China's Tariff Policy Shift: Implications For Specific US Products

Table of Contents

China's tariff policy shift encompasses a range of adjustments to import and export duties. Some sectors have seen significant tariff reductions, aiming to encourage specific imports and boost domestic consumption. Conversely, other sectors have experienced tariff increases, often in response to trade disputes or to protect domestic industries. For example, tariffs on some agricultural products fluctuated drastically, while those on technology and automotive goods saw targeted adjustments depending on the specific product and origin. The goal of this analysis is to dissect the consequences of these varied adjustments for key US export categories.

Impact on Agricultural Products

The agricultural sector has been particularly sensitive to China's tariff policy shifts. The ongoing trade relationship, historically marked by significant US agricultural exports to China, has experienced considerable volatility.

Soybean Tariffs

Soybean tariffs represent a prime example of the impact of China's fluctuating trade policy. Historically a major importer of US soybeans, China's imposition of tariffs led to sharp price fluctuations and a significant decline in US soybean exports.

- Price fluctuations: Tariffs caused a substantial drop in soybean prices in the US, impacting farmers' profitability.

- Market share changes: Other soybean-exporting countries, like Brazil, capitalized on the reduced US competitiveness, gaining significant market share in China.

- Government support programs: The US government implemented various support programs to mitigate the negative effects of the tariffs on US farmers, offering financial assistance and exploring alternative markets.

Pork and Poultry Tariffs

Similar to soybeans, US pork and poultry exports to China faced challenges due to tariff adjustments. While some tariffs were reduced, others remained high, impacting export volumes and profitability.

- Competition from other countries: Increased tariffs on US meat products gave an advantage to producers in other countries, increasing competition in the Chinese market.

- Consumer demand in China: Despite the tariffs, consumer demand for high-quality protein sources in China remained robust, but the source of that protein shifted away from the US in many cases.

- Impact on US producers: US meat producers faced reduced profitability and were forced to adjust production levels and explore new markets to compensate for reduced Chinese demand.

Impact on Manufactured Goods

The impact of China's tariff policy shift extends beyond agriculture, significantly influencing the manufactured goods sector.

Technology Products

US technology companies, such as Apple and Intel, have been directly affected by changes in China's tariff policy. These tariffs impacted supply chains, pricing strategies, and overall competitiveness.

- Supply chain adjustments: Companies had to reassess their supply chains, potentially shifting production to other countries to mitigate the impact of tariffs.

- Pricing strategies: Some companies absorbed some tariff costs, while others passed them on to consumers, leading to higher prices for tech products in China.

- Impact on innovation: Uncertainty caused by shifting tariffs could potentially hinder investment in research and development, potentially slowing down technological innovation.

Automotive Sector

The automotive sector has also experienced the effects of the evolving tariff landscape. US automakers, including Ford and GM, faced challenges in navigating these changes.

- Sales volume changes: Tariffs on US-made vehicles led to decreased sales volumes in the Chinese market.

- Production adjustments: Some US automakers adjusted their production strategies, possibly reducing output destined for China or shifting production elsewhere.

- Competition with domestic Chinese brands: Tariffs provided a boost to domestic Chinese automakers, increasing competition for US brands in the Chinese market.

Overall Economic Implications and Responses

China's tariff policy shift has broad economic implications for both the US and China.

US Trade Deficit

The tariff policy shift has significantly influenced the US-China trade deficit. While the immediate impact was complex, long-term effects are still being assessed.

- Data on trade volumes: Changes in tariff rates directly impact the volume of goods traded between the two countries.

- Impact on the US economy: The trade deficit has broader economic consequences, affecting employment, investment, and overall economic growth.

- Government responses: The US government has employed various strategies, including retaliatory tariffs and trade negotiations, in response to China's policies.

Negotiations and Future Outlook

The future of US-China trade relations and tariff policies remains uncertain. Ongoing negotiations and potential future agreements will play a crucial role in shaping the landscape.

- Predictions for future trade relations: Analysts offer differing predictions, ranging from further escalation to a gradual de-escalation of trade tensions.

- Potential for further changes in tariffs: The possibility of further tariff adjustments remains high, emphasizing the importance of monitoring these developments closely.

Conclusion: Analyzing China's Tariff Policy Shift's Impact on US Products

China's tariff policy shift has had a profound and multifaceted impact on specific US products across various sectors. Agricultural products, particularly soybeans and meat, experienced significant price volatility and market share losses. The technology and automotive sectors also faced challenges related to supply chain disruptions, pricing adjustments, and increased competition. The overall effect on the US trade deficit and the broader US economy requires continuous monitoring and analysis.

Key Takeaways: The instability introduced by China's shifting tariff policy underscores the need for American businesses to adapt proactively to volatile trade environments. Understanding the intricacies of these policies is crucial for effective risk management and strategic planning.

Call to Action: Stay updated on the latest developments in China's tariff policy and its implications for your business. Continue monitoring China's tariff policy shifts for proactive planning and to navigate this dynamic trade landscape successfully.

