Chinese Stocks In Hong Kong: A Trade-Driven Market Upswing

Table of Contents

The Resurgence of Trade and its Impact on Chinese Stocks in Hong Kong

Improved global trade relations, particularly between China and the US, are significantly boosting investor confidence in the Chinese equity market, including those listed on the Hong Kong Stock Exchange. This renewed optimism is translating into tangible results.

-

Improved Sino-US Trade Relations: Easing trade tensions between the world's two largest economies are creating a more stable and predictable environment for businesses, fostering increased investment and economic activity. This positive sentiment is directly impacting the performance of Chinese stocks in Hong Kong.

-

Increased Export and Import Volumes: The growth in both exports and imports from China is a key driver of this market upswing. Chinese companies involved in manufacturing, technology, and consumer goods are experiencing increased demand, leading to improved profits and higher stock valuations.

-

Hong Kong's Enhanced Role as a Financial Hub: The positive spillover effect of global trade growth is further strengthening Hong Kong's position as a leading financial center. This attracts more international investment, further fueling the growth of the Hong Kong market and, consequently, Chinese stocks listed there.

-

Specific Industries Benefiting: Sectors such as technology (particularly companies involved in 5G and artificial intelligence), manufacturing (especially those involved in supplying global supply chains), and consumer staples are experiencing significant benefits from increased trade activity.

-

Trade Data Correlation with Stock Market Performance: Recent data clearly shows a positive correlation between increased trade volumes and the performance of Chinese stocks listed in Hong Kong. As trade continues to improve, we can expect this positive trend to continue.

Economic Growth in Mainland China Fueling Hong Kong's Market

Robust economic growth in mainland China is a fundamental driver of the current upswing in the Hong Kong stock market. This growth directly translates into increased demand for Chinese stocks listed in Hong Kong.

-

Mainland China's Economic Strength: Key economic indicators, such as GDP growth, consumer spending, and industrial production, are demonstrating the continued strength of the Chinese economy. This sustained growth provides a solid foundation for the continued success of Chinese companies and their corresponding stocks.

-

Government Policies and Reforms: The Chinese government's continued implementation of economic reforms and supportive policies is creating a favorable environment for businesses and investment. These measures are driving economic expansion and attracting both domestic and foreign investment.

-

The Belt and Road Initiative's Impact: China's Belt and Road Initiative (BRI) continues to generate significant infrastructure development and trade opportunities across Asia and beyond. Companies involved in infrastructure, logistics, and related sectors are experiencing substantial growth.

-

Potential for Continued Economic Growth: Analysts predict that China's economic growth will remain robust in the coming years. This continued growth will likely further fuel the demand for Chinese stocks listed in Hong Kong.

Attractive Valuation and Investment Opportunities in Chinese Stocks

The current market presents several compelling investment opportunities in Chinese stocks listed in Hong Kong. However, it's important to conduct thorough due diligence and understand the potential risks.

-

Undervalued Stocks: Analysis reveals that several Chinese stocks listed in Hong Kong are currently trading at attractive valuations, potentially offering significant upside potential for long-term investors.

-

High-Growth Potential Sectors: Sectors such as technology (e.g., fintech, e-commerce), renewable energy, and healthcare are experiencing significant growth and are expected to continue expanding.

-

Investment Strategies: Investors should consider employing diversified investment strategies, balancing long-term investments with potentially short-term trades, depending on their risk tolerance and investment goals.

-

Risk Assessment: Investing in Chinese stocks, like any investment, carries inherent risk. Investors must carefully assess factors such as political and economic instability, regulatory changes, and market volatility.

-

Resources for Research: Numerous resources and tools, including financial news websites, brokerage research reports, and dedicated investment platforms, are available to aid investors in their research and selection of Chinese stocks.

Navigating the Hong Kong Stock Market: Tips for Investors

Successfully navigating the Hong Kong stock market requires careful planning and execution. Here are some crucial tips for investors interested in Chinese stocks:

-

Thorough Due Diligence: Before investing, conduct comprehensive due diligence on each company, reviewing financial statements, management teams, and industry trends.

-

Understanding the Regulatory Landscape: Familiarize yourself with the regulations and rules governing the Hong Kong Stock Exchange.

-

Utilizing Market Analysis Tools: Leverage market analysis tools and resources to gain insights into market trends and identify potential investment opportunities.

-

Robust Risk Management: Develop a well-defined risk management strategy, setting stop-loss orders and diversifying your portfolio to mitigate potential losses.

-

Appropriate Investment Strategies: Select investment strategies that align with your risk tolerance and investment objectives. Consider long-term growth investments versus short-term trading strategies.

Conclusion

The current upswing in the Hong Kong stock market, particularly regarding Chinese stocks, is primarily driven by increased trade activity and the robust performance of the mainland Chinese economy. This presents compelling investment opportunities, but careful research and risk management are crucial. Don't let the potential for high returns overshadow the inherent risks.

Call to Action: Capitalize on the exciting opportunities presented by the trade-driven upswing in the Chinese stocks in Hong Kong market. Conduct thorough research, develop a sound investment strategy, and consider diversifying your portfolio to mitigate risk. Don't miss out on this potentially lucrative market; start exploring Chinese stocks in Hong Kong today!

