BofA Reassures Investors: Why High Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Rationale Behind the Positive Outlook

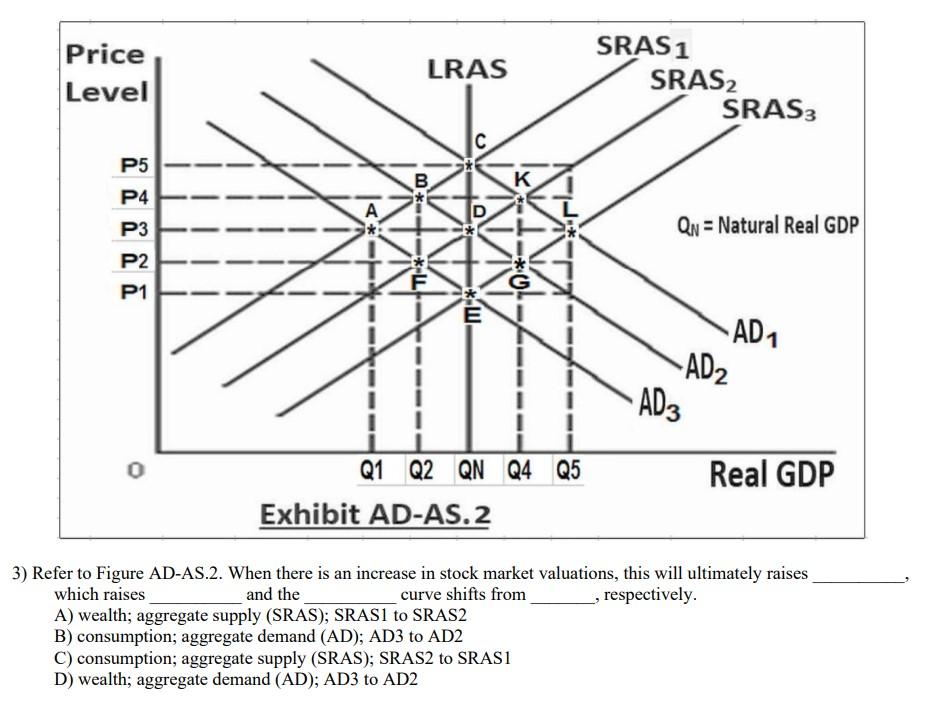

BofA's optimistic stance on high stock market valuations rests on three key pillars: strong corporate earnings and profitability, supportive monetary policy characterized by low interest rates, and the ongoing engine of technological innovation driving growth in specific sectors.

Strong Corporate Earnings and Profitability

BofA's analysis points to robust corporate earnings as a primary justification for the current valuations. Many sectors are demonstrating impressive performance, exceeding expectations and fueling market confidence.

- Technology: The tech sector continues to be a significant driver, with major companies reporting strong revenue growth and innovation.

- Healthcare: Pharmaceuticals and medical technology companies are benefiting from aging populations and advancements in medical research.

- Financials: Despite some economic uncertainty, the financial sector remains relatively stable, contributing positively to overall market performance.

These strong performances are supported by positive economic indicators. GDP growth remains relatively healthy, and consumer spending continues to be robust, indicating a resilient economy capable of supporting high valuations. Data from Q[Insert Quarter] 2024 shows a [Insert Percentage]% increase in corporate profits compared to the same period last year, further validating BofA's assessment.

Low Interest Rates and Monetary Policy

The current environment of low interest rates plays a crucial role in supporting stock market valuations. Central bank policies designed to stimulate economic growth have kept borrowing costs low, encouraging investment and fueling corporate expansion.

- Easy Monetary Policy: Low interest rates make borrowing cheaper for companies, allowing them to invest in growth initiatives and increase profitability.

- Increased Liquidity: Abundant liquidity in the market makes it easier for investors to acquire assets, driving up demand and prices.

- Reduced Risk-Free Return: Low interest rates on government bonds make stocks, with their potential for higher returns, more attractive.

While future interest rate changes remain uncertain, BofA's analysis suggests that any increases are likely to be gradual, minimizing the potential negative impact on stock prices. Experts at BofA predict a slow and controlled increase in rates, allowing the market to adapt and minimizing significant shocks.

