Credit Card Industry Faces Headwinds Amidst Consumer Spending Slowdown

Table of Contents

Rising Interest Rates and Their Impact on Credit Card Debt

Higher interest rates represent a significant threat to the credit card industry. The increased cost of borrowing directly impacts consumers, leading to several detrimental consequences. As the Federal Reserve and other central banks raise interest rates to combat inflation, the cost of revolving credit, such as credit cards, increases proportionally. This results in higher Annual Percentage Rates (APRs) for consumers, making it more expensive to carry a balance.

This rise in borrowing costs has several significant implications:

- Increased minimum payments: Consumers find themselves struggling to make even the minimum payments on their credit card balances, leading to further debt accumulation.

- Higher APRs (Annual Percentage Rates): The escalating APRs translate to a substantially larger interest burden, making debt repayment significantly more difficult.

- Reduced consumer borrowing capacity: With higher interest rates, consumers have less disposable income, limiting their ability to borrow further, impacting spending and overall economic activity.

- Potential for increased loan defaults: The combination of higher interest rates, reduced disposable income, and increased minimum payments increases the risk of borrowers defaulting on their credit card debts.

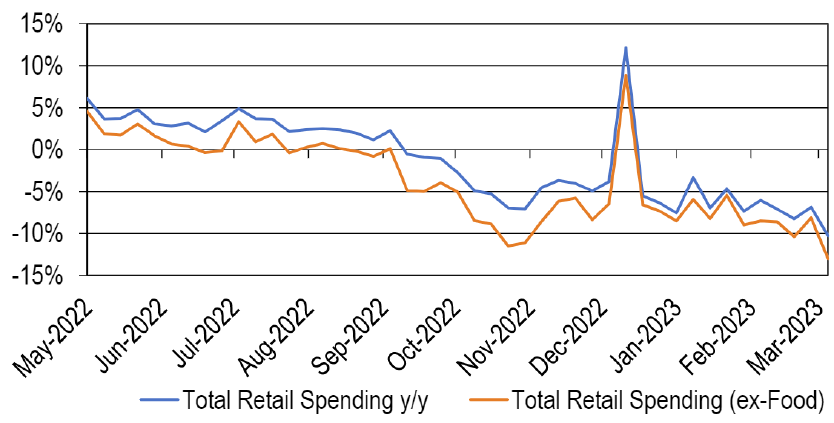

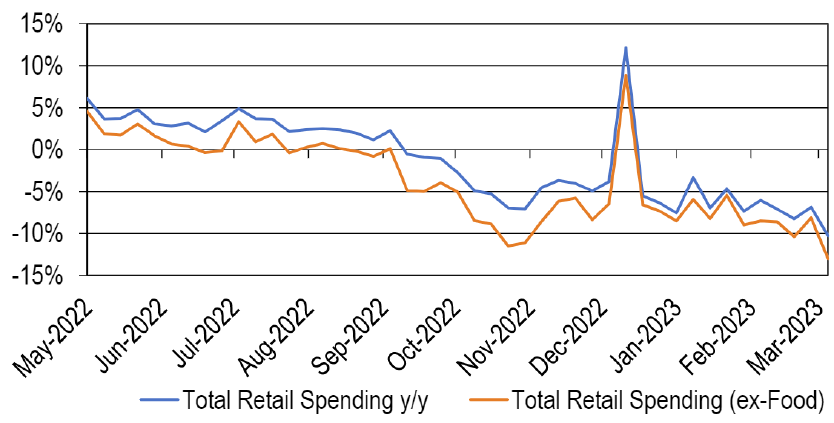

Reduced Consumer Spending and Its Effect on Credit Card Transactions

Consumer spending is inextricably linked to credit card usage. When consumers tighten their belts due to economic uncertainty and inflation, credit card transactions naturally decline. This reduction in spending directly impacts the revenue streams of credit card companies in several ways:

- Decreased transaction volume: Fewer purchases mean fewer transactions processed, leading to a direct reduction in revenue for credit card companies.

- Lower merchant fees for credit card companies: Merchant fees, a significant portion of credit card company revenue, are directly tied to transaction volume. A drop in spending translates to lower merchant fees.

- Impact on reward programs and cashback offers: Credit card companies may need to scale back on lucrative rewards programs and cashback offers to offset reduced revenues, impacting consumer loyalty.

- Potential for reduced profitability: The combination of decreased transaction volume and lower merchant fees can severely impact the profitability of credit card companies.

Increased Competition and Fintech Disruption

The credit card industry is no longer a monolithic landscape. The rise of fintech companies and alternative payment solutions is creating intense competition and disrupting traditional business models. The emergence of Buy Now Pay Later (BNPL) services and mobile payment apps offers consumers more choices and potentially lower costs.

- Rise of BNPL (Buy Now Pay Later) services: BNPL providers offer consumers the ability to pay for purchases in installments, often bypassing traditional credit cards altogether.

- Increased use of mobile payment apps: Mobile wallets like Apple Pay and Google Pay are gaining popularity, offering seamless payment experiences and potentially reducing reliance on traditional credit cards.

- Competition from digital banks and challenger banks: Digital banks are offering competitive credit card products with attractive features, challenging the dominance of established players.

- Pressure on credit card companies to innovate and adapt: To remain competitive, credit card companies must invest in technology and innovation to provide superior customer experiences and more attractive products.

Strategies for Credit Card Companies to Navigate the Challenges

Credit card companies need to adopt proactive strategies to mitigate the negative impacts of the current economic climate. This includes:

- Offering competitive interest rates and rewards programs: Attractive interest rates and compelling rewards can help retain customers and attract new ones.

- Improving customer service and providing financial literacy resources: Exceptional customer service and access to financial education can foster customer loyalty and responsible credit card usage.

- Implementing robust fraud detection and prevention systems: Protecting customers from fraud is crucial for maintaining trust and mitigating financial losses.

- Investing in technological advancements to streamline processes: Technology can improve efficiency, reduce costs, and enhance customer experiences.

Navigating the Credit Card Industry Headwinds

The credit card industry faces a trifecta of challenges: rising interest rates impacting consumer debt, reduced consumer spending impacting transaction volume, and increased competition from fintech disruptors. Adapting to this changing economic climate and evolving consumer behavior is paramount. By implementing the strategies outlined above, credit card companies can better position themselves to navigate these Credit Card Industry Headwinds and maintain a sustainable future. Understanding these Credit Card Industry Headwinds is crucial for both consumers and industry professionals. Stay informed about the latest trends and strategies to effectively manage your finances and navigate this dynamic market.

Featured Posts

-

The Bold And The Beautiful April 3rd Recap Liam Bill And Hopes Dramatic Thursday

Apr 24, 2025

The Bold And The Beautiful April 3rd Recap Liam Bill And Hopes Dramatic Thursday

Apr 24, 2025 -

John Travolta Honors Late Son Jett With A Birthday Post

Apr 24, 2025

John Travolta Honors Late Son Jett With A Birthday Post

Apr 24, 2025 -

Remembering Jett Travolta A Photo Tribute On His Birthday

Apr 24, 2025

Remembering Jett Travolta A Photo Tribute On His Birthday

Apr 24, 2025 -

Hudsons Bay 65 Leases Attract Significant Interest

Apr 24, 2025

Hudsons Bay 65 Leases Attract Significant Interest

Apr 24, 2025 -

Is Betting On The Los Angeles Wildfires A Sign Of The Times

Apr 24, 2025

Is Betting On The Los Angeles Wildfires A Sign Of The Times

Apr 24, 2025