Deloitte On US Economic Outlook: Predicting Considerable Growth Slowdown

Table of Contents

Key Factors Contributing to Deloitte's Growth Slowdown Prediction

Deloitte's prediction of a considerable growth slowdown is based on a confluence of significant economic headwinds. Understanding these factors is crucial for navigating the evolving economic landscape.

Inflation and Interest Rate Hikes

Persistent inflation remains a primary driver of Deloitte's cautious outlook. The Federal Reserve's aggressive response, involving substantial interest rate hikes, aims to curb inflation but simultaneously risks slowing economic activity.

- Impact on Consumer Spending: Higher interest rates increase borrowing costs, leading to reduced consumer spending on durable goods like houses and cars. This dampens overall economic demand.

- Impact on Business Investment: Increased borrowing costs also discourage businesses from making significant capital investments, hindering expansion and job creation.

- Impact on Housing Market: Rising mortgage rates are already cooling the once-hot housing market, impacting construction and related industries. Deloitte's report likely reflects these trends, showing a significant decrease in housing starts.

Deloitte's data likely incorporates these factors, showing a correlation between interest rate hikes and a decrease in key economic indicators. The effectiveness of the Federal Reserve's monetary policy in controlling inflation without triggering a recession remains a key uncertainty.

Geopolitical Uncertainty and Supply Chain Disruptions

The ongoing war in Ukraine and other geopolitical tensions contribute significantly to global economic instability. Supply chain disruptions, exacerbated by these events, continue to impact production costs and fuel inflation.

- Examples of Disruptions: The war in Ukraine has significantly impacted energy prices and the availability of key commodities. Other global events further complicate supply chains, leading to delays and increased costs.

- Effect on Production Costs: Increased energy and commodity prices directly translate to higher production costs for businesses, potentially leading to price increases or reduced profit margins.

- Impact on Inflation: Supply chain disruptions contribute to inflationary pressures, making it more challenging for the Federal Reserve to achieve its inflation targets.

Deloitte's analysis likely incorporates the cumulative impact of these geopolitical risks on the US economy, highlighting their role in slowing economic growth.

Labor Market Dynamics

The US labor market, while showing strength in terms of low unemployment, presents a complex picture impacting economic growth.

- Unemployment Rates: While unemployment remains relatively low, it doesn't tell the whole story. Hidden unemployment, underemployment, and labor force participation rates all influence economic output.

- Wage Growth: Strong wage growth, while positive for workers, contributes to inflationary pressures, potentially leading to further interest rate hikes.

- Labor Shortages: Certain sectors continue to experience significant labor shortages, hindering productivity and economic expansion. These shortages also put upward pressure on wages.

Deloitte's assessment of the labor market likely integrates these nuances, highlighting both the positive and negative aspects on the overall economic outlook.

Deloitte's Specific Forecasts and Projections

Deloitte's US Economic Outlook provides specific forecasts that offer valuable insight into the potential trajectory of the US economy.

