Canada's Fiscal Future: A Vision Of Responsible Spending

Table of Contents

Analyzing Current Spending Trends in Canada

Understanding Canada's current fiscal situation is crucial for planning a future of responsible spending. This involves examining government spending, the Canadian budget, the fiscal deficit, and the level of public debt.

-

Government Expenditure: The Canadian government allocates significant funds to key areas such as healthcare, education, and national defense. Analyzing the proportion of the budget dedicated to each sector reveals priorities and potential areas for optimization. For example, while healthcare receives a substantial portion, a closer look at efficiency and cost-effectiveness within the system is necessary for responsible spending.

-

Fiscal Deficit and Public Debt: Canada's fiscal deficit represents the difference between government revenues and expenditures in a given year. A persistent deficit contributes to the accumulation of public debt. Understanding the current deficit and the overall level of public debt is critical to assessing Canada's long-term fiscal health. Transparent reporting and publicly available data are essential for informed discussion and decision-making.

-

International Comparison: Comparing Canada's spending levels and debt-to-GDP ratios with other developed nations, particularly members of the OECD (Organisation for Economic Co-operation and Development), provides valuable context and benchmarks for evaluating fiscal performance. This comparative analysis allows for identifying areas where Canada excels and where improvements are needed regarding responsible spending practices.

