BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale Behind Downplaying Valuation Concerns

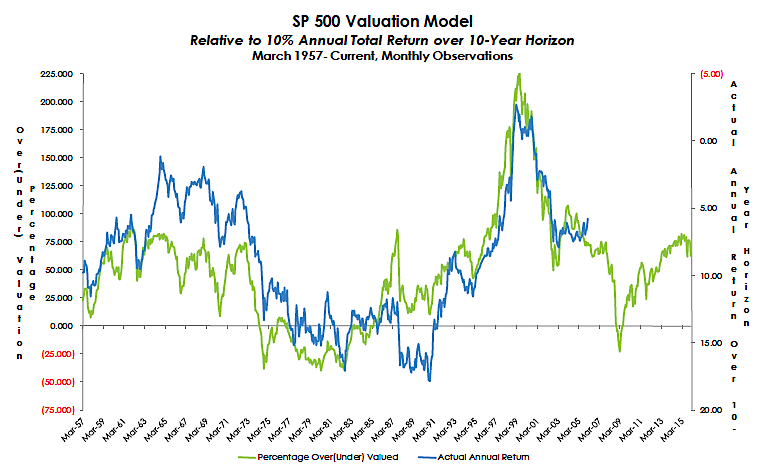

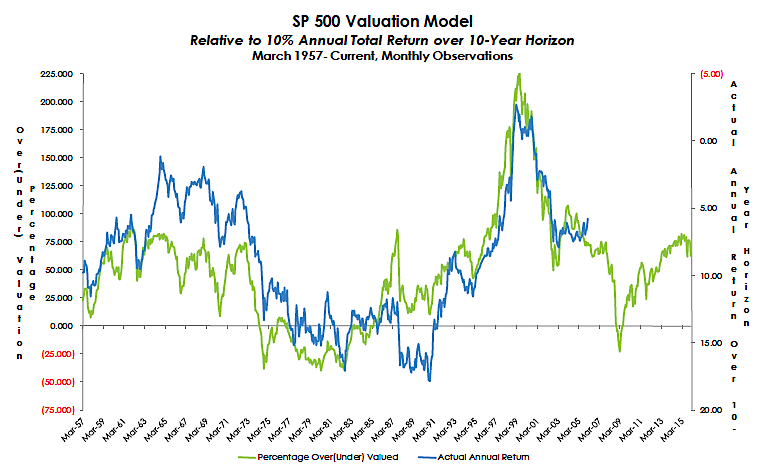

BofA's assessment suggests that current stock market valuations, while high, aren't necessarily cause for alarm. Their analysis hinges on several key factors:

-

Robust Corporate Earnings Growth: BofA points to strong corporate earnings growth as a key justification for the current valuations. Many companies are exceeding expectations, demonstrating resilience despite economic headwinds. This robust earnings growth helps to support higher price-to-earnings (P/E) ratios, a common valuation metric. They argue that future earnings growth could further justify current prices.

-

Falling Inflation and Interest Rate Impacts: The recent decline in inflation has led to expectations of slower interest rate hikes by central banks. Lower interest rates generally make borrowing cheaper for companies and stimulate investment, thereby boosting future earnings potential. BofA incorporates this into their discounted cash flow (DCF) models, which suggest current valuations are not overly inflated.

-

Potential for Earnings Surprises: BofA's analysis anticipates the possibility of positive earnings surprises from several key sectors. This could further support current market valuations and potentially drive further market growth.

-

Supporting Economic Factors: BofA also highlights the resilience of the consumer and the labor market as contributing factors to their relatively optimistic outlook. Strong consumer spending and low unemployment suggest continued economic strength that could further bolster corporate earnings.

-

Counterarguments Acknowledged: It's important to acknowledge that not everyone agrees with BofA's assessment. Critics argue that current valuations are still historically high and that a correction remains a possibility, driven by factors like persistent inflation or unexpected geopolitical events.

