Are Stock Investors Prepared For More Market Downturns?

Table of Contents

Understanding the Nature of Market Downturns

Identifying Market Cycles and Trends

The stock market operates in cyclical patterns, alternating between bull markets (periods of sustained growth) and bear markets (periods of sustained decline). Understanding these cycles is vital for anticipating potential downturns. Several leading indicators can signal an impending market correction or bear market.

- Economic Indicators: Key economic indicators like inflation rates, unemployment figures, GDP growth, and consumer confidence can provide valuable insights into the overall health of the economy and potential market shifts. A sharp rise in inflation or a significant drop in GDP growth, for example, often precedes market downturns.

- Investor Sentiment: Tracking investor sentiment through surveys, news reports, and social media can reveal shifts in market optimism or pessimism. Excessive bullishness can be a contrarian indicator, suggesting a potential market correction is due. Conversely, extreme pessimism can signal a potential bottom.

- Technical Analysis Indicators: Technical analysis utilizes chart patterns and indicators (like moving averages, RSI, and MACD) to identify potential trend reversals and predict market behavior. While not foolproof, these tools can complement fundamental analysis in identifying potential downturns.

Types of Market Downturns

It's important to distinguish between different types of market declines:

- Corrections: A correction is a 10-20% drop from a recent market peak. Corrections are relatively common and often short-lived. Examples include the 2018 market correction and various others throughout history.

- Bear Markets: A bear market is a more significant decline, typically defined as a 20% or greater drop from a recent peak. Bear markets can last for months or even years. The 2008 financial crisis is a prime example of a severe bear market.

- Crashes: A market crash is a sudden, sharp, and often unexpected decline, typically characterized by extreme volatility and panic selling. The 1929 stock market crash is a historical example.