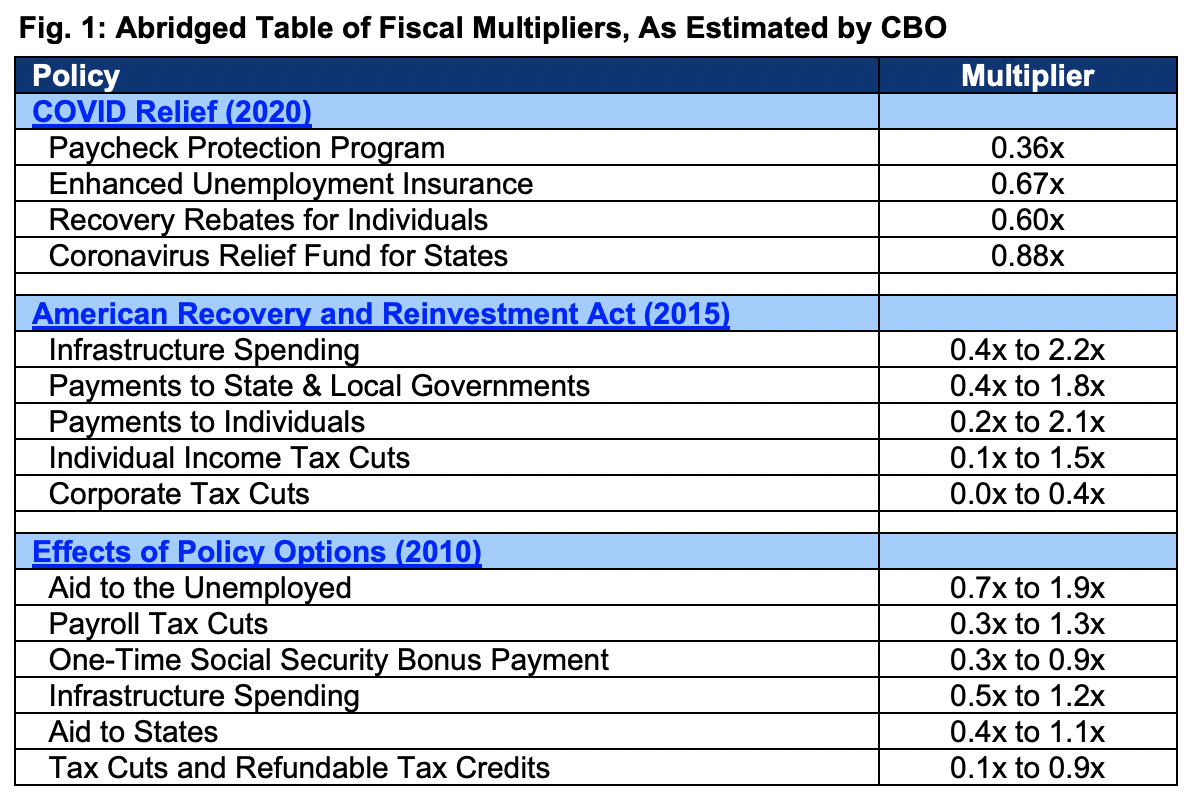

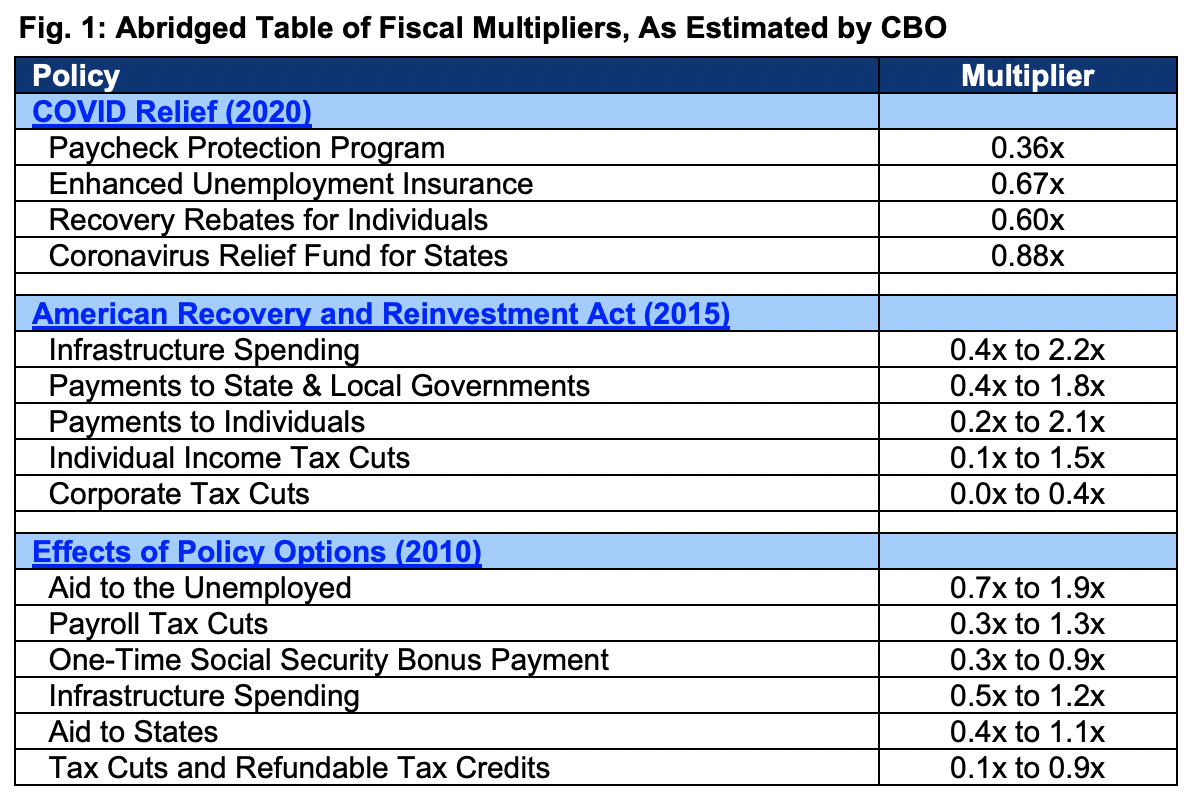

(Include relevant statistics and charts here to illustrate the points. For example, a chart showing the breakdown of government spending by sector or a graph comparing Canada's debt-to-GDP ratio to other OECD countries.)

Challenges and Opportunities for Responsible Spending

Canada faces several challenges in maintaining fiscal sustainability, but also possesses significant opportunities for growth.

-

Aging Population: Canada's aging population presents a significant challenge to fiscal sustainability, particularly concerning healthcare and pension costs. Innovative solutions are needed to ensure the long-term viability of these crucial social programs while adhering to responsible spending principles.

-

Infrastructure Investment: Investing in modern infrastructure – including transportation, energy, and digital networks – is vital for driving economic growth and creating jobs. Strategic infrastructure projects can improve productivity, attract investment, and enhance the overall quality of life, making responsible spending in this area a key priority.