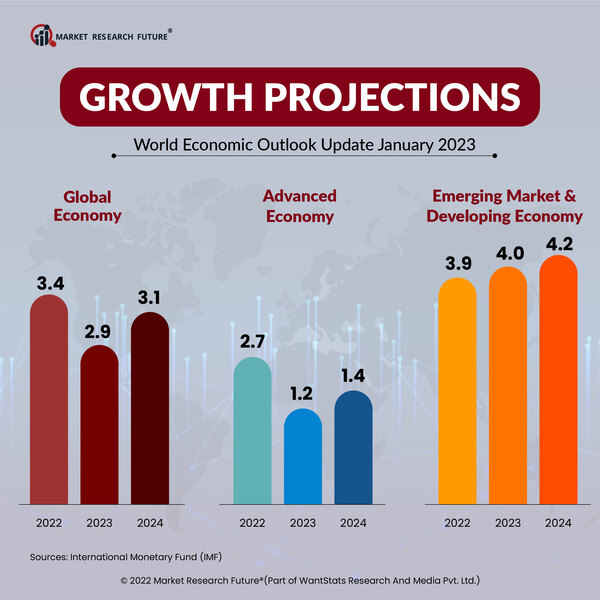

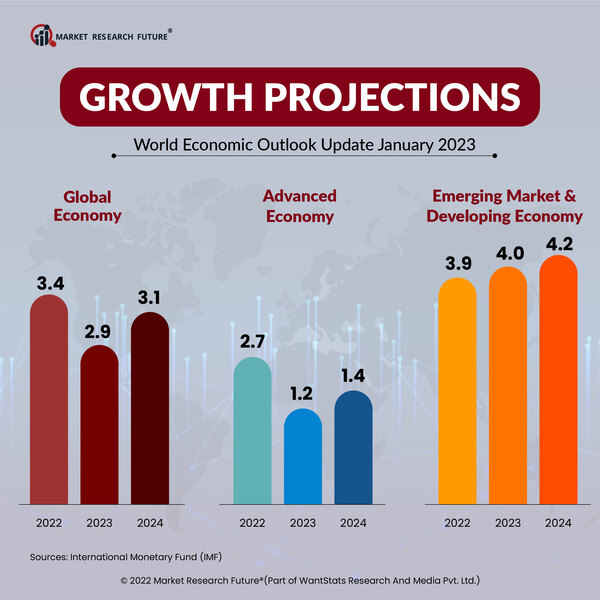

GDP Growth Predictions

Deloitte's report likely provides specific numerical projections for US GDP growth over the next few quarters and years. These projections will likely show a significant slowdown compared to previous years, potentially indicating a period of subpar growth or even a recessionary risk.

- Specific Numerical Forecasts: The report should detail concrete GDP growth estimates, perhaps offering a range of possible outcomes to reflect the inherent uncertainty.

- Comparison to Previous Forecasts: A comparison with previous Deloitte forecasts will illustrate the degree of downward revision in their economic outlook.

- Potential Range of Outcomes: Acknowledging the inherent uncertainties, Deloitte likely presents a range of potential scenarios, outlining both optimistic and pessimistic projections.

These predictions are crucial for businesses and investors making strategic decisions.

Sector-Specific Analyses

Deloitte's report probably offers granular analyses for various sectors of the US economy. This sector-specific detail provides a more nuanced understanding of the potential impact of the slowdown.

- Key Findings for Each Sector: The report will likely highlight the expected performance of key sectors like manufacturing, technology, and real estate.

- Potential Opportunities and Challenges: For each sector, Deloitte likely identifies potential opportunities and challenges arising from the predicted slowdown. This allows businesses to adapt their strategies accordingly.

Understanding sector-specific forecasts is crucial for businesses to adapt and thrive in a changing economic environment.

Potential Risks and Uncertainties

Deloitte's report undoubtedly acknowledges several risks and uncertainties that could impact its forecasts.

- Unforeseen Events: Unexpected geopolitical developments, natural disasters, or other unforeseen events could significantly alter the economic outlook.

- Potential Changes in Government Policy: Shifts in fiscal or monetary policy could influence the trajectory of the economy, potentially mitigating or exacerbating the predicted slowdown.

- Other Factors Impacting the Forecast: Other unpredictable factors, such as changes in consumer confidence or technological disruptions, could affect the accuracy of the forecast.

Recognizing these uncertainties is vital for informed decision-making.

Conclusion

Deloitte's US Economic Outlook predicts a considerable slowdown in US economic growth, driven by a combination of persistent inflation, aggressive interest rate hikes, geopolitical uncertainty, supply chain disruptions, and complex labor market dynamics. Understanding these factors and Deloitte's specific forecasts, including sector-specific analyses and potential risks, is crucial for businesses and investors. The report's detailed projections on GDP growth, coupled with its nuanced sector-specific insights, provide valuable guidance for navigating the challenges ahead. To gain a deeper understanding of the Deloitte US Economic Outlook and make informed decisions, access the complete report to leverage their expert analysis and insights for strategic planning. Don't miss out on this critical resource for navigating the potential US economic growth slowdown.

Featured Posts

-

Hhs Appoints Anti Vaccine Activist To Review Debunked Autism Vaccine Link Sources

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Debunked Autism Vaccine Link Sources

Apr 27, 2025 -

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025 -

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025 -

Elina Svitolina Dominates Anna Kalinskaya In Us Open First Round

Apr 27, 2025

Elina Svitolina Dominates Anna Kalinskaya In Us Open First Round

Apr 27, 2025 -

Free Movies And Shows On Kanopy The Ultimate Streaming List

Apr 27, 2025

Free Movies And Shows On Kanopy The Ultimate Streaming List

Apr 27, 2025