Are High Stock Market Valuations A Concern? BofA Says No.

Table of Contents

BofA's Rationale for Dismissing High Valuations

BofA's bullish stance on high stock market valuations rests on several key pillars. They believe that several significant factors currently mitigate the risks typically associated with high market valuation.

Low Interest Rates and Abundant Liquidity

Low interest rates and abundant liquidity are key drivers fueling stock market growth and impacting valuations. Lower rates make borrowing cheaper for both companies and investors, encouraging investment and driving up stock prices.

- Mechanism: Lower borrowing costs allow companies to invest more in expansion and research & development, boosting earnings and attracting investors. Individuals also borrow more, increasing consumer spending and further stimulating economic growth.

- Quantitative Easing: Central bank policies like quantitative easing (QE) inject massive amounts of liquidity into the financial system, further increasing the availability of capital for investment. This increased liquidity often finds its way into the stock market, pushing up prices.

- Data Point: For example, historically low interest rates throughout much of 2023 contributed significantly to increased investment and higher stock prices despite concerns about stock market valuation. (Note: Specific data points should be added here reflecting the most current economic data.)

Strong Corporate Earnings and Profitability

BofA points to robust corporate earnings and profitability as justification for the high valuations. Strong earnings suggest companies are performing well, making their higher stock prices seem more reasonable.

- Examples: Several sectors, such as technology and healthcare, have shown particularly strong earnings growth in recent years. (Again, specific examples and data should be inserted reflecting the current market).

- Profit Margins and Revenue Growth: Data indicating consistently high profit margins and robust revenue growth across various sectors support the argument that current high valuations are justifiable.

- Contributing Factors: Technological advancements, improved operational efficiency, and a favorable regulatory environment have all contributed to strong corporate performance.

Long-Term Growth Potential

BofA's optimism extends to the long-term economic outlook. They see significant growth potential in the coming years, suggesting current high stock market valuations are not necessarily unsustainable.

- Future Growth Drivers: Potential future growth drivers include continued technological innovation, demographic shifts (e.g., a growing middle class in emerging markets), and ongoing advancements in renewable energy.

- Long-Term Projections: While specific long-term projections vary among analysts, the overall sentiment suggests a positive outlook for economic growth, supporting the belief that current valuations can be sustained or even exceeded over time. (Again, include specific data relevant to the current market analysis).

- Justification for Valuations: This long-term growth outlook suggests that current stock prices, while seemingly high now, might still be considered reasonable when accounting for expected future earnings growth.

Counterarguments and Potential Risks

While BofA presents a compelling case, it's crucial to acknowledge counterarguments and potential risks associated with high stock market valuations.

Valuation Metrics and Historical Comparisons

Concerns remain regarding high price-to-earnings ratios (P/E) and other valuation metrics. Comparing current valuations to historical averages reveals that several key metrics are above long-term averages.

- Key Valuation Ratios: Elevated P/E ratios, along with other metrics like the Price-to-Sales (P/S) ratio and the Cyclically Adjusted Price-to-Earnings Ratio (CAPE or Shiller PE), suggest potential overvaluation compared to historical norms.

- Historical Comparisons: Analyzing historical data offers valuable context, but it's important to note that past performance is not indicative of future results. Market conditions and economic factors constantly change, making direct comparisons imperfect.

- Limitations of Historical Data: Using historical data alone can be misleading. Technological advancements, globalization, and regulatory changes can significantly alter market dynamics.

Geopolitical and Economic Uncertainty

Geopolitical instability, inflation, supply chain disruptions, and other unforeseen economic events present significant risks that could significantly impact stock market valuations.

- Potential Scenarios: A global recession, escalating geopolitical tensions, or a significant supply chain disruption could trigger a sharp market correction.

- Impact on Stock Prices: Such events could erode investor confidence, leading to a decline in stock prices and potentially exposing the overvaluation of many stocks.

- Uncertain Future: The inherent uncertainty associated with predicting future market performance necessitates a cautious approach.

Interest Rate Hikes and Inflation

Rising interest rates and persistent inflation pose significant challenges to stock market valuations.

- Impact on Company Profitability: Higher interest rates increase borrowing costs for companies, potentially impacting profitability and reducing investment.

- Investor Sentiment: Increased inflation erodes purchasing power and can negatively affect investor sentiment, leading to reduced demand for stocks.

- Potential Market Corrections: A combination of rising interest rates and high inflation often leads to market corrections, as investors adjust their portfolios to account for the changed economic landscape.

Conclusion: Navigating High Stock Market Valuations – A Balanced Perspective

BofA's argument for dismissing concerns about high stock market valuations hinges on factors like low interest rates, robust corporate earnings, and anticipated long-term growth. However, counterarguments highlight risks associated with elevated valuation metrics, geopolitical uncertainties, and the potential impact of rising interest rates and inflation.

While BofA's optimistic outlook has merit, a balanced perspective is essential. High stock market valuations, while potentially justified by some factors, always carry inherent risks. Careful consideration of these risks is crucial for any investor. A well-diversified portfolio, tailored to your individual risk tolerance, is crucial in navigating the complexities of the current market.

