Cantor Fitzgerald In Talks For $3 Billion Crypto SPAC With Tether And SoftBank

Table of Contents

The Players Involved: A Deep Dive

This monumental undertaking involves three key players, each bringing unique strengths and potential challenges to the table.

Cantor Fitzgerald's Role

Cantor Fitzgerald, a well-established player in global financial markets, brings decades of experience in trading, investment banking, and financial technology. Their involvement suggests a significant strategic shift towards the cryptocurrency space. This move positions them to capitalize on the burgeoning crypto market and offer new services to their existing client base, potentially attracting a new generation of investors.

- History of Cantor Fitzgerald: A long and established history in financial markets, building credibility and trust.

- Previous Forays into Innovative Instruments: Demonstrated a willingness to embrace innovative financial technologies and strategies.

- Potential Benefits for Existing Client Base: Expands service offerings and provides access to a high-growth asset class. This could attract new clients while strengthening relationships with existing ones.

Tether's Involvement

Tether, the world's largest stablecoin by market capitalization, is a controversial but undeniably influential player in the crypto ecosystem. Its participation in this SPAC is particularly noteworthy, given the ongoing regulatory scrutiny surrounding its reserves and operations. However, the potential for increased legitimacy and market expansion through this partnership could be significant.

- Tether's Market Capitalization: Its massive market cap represents a significant stake in the overall crypto market.

- Ongoing Regulatory Scrutiny: The ongoing legal challenges and investigations present both risks and opportunities for Tether.

- Potential Benefits for Tether: A successful SPAC could enhance Tether's credibility, attracting more institutional investors and expanding its market reach.

SoftBank's Role

SoftBank, a global investment firm known for its bold bets in technology and finance, brings considerable financial clout and expertise to the table. Their participation signals a significant vote of confidence in the future of cryptocurrencies and the potential for substantial returns.

- SoftBank's Investment History in Crypto and Fintech: A proven track record of identifying and investing in high-growth sectors.

- Strategic Rationale Behind This Investment: Diversification into a rapidly growing market with potential for significant returns.

- Potential Returns for SoftBank: The massive scale of the SPAC suggests the potential for immense profits if the venture is successful.

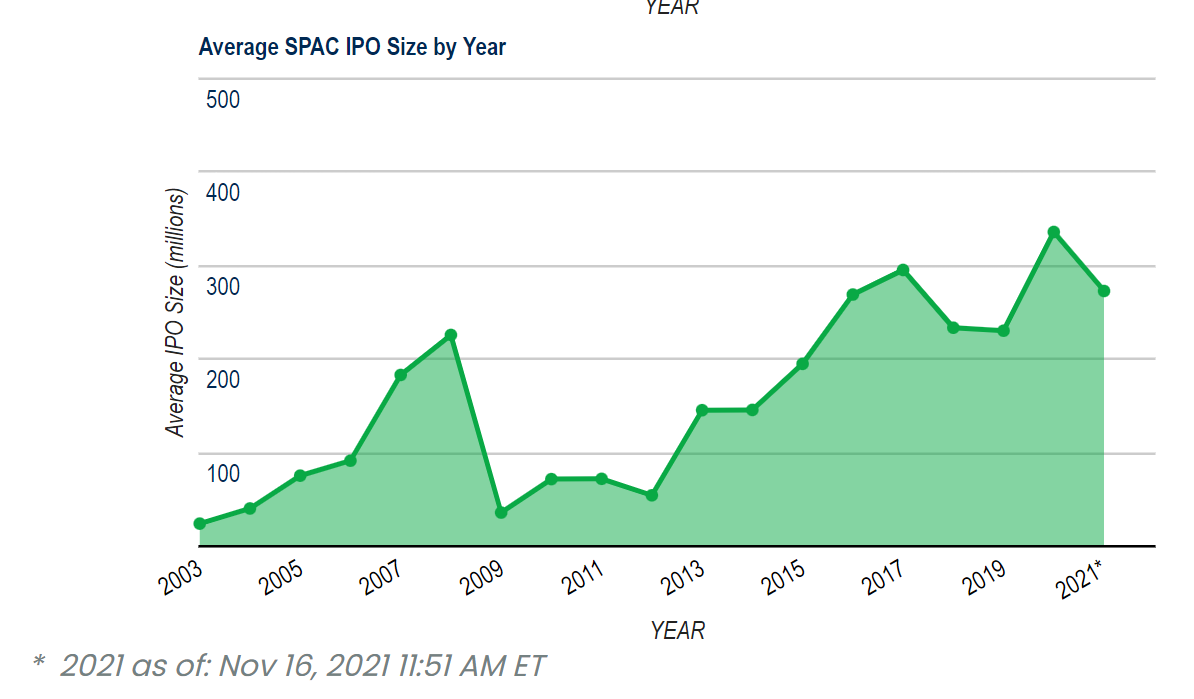

The Proposed $3 Billion Crypto SPAC: Details and Implications

The proposed $3 billion crypto SPAC aims to acquire or merge with promising cryptocurrency companies. This structure allows for a streamlined entry into the crypto market for institutional investors.

