Chinese Equities In Hong Kong Jump On Reduced Trade Concerns

Table of Contents

Easing US-China Trade Tensions

The improved relationship between the US and China has played a pivotal role in boosting investor confidence. The easing of trade tensions has created a more predictable and stable environment for investment.

Phase One Deal Impact

The initial US-China trade deal, while not a complete resolution, has had a tangible positive impact. Specific aspects of the deal have directly contributed to the surge in Chinese equities.

- Tariff Reductions: The reduction of tariffs on certain Chinese goods has lessened the burden on businesses and improved profit margins, making Chinese companies more attractive to investors.

- Increased Chinese Exports to the US: The deal led to an increase in the volume of certain Chinese goods exported to the US, indicating a strengthening of trade relations and positive economic indicators for involved companies.

- Positive Market Reactions Following Specific Announcements: Each positive development in the trade negotiations, such as the signing of the Phase One deal, has been met with immediate positive reactions in the Hong Kong stock market, pushing up the prices of Chinese equities.

Keywords: US-China trade war, trade deal impact, tariff reductions, investor confidence, market sentiment

Reduced Uncertainty

The reduction in uncertainty surrounding trade relations is equally crucial. Prior to the easing of tensions, the constant threat of escalating tariffs and trade restrictions created a climate of fear and uncertainty, deterring investment.

- Reduced Market Volatility: The market has become noticeably less volatile since the trade tensions lessened, reflecting a greater sense of stability and predictability.

- Increased Foreign Investment: Foreign investors, previously hesitant due to trade war uncertainty, are now returning to the Hong Kong market, boosting demand for Chinese equities.

- Positive Analyst Forecasts: Many analysts have revised their forecasts for Chinese equities upward, reflecting the improved outlook resulting from reduced trade uncertainty.

Keywords: market volatility, foreign investment, investor sentiment, risk appetite

Strong Performance of Key Sectors

The overall market jump isn't just a broad-based phenomenon; certain sectors have significantly outperformed others, contributing to the overall positive trend.

Technology Sector Growth

The technology sector has been a star performer, largely driven by strong domestic demand and innovation.

- Stock Performance Data for Specific Technology Companies Listed in Hong Kong: Companies like Tencent and Alibaba have seen substantial growth in their stock prices, reflecting investor confidence in the sector's long-term potential.

- Analysis of Growth Drivers: This growth is driven by a combination of factors, including the increasing adoption of technology in China and the rise of e-commerce and mobile payments.

Keywords: technology stocks, Hong Kong Stock Exchange, sector performance, growth drivers

Financials and Consumer Staples

Other sectors, including financials and consumer staples, have also contributed to the overall market positivity.

- Examples of Strong Performing Companies within These Sectors: Leading banks and consumer goods companies have shown robust performance, indicating a broad-based economic recovery in China.

- Analysis of Underlying Factors for Growth: This growth is influenced by factors such as increasing disposable incomes among the Chinese middle class and continued expansion of the financial services sector.

Keywords: financial stocks, consumer staples, market capitalization, stock market indices

Increased Investor Interest in Hong Kong Market

Hong Kong's position as a key financial hub continues to attract investors seeking exposure to Chinese equities.

Hong Kong as a Hub

Hong Kong's advantages as an investment destination remain significant.

- Hong Kong's Strengths as a Financial Center: Its established infrastructure, robust legal framework, and deep liquidity make it an attractive place to invest.

- Ease of Investment: The relatively straightforward regulatory environment makes it easier for both domestic and international investors to participate in the market.

- Regulatory Clarity: A clear and transparent regulatory system ensures investor confidence and reduces risks.

Keywords: Hong Kong financial market, investment opportunities, regulatory environment, stock exchange liquidity

Southbound Trading Activity

The increased activity in southbound trading – mainland Chinese investors buying Hong Kong-listed stocks – has significantly fueled market growth.

- Data on Southbound Trading Volume: The volume of southbound trading has increased substantially, indicating strong domestic interest in Hong Kong-listed Chinese companies.

- Its Contribution to the Market's Growth: This influx of capital has further driven up the prices of Chinese equities listed in Hong Kong.

Keywords: southbound trading, mainland China investors, stock market trading volume

Conclusion

The surge in Chinese equities in Hong Kong is a result of several interconnected factors, primarily the easing of US-China trade tensions and the strong performance of key sectors. The improved investor sentiment, coupled with Hong Kong's position as a premier financial hub, has created a favorable environment for investment. This upward trend is likely to continue as long as trade relations remain positive and the Chinese economy continues its growth trajectory.

To capitalize on these potential opportunities, researching investment opportunities in Chinese equities in Hong Kong is crucial. Staying informed about US-China trade relations and Hong Kong market trends is essential for making informed investment decisions. For further analysis of the Hong Kong stock market, consider exploring resources like the Hong Kong Exchanges and Clearing website and reputable financial news outlets.

Featured Posts

-

Tyler Herros 3 Point Contest Win Highlights All Star Weekend

Apr 24, 2025

Tyler Herros 3 Point Contest Win Highlights All Star Weekend

Apr 24, 2025 -

The Ethics Of Wildfire Wagers Examining The Los Angeles Example

Apr 24, 2025

The Ethics Of Wildfire Wagers Examining The Los Angeles Example

Apr 24, 2025 -

Facebooks Fate Zuckerbergs Leadership During The Trump Era

Apr 24, 2025

Facebooks Fate Zuckerbergs Leadership During The Trump Era

Apr 24, 2025 -

Village Roadshows 417 5 Million Alcon Deal Approved Key Details

Apr 24, 2025

Village Roadshows 417 5 Million Alcon Deal Approved Key Details

Apr 24, 2025 -

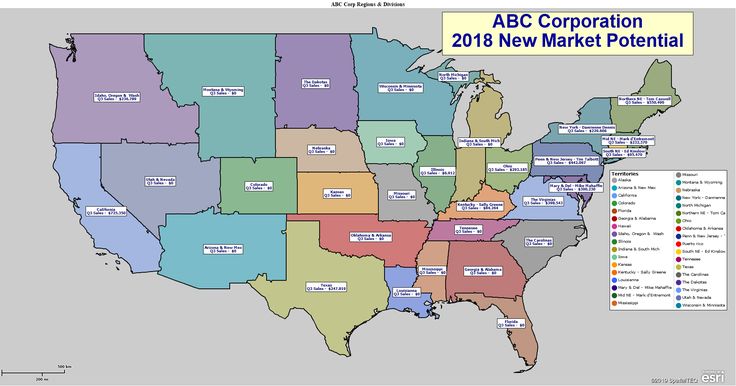

Mapping The Countrys Hottest New Business Locations

Apr 24, 2025

Mapping The Countrys Hottest New Business Locations

Apr 24, 2025