Canada Election: Conservatives Pledge Lower Taxes, Fiscal Responsibility

Table of Contents

Core Promises: Tax Cuts and Economic Growth

The Conservative party's core promise revolves around significant tax cuts to stimulate economic growth. Their plan includes reductions across various tax brackets, targeting both individuals and corporations. Understanding the specifics of these proposed cuts is crucial for voters assessing the Canada Election Conservatives platform.

- Income Tax Reductions: The Conservatives propose a reduction in personal income tax rates, with specific percentage decreases varying across different income brackets. For example, they may propose a 10% reduction for the lowest bracket and a 5% reduction for higher brackets. The exact figures are subject to change and should be verified on their official platform.

- Corporate Tax Cuts: A reduction in corporate tax rates is also planned, aiming to encourage business investment and job creation. This, they argue, will lead to increased economic activity and higher tax revenues in the long run. The proposed reduction is likely to affect small businesses and large corporations alike.

- Tax Credit Enhancements: The Conservatives may propose enhancements to existing tax credits or introduce new ones to benefit specific groups, such as families with children or low-income earners. These credits could offset the impact of tax cuts on lower-income individuals.

- Tax System Simplification: The party's platform may include plans to simplify the Canadian tax system, making it easier for individuals and businesses to comply. This simplification could involve reducing the number of tax brackets or streamlining deductions. The goal is to improve efficiency and reduce administrative burdens.

The Conservatives project that these tax cuts, combined with their planned spending reductions (detailed below), will lead to significant economic growth, outweighing the initial loss of government revenue. However, independent economic analysis is needed to verify these projections.

Fiscal Responsibility: Managing the National Debt

A key aspect of the Canada Election Conservatives platform is a commitment to fiscal responsibility and a plan to manage Canada's national debt. Their strategy involves a combination of spending cuts and revenue generation initiatives.

- Targeted Spending Cuts: The Conservatives have outlined plans to reduce government spending in various areas. Specific details are usually found in their official election platform. Areas targeted might include government administration, social programs (with potential restructuring rather than outright elimination), and potentially defense spending. The party will likely highlight inefficiencies and waste to justify these cuts.

- Increased Efficiency and Reduced Waste: The party’s plan aims to improve the efficiency of government operations, reducing waste and duplication to free up resources. This could involve streamlining bureaucratic processes and modernizing government systems.

- Revenue Generation Beyond Tax Cuts: While tax cuts are central, the Conservatives may also propose measures to increase government revenue, such as strengthening tax collection mechanisms or focusing on economic growth initiatives.

- Projected Timeline for Fiscal Balance: The Conservative party is likely to project a timeline for achieving a balanced budget. This timeframe, along with their proposed mechanisms, will be crucial for voters to assess the realism and effectiveness of their plan. Comparisons to the current government's fiscal track record are essential for a comprehensive evaluation.

Impact on Different Sectors and Voter Demographics

The Conservative platform's impact will vary significantly across different sectors of the Canadian economy and population segments. Understanding these impacts is crucial for analyzing the Canada Election Conservatives strategy.

- High-Income vs. Low-Income Earners: The proposed tax cuts will likely benefit high-income earners more significantly than low-income earners, potentially exacerbating income inequality. The party's platform should clarify the net effect on different income levels, considering both tax cuts and potential changes to social programs.

- Small Businesses and Large Corporations: Corporate tax cuts are intended to stimulate business investment and job creation. However, the specific impact on small businesses versus large corporations will depend on the details of the tax cuts and the overall economic climate.

- Social Programs and Services: Potential spending cuts could lead to reductions or changes in social programs and services. This aspect will undoubtedly be a major point of discussion and concern during the campaign, with the Conservatives needing to address potential negative impacts and explain how they will mitigate these consequences.

- Regional and Demographic Variations: The impact of the Conservative platform is likely to vary across different regions and demographics, reflecting Canada’s diversity. Voters in resource-rich provinces might react differently to the plan than those in other regions. Similarly, the impact on different age groups, ethnic communities, and urban versus rural populations will vary.

Potential Challenges and Criticisms

The Conservative plan faces several potential challenges and criticisms:

- Increased Inequality: Critics argue that the proposed tax cuts will disproportionately benefit high-income earners, potentially increasing income inequality. The Conservatives will need to address this concern convincingly.

- Reduced Social Services: Spending cuts could lead to reductions in essential social programs, impacting vulnerable populations. The party needs to clearly outline how they will mitigate this risk and ensure the continued provision of necessary social services.

- Economic Risk and Uncertainty: There is always economic uncertainty surrounding large-scale tax cuts and spending adjustments. Independent economic analysis of the Conservative plan’s feasibility and potential long-term consequences is crucial for informed voter assessment.

- Party Responses to Criticisms: How effectively the Conservative party addresses and counters these criticisms will significantly influence public perception and voter decisions.

