Canadian Funds Flood US Stock Market: Trade War Impact Analyzed

Table of Contents

The Flight to Safety: Why Canadian Investors Are Choosing the US Market

The recent increase in Canadian investment in the US stock market is largely a response to the turbulent global economic landscape.

Uncertainty in Global Markets

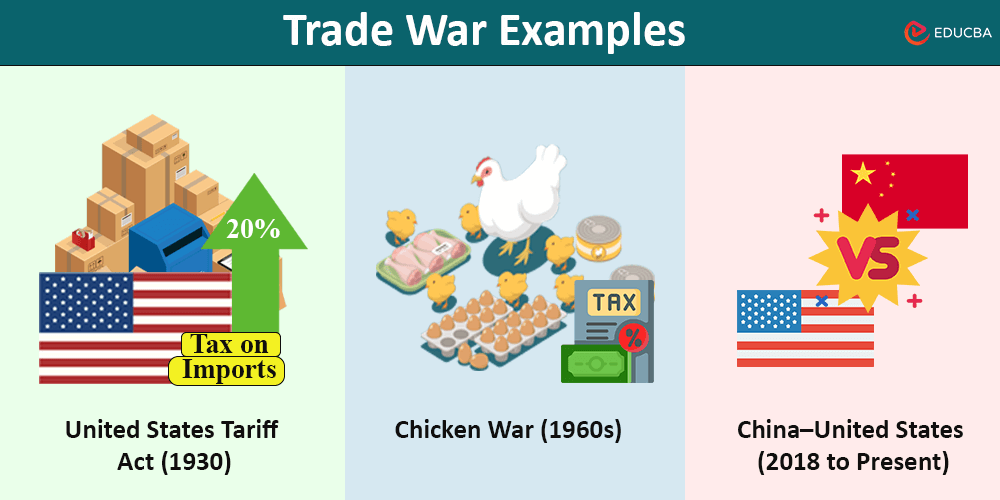

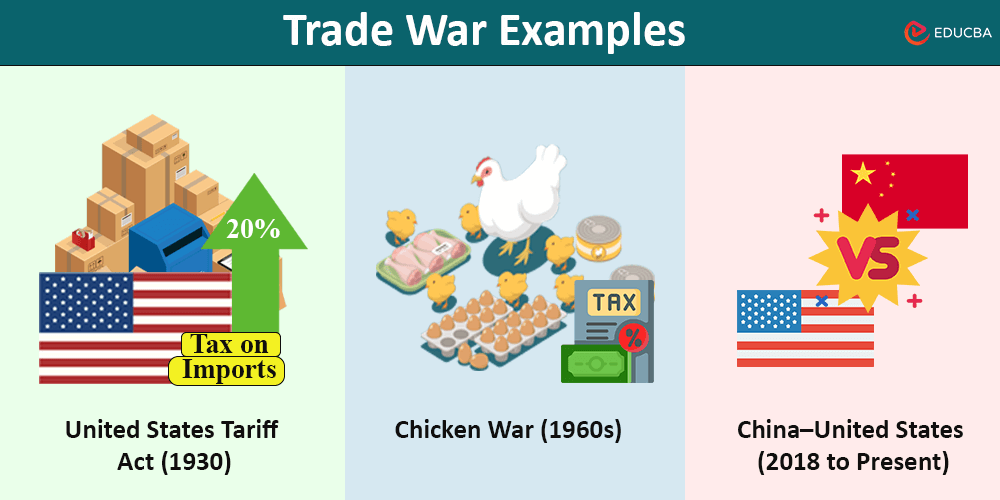

The ongoing trade war has created significant uncertainty, impacting various sectors.

- Trade war uncertainty impacting Canadian businesses reliant on US/Chinese trade: Many Canadian companies rely heavily on trade with both the US and China. The unpredictable nature of tariffs and trade restrictions has introduced substantial risk into their business models, prompting a search for more stable investment opportunities.

- Concerns about global economic slowdown impacting Canadian investment options: The trade war's ripple effect has fueled concerns about a global economic slowdown. This uncertainty makes domestic investment less appealing, pushing investors towards perceived safer havens.

- Search for relative stability in a volatile market environment: With global markets fluctuating wildly, Canadian investors are seeking relatively stable investments to protect their portfolios. The US market, while not immune to global trends, is often viewed as a more stable option.

- Diversification strategy to mitigate risk associated with Canadian market fluctuations: Diversifying investment portfolios across borders is a standard risk management strategy. Investing in the US market allows Canadian investors to reduce their dependence on the performance of the Canadian economy.

The Attractiveness of US Assets

The US market offers several advantages that make it an attractive destination for Canadian investment.