Assessing Investor Preparedness

Evaluating Portfolio Diversification

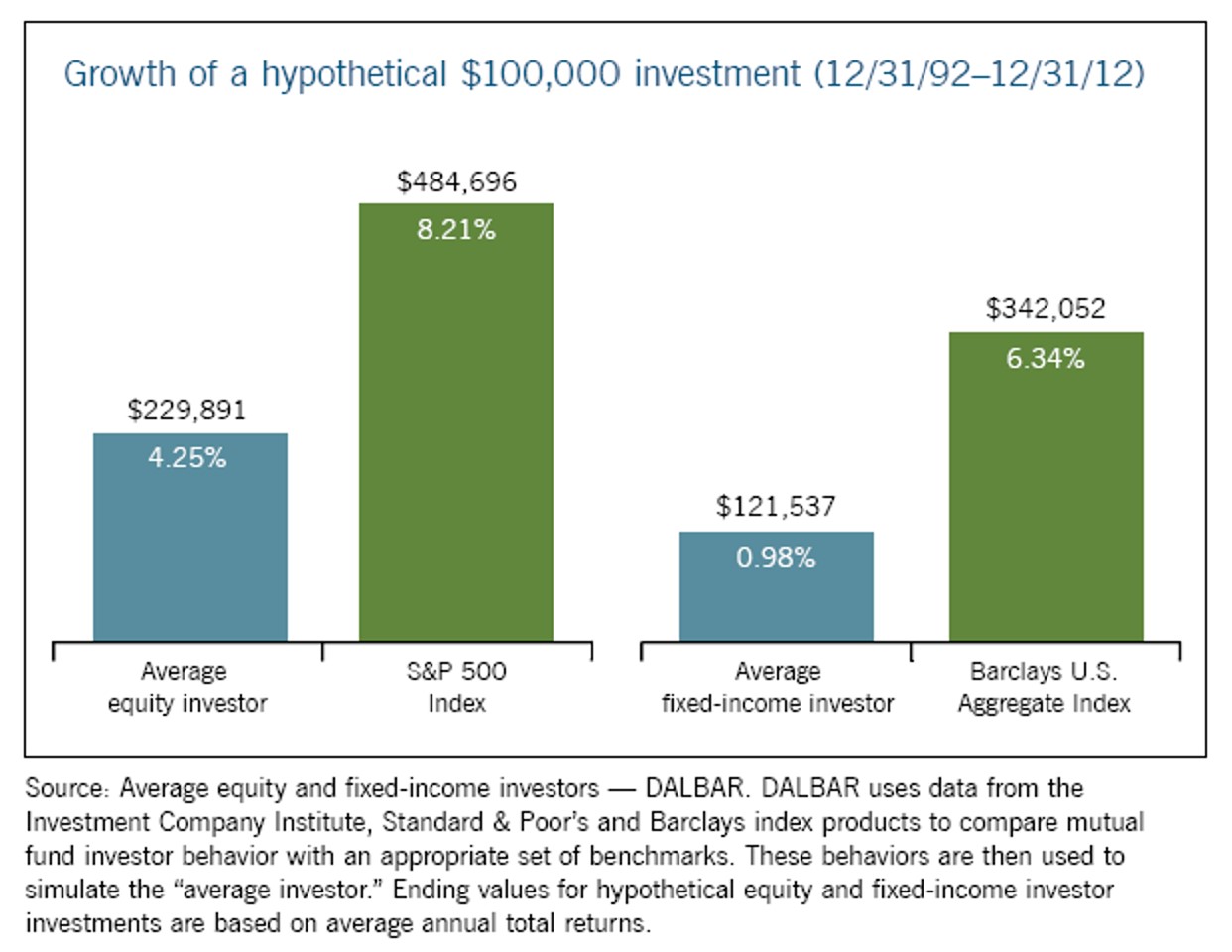

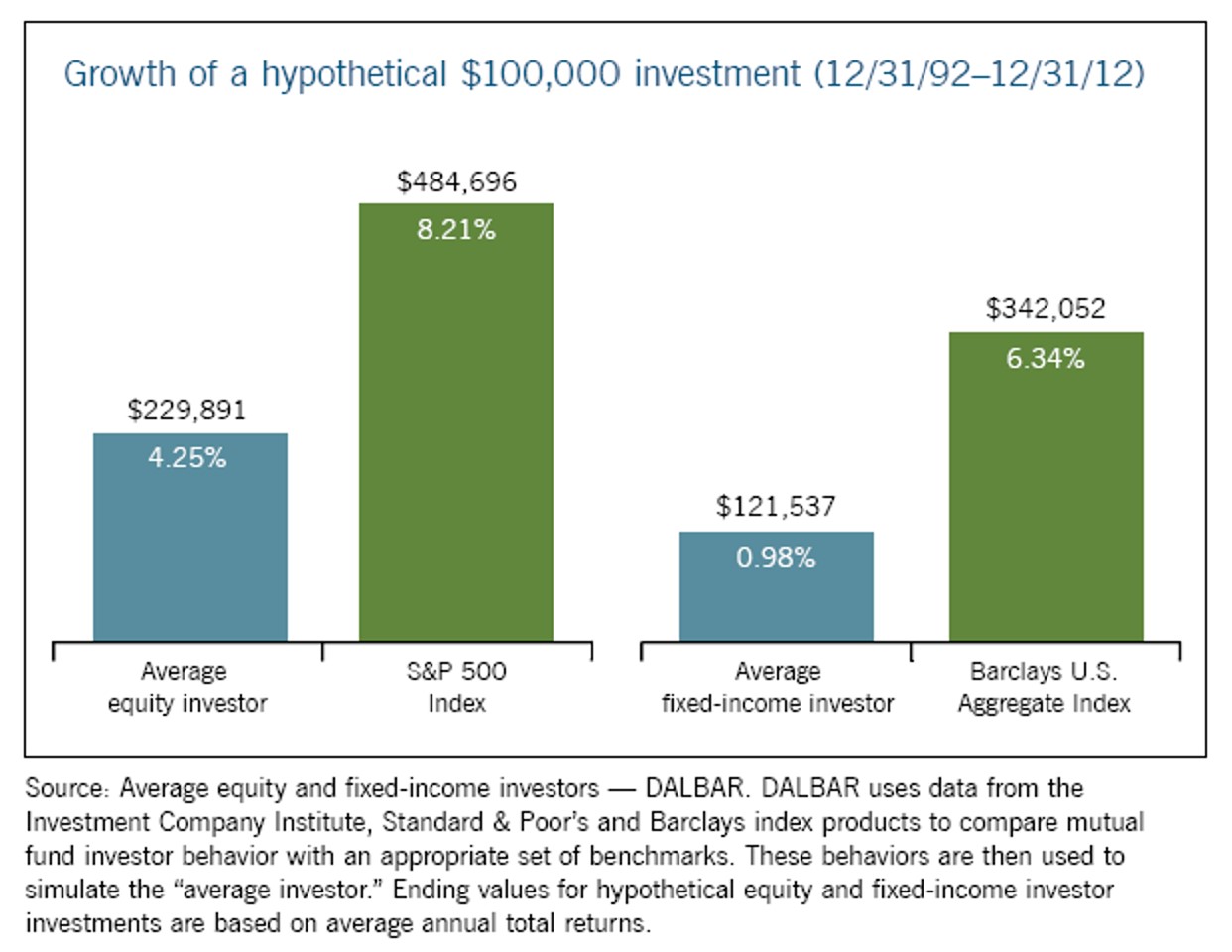

Diversification is a cornerstone of risk management. A well-diversified portfolio spreads investments across various asset classes, reducing the impact of a downturn in any single sector or market.

