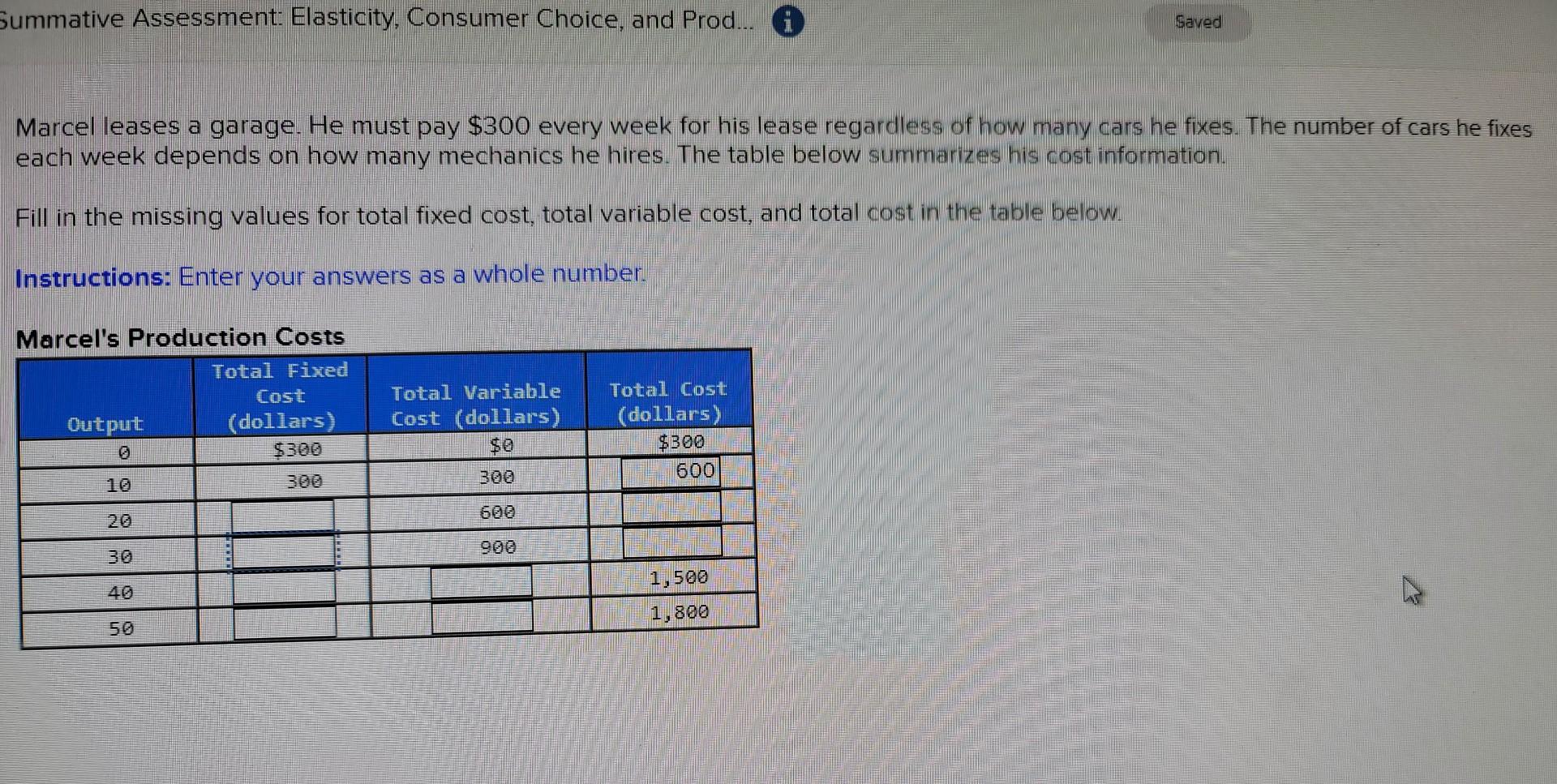

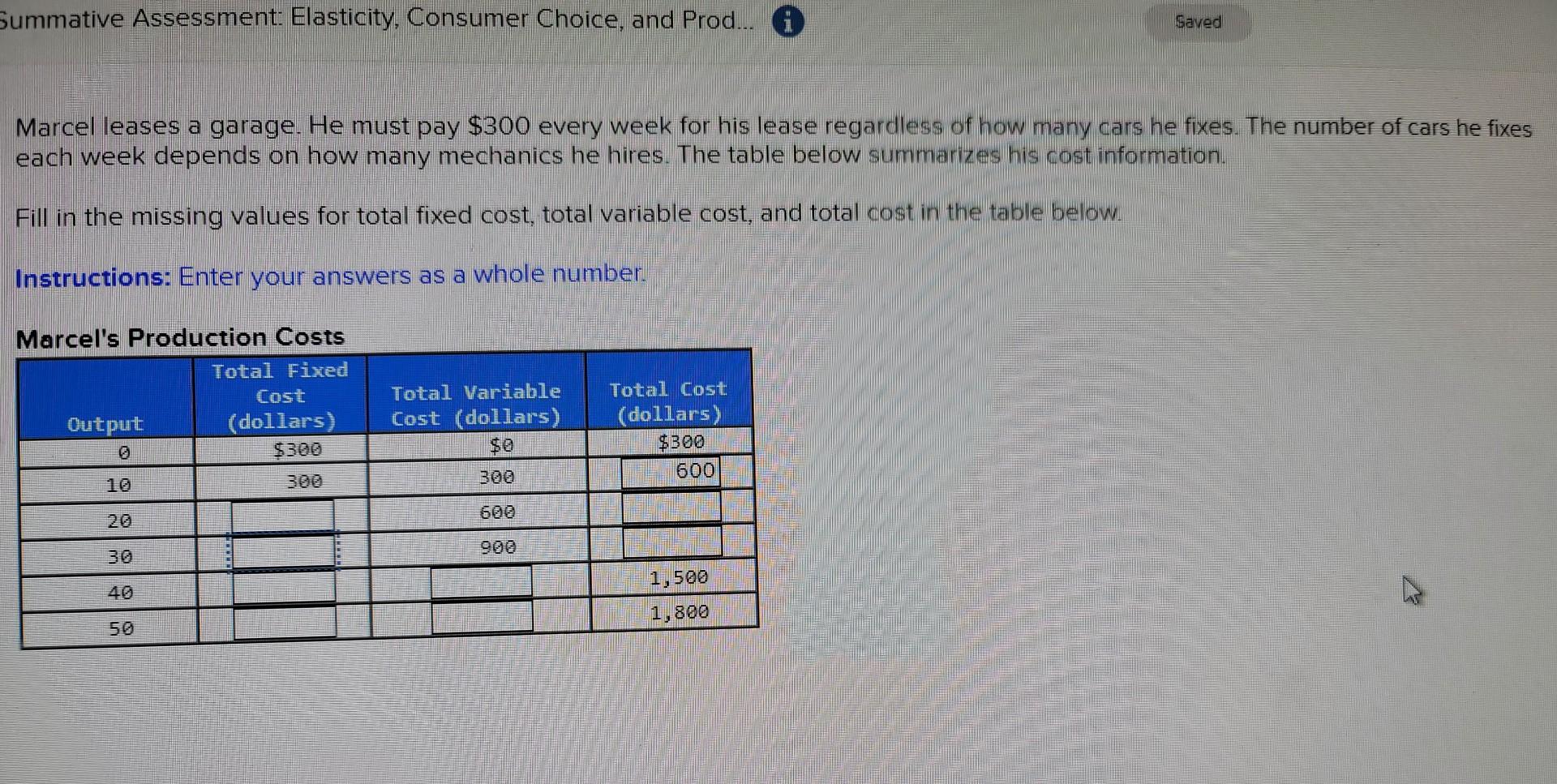

65 Hudson's Bay Leases Generate Buyer Interest

Table of Contents

Attractive Locations Driving Demand for Hudson's Bay Leases

A key driver of the intense interest in these 65 Hudson's Bay leases is their strategic location. These properties are situated in prime retail locations across key markets, boasting high foot traffic and excellent accessibility. These aren't just any retail spaces; they're situated in high-demand urban centers, often within close proximity to major transportation hubs, ensuring significant exposure and accessibility for potential tenants.

- High-Traffic Areas: Many of the leases are located in bustling shopping districts and city centers known for their consistently high foot traffic.

- Proximity to Transportation: Several leases benefit from convenient access to public transit, including subway stations, bus routes, and commuter rail lines, maximizing customer reach.

- Strategic Urban Centers: The locations strategically target key demographics and consumer bases, maximizing the potential for retail success and return on investment.

- Examples: While specific addresses are confidential at this stage, the portfolio includes properties in major metropolitan areas across the country, known for their strong retail performance and consumer spending.

This strategic positioning makes these Hudson's Bay leases a highly attractive proposition for investors seeking prime retail property investment opportunities.

Potential for Redevelopment and Increased Value in Hudson's Bay Leases

Beyond their existing appeal, the 65 Hudson's Bay leases offer significant potential for redevelopment and value appreciation. Many of these properties present exciting opportunities for adaptive reuse, allowing for creative repurposing to attract a broader range of tenants and maximize rental income. This could include converting existing spaces into trendy co-working spaces, modern apartments, or mixed-use developments.

