AT&T Sounds Alarm: Broadcom's VMware Deal Leads To 1,050% Cost Surge

Table of Contents

The VMware Acquisition: A Closer Look at Broadcom's Strategy

Broadcom's acquisition of VMware, a leading provider of virtualization and cloud infrastructure software, represents a significant shift in the enterprise technology landscape. Broadcom's rationale behind the acquisition centers on several key strategic objectives: expanding its portfolio into the lucrative enterprise software market, leveraging synergies between its existing infrastructure solutions and VMware's software, and eliminating a significant competitor.

The potential synergies are substantial. Broadcom aims to cross-sell and upsell its existing networking and semiconductor products to VMware's vast customer base, boosting its overall revenue streams. Furthermore, the acquisition consolidates market share, giving Broadcom a dominant position in the enterprise software sector.

The initial market reaction to the acquisition was mixed, with some analysts expressing concerns about potential monopolistic practices and price increases. However, Broadcom framed the deal as beneficial for both customers and shareholders, emphasizing innovation and improved product integration.

- Increased market share for Broadcom in the enterprise software market.

- Potential for cross-selling and upselling of products to existing and new customers.

- Elimination of a major competitor, leading to reduced competition in the virtualization market.

Deconstructing AT&T's 1,050% Cost Increase

AT&T's 1,050% VMware cost increase is a stark illustration of the potential financial implications of Broadcom's acquisition. While the exact reasons behind this dramatic surge remain unclear, several factors likely contributed: renegotiated licensing terms less favorable to AT&T, a lack of substantial negotiation power in the face of Broadcom's market dominance, and potentially unfavorable bundled contract structures.

This massive cost increase significantly impacts AT&T's profitability and financial performance, forcing the company to reassess its IT spending and potentially explore alternative solutions. The situation also raises potential legal and regulatory concerns, with some suggesting the need for further investigation into potential anti-competitive practices. Regulatory bodies might scrutinize Broadcom's pricing strategies to ensure fair market competition.

- Comparison of previous VMware licensing costs (pre-acquisition) with the new costs shows an unprecedented jump.

- Impact on AT&T's bottom line is substantial, requiring adjustments to budgets and potentially impacting shareholder returns.

- Potential for lawsuits or regulatory scrutiny due to the dramatic price increase and potential anti-competitive practices.

Implications for Other Businesses Relying on VMware

AT&T's experience serves as a cautionary tale for other businesses heavily reliant on VMware products. Many organizations could face similar, albeit potentially less extreme, cost increases following Broadcom's takeover. Companies like Verizon, Comcast, and other large telecom firms, along with many enterprises utilizing VMware solutions, are at risk.

Mitigating these potential cost increases requires proactive strategies:

- Negotiating better licensing terms with Broadcom, leveraging collective bargaining power if possible.

- Exploring alternative virtualization solutions from competitors like Microsoft Azure, Amazon Web Services (AWS), or Google Cloud Platform (GCP).

- Implementing thorough cost analysis of VMware licensing and usage to identify areas for optimization.

The broader implications for the enterprise software market are significant. The acquisition raises concerns about potential market consolidation, reduced innovation, and increased pricing pressure on businesses.

Long-Term Outlook and Future Predictions

The long-term implications of the Broadcom-VMware merger remain uncertain, but several potential scenarios are possible:

- Increased VMware pricing in the coming years, potentially impacting the affordability and accessibility of virtualization solutions for smaller businesses.

- Increased competition in the virtualization market as businesses seek alternatives to VMware due to pricing concerns.

- Reduced innovation within the virtualization space due to less competitive pressure.

The situation requires careful monitoring and strategic planning by businesses. The merger could lead to a more consolidated and less competitive market, potentially affecting future technological advancements.

Conclusion: Understanding the Ripple Effect of the Broadcom-VMware Deal

The Broadcom-VMware merger has demonstrably resulted in a significant cost increase for AT&T, a 1,050% surge in VMware licensing costs. This case study underscores the potential for similar financial impacts on other organizations relying on VMware's products. Understanding the long-term effects of this deal is crucial for businesses to navigate this changing landscape and effectively manage their IT infrastructure costs.

Don't let your business become another victim of the Broadcom-VMware merger's price surge. Analyze your VMware licensing costs today and explore cost-saving strategies like VMware cost optimization and alternative VMware licensing strategies before it's too late! Proactive planning and a thorough evaluation of your VMware licensing agreements are essential to mitigate the potential impact of this acquisition on your bottom line. Understanding the Broadcom acquisition impact is paramount for informed decision-making.

