Bank Of Canada's Rate Pause: Expert Analysis From FP Video

Table of Contents

Understanding the Bank of Canada's Decision to Pause

The Bank of Canada's decision to pause interest rate hikes, after a series of aggressive increases, was a surprising move. This decision needs to be understood within the context of recent economic data and projections. The central bank carefully weighs various factors when setting its monetary policy, aiming to balance inflation control with economic growth.

- Current Inflation Rate and its Trajectory: While inflation has been declining from its peak, it still remains above the Bank of Canada's target of 2%. The rate at which inflation is falling is a key indicator informing their decisions.

- GDP Growth Forecasts and Their Uncertainties: Economic growth forecasts are showing signs of slowing, raising concerns about a potential recession. The Bank of Canada must carefully consider the impact of further rate hikes on already fragile economic growth.

- Potential Risks Associated with Further Rate Hikes: Raising interest rates too aggressively risks triggering a recession, which would further complicate the economic situation. The Bank carefully weighs the risk of inflation versus the risk of recession.

- The Bank of Canada's Mandate and its Inflation Target: The Bank of Canada's primary mandate is to maintain price stability, which is typically defined as an inflation rate of 2%. The current inflation rate, albeit decreasing, is still significantly influencing their decisions.

Expert Opinions from the FP Video

The Financial Post video featured several leading economists and financial analysts who offered their perspectives on the Bank of Canada's rate pause. Their insights provide valuable context to interpret the implications of this decision.

- Expert 1's Perspective and Reasoning: [Insert Expert 1's Name] argued that the pause is a strategic move to assess the impact of previous rate hikes on inflation and economic growth. “[Insert a relevant quote from Expert 1, focusing on the rate pause].”

- Expert 2's Analysis and Predictions: [Insert Expert 2's Name] suggested that the pause reflects uncertainty about the future economic trajectory. “[Insert a relevant quote from Expert 2, offering predictions or analysis].”

- Differing Opinions or Debates Amongst the Experts: The FP video also highlighted some disagreements among the experts. Some believe the pause signifies a potential shift in monetary policy, while others view it as a temporary measure.

- Predictions for Future Interest Rate Movements: The experts offered varied predictions. Some foresee further rate hikes later this year, while others believe rates might remain unchanged or even be cut depending on the economic data.

Impact on the Canadian Economy

The Bank of Canada's rate pause will have significant ripple effects throughout the Canadian economy, influencing various sectors differently.

- Impact on Housing Market (Prices, Mortgage Rates): The pause is likely to offer some temporary relief to the housing market, potentially slowing down the decline in house prices and stabilizing mortgage rates.

- Effects on Consumer Spending and Borrowing: Lower borrowing costs could stimulate consumer spending in the short-term, but this is contingent on consumer confidence and economic outlook.

- Influence on the Canadian Dollar Exchange Rate: The decision may influence the value of the Canadian dollar, potentially affecting trade and investment flows.

- Implications for Businesses and Investments: Businesses may find it slightly easier to access credit, but the uncertainty surrounding future rate movements can impact investment decisions.

What the Future Holds: Predictions and Implications

The Bank of Canada's rate pause introduces considerable uncertainty, making the future economic trajectory difficult to predict with certainty. Several scenarios are possible.

- Possibility of Future Rate Hikes or Cuts: The next move by the Bank of Canada will heavily depend on upcoming economic data, specifically inflation figures and GDP growth. Further hikes or potential rate cuts remain possibilities.

- Long-Term Outlook for Inflation and Economic Growth: The long-term outlook hinges on the effectiveness of the pause in controlling inflation without significantly hindering economic growth.

- Advice for Investors and Homeowners Based on the Expert Analysis: Investors should carefully consider the risks and opportunities presented by the pause, adjusting their portfolios based on the potential future scenarios outlined by the experts in the FP video. Homeowners should carefully assess their financial situations and consider their future mortgage obligations.

- Potential Risks or Uncertainties: Global economic conditions, geopolitical events, and unforeseen shocks could significantly impact the Canadian economy and the Bank of Canada's future decisions.

