Broadcom's VMware Deal: AT&T Reveals A Staggering Price Increase

Table of Contents

AT&T's Price Increase: The Numbers and the Impact

AT&T announced a significant price increase for its VMware services, impacting many businesses relying on this crucial technology. This price hike is a direct consequence of the Broadcom VMware acquisition and has significant implications for the telecom industry and beyond.

-

The Percentage Increase: AT&T announced a 20% price increase for its VMware services, a staggering jump that has sent shockwaves through the industry. This affects a broad range of VMware solutions, significantly impacting operational budgets.

-

VMware Services Affected: This substantial increase impacts key VMware services including vSphere (server virtualization), vSAN (virtual storage), and NSX (network virtualization). These are core components of many enterprise IT infrastructures, making the price hike particularly impactful.

-

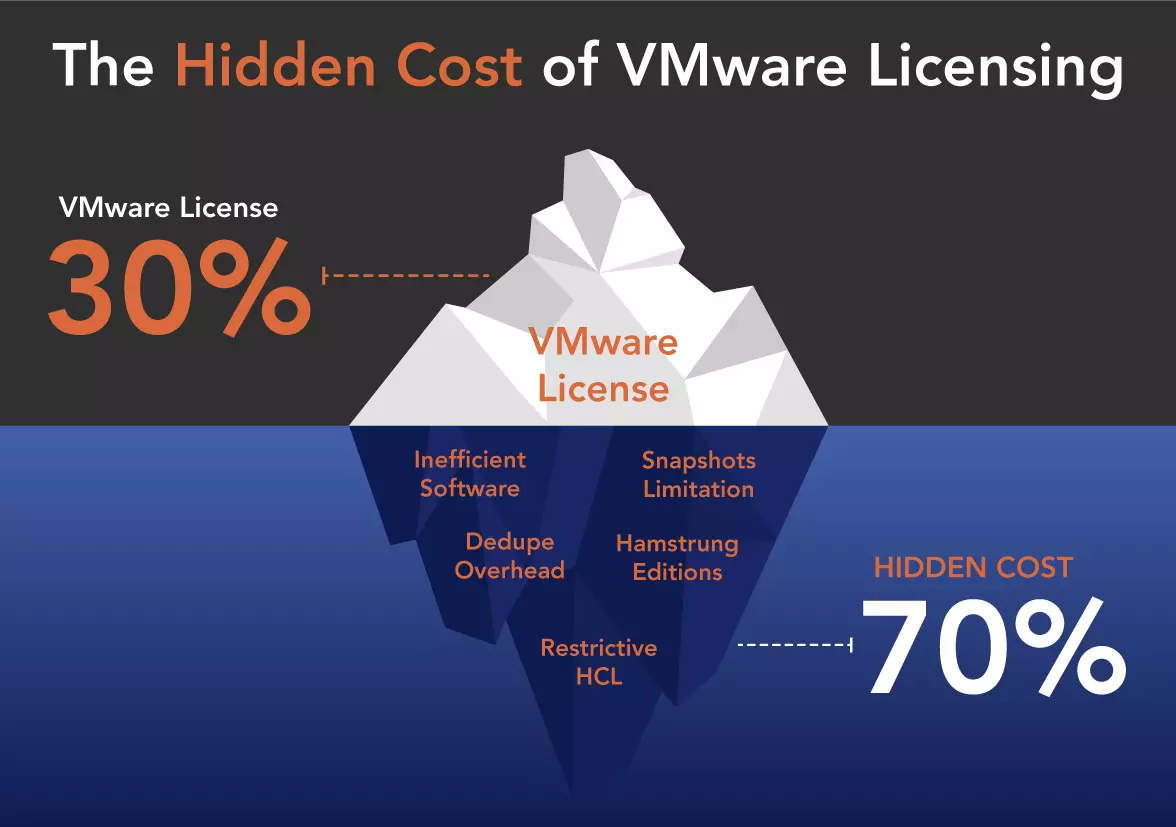

Financial Burden on Businesses: For businesses already grappling with inflation and rising operational costs, this represents a significant blow to IT budgets. Many organizations may need to re-evaluate their IT spending strategies and potentially look for alternative virtualization solutions. The ripple effect could be felt throughout supply chains and ultimately impact end consumers.