SPAC Structure and Objectives

A SPAC, or Special Purpose Acquisition Company, is a shell corporation with the sole purpose of raising capital through an initial public offering (IPO) to acquire a private company. This crypto SPAC will likely target companies in various segments of the cryptocurrency industry.

- Description of a SPAC: A blank-check company that raises capital to acquire a target company.

- Acquisition Process: The SPAC will identify, negotiate, and acquire a target company, usually within a specified timeframe.

- Potential Target Companies: This could include cryptocurrency exchanges, blockchain infrastructure providers, decentralized finance (DeFi) projects, and other innovative crypto businesses.

Market Impact and Potential Disruption

The potential impact of this mega-SPAC on the cryptocurrency market is substantial. It could significantly influence investment flows, regulatory scrutiny, and overall adoption.

- Potential Increase in Institutional Investment in Crypto: Attracting large institutional investors who may have been hesitant to enter the market directly.

- Increased Regulatory Scrutiny of the Crypto Market: The increased attention from institutional investors and major financial players could lead to more stringent regulations.

- Broader Adoption of Crypto Assets: A successful SPAC could significantly increase the mainstream adoption of cryptocurrencies.

Potential Challenges and Risks

Despite the potential rewards, the proposed Cantor Fitzgerald crypto SPAC faces significant challenges and risks.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving and varies greatly across jurisdictions. This presents a significant hurdle for the SPAC.

- Varying Regulatory Frameworks Across Jurisdictions: Navigating the complex and often conflicting regulations in different countries.

- Potential Regulatory Hurdles for Tether: Tether's controversial past and ongoing legal battles could pose significant regulatory risks.

- Risk of Regulatory Crackdown: Increased regulatory scrutiny could stifle the growth and potentially lead to a market downturn.

Market Volatility

Cryptocurrency markets are notoriously volatile, prone to dramatic price swings. This inherent risk is a major factor for investors.

- Crypto Market Fluctuations: The unpredictable nature of crypto markets presents a significant risk of losses.

- Potential for Significant Losses: Investors need to be aware of the potential for substantial financial losses.

- The Need for Careful Due Diligence: Thorough research and risk assessment are critical before investing.

Reputational Risks

Tether's involvement brings significant reputational risks, potentially impacting the SPAC's success.

- Tether's Past Controversies: Addressing past controversies and maintaining transparency is critical for investor confidence.

- Potential for Negative Media Attention: Negative publicity could damage the reputation of the SPAC and deter potential investors.

- Impact on Investor Confidence: Concerns about Tether's stability could negatively affect the confidence of potential investors.

Conclusion

The potential formation of a $3 billion crypto SPAC led by Cantor Fitzgerald, Tether, and SoftBank signifies a pivotal moment in the cryptocurrency industry. This partnership has the potential to attract significant institutional investment, drive broader adoption, and reshape the regulatory landscape. However, significant challenges remain, including regulatory uncertainty, market volatility, and reputational risks associated with Tether. Closely monitoring developments surrounding this Cantor Fitzgerald crypto SPAC will be crucial to understanding its ultimate impact on the future of cryptocurrencies. Stay informed and follow the latest news to track the progress of this potentially game-changing venture.

Featured Posts

-

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025 -

Stock Market Live Dow S And P 500 And Nasdaq April 23rd Update

Apr 24, 2025

Stock Market Live Dow S And P 500 And Nasdaq April 23rd Update

Apr 24, 2025 -

India Market Update Tailwinds Power Niftys Bullish Momentum

Apr 24, 2025

India Market Update Tailwinds Power Niftys Bullish Momentum

Apr 24, 2025 -

Sk Hynixs Dram Market Leadership Fueled By Ai Demand

Apr 24, 2025

Sk Hynixs Dram Market Leadership Fueled By Ai Demand

Apr 24, 2025 -

Zuckerberg And Trump A New Era For Tech And Politics

Apr 24, 2025

Zuckerberg And Trump A New Era For Tech And Politics

Apr 24, 2025