Understanding the Current Market Environment

The current market environment is undeniably complex. Significant market volatility persists, driven by several factors:

-

Geopolitical Risks: The ongoing war in Ukraine and other geopolitical tensions contribute to uncertainty in the market. These uncertainties can impact investor sentiment and market valuations.

-

Inflation Trends and Interest Rate Hikes: While inflation is cooling, it still remains above target levels in many countries. Central banks continue to grapple with balancing inflation control and economic growth, leading to ongoing uncertainty regarding future interest rate decisions.

-

Recession Probabilities: The possibility of a recession continues to loom large in the minds of investors. While BofA's analysis seems to downplay this risk, it remains a potential headwind for market valuations.

-

BofA's Risk Incorporation: In their analysis, BofA likely incorporates these risks to some extent, adjusting their valuation models to reflect the potential impact of these factors. The degree to which these risks are factored in is key to understanding their overall conclusion.

-

Investment Strategies: Given the market uncertainty, investors should consider their risk tolerance when formulating their investment strategies. Some might choose a more conservative approach, focusing on defensive stocks or bonds, while others might adopt a more growth-oriented strategy, seeking higher returns despite higher risks.

Analyzing BofA's Track Record and Expertise

BofA is a major global financial institution with extensive research capabilities and a long history in investment banking and financial analysis. Their research often influences market sentiment, making their opinions highly valued. They possess significant expertise in macroeconomic forecasting and equity valuation.

-

Successful Predictions: BofA has a track record of successful market predictions, although like any financial institution, their forecasts have not always been accurate.

-

Past Inaccuracies: It's crucial to acknowledge that no financial institution can perfectly predict the future. BofA, like others, has had instances where their predictions were inaccurate. Objectivity requires considering both their successes and failures.

Implications for Investors: Should You Buy, Sell, or Hold?

BofA's analysis suggests that while valuations are stretched, the underlying fundamentals of the market remain relatively strong. However, the current market environment requires careful consideration:

-

Investment Decisions: Investors should base their decisions on their individual risk profiles and long-term investment goals. Those with a higher risk tolerance and longer time horizons might find BofA's assessment more encouraging, while more risk-averse investors might prefer a more cautious approach.

-

Portfolio Strategy: Diversification remains crucial. Investors should spread their investments across different asset classes and sectors to mitigate risk.

-

Risk Management: Careful risk management is paramount. Investors should understand their exposure to various market risks and adjust their portfolios accordingly.

-

Long-Term vs. Short-Term: BofA's analysis is likely geared towards a long-term perspective. Short-term traders may need to consider additional factors and shorter-term market trends.

-

Professional Advice: It is strongly recommended to consult a financial advisor before making any significant investment decisions.

Conclusion

BofA's assessment of stretched stock market valuations provides a valuable perspective, suggesting that current high valuations are not necessarily an immediate cause for panic. Their analysis highlights strong corporate earnings, the impact of falling inflation on interest rates, and the potential for future earnings surprises. However, the current market environment remains complex, with geopolitical risks, inflation concerns, and recession probabilities needing careful consideration. While BofA suggests that stretched stock market valuations are not necessarily cause for immediate concern, it's crucial to conduct your own research and potentially consult a financial advisor before making any investment decisions based on this analysis. Remember to carefully evaluate your risk tolerance and investment goals before making any changes to your portfolio.

Featured Posts

-

Pirates Steal Victory From Yankees With Walk Off In Extra Innings

Apr 28, 2025

Pirates Steal Victory From Yankees With Walk Off In Extra Innings

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025 Free Live Stream

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025 Free Live Stream

Apr 28, 2025 -

Analysis Of Trumps Campus Crackdown Consequences For All Colleges And Universities

Apr 28, 2025

Analysis Of Trumps Campus Crackdown Consequences For All Colleges And Universities

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Reports Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Reports Extreme Price Increase

Apr 28, 2025 -

The Proposed Broadcom V Mware Acquisition An Extreme Price Surge

Apr 28, 2025

The Proposed Broadcom V Mware Acquisition An Extreme Price Surge

Apr 28, 2025