-

Social Programs: Balancing the need for robust social programs with the imperative of fiscal responsibility requires careful consideration. Targeted programs and efficient delivery mechanisms are essential to maximize the impact of social spending while minimizing costs.

-

Revenue Generation: Exploring potential revenue generation strategies, such as reforming tax policies to broaden the tax base and address tax avoidance, is crucial for bolstering government revenues and enhancing fiscal sustainability.

-

Technological Advancements and Economic Diversification: Embracing technological advancements and fostering economic diversification can lead to increased productivity, new industries, and improved fiscal outcomes. Investing in research and development, education, and skills training will ensure that Canada can adapt and thrive in a rapidly evolving global economy.

Strategies for Achieving Fiscal Responsibility in Canada

Implementing effective strategies is essential to achieve fiscal responsibility and build a sustainable future for Canada.

-

Improved Budget Planning and Transparency: Adopting robust, multi-year budget planning processes and enhancing transparency in government spending are paramount. Clear, accessible information about government finances fosters public trust and facilitates informed debate.

-

Government Efficiency: Identifying and eliminating wasteful government spending through streamlining processes, improving procurement practices, and leveraging technology are essential for maximizing the value of taxpayer dollars.

-

Tax Reform: Progressive tax reforms can enhance the fairness and efficiency of the tax system, broadening the tax base and ensuring a more equitable distribution of the tax burden while contributing to responsible spending.

-

Long-Term Fiscal Planning: Developing and implementing a comprehensive, long-term fiscal plan that considers demographic trends, economic projections, and potential risks allows for proactive management of public finances.

-

Public-Private Partnerships: Utilizing public-private partnerships (PPPs) can facilitate large-scale infrastructure projects by leveraging private sector expertise and capital while sharing risks and benefits. Careful oversight and transparent governance are crucial for the success of these partnerships.

The Importance of Public Engagement in Fiscal Decision-Making

Meaningful public engagement is vital for building consensus and achieving responsible spending.

-

Transparent Communication: Open and transparent communication from the government regarding fiscal policy fosters public trust and enables informed citizen participation in the decision-making process.

-

Public Consultation: Actively seeking public input through budget consultations, town halls, and online forums ensures that diverse perspectives are considered when shaping fiscal policy.

-

Accountable Governance: Accountable governance mechanisms, including strong oversight institutions and independent audits, are essential for ensuring responsible spending and preventing misuse of public funds.

-

Role of Media and Civil Society: The media and civil society organizations play a crucial role in promoting fiscal transparency, holding the government accountable, and fostering informed public discourse.

Conclusion

Securing Canada's fiscal future requires a commitment to responsible spending. This involves careful analysis of current spending trends, addressing looming challenges, and implementing strategic solutions. Improved budget planning, increased government efficiency, and open public engagement are crucial for achieving long-term fiscal sustainability. Responsible spending is not merely about reducing deficits; it's about investing wisely in Canada's future, ensuring the well-being of its citizens, and building a strong and prosperous nation.

Call to Action: Let's work together to build a brighter future for Canada by advocating for responsible spending policies and holding our government accountable for sound fiscal management. Join the conversation and learn more about how you can contribute to a more financially secure Canada.

Featured Posts

-

Facebooks Fate Zuckerbergs Leadership During The Trump Era

Apr 24, 2025

Facebooks Fate Zuckerbergs Leadership During The Trump Era

Apr 24, 2025 -

Oblivion Remastered Download And Play Today

Apr 24, 2025

Oblivion Remastered Download And Play Today

Apr 24, 2025 -

Hopes Shocking Twists Liams Pledge To Steffy And Lunas Impact The Bold And The Beautifuls Upcoming Episodes

Apr 24, 2025

Hopes Shocking Twists Liams Pledge To Steffy And Lunas Impact The Bold And The Beautifuls Upcoming Episodes

Apr 24, 2025 -

77 Lg C3 Oled Tv A Comprehensive Look

Apr 24, 2025

77 Lg C3 Oled Tv A Comprehensive Look

Apr 24, 2025 -

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025