Dissecting Trump's Economic Policies: A Cost-Benefit Analysis

Table of Contents

H2: Tax Cuts and Their Impact

Trump's signature economic policy was the Tax Cuts and Jobs Act of 2017, which significantly lowered both corporate and individual income tax rates.

H3: Corporate Tax Cuts

The Act slashed the corporate tax rate from 35% to 21%, a dramatic reduction intended to stimulate investment and job creation. While corporate profits soared following the tax cuts, the promised surge in job growth proved more elusive. The increase in corporate profits was substantial, yet it did not automatically translate into widespread job creation or significant increases in capital investment as some proponents had predicted.

- GDP Growth: While GDP growth experienced a temporary bump, attributing it solely to the tax cuts is difficult, given other economic factors at play. Studies from the Congressional Budget Office offer nuanced perspectives on this relationship.

- Investment Levels: While some companies increased investment, others used the extra cash for stock buybacks or increased executive compensation, rather than creating new jobs or expanding operations.

- Job Creation Numbers: Job creation remained steady but didn't experience a dramatic acceleration as initially projected. Analysis from the Bureau of Labor Statistics provides valuable data on this aspect of the tax cuts' impact.

- Downsides: Critics point to increased income inequality and a widening national debt as significant downsides. The tax cuts disproportionately benefited high-income earners, further exacerbating wealth disparity.

H3: Individual Tax Cuts

Individual tax cuts also resulted in changes to income tax brackets, standard deductions, and other provisions.

- Winners and Losers: While many taxpayers saw a modest reduction in their tax burden, the benefits were not evenly distributed. Higher-income individuals benefited disproportionately.

- Tax Revenue Changes: The tax cuts led to a decrease in government revenue, contributing to the growing national debt. Data from the Treasury Department reveals the extent of this revenue shortfall.

- Impact on Consumer Spending and Saving: The impact on consumer spending and saving was mixed, with some arguing that the additional disposable income stimulated economic activity, while others contend that the effects were limited.

H2: Trade Policies and Their Consequences

Trump's administration pursued a protectionist trade agenda, marked by the imposition of tariffs and renegotiation of trade agreements.

H3: Tariffs and Trade Wars

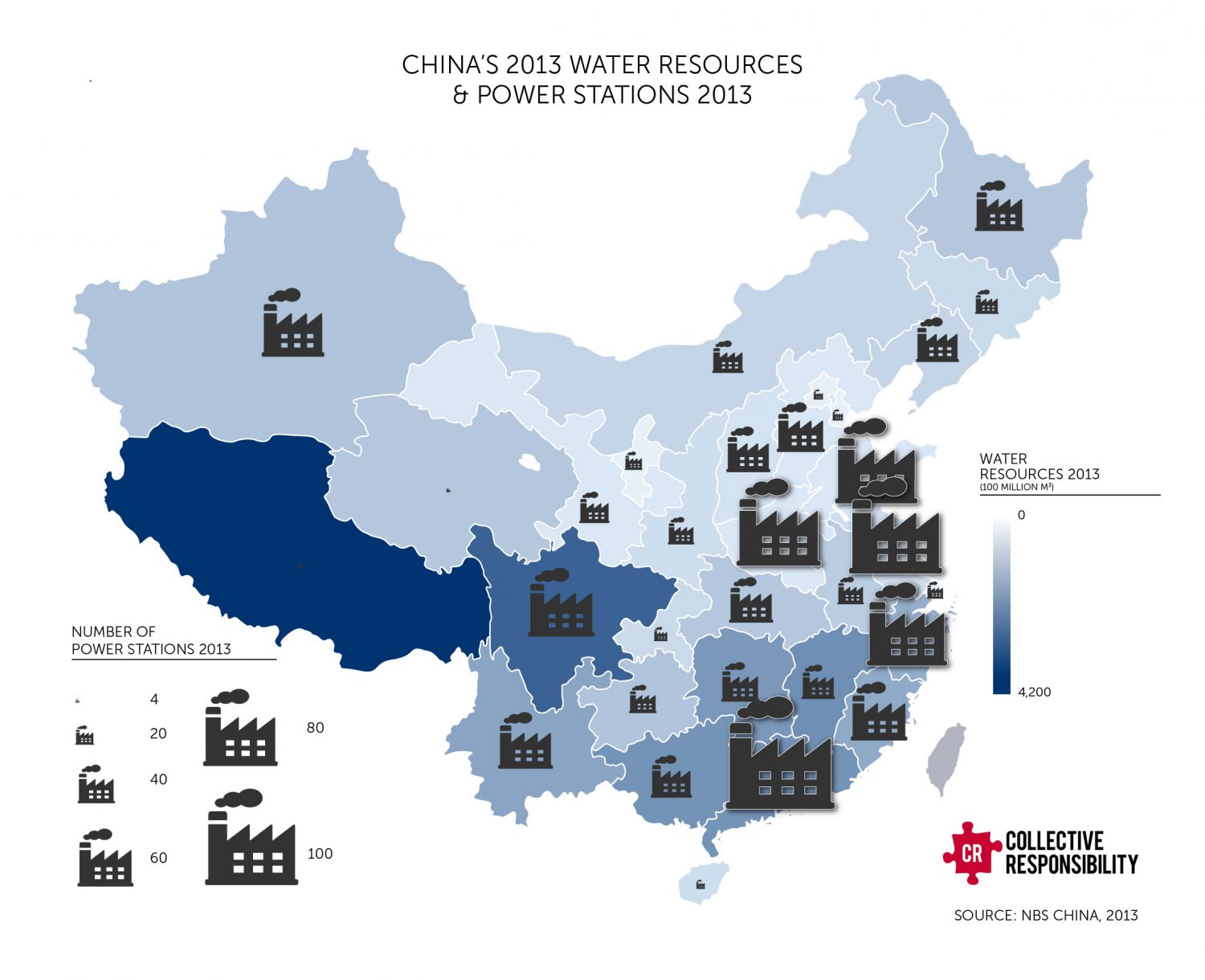

The imposition of tariffs on goods from China and other countries initiated a series of trade wars, leading to retaliatory tariffs and disruptions to global supply chains.

- Impact on Specific Industries: Industries like steel and agriculture experienced both benefits (temporary protection from foreign competition) and drawbacks (increased input costs and reduced export markets).

- Impact on Prices for Consumers: Tariffs increased the prices of imported goods for American consumers, leading to increased inflation in certain sectors.

- Impact on Global Trade