Analyzing The U.S. Dollar's Performance: A Comparison To The Nixon Presidency

Table of Contents

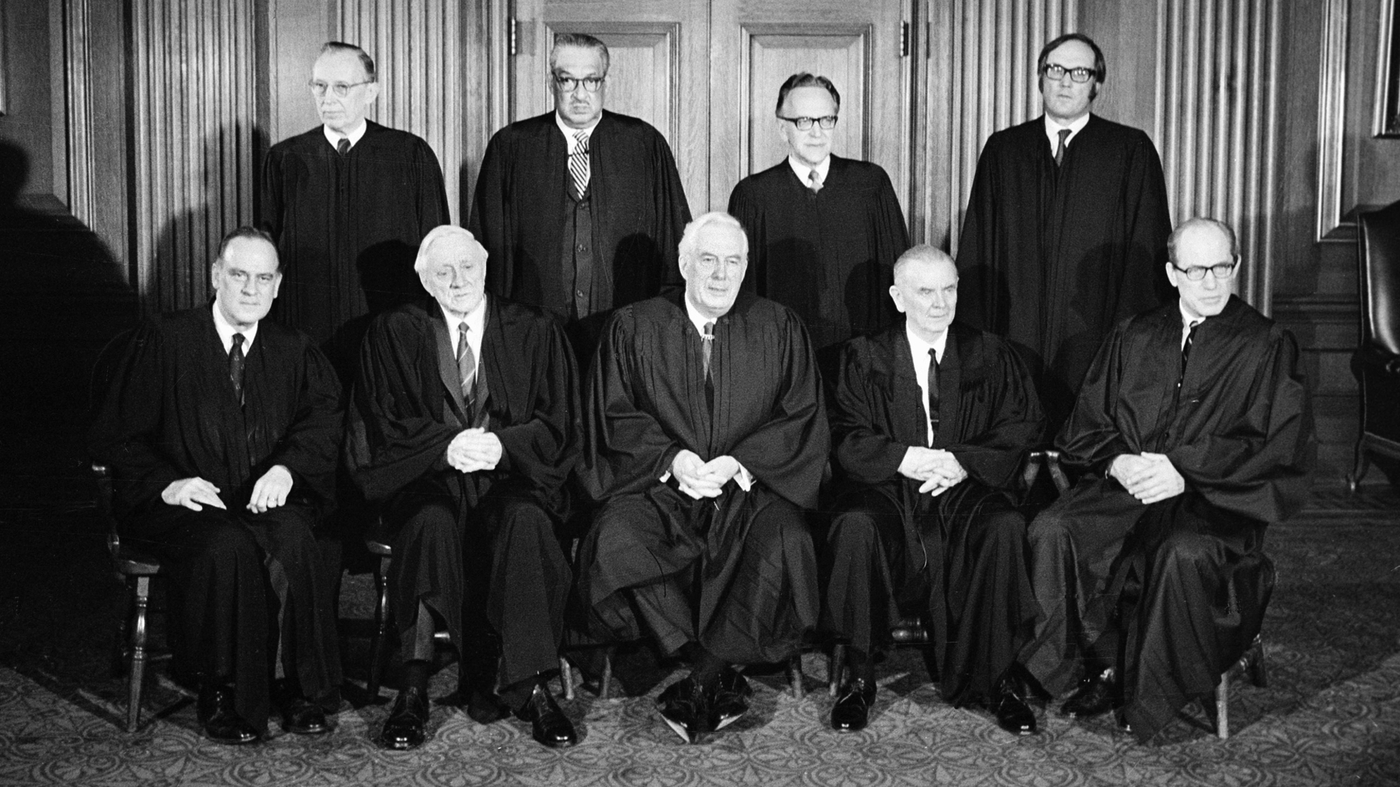

The Nixon Shock and its Immediate Impact on the U.S. Dollar

The Nixon shock, a series of economic measures implemented in August 1971, fundamentally altered the U.S. dollar's role in the global economy. Its most significant element was the closing of the gold window.

Closing the Gold Window

President Nixon's decision to unilaterally end the convertibility of the U.S. dollar to gold, effectively severing the link established under the Bretton Woods system, had immediate and far-reaching consequences.

- Short-term effects: Exchange rates became more volatile, as the dollar was no longer pegged to a fixed gold price. International currency markets experienced significant fluctuations.

- Inflationary pressure: The move contributed to increased inflation in the U.S. and globally, as the money supply was no longer constrained by gold reserves.

- Fiat currency system: The U.S. transitioned to a fiat currency system, where the dollar's value was determined by market forces rather than a fixed gold standard. This ushered in an era of floating exchange rates.

Bretton Woods System Collapse

The closure of the gold window marked the collapse of the Bretton Woods system, a post-World War II agreement that had established a relatively stable international monetary order.

- Challenges of a floating exchange rate system: The new system, characterized by fluctuating exchange rates, presented challenges for international trade and investment. Uncertainty around currency values increased transaction costs and risks.

