BofA On Stock Market Valuations: A Reason For Investor Calm

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

BofA's comprehensive valuation report provides a detailed assessment of the current stock market landscape, employing various metrics to gauge market health. Their analysis incorporates crucial factors like price-to-earnings ratios (P/E), forward P/E ratios, and other key valuation multiples to arrive at a well-rounded assessment. This sophisticated approach, using models like discounted cash flow (DCF) analysis, adds a layer of credibility to their conclusions.

-

BofA's Overall Valuation Assessment: While acknowledging some sectors are slightly overvalued, BofA's overall assessment suggests that the market is currently fairly valued, considering the broader economic context. This conclusion contrasts with the extreme pessimism observed in some market forecasts.

-

Sector-Specific Valuations: The report highlights specific sectors. For example, while some technology stocks might be deemed overvalued based on historical P/E ratios, BofA points to other sectors, like certain energy companies, exhibiting potentially undervalued characteristics, suggesting opportunities for strategic investors.

-

Specific Company Mentions: Although the report doesn't name specific companies individually in all cases, their analysis often references industry trends that impact individual company valuations, allowing investors to apply their findings on a case-by-case basis.

-

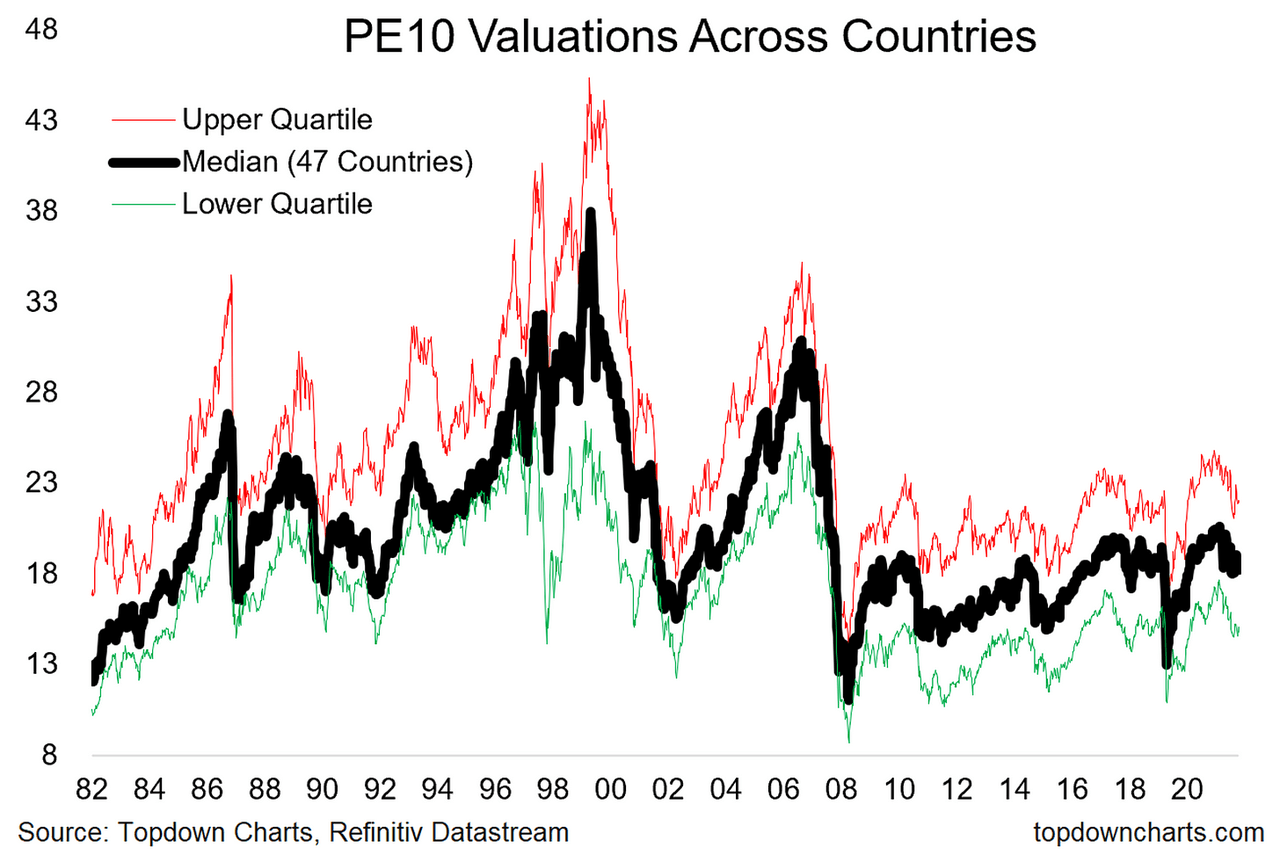

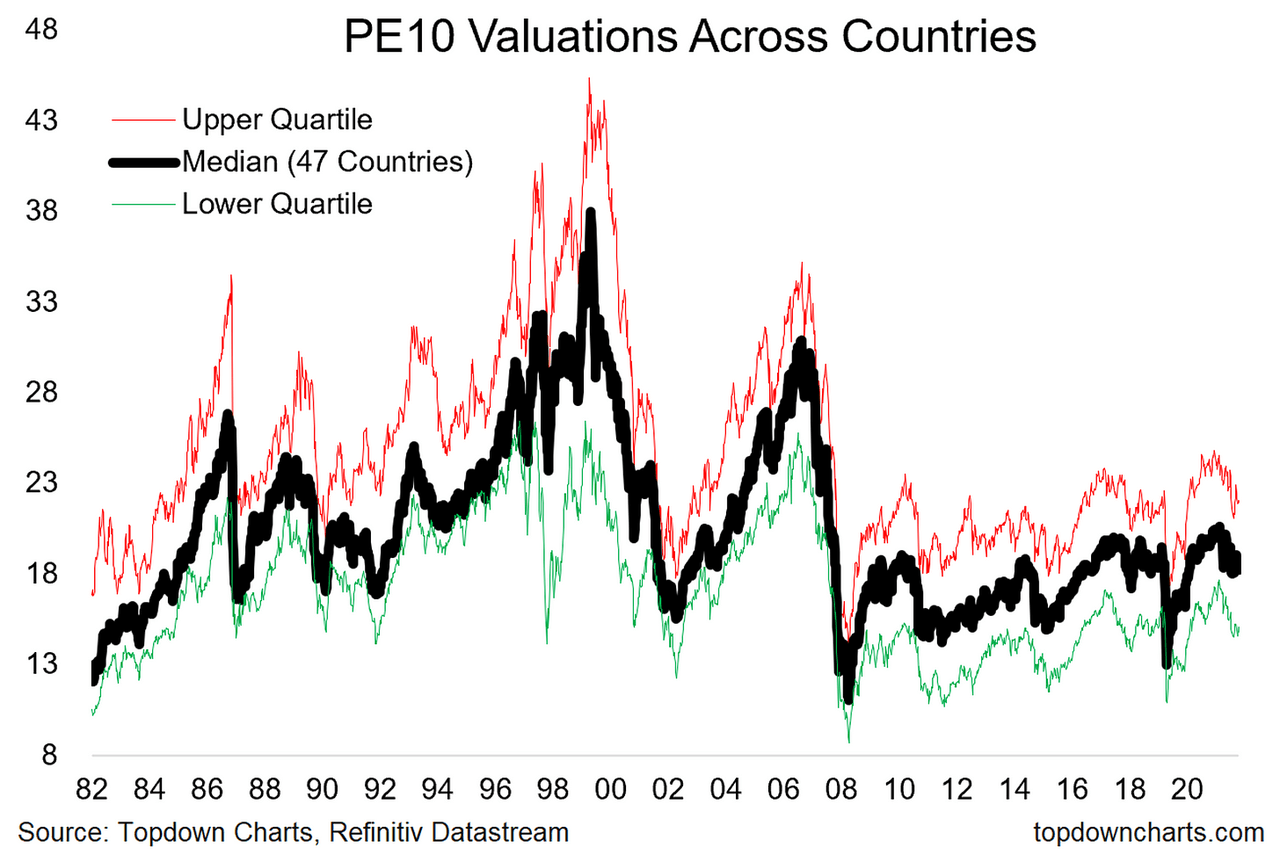

Historical Comparisons: BofA's analysis compares current market capitalization and P/E ratios to long-term historical averages, demonstrating that while valuations might seem high in a vacuum, they are not exceptionally out of line with historical trends, when considered alongside current economic expectations.