- Strength of the US dollar providing a hedge against currency fluctuations: The US dollar's relative strength offers a hedge against currency fluctuations for Canadian investors, mitigating some of the risks associated with converting Canadian dollars to other currencies.

- Relatively stable US stock market compared to other global markets: While subject to its own volatility, the US stock market is often perceived as relatively stable compared to other global markets, particularly emerging markets more susceptible to trade war shocks.

- Continued growth in certain US sectors, despite trade war headwinds: Despite trade war challenges, specific US sectors continue to show growth, attracting investment from abroad. Technology, healthcare, and certain consumer staples often demonstrate resilience.

- Lower interest rates in the US compared to Canada, making US investments more attractive: Lower interest rates in the US can make certain investment vehicles, such as bonds, more attractive to Canadian investors seeking yield.

The Impact of Trade Wars on Canadian Investment Decisions

The US-China trade war has fundamentally reshaped Canadian investment strategies.

Trade Diversification Strategies

Canadian businesses are actively seeking to diversify their trade relationships.

- Canadian companies seeking to lessen reliance on trade with China: The unpredictability of the US-China trade relationship has prompted Canadian businesses to explore alternative markets and reduce their dependence on Chinese trade.

- US market seen as a more stable and predictable trading partner: Compared to the volatile US-China relationship, the US market is perceived as a more stable and reliable trading partner, offering more predictable business conditions.

- Investments in US companies to secure supply chains and expand market access: Investing in US companies can help Canadian businesses secure supply chains and gain access to the large US consumer market.

Currency Fluctuations and Hedging

Fluctuations in the USD/CAD exchange rate play a crucial role in investment decisions.

- Impact of fluctuating USD/CAD exchange rates on investment returns: The value of Canadian investments in US assets directly depends on the exchange rate. Fluctuations can either increase or decrease the returns for Canadian investors.

- Strategies used by Canadian investors to mitigate currency risk: Sophisticated hedging strategies are used by Canadian investors to mitigate the risks associated with currency fluctuations. These strategies aim to lock in favorable exchange rates, protecting returns.

- Potential for increased profit through strategic currency hedging: Skilled investors can use currency hedging to enhance their returns, making strategic investments despite exchange rate volatility.

Economic Implications for Both Countries

The increased Canadian investment in the US stock market has significant implications for both economies.

Benefits for the US Economy

The influx of Canadian capital provides several benefits to the US economy.

- Increased capital inflow boosts US market liquidity: Additional capital from Canada increases the liquidity of the US stock market, making it more efficient and facilitating trading.

- Supports economic growth through increased investment in US companies: This investment fuels growth by providing capital for expansion, research and development, and job creation.

- Potential job creation spurred by Canadian investment: Canadian investment in US companies can lead to job creation as companies expand their operations to accommodate increased demand or production.

Potential Implications for the Canadian Economy

While beneficial, the trend also presents potential risks for Canada.

- Diversification of investment portfolio reduces reliance on domestic market: This diversification reduces Canada's vulnerability to domestic economic shocks.

- Risk of overexposure to the US market should the US economy falter: Over-reliance on the US market makes Canada vulnerable to a potential downturn in the US economy.

- Potential for capital flight back to Canada if the US market becomes less attractive: If conditions in the US market deteriorate, Canadian investors might repatriate their funds, impacting both markets.

Conclusion

The surge in Canadian investment in the US stock market is a multifaceted phenomenon stemming from global uncertainties and the perceived safety of US assets. While beneficial for the US economy, it necessitates careful risk assessment for Canadian investors. Understanding this intricate dynamic is vital for all stakeholders. To stay informed about the evolving landscape of Canadian investment in the US stock market and its global implications, continue exploring our in-depth analysis and subscribe to our newsletter for regular updates! Learn more about the ongoing impact of Canadian investments in the US stock market and how trade wars influence global finance.

Featured Posts

-

Tigers Skubal Throws 7 Shutout Innings Dominates Brewers

Apr 23, 2025

Tigers Skubal Throws 7 Shutout Innings Dominates Brewers

Apr 23, 2025 -

Nine Stolen Bases Brewers Rewrite Record Books In Historic Game

Apr 23, 2025

Nine Stolen Bases Brewers Rewrite Record Books In Historic Game

Apr 23, 2025 -

Baseball Power Rankings Fan Graphs Perspective March 27 April 6

Apr 23, 2025

Baseball Power Rankings Fan Graphs Perspective March 27 April 6

Apr 23, 2025 -

Athletics Rout Brewers Achieve Unprecedented Win

Apr 23, 2025

Athletics Rout Brewers Achieve Unprecedented Win

Apr 23, 2025 -

Royals Fall To Brewers On Walk Off Bunt

Apr 23, 2025

Royals Fall To Brewers On Walk Off Bunt

Apr 23, 2025