Featured Posts

-

Canadian Dollars Contradictory Performance Analysis And Outlook

Apr 24, 2025

Canadian Dollars Contradictory Performance Analysis And Outlook

Apr 24, 2025 -

Selling Sunset Star Exposes La Landlord Price Gouging After Fires

Apr 24, 2025

Selling Sunset Star Exposes La Landlord Price Gouging After Fires

Apr 24, 2025 -

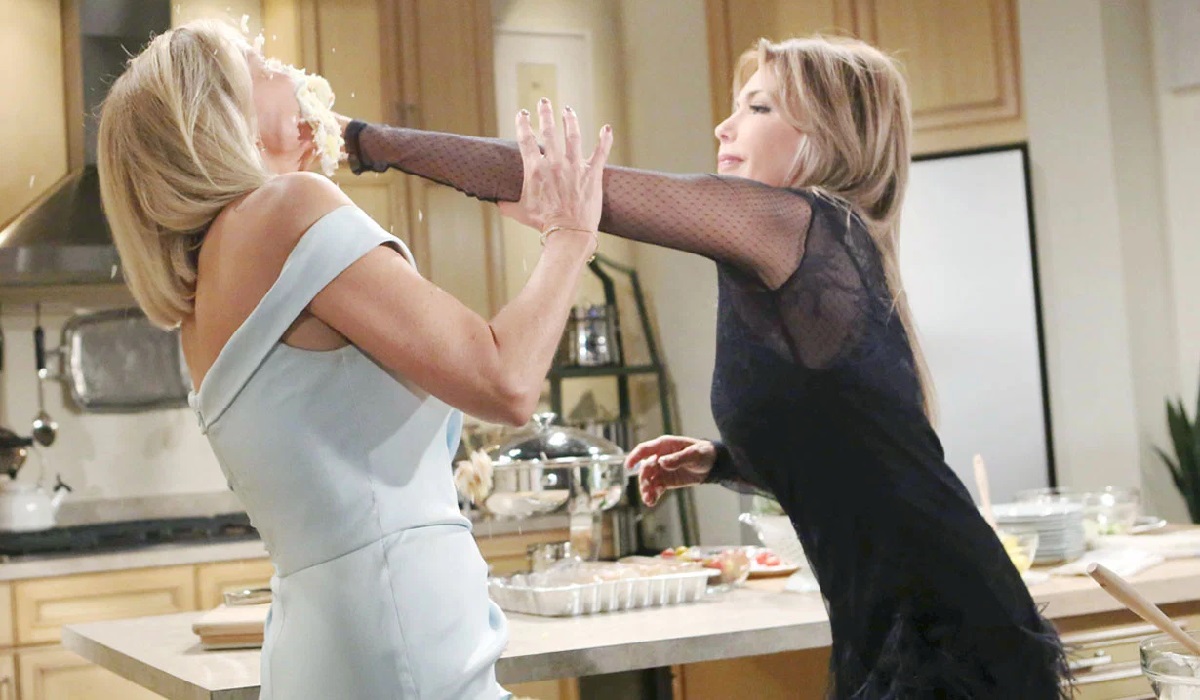

The Bold And The Beautiful Liams Fight For Survival

Apr 24, 2025

The Bold And The Beautiful Liams Fight For Survival

Apr 24, 2025 -

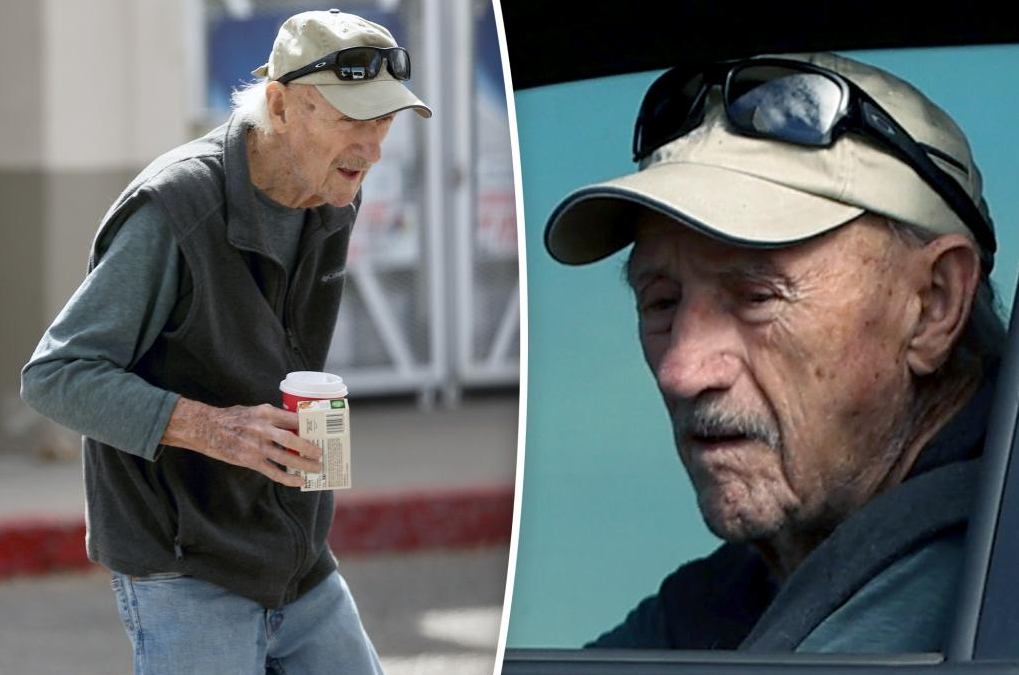

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025 -

Activision Blizzard Deal Faces Ftc Appeal A Deeper Look

Apr 24, 2025

Activision Blizzard Deal Faces Ftc Appeal A Deeper Look

Apr 24, 2025