Understanding high stock market valuations is crucial for successful investing. Conduct thorough research and consider consulting a financial advisor to create a strategy that aligns with your risk tolerance. Remember that this information is for educational purposes only and not financial advice.

Featured Posts

-

Harvard Lawsuit Trump Administration Shows Willingness To Negotiate

Apr 24, 2025

Harvard Lawsuit Trump Administration Shows Willingness To Negotiate

Apr 24, 2025 -

16 Million Fine For T Mobile Details On Three Years Of Data Security Lapses

Apr 24, 2025

16 Million Fine For T Mobile Details On Three Years Of Data Security Lapses

Apr 24, 2025 -

Remembering Jett Travolta A Photo Tribute On His Birthday

Apr 24, 2025

Remembering Jett Travolta A Photo Tribute On His Birthday

Apr 24, 2025 -

Miami Heats Herro Crowned Nba 3 Point Champion Beats Buddy Hield

Apr 24, 2025

Miami Heats Herro Crowned Nba 3 Point Champion Beats Buddy Hield

Apr 24, 2025 -

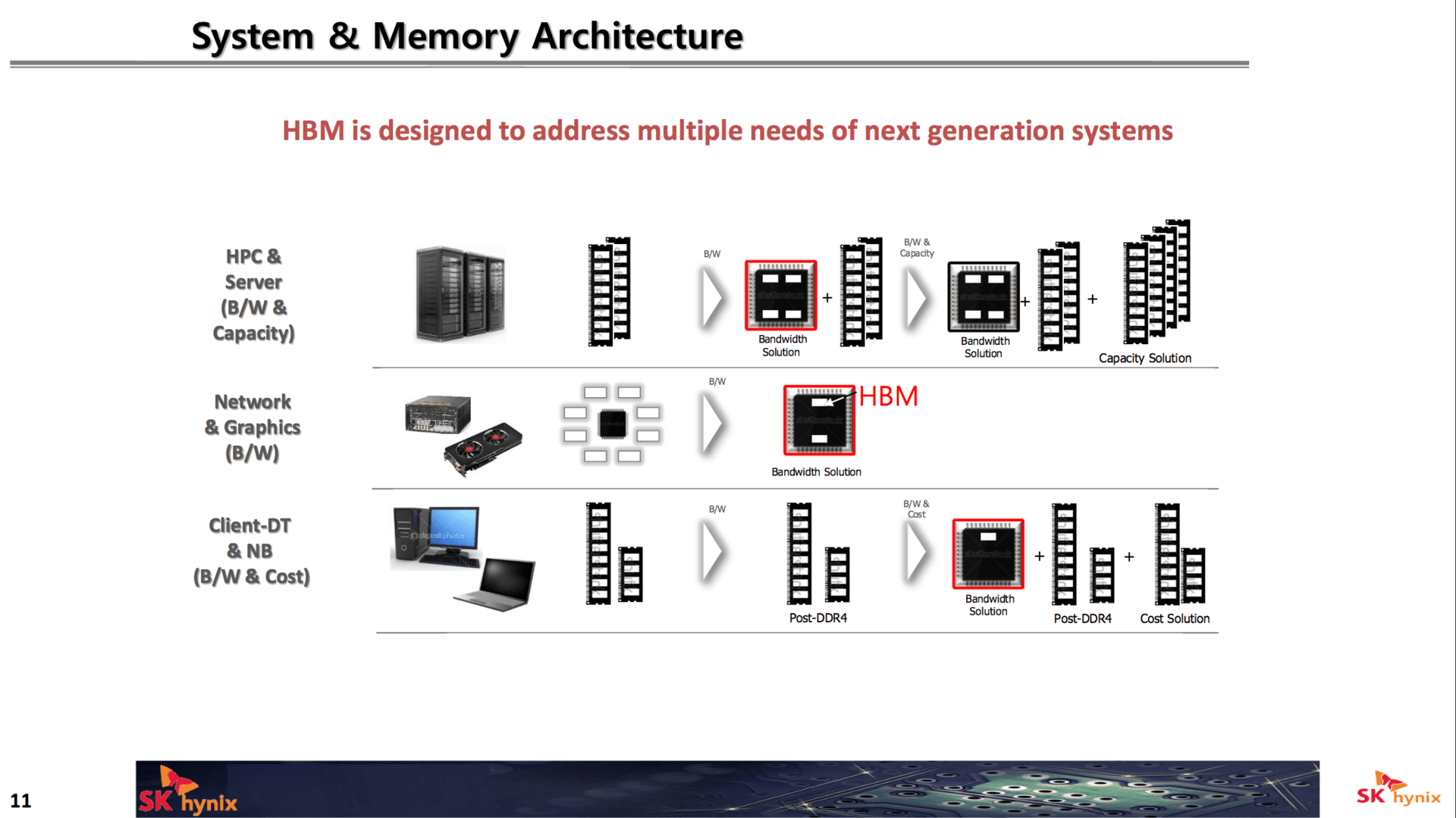

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025