investing in new products that are less susceptible to tariffs.

The success of these strategic adjustments will be crucial in determining Colgate's long-term competitiveness. While these measures offer potential for mitigation, their effectiveness in completely offsetting the losses from tariffs remains to be seen. Keywords such as Colgate strategy, trade war, supply chain diversification, market diversification, and competitive advantage are key for this analysis.

Conclusion: The Long Shadow of Tariffs on Colgate (CL)'s Financial Future

The $200 million tariff burden has undeniably cast a long shadow on Colgate's latest financial results, impacting revenue, profitability, and stock performance. While the company has implemented several strategic responses to counter the negative effects, the long-term implications remain uncertain. The success of these strategies, and the broader impact of global trade policies on Colgate and the consumer goods industry, will be closely watched in the coming quarters. To stay informed about Colgate's future financial reports and the ongoing impact of trade policies, continue to monitor Colgate financial results, the Colgate tariff impact, and perform regular Colgate stock analysis.

Featured Posts

-

San Franciscos Anchor Brewing Company Closes Its Doors After 127 Years

Apr 26, 2025

San Franciscos Anchor Brewing Company Closes Its Doors After 127 Years

Apr 26, 2025 -

Economic Power Shift Californias Rise To Fourth Largest Economy

Apr 26, 2025

Economic Power Shift Californias Rise To Fourth Largest Economy

Apr 26, 2025 -

Abb Vie Abbv Stock Rises On Exceeded Sales Expectations And Revised Profit Guidance

Apr 26, 2025

Abb Vie Abbv Stock Rises On Exceeded Sales Expectations And Revised Profit Guidance

Apr 26, 2025 -

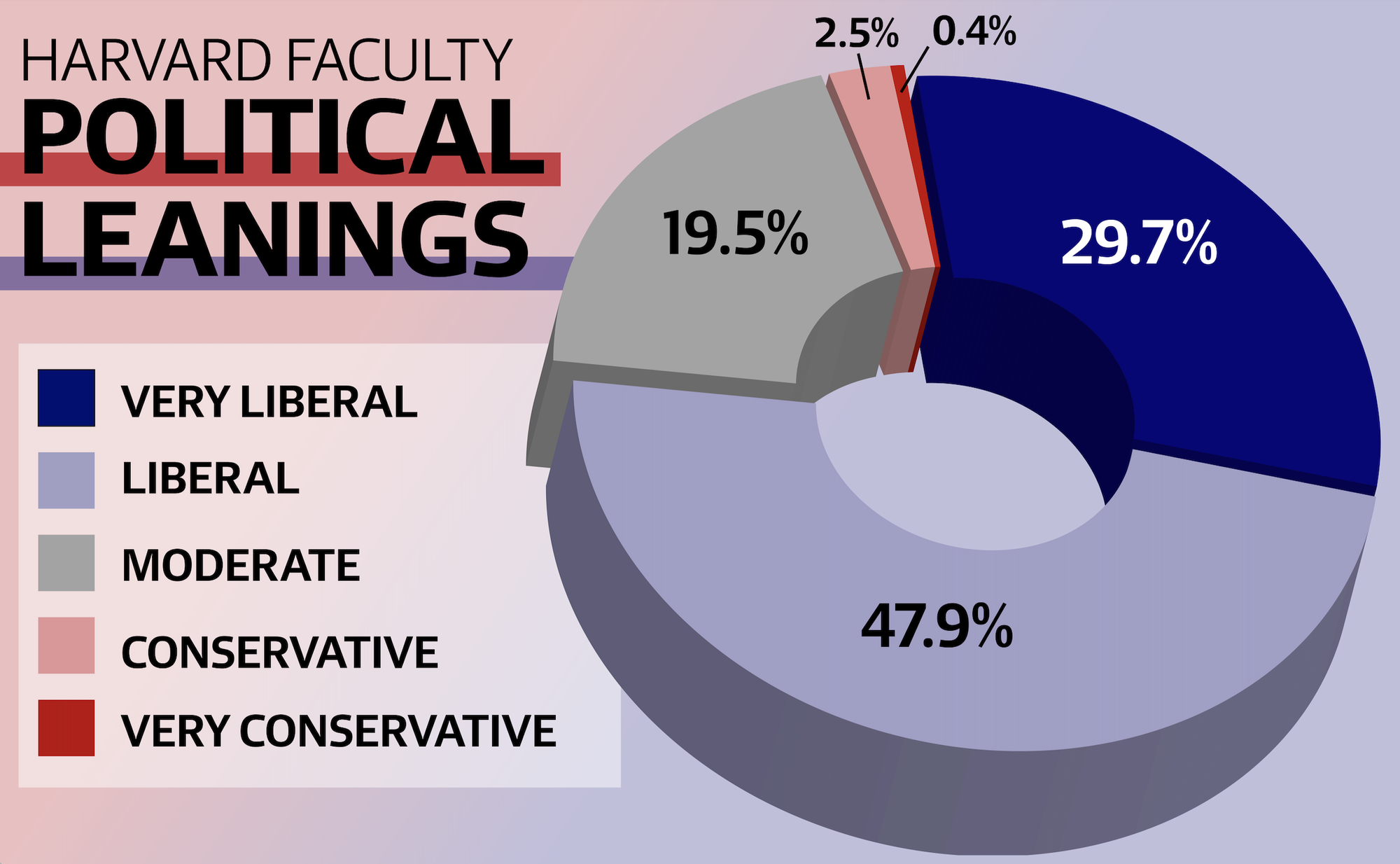

A Conservative Harvard Professors Prescription For Harvards Future

Apr 26, 2025

A Conservative Harvard Professors Prescription For Harvards Future

Apr 26, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 26, 2025

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 26, 2025