- Redevelopment Opportunities: Many of the properties are well-suited for renovation and modernization, enhancing their appeal to potential tenants and increasing their market value.

- Adaptive Reuse: The versatility of the spaces allows for creative repurposing, transforming them into thriving hubs for diverse businesses and lifestyles.

- Property Renovation: Strategic renovations and upgrades can significantly boost the value and rental potential of these properties.

- Value Appreciation: Investments in renovation and adaptive reuse are expected to generate substantial value appreciation over time, ensuring a strong return on investment (ROI).

This potential for redevelopment significantly enhances the overall attractiveness of these Hudson's Bay leases for investors focused on long-term growth and value appreciation.

Strong Tenant Demand Fuels Hudson's Bay Leases’ Appeal

The current robust demand for retail spaces, especially high-quality spaces in prime locations like those offered by these Hudson's Bay leases, is another significant contributing factor to the buyer interest. The retail market is showing positive signs of recovery, and there's a strong appetite for well-located, attractive spaces.

- Tenant Demand: Market reports indicate a high demand for retail space in the areas where these properties are located, ensuring strong occupancy rates.

- Rental Income: The potential for attracting a diverse tenant mix translates into consistent and growing rental income streams.

- Retail Market Trends: Current retail market trends indicate a shift towards experiential retail and a demand for unique spaces, making many of these leases particularly attractive.

- Strong Lease Agreements: Securing strong lease agreements with reliable tenants will ensure a stable and predictable income stream for investors.

This strong tenant demand further solidifies the investment potential of these Hudson's Bay leases, offering a compelling opportunity for both short-term and long-term returns.

Financial Incentives and Favorable Lease Terms for Hudson's Bay Leases

To attract buyers, HBC and their brokers are offering attractive financial incentives and favorable lease terms. These incentives, combined with the already appealing attributes of the properties, create a compelling investment package.

- Attractive Pricing: Negotiable pricing strategies are in place to ensure competitive investment opportunities.

- Financial Incentives: Potential buyers can explore various financial incentives tailored to the specific circumstances of each lease.

- Lease Terms: Favorable lease terms, including flexible lease lengths and renewal options, are available, providing investors with greater flexibility and control.

- Investment Deals: These are structured to maximize the return on investment for buyers while simultaneously supporting a smooth transition for HBC.

These favorable conditions significantly contribute to the high buyer interest in these Hudson's Bay leases.

Impact of Hudson's Bay Leases’ Sale on the Retail Market

The sale of these 65 Hudson's Bay leases will undoubtedly have a noticeable impact on the wider retail landscape and commercial real estate market. This significant transaction will likely reshape the competitive dynamics of the retail sector in various markets.

- Market Impact: The sale will undoubtedly influence the valuation of similar retail properties and could lead to further consolidation in the retail sector.

- Retail Landscape: The acquisition of these leases by new owners could trigger renovations and revitalization efforts, impacting the overall retail landscape of affected areas.

- Commercial Real Estate Trends: This large-scale transaction will contribute to ongoing trends in commercial real estate investment and highlight the enduring demand for prime retail space.

- Industry Analysis: Market analysts will closely follow the outcome of this sale, observing its effects on various sectors of the commercial real estate market.

The sale of these 65 Hudson's Bay leases represents a significant turning point for the retail sector, promising considerable change and exciting new opportunities.

Conclusion: Investing in the Future: Capitalize on Hudson's Bay Leases

The high buyer interest in the 65 Hudson's Bay leases is driven by a confluence of factors: prime locations, redevelopment potential, strong tenant demand, and favorable lease terms. These factors, combined, present a compelling investment opportunity with the potential for strong returns. Don't miss this chance to invest in a portfolio of prime commercial real estate and secure a piece of the evolving retail landscape. Contact us today to learn more about the available Hudson's Bay leases and explore this exceptional investment opportunity in retail property investment and commercial real estate investment. Secure your future – invest in Hudson's Bay leases.

Featured Posts

-

Tyler Herro Wins 3 Point Contest Heat Star Shines Cavs Duo Dominates Skills Challenge

Apr 24, 2025

Tyler Herro Wins 3 Point Contest Heat Star Shines Cavs Duo Dominates Skills Challenge

Apr 24, 2025 -

Why Pope Franciss Papal Ring Will Be Destroyed After His Death

Apr 24, 2025

Why Pope Franciss Papal Ring Will Be Destroyed After His Death

Apr 24, 2025 -

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025 -

Fundraising Intensifies As Elite Universities Navigate Political Headwinds

Apr 24, 2025

Fundraising Intensifies As Elite Universities Navigate Political Headwinds

Apr 24, 2025 -

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025