Featured Posts

-

Times Trump Interview 9 Key Takeaways On Annexing Canada Xis Calls And Third Term Loopholes

Apr 28, 2025

Times Trump Interview 9 Key Takeaways On Annexing Canada Xis Calls And Third Term Loopholes

Apr 28, 2025 -

Samantha Bracksieck And Aaron Judge Announce The Arrival Of Their Firstborn

Apr 28, 2025

Samantha Bracksieck And Aaron Judge Announce The Arrival Of Their Firstborn

Apr 28, 2025 -

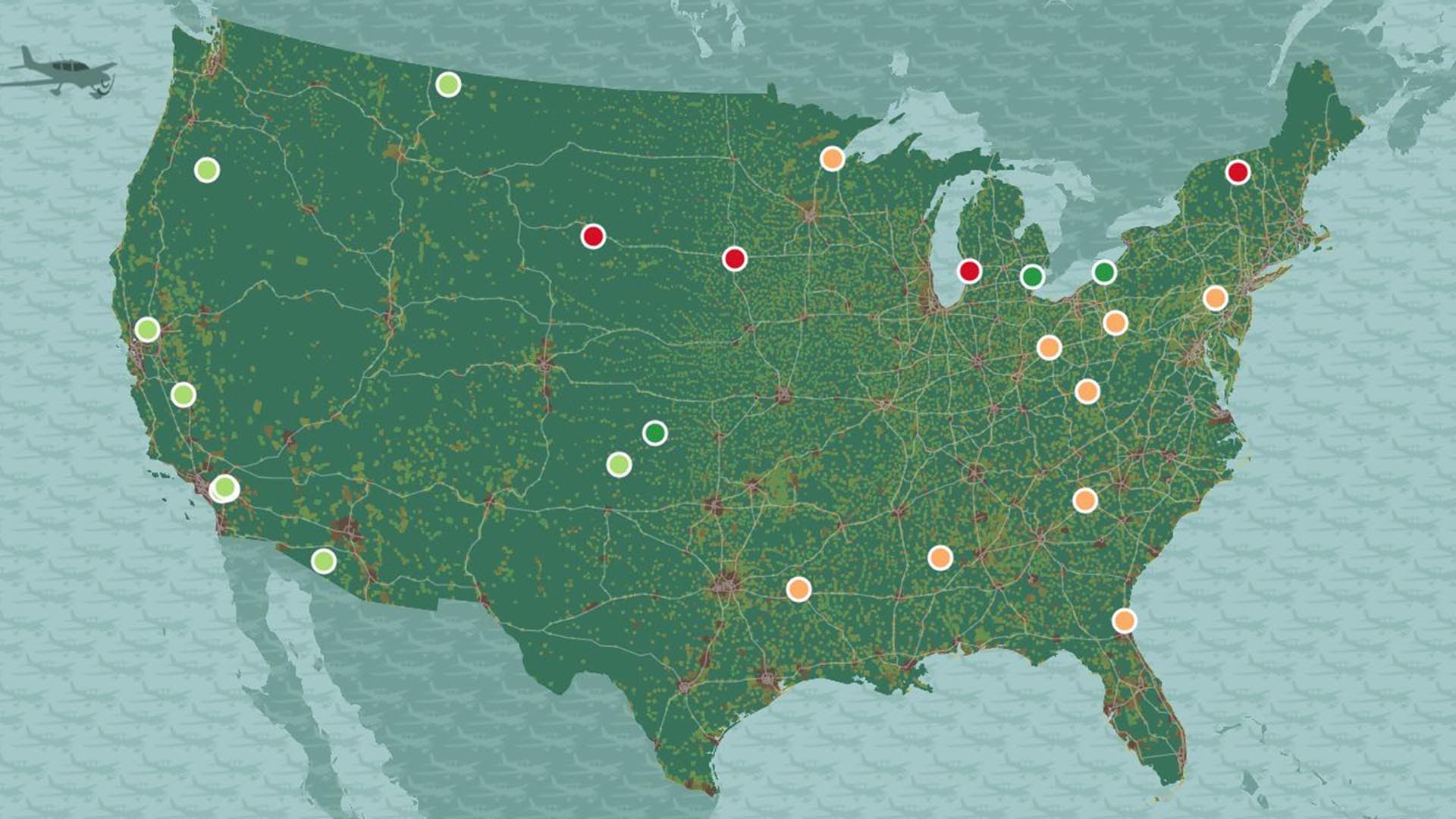

Uncovering The Countrys Next Big Business Hubs

Apr 28, 2025

Uncovering The Countrys Next Big Business Hubs

Apr 28, 2025 -

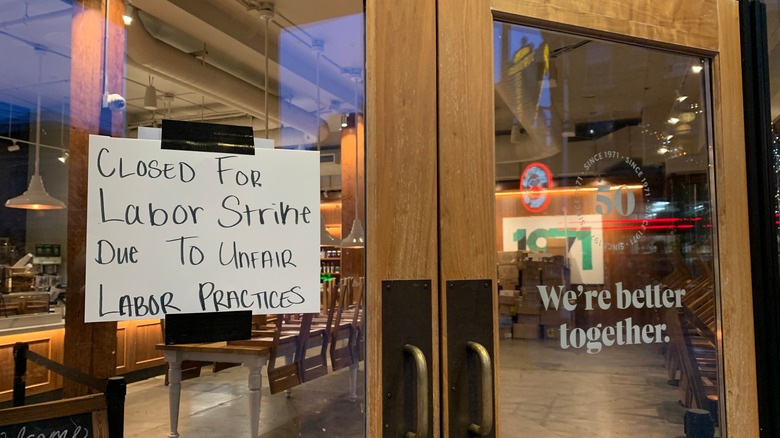

Unionized Starbucks Employees Turn Down Companys Guaranteed Raise

Apr 28, 2025

Unionized Starbucks Employees Turn Down Companys Guaranteed Raise

Apr 28, 2025 -

Fn Abwzby Antlaq Fealyath Fy 19 Nwfmbr

Apr 28, 2025

Fn Abwzby Antlaq Fealyath Fy 19 Nwfmbr

Apr 28, 2025