- Examples of Diversified Portfolios: A balanced portfolio might include a mix of stocks (across different sectors and market caps), bonds (government and corporate), real estate, and potentially alternative investments.

- Risks of Over-Concentration: Over-concentration in a single asset class or sector exposes investors to significant risk during market downturns. For instance, heavy investment in technology stocks during a tech bubble burst could lead to substantial losses.

- The Role of Different Asset Classes: Different asset classes tend to perform differently during market downturns. Bonds, for example, often act as a safe haven during times of uncertainty, offering relative stability compared to stocks.

Examining Risk Tolerance and Investment Time Horizon

Understanding your risk tolerance and investment time horizon is critical in determining your investment strategy.

- Methods for Assessing Risk Tolerance: Several questionnaires and tools help assess your comfort level with potential investment losses. Honest self-assessment is crucial.

- How Time Horizon Affects Investment Strategies: Investors with a longer time horizon (e.g., retirement planning) can tolerate more risk and potentially ride out market downturns. Those with shorter time horizons need a more conservative approach.

- Importance of Long-Term Perspective: A long-term perspective is essential when navigating market volatility. Focusing on long-term goals rather than short-term fluctuations can help maintain a disciplined investment strategy.

Emergency Fund and Debt Management

A robust emergency fund is crucial for weathering financial storms. Managing debt effectively also reduces vulnerability during market downturns.

- Recommended Emergency Fund Size: Aim for 3-6 months' worth of living expenses in a readily accessible account.

- Strategies for Debt Reduction: Prioritize paying down high-interest debt (credit cards, personal loans) to reduce your financial burden during market downturns.

- Impact of High Debt on Market Downturn Resilience: High debt levels increase financial stress during market downturns, potentially forcing you to sell assets at unfavorable prices.

Strategies for Navigating Market Downturns

Defensive Investment Strategies

Several strategies can help protect your investments during market downturns:

- Shifting to More Conservative Asset Classes: Consider shifting a portion of your portfolio to less volatile assets like bonds or cash during periods of heightened market uncertainty.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. It reduces the risk of investing a large sum at a market peak.

- Utilizing Stop-Loss Orders: Stop-loss orders automatically sell a security when it reaches a predetermined price, limiting potential losses.

Opportunities During Market Corrections

Market downturns can also present opportunities for savvy investors:

- Identifying Undervalued Assets: Market corrections can create opportunities to purchase high-quality assets at discounted prices. Thorough research and due diligence are crucial.

- The Importance of Patience: Capitalizing on market dips requires patience and discipline. Avoid impulsive decisions based on short-term market fluctuations.

- Risks of Trying to Time the Market: Attempting to perfectly time the market is risky and often unsuccessful. Focus on a long-term investment strategy.

Conclusion

Navigating market downturns requires a combination of understanding market cycles, assessing personal preparedness, and implementing effective strategies. Key takeaways include the importance of portfolio diversification, managing debt, having an emergency fund, and employing defensive investment strategies. Market corrections are inevitable, but with proper preparation and a long-term perspective, investors can mitigate risk and even capitalize on opportunities. Are you prepared for the next market downturn? Take a thorough assessment of your portfolio and investment strategy today. Understanding and planning for market downturns is crucial for long-term investment success.