Conclusion: Navigating the Bank of Canada's Rate Pause

The Bank of Canada's decision to pause interest rate hikes is a complex issue with far-reaching implications for the Canadian economy. Expert analysis from the FP video highlights the uncertainties and varying predictions for future interest rate movements. Understanding the potential impacts on the housing market, consumer spending, and investment decisions is crucial for individuals and businesses alike. The long-term outlook remains uncertain, emphasizing the need for careful monitoring of economic data and the Bank of Canada's communications.

Key Takeaways: The Bank of Canada's rate pause reflects a strategic assessment of the current economic landscape. The future direction of interest rates remains uncertain, with potential for both hikes and cuts depending on upcoming economic data. It’s vital to stay informed about these developments.

For a deeper dive into the Bank of Canada's rate pause and expert predictions, watch the full Financial Post video now and stay informed about crucial developments affecting the Canadian economy. [Insert Link to FP Video Here]

Featured Posts

-

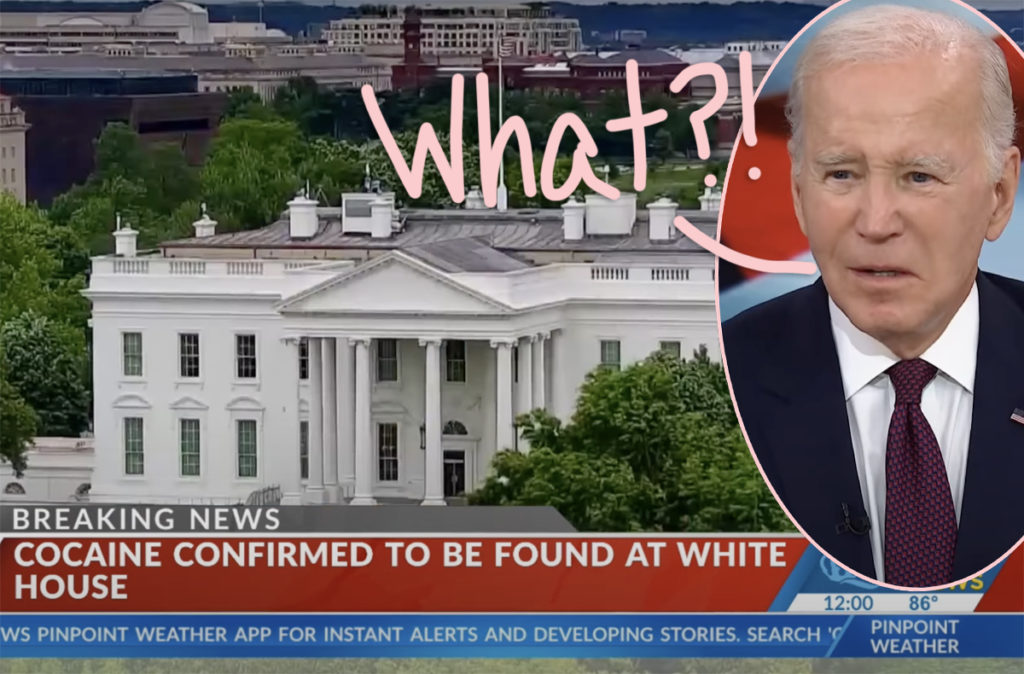

Cocaine Found At White House Secret Service Ends Investigation

Apr 22, 2025

Cocaine Found At White House Secret Service Ends Investigation

Apr 22, 2025 -

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 22, 2025

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 22, 2025 -

500 Million Settlement Looms In Historic Canadian Bread Price Fixing Case

Apr 22, 2025

500 Million Settlement Looms In Historic Canadian Bread Price Fixing Case

Apr 22, 2025 -

Joint Nordic Defense The Synergies Of Swedish Armor And Finnish Infantry

Apr 22, 2025

Joint Nordic Defense The Synergies Of Swedish Armor And Finnish Infantry

Apr 22, 2025 -

Saudi Aramco And Byds Ev Technology Joint Venture Potential And Challenges

Apr 22, 2025

Saudi Aramco And Byds Ev Technology Joint Venture Potential And Challenges

Apr 22, 2025