BTC Price Increase: Impact Of Trump's Policies On Cryptocurrency Market

Table of Contents

Deregulation and its Effect on BTC Price

Trump's administration championed deregulation across various sectors, a policy approach with notable implications for the cryptocurrency market. This emphasis on reduced governmental oversight potentially fostered a more favorable environment for investment in riskier assets like Bitcoin.

Reduced Financial Regulation

The push for deregulation created a climate of increased investor appetite for alternative assets. This was partly due to a perception of reduced barriers to entry and increased potential for high returns.

- Examples of specific deregulatory measures: While not directly targeting cryptocurrencies, the general trend towards reduced financial regulation under the Trump administration indirectly impacted investor sentiment. This included potential easing of regulations on financial institutions, allowing them more freedom to invest in emerging markets, including crypto.

- Increased investor appetite for alternative assets: With traditional investment avenues potentially appearing less lucrative or more heavily regulated, some investors turned to cryptocurrencies like Bitcoin as a way to diversify their portfolios and potentially achieve higher returns.

- Impact on traditional financial markets: Fluctuations in the stock market and other traditional assets, partly driven by Trump's economic policies, influenced the perception of risk and subsequently affected the flow of capital into crypto markets.

Impact on Traditional Markets

Shifts in traditional financial markets, influenced by Trump's policies, indirectly influenced Bitcoin's price. Periods of uncertainty in traditional markets often led investors to seek safe havens or hedges against potential losses.

- Specific examples of market shifts: Consider significant events such as tax cuts or trade disputes. These created market volatility which in turn impacted investor behavior.

- Correlation between traditional market volatility and BTC price movements: Increased uncertainty and volatility in traditional markets often correlated with increased demand for Bitcoin as investors sought diversification and a perceived store of value.

- Bitcoin as a potential inflation hedge: Some investors viewed Bitcoin as a potential hedge against inflation, especially during periods of economic uncertainty or loose monetary policy.

Increased Uncertainty and its Role in BTC Volatility

While deregulation potentially boosted investor interest, the lack of clear regulatory frameworks for cryptocurrencies under the Trump administration contributed significantly to BTC price volatility.

Regulatory Uncertainty surrounding Cryptocurrencies

The absence of comprehensive cryptocurrency regulations created a climate of uncertainty, fueling both price surges (fueled by FOMO) and sharp drops driven by fear and regulatory speculation.

- Examples of statements or actions from the administration regarding crypto: The inconsistent and at times contradictory statements by various government officials regarding cryptocurrency regulation contributed to the uncertainty.

- Impact of this uncertainty on investor confidence: Periods of regulatory uncertainty could trigger both panic selling and frenzied buying, resulting in significant price swings.

- The "fear of missing out" (FOMO) factor: The uncertainty also fueled a "fear of missing out" mentality amongst some investors, potentially driving prices higher.

Geopolitical Events and their Influence

International events and trade tensions during the Trump presidency also played a part in shaping Bitcoin's price.

- Examples of significant geopolitical events: Trade wars, international sanctions, and other geopolitical events created uncertainty in global markets, potentially driving demand for Bitcoin as a decentralized, less susceptible asset.

- Impact on investor risk appetite and subsequent BTC price fluctuations: Increased geopolitical tensions often led to reduced risk appetite in traditional markets, causing a shift towards assets perceived as less correlated to traditional financial systems, such as Bitcoin.

- Bitcoin's role as a potential safe haven asset: During periods of geopolitical instability, Bitcoin’s decentralized nature potentially made it attractive as a safe haven asset for investors seeking to protect their wealth from global uncertainties.

The Influence of Tax Policies on Cryptocurrency Investment

Changes in tax policies, or the lack thereof, regarding cryptocurrency investment can significantly impact market behavior and therefore BTC price.

Tax implications for crypto trading

While there weren't significant changes in the US tax code specifically targeting cryptocurrency during this period, the lack of clear guidelines still impacted how investors approached crypto trading.

- Details on specific tax policies or proposals: The existing tax framework for cryptocurrencies, which treated them as property rather than currency, had implications for capital gains taxes and other relevant financial considerations.

- Analysis of how tax implications influenced the attractiveness of Bitcoin as an investment: The tax implications of holding and trading Bitcoin influenced investment strategies and potentially affected market liquidity.

- Potential impact on market liquidity: Uncertainty about tax reporting and liability could potentially discourage some investors, reducing overall market liquidity.

Conclusion

The relationship between Trump's economic policies and the BTC price increase is complex and multifaceted. Deregulation, while potentially boosting investor interest, also exacerbated the challenges created by regulatory uncertainty. Geopolitical events further contributed to Bitcoin's volatility, highlighting its dual role as a potentially high-reward investment and a hedge against global instability. Understanding the interplay of these factors is crucial for navigating the cryptocurrency market. Understand the impact of government policy on your BTC investments. Learn more about how political decisions affect the cryptocurrency market. Explore the complex relationship between economic policy and the BTC price increase. Stay informed about factors affecting BTC price.

