Bitcoin Price Surge: Trump's Actions Ease Market Uncertainty

Table of Contents

The recent surge in Bitcoin's price has left many wondering about the contributing factors. While cryptocurrency markets are notoriously volatile, a significant influence appears to be stemming from recent actions and statements made by former President Donald Trump. This article delves into how Trump's actions have contributed to easing market uncertainty and driving the Bitcoin price upward. We will examine the specific events and their impact on investor sentiment, exploring the complex relationship between political events and the volatile world of cryptocurrency.

Trump's Statements and Their Impact on Market Sentiment

Positive statements from Trump regarding the economy or Bitcoin specifically can significantly influence investor confidence. His pronouncements, even seemingly off-hand remarks, can create ripples throughout the financial world, including the cryptocurrency market. This is partly due to his large and engaged following, as well as his history of influencing traditional markets.

- Examples of specific statements and their immediate effect on Bitcoin price: For example, a tweet expressing positive sentiment towards cryptocurrencies or a public comment downplaying regulatory concerns could lead to an immediate, albeit temporary, increase in Bitcoin's price. Conversely, negative comments can trigger price drops. Pinpointing exact causal links is challenging due to the inherent volatility of the market.

- Analysis of social media reactions and news coverage following these statements: Social media platforms often amplify Trump's statements, leading to widespread discussions and speculation amongst Bitcoin investors. News outlets also heavily cover these events, further contributing to market fluctuations. Tracking these responses helps to gauge the real-time impact of his words.

- Discussion of how Trump's influence on traditional markets indirectly affects crypto: Trump's actions concerning traditional financial markets—such as tax cuts or deregulation—can indirectly affect Bitcoin. Positive economic news often boosts investor confidence across all asset classes, potentially benefiting Bitcoin as well. Conversely, negative economic news can lead to investors seeking safer havens, including cryptocurrencies.

Reduced Regulatory Uncertainty Under Trump's Influence (or Lack Thereof)

The perceived (or actual) reduction in regulatory uncertainty concerning cryptocurrency during Trump's tenure played a significant role in shaping investor sentiment. While not explicitly pro-crypto, his administration's relatively hands-off approach compared to some other governments created a more favorable climate for investment.

- Comparison of regulatory approaches during different presidential administrations: A comparison of regulatory approaches during different presidential administrations reveals differing levels of intervention in the cryptocurrency space. Trump's administration was generally less interventionist than others, potentially contributing to a more positive perception of the regulatory landscape.

- Analysis of how uncertainty affects institutional investment in Bitcoin: Institutional investors are often risk-averse and require regulatory clarity before making large investments. A less uncertain regulatory environment makes it easier for institutional players to enter the Bitcoin market, further driving up prices.

- Exploration of how less stringent regulations can attract more investors: Less stringent regulations attract more individual investors as well, expanding the market and boosting demand. Increased accessibility and reduced fear of government crackdowns encourage wider adoption.

Trump's Economic Policies and Their Correlation with Bitcoin Price

Trump's economic policies, such as tax cuts and deregulation, may have influenced Bitcoin's value as a safe haven asset or inflation hedge. Economic uncertainty often drives investors towards assets perceived as less correlated with traditional markets.

- Examination of Bitcoin's performance during periods of economic uncertainty under Trump's presidency: Analyzing Bitcoin's performance during periods of economic uncertainty under Trump's presidency reveals potential correlations between macroeconomic conditions and Bitcoin price movements.

- Discussion of Bitcoin's role as a hedge against inflation or market instability: Bitcoin is often considered a hedge against inflation or market instability. During times of economic uncertainty, investors might flock to Bitcoin, driving its price upwards.

- Analysis of how investor behavior shifts based on economic predictions: Investor behavior is heavily influenced by economic predictions and forecasts. Positive economic news tends to lead to increased risk appetite, while negative news pushes investors towards safer options like Bitcoin.

Conclusion

This article has explored the potential connections between former President Trump's actions, statements, and policies, and the resulting surge in Bitcoin's price. We examined how Trump's pronouncements influenced market sentiment, how a perceived reduction in regulatory uncertainty encouraged investment, and how his economic policies may have contributed to Bitcoin's role as a safe haven asset. The interplay between political events and the volatile cryptocurrency market is complex and requires ongoing analysis.

Call to Action: While the relationship between Trump's actions and the Bitcoin price surge remains complex and requires further analysis, understanding these potential correlations is crucial for navigating the cryptocurrency market. Stay informed about political developments and their potential impact on your Bitcoin investments. Continue researching the factors influencing Bitcoin price to make informed decisions. Follow our blog for further insights on the ever-changing world of Bitcoin and Bitcoin price analysis.

Featured Posts

-

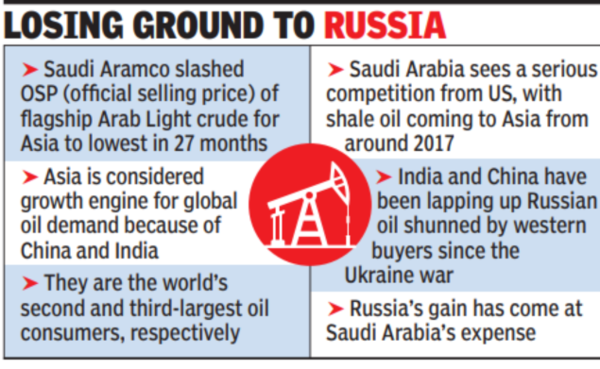

India And Saudi Arabia Partner On Two New Oil Refineries

Apr 24, 2025

India And Saudi Arabia Partner On Two New Oil Refineries

Apr 24, 2025 -

Is The Lg C3 77 Inch Oled Worth The Hype A Review

Apr 24, 2025

Is The Lg C3 77 Inch Oled Worth The Hype A Review

Apr 24, 2025 -

Ai Boom Propels Sk Hynix Past Samsung In Dram Sales

Apr 24, 2025

Ai Boom Propels Sk Hynix Past Samsung In Dram Sales

Apr 24, 2025 -

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 24, 2025

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 24, 2025 -

1 050 V Mware Price Increase At And T Details Broadcoms Extreme Proposal

Apr 24, 2025

1 050 V Mware Price Increase At And T Details Broadcoms Extreme Proposal

Apr 24, 2025