-

Impact on AT&T's Competitiveness: The increased cost of VMware services could impact AT&T's profitability and potentially make them less competitive in the market. Higher operational costs may need to be passed on to customers, affecting their pricing strategies and market positioning.

Analyzing the Rationale Behind AT&T's Decision

The rationale behind AT&T's price increase is multifaceted and likely linked to Broadcom's acquisition of VMware.

-

Broadcom's Consolidation of Power: One possible explanation is the consolidation of power following Broadcom's acquisition of VMware. This acquisition creates a powerful entity controlling a significant portion of the virtualization market, potentially leading to increased pricing leverage.

-

Broadcom's Acquisition Cost Recovery: Broadcom may be aiming to recoup its substantial acquisition costs and increase profitability by raising prices. This strategy is common after large mergers and acquisitions, allowing the acquiring company to offset the costs and maximize returns for shareholders.

-

Market Dynamics: The increasing consolidation in the telecom and cloud computing markets is driving up prices across the board. The industry is seeing a trend of fewer, larger players, resulting in less competition and increased pricing power for the dominant entities.

Broader Implications of Broadcom's VMware Deal

The Broadcom-VMware deal has far-reaching implications that extend beyond the immediate price increases announced by AT&T.

-

Antitrust Concerns: Regulators are scrutinizing the Broadcom-VMware deal for potential anti-competitive practices. The acquisition significantly increases Broadcom's market power, raising concerns about monopolies and reduced competition. Investigations are underway in multiple jurisdictions to assess the potential for anti-competitive behavior.

-

Impact on Market Competition: The merger could lead to reduced competition and less innovation in the virtualization market. With less competition, there is less pressure to offer innovative solutions or competitive pricing, potentially stifling progress in the field.

-

Long-Term Effects on Enterprise Customers: Businesses are now faced with greater dependence on a single powerful entity for critical virtualization technologies. This reliance raises concerns about potential vendor lock-in, limited choices, and the risk of price increases without competitive alternatives.

Conclusion

The Broadcom-VMware deal, coupled with AT&T's significant price increase, highlights the evolving dynamics within the technology industry. The implications are far-reaching, affecting not only major telecom providers like AT&T but also countless businesses reliant on VMware technologies. The acquisition raises concerns about market concentration, potential price gouging, and the overall competitiveness of the cloud computing ecosystem. The impact of the Broadcom VMware acquisition needs to be carefully considered by businesses relying on these technologies.

Call to Action: Stay informed about the ongoing developments surrounding Broadcom's VMware acquisition and its impact on pricing. Monitor industry news and analyze the implications for your business to proactively manage your IT spending and explore alternative solutions in light of these significant price increases driven by the Broadcom VMware deal. Consider diversifying your technology stack and exploring open-source alternatives to mitigate risk and reduce dependence on a single vendor.

Featured Posts

-

Fn Abwzby Tfasyl Almerd Almntzr Fy 19 Nwfmbr

Apr 28, 2025

Fn Abwzby Tfasyl Almerd Almntzr Fy 19 Nwfmbr

Apr 28, 2025 -

Sharp Increase In V Mware Costs At And T Challenges Broadcoms Pricing

Apr 28, 2025

Sharp Increase In V Mware Costs At And T Challenges Broadcoms Pricing

Apr 28, 2025 -

Us Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025

Us Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Dwyane Wade On Doris Burkes Insightful Thunder Timberwolves Commentary

Apr 28, 2025

Dwyane Wade On Doris Burkes Insightful Thunder Timberwolves Commentary

Apr 28, 2025 -

Uae Sim Card With 10 Gb Data Abu Dhabi Pass Discount

Apr 28, 2025

Uae Sim Card With 10 Gb Data Abu Dhabi Pass Discount

Apr 28, 2025