Featured Posts

-

Live Stock Market Updates Dow Futures Dollar And Trade Worries

Apr 22, 2025

Live Stock Market Updates Dow Futures Dollar And Trade Worries

Apr 22, 2025 -

Higher Bids Higher Risks Stock Investors Face Continued Market Uncertainty

Apr 22, 2025

Higher Bids Higher Risks Stock Investors Face Continued Market Uncertainty

Apr 22, 2025 -

The Pan Nordic Army A Combined Strength Of Swedish Tanks And Finnish Troops

Apr 22, 2025

The Pan Nordic Army A Combined Strength Of Swedish Tanks And Finnish Troops

Apr 22, 2025 -

Just Contact Us Investigating Tik Toks Involvement In Tariff Avoidance

Apr 22, 2025

Just Contact Us Investigating Tik Toks Involvement In Tariff Avoidance

Apr 22, 2025 -

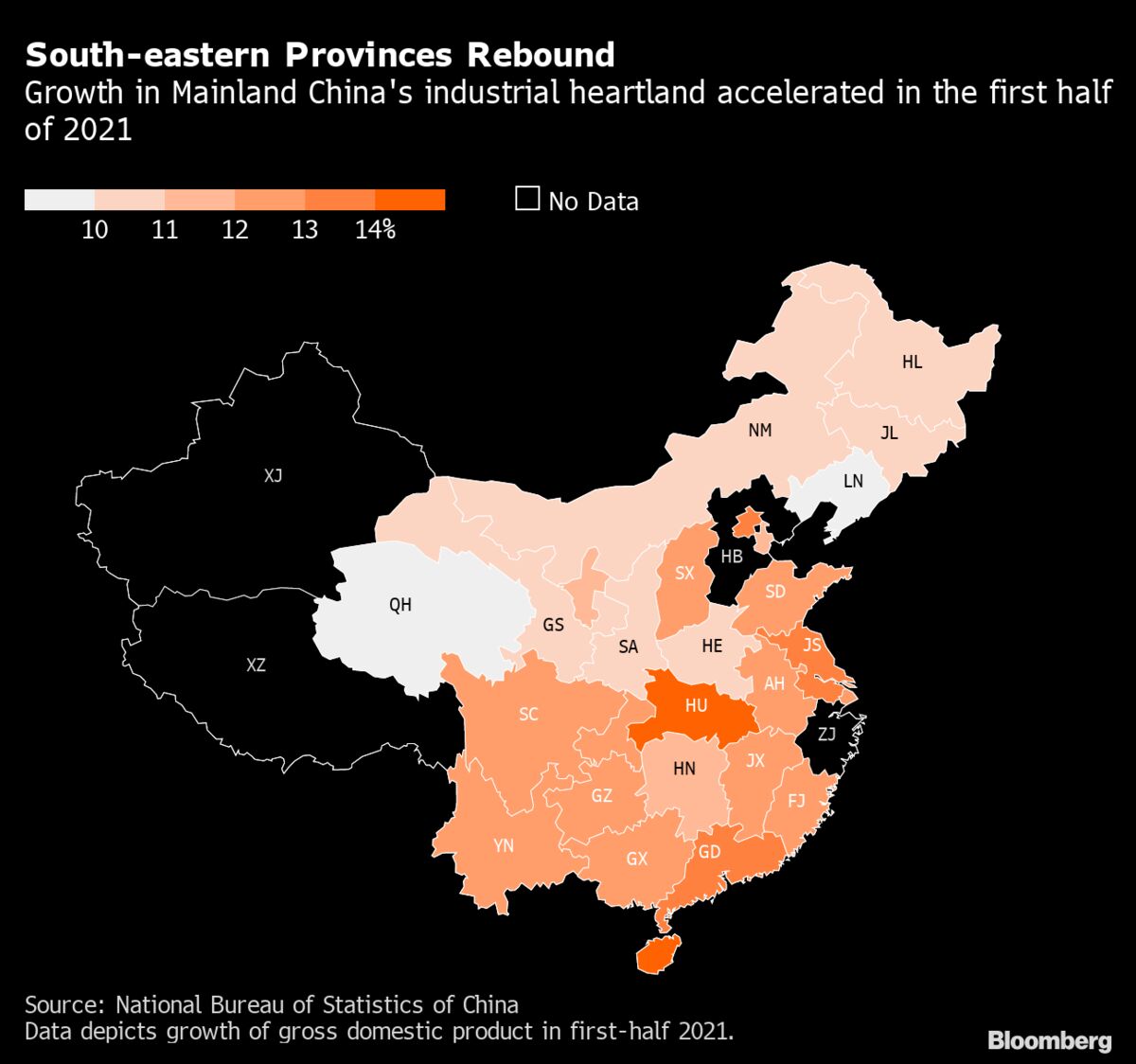

Tariff Sensitivity Assessing Risks To Chinas Export Oriented Growth

Apr 22, 2025

Tariff Sensitivity Assessing Risks To Chinas Export Oriented Growth

Apr 22, 2025