Featured Posts

-

Luxury Car Sales In China Analyzing The Difficulties Faced By Brands Like Bmw And Porsche

Apr 24, 2025

Luxury Car Sales In China Analyzing The Difficulties Faced By Brands Like Bmw And Porsche

Apr 24, 2025 -

Car Dealerships Continue To Oppose Mandatory Electric Vehicle Sales

Apr 24, 2025

Car Dealerships Continue To Oppose Mandatory Electric Vehicle Sales

Apr 24, 2025 -

Nba All Star Weekend Herros 3 Point Show And Cavs Skills Challenge Success

Apr 24, 2025

Nba All Star Weekend Herros 3 Point Show And Cavs Skills Challenge Success

Apr 24, 2025 -

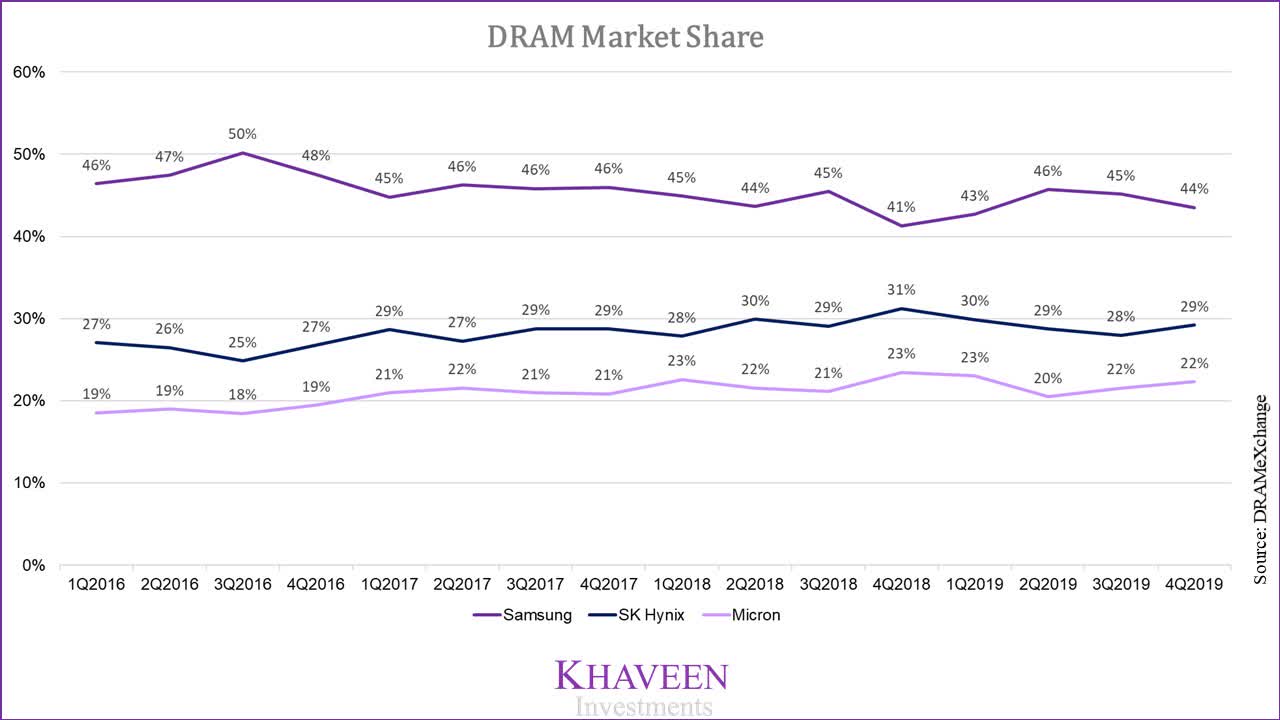

Dram Market Reshaped Sk Hynixs Ai Driven Ascent To The Top

Apr 24, 2025

Dram Market Reshaped Sk Hynixs Ai Driven Ascent To The Top

Apr 24, 2025 -

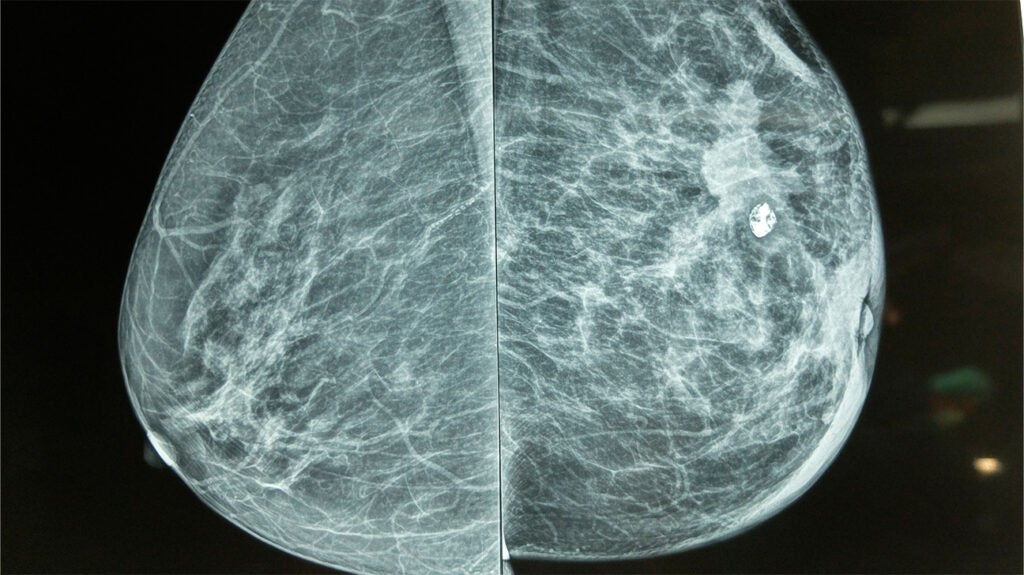

Breast Cancer Diagnosis After Missed Mammogram Lessons From Tina Knowles Experience

Apr 24, 2025

Breast Cancer Diagnosis After Missed Mammogram Lessons From Tina Knowles Experience

Apr 24, 2025