Featured Posts

-

Decoding Niftys Rally Key Factors Driving Indias Market Buzz

Apr 24, 2025

Decoding Niftys Rally Key Factors Driving Indias Market Buzz

Apr 24, 2025 -

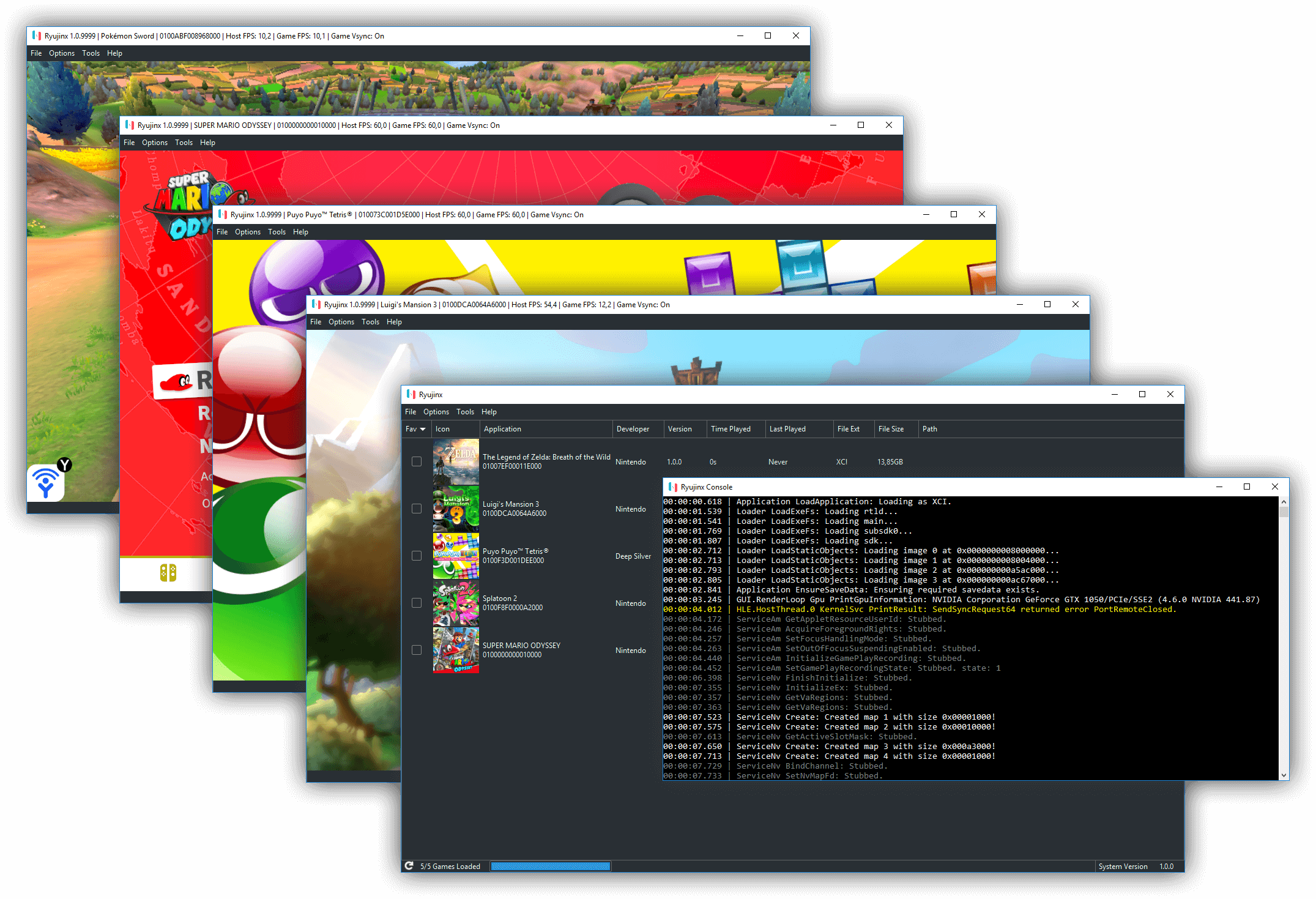

Ryujinx Emulator Development Halted Nintendos Impact

Apr 24, 2025

Ryujinx Emulator Development Halted Nintendos Impact

Apr 24, 2025 -

Abrego Garcia Judge Orders End To Stonewalling By Us Lawyers

Apr 24, 2025

Abrego Garcia Judge Orders End To Stonewalling By Us Lawyers

Apr 24, 2025 -

Nba

Apr 24, 2025

Nba

Apr 24, 2025 -

The Bold And The Beautiful April 16 Recap Hopes Worries And Bridgets Revelation

Apr 24, 2025

The Bold And The Beautiful April 16 Recap Hopes Worries And Bridgets Revelation

Apr 24, 2025