Conclusion

The Conservative party's platform for the Canada election hinges on a core promise of lower taxes alongside responsible fiscal management. While the proposed tax cuts aim to stimulate economic growth and create jobs, their success depends significantly on the effectiveness of the planned spending reductions and their ability to achieve fiscal balance without negatively impacting essential social programs or creating undue economic risk. Understanding the Canada Election Conservatives economic plan, its potential benefits and drawbacks, is essential for making an informed voting decision. Stay engaged by following reputable news sources and analyzing the complete party platform to ensure your voice is heard in this crucial Canada Election Conservatives campaign. Make sure you vote!

Featured Posts

-

Chainalysis And Alterya A Strategic Merger In Blockchain And Ai

Apr 24, 2025

Chainalysis And Alterya A Strategic Merger In Blockchain And Ai

Apr 24, 2025 -

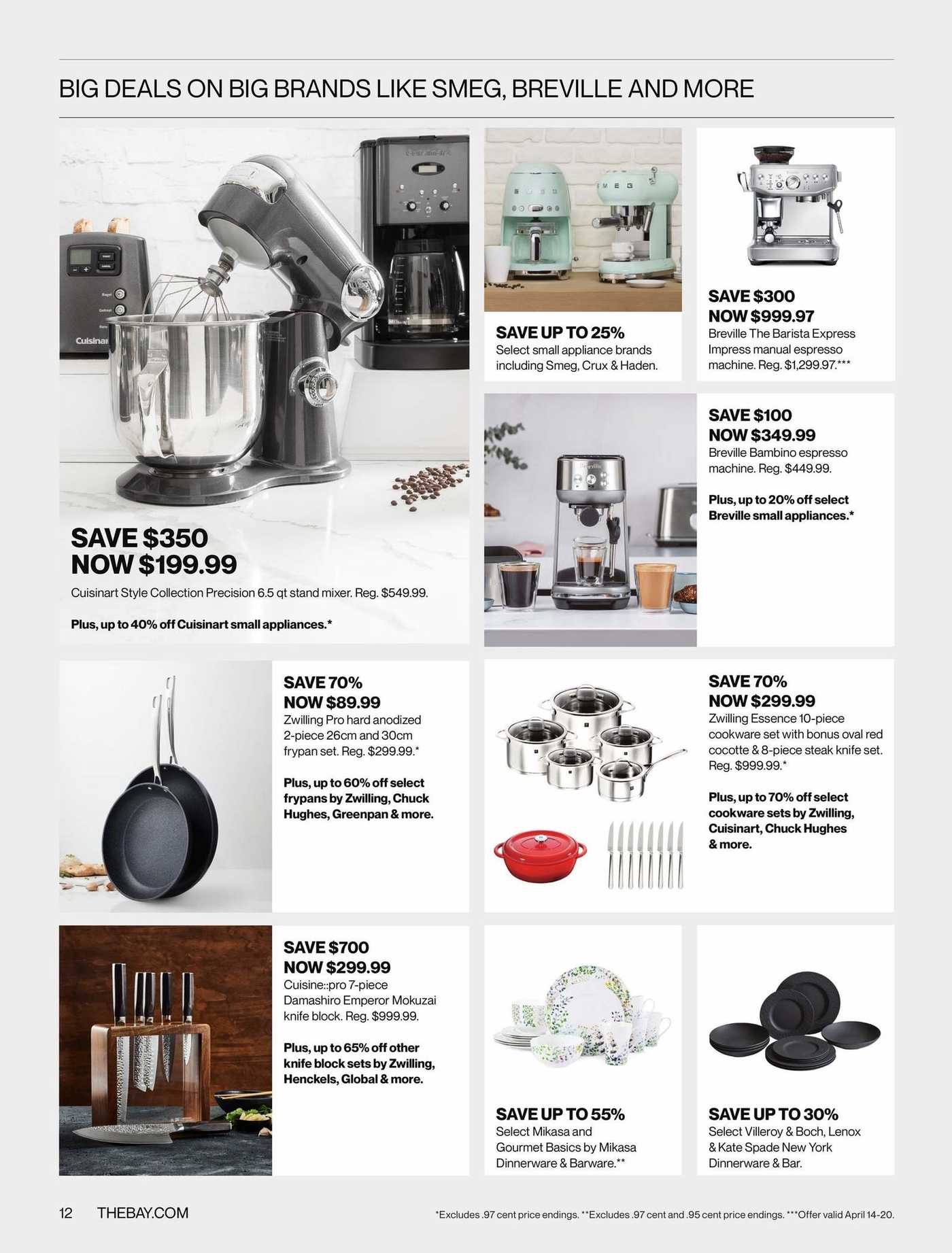

Hudsons Bay 65 Leases Attract Significant Interest

Apr 24, 2025

Hudsons Bay 65 Leases Attract Significant Interest

Apr 24, 2025 -

The Countrys Evolving Business Landscape Key Growth Areas Highlighted

Apr 24, 2025

The Countrys Evolving Business Landscape Key Growth Areas Highlighted

Apr 24, 2025 -

Oblivion Remastered Download And Play Today

Apr 24, 2025

Oblivion Remastered Download And Play Today

Apr 24, 2025 -

Negotiation Talks Emerge After Harvard Files Lawsuit Against Trump Administration

Apr 24, 2025

Negotiation Talks Emerge After Harvard Files Lawsuit Against Trump Administration

Apr 24, 2025