Factors Contributing to BofA's Relatively Positive Outlook

BofA's relatively positive outlook isn't based solely on current valuations. Their assessment integrates a complex interplay of economic factors, creating a more nuanced perspective than a simple valuation metric can provide.

-

Economic Forecast and its Impact: BofA's economic forecast projects moderate growth, suggesting that corporate earnings will remain relatively robust, supporting current market valuations. This moderate growth projection factors in the influence of interest rate increases.

-

Interest Rate Hikes and Market Response: While acknowledging the impact of interest rate hikes on borrowing costs, BofA's analysis suggests the market has largely priced in these increases, mitigating their potential to significantly deflate valuations further.

-

Corporate Earnings Growth as a Stabilizing Factor: Projected corporate earnings growth plays a significant role in BofA's positive outlook. Sustained earnings growth can justify existing valuations and even support further appreciation in certain sectors.

-

Geopolitical Considerations: BofA's report explicitly considers geopolitical factors, acknowledging the inherent uncertainties but arguing that current market valuations largely reflect these risks, indicating a degree of resilience in the market's pricing.

BofA's Recommendations for Investors

Based on their thorough valuation analysis and economic outlook, BofA offers several key recommendations for investors navigating the current market conditions.

-

Investment Strategies: BofA advocates a balanced investment strategy, suggesting diversification across different sectors and asset classes.

-

Sector Diversification: The recommendation for diversification reflects their analysis of both overvalued and undervalued sectors, encouraging investors to seize opportunities while mitigating risk.

-

Portfolio Risk Management: While maintaining a long-term perspective, BofA stresses the importance of careful risk management strategies, tailored to individual investor profiles and risk tolerance levels.

-

Long-Term Investing Horizon: The consistent emphasis on long-term investing highlights the importance of avoiding knee-jerk reactions to short-term market fluctuations and focusing on the overall growth potential of carefully selected investments.

Conclusion

BofA's report on stock market valuations offers a valuable perspective for investors, suggesting reasons for calm amidst current market volatility. By considering a wide range of factors – valuations, economic forecasts, and geopolitical risks – BofA paints a picture of a market that, while not without challenges, appears reasonably valued and possesses significant growth potential. The key takeaway is the importance of a well-informed, long-term investment strategy that leverages diversification and careful risk management. Learn more about BofA's analysis on stock market valuations and make informed investment decisions for your portfolio. Understanding BofA's perspective on stock market valuations can help you navigate the current market effectively.

Featured Posts

-

Jeff Bezos Blue Origin A Bigger Flop Than Katy Perrys Super Bowl

Apr 22, 2025

Jeff Bezos Blue Origin A Bigger Flop Than Katy Perrys Super Bowl

Apr 22, 2025 -

Escalating Conflict Trump Administration Announces Additional 1 Billion Cut To Harvard Funding

Apr 22, 2025

Escalating Conflict Trump Administration Announces Additional 1 Billion Cut To Harvard Funding

Apr 22, 2025 -

Pope Francis A Legacy Of Compassion Concludes At 88

Apr 22, 2025

Pope Francis A Legacy Of Compassion Concludes At 88

Apr 22, 2025 -

T Mobile Data Breaches Result In 16 Million Fine

Apr 22, 2025

T Mobile Data Breaches Result In 16 Million Fine

Apr 22, 2025 -

Over The Counter Birth Control A Post Roe Game Changer

Apr 22, 2025

Over The Counter Birth Control A Post Roe Game Changer

Apr 22, 2025