Technological Innovation and Growth Sectors

The rapid pace of technological innovation continues to be a powerful catalyst for stock market growth, counteracting concerns related to high valuations. Emerging industries and groundbreaking technologies offer significant growth potential, justifying the higher valuations in these sectors.

- Artificial Intelligence (AI): The widespread adoption of AI across various industries is creating new revenue streams and driving significant growth for many companies.

- Renewable Energy: Investments in renewable energy technologies are booming, driven by increasing environmental awareness and government incentives.

- Biotechnology: Advancements in biotechnology and genetic engineering are leading to new breakthroughs and significant market opportunities.

These high-growth sectors are not only generating impressive returns but also attract significant investment, further contributing to overall market valuations. The dynamism and future potential of these sectors are seen by BofA as a counterbalance to concerns about high valuations in the broader market.

Addressing Common Concerns About High Stock Market Valuations

While BofA's outlook is optimistic, it acknowledges the validity of some concerns about high stock market valuations. This section addresses some of the most commonly cited anxieties.

The P/E Ratio Debate

The high Price-to-Earnings (P/E) ratios of some companies are frequently cited as a cause for concern. However, BofA argues that relying solely on P/E ratios can be misleading.

- Alternative Valuation Metrics: BofA points to other valuation metrics, such as Price-to-Sales (P/S) and Price-to-Book (P/B) ratios, which may offer a more balanced perspective.

- Growth Expectations: High P/E ratios can be justified if companies are expected to experience significant future growth. BofA's analysis takes into account future earnings projections.

- Sector-Specific Variations: P/E ratios vary significantly across sectors; comparing companies across different industries using only P/E ratios can be inaccurate.

Potential Market Corrections and Volatility

BofA acknowledges the possibility of market corrections and periods of increased volatility. However, the firm believes that these are manageable risks within the broader context of positive long-term growth.

- Gradual Adjustments: BofA anticipates any corrections to be gradual adjustments rather than sharp declines, allowing investors time to adapt.

- Risk Mitigation Strategies: The firm suggests strategies such as diversification and disciplined portfolio management to mitigate potential risks.

- Long-Term Growth Potential: The underlying strength of the economy and corporate earnings supports BofA's belief in the long-term potential for growth despite short-term fluctuations.

Geopolitical Risks and Their Impact

Geopolitical risks, such as trade tensions or regional conflicts, are always potential threats to market stability. BofA's assessment incorporates these risks.

- Risk Assessment and Incorporation: BofA analysts closely monitor geopolitical developments and incorporate potential impacts into their valuations.

- Market Resilience: The market has historically shown resilience to geopolitical shocks, and BofA believes the current situation is manageable.

- Diversification as a Hedge: Diversification across different asset classes and geographies is a key strategy for mitigating geopolitical risks.

Conclusion

BofA's analysis offers a reassuring perspective on high stock market valuations. Strong corporate earnings, supportive monetary policy, and the transformative power of technological innovation provide compelling reasons for a cautiously optimistic outlook. While market volatility is inherent, BofA's analysis provides a compelling argument for a nuanced perspective on high stock market valuations. Learn more about BofA's investment strategies and gain a deeper understanding of the current market landscape. The long-term potential for growth remains substantial, even with currently elevated valuations. Understanding the nuances of stock market valuations is crucial for informed investment decisions.

Featured Posts

-

Analyzing A Startup Airlines Reliance On Deportation Flights

Apr 24, 2025

Analyzing A Startup Airlines Reliance On Deportation Flights

Apr 24, 2025 -

Tyler Herro Wins Nba 3 Point Contest Defeats Buddy Hield In Thrilling Finale

Apr 24, 2025

Tyler Herro Wins Nba 3 Point Contest Defeats Buddy Hield In Thrilling Finale

Apr 24, 2025 -

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 24, 2025

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 24, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025 -

Analyzing The Trend Betting On The Destruction Of Los Angeles

Apr 24, 2025

Analyzing The Trend Betting On The Destruction Of Los Angeles

Apr 24, 2025