- Increased volatility: The dollar's value became subject to the interplay of various economic and political factors, leading to periods of both strength and weakness.

- Impact on international monetary cooperation: The demise of Bretton Woods weakened international monetary cooperation, as nations were no longer bound by a common framework for managing their currencies.

The U.S. Dollar's Performance in the Post-Nixon Era

The post-Nixon era witnessed significant fluctuations in the U.S. dollar's value, shaped by a complex interplay of economic and geopolitical forces.

Periods of Strength and Weakness

Since the 1970s, the U.S. dollar has experienced periods of both remarkable strength and considerable weakness.

- Economic events and their correlation: Oil crises, recessions (like the 2008 financial crisis), and periods of high inflation have all significantly influenced the dollar's value. For example, the strong dollar of the early 1980s coincided with high U.S. interest rates under Paul Volcker's chairmanship of the Federal Reserve.

- Visual representation: [Insert chart or graph here illustrating the U.S. dollar index over time, highlighting periods of strength and weakness].

- Monetary policy's role: The Federal Reserve's monetary policy decisions, particularly interest rate adjustments, have played a crucial role in determining the dollar's strength relative to other currencies.

The Role of Geopolitical Factors

Geopolitical events have consistently influenced the U.S. dollar's performance, often making it a safe haven asset during times of global uncertainty.

- Key international events and their impact: The Cold War, various regional conflicts, and global terrorism have all impacted the dollar's value. During periods of uncertainty, investors often flock to the dollar, perceiving it as a relatively stable and reliable asset.

- Safe haven asset: The dollar's status as a global reserve currency contributes to its role as a safe haven asset. Investors tend to move their funds into dollars when other assets appear risky.

- Global power dynamics: The relative power and stability of the United States compared to other global powers significantly influences the dollar's value.

Comparing the U.S. Dollar's Performance Then and Now

By comparing the U.S. dollar's performance in the post-Nixon era to its current trajectory, we can identify both similarities and differences.

Similarities between the Nixon Era and Today

Several parallels exist between the economic conditions following the Nixon shock and the current global economic landscape.

- Inflationary pressures: Both eras have experienced periods of significant inflationary pressure, demanding decisive action from central banks.

- Global economic uncertainty: Both periods are marked by considerable global economic uncertainty, influencing investor behavior and currency values.

- U.S. dollar's role: The U.S. dollar remains a dominant force in the global economy, though its dominance is arguably less absolute today than it was in the early post-Nixon years.

- Central bank responses: Central banks in both eras have employed similar monetary policy tools (interest rate adjustments, quantitative easing) to address economic challenges.

Key Differences

Despite the similarities, notable differences exist between the global economic landscape of the post-Nixon era and the present day.

- Globalization: The degree of globalization is far greater now than in the 1970s, creating a more interconnected and interdependent global financial system.

- Technological advancements: Technological advancements, particularly in finance and communication, have transformed global financial markets, enhancing both speed and complexity.

- Emerging markets: The rise of emerging market economies has significantly altered the global economic balance of power, reducing the U.S. dollar's relative dominance.

- International trade and finance: The nature of international trade and finance has evolved significantly, impacting the dynamics of currency exchange.

Conclusion

Analyzing the U.S. dollar's performance since the Nixon shock reveals a complex interplay of economic and geopolitical factors. While parallels exist between the post-Nixon era and the current economic climate—particularly in terms of inflationary pressures and global uncertainty—significant differences also exist, largely driven by increased globalization, technological advancements, and the rise of emerging economies. Understanding this historical context is crucial for predicting future trends in the value of the U.S. dollar. Key takeaways include the lasting impact of the Nixon shock on the global monetary system and the persistent influence of geopolitical factors on U.S. dollar performance. Stay informed about the fluctuations of the U.S. dollar and its effect on global markets by following financial news and conducting further research into the historical performance of the U.S. dollar, focusing on specific periods or events discussed in this article.

Featured Posts

-

Minnesota Twins Secure 6 3 Win Over New York Mets

Apr 28, 2025

Minnesota Twins Secure 6 3 Win Over New York Mets

Apr 28, 2025 -

Aaron Judge Welcomes First Baby With Wife

Apr 28, 2025

Aaron Judge Welcomes First Baby With Wife

Apr 28, 2025 -

Kuxius Revolutionary Solid State Power Bank Durability And Performance

Apr 28, 2025

Kuxius Revolutionary Solid State Power Bank Durability And Performance

Apr 28, 2025 -

Mets Make Roster Adjustments Nez To Syracuse Megill To Rotation

Apr 28, 2025

Mets Make Roster Adjustments Nez To Syracuse Megill To Rotation

Apr 28, 2025 -

Over The Counter Birth Control Implications For Reproductive Rights After Roe V Wade

Apr 28, 2025

Over The Counter Birth Control Implications For Reproductive Rights After Roe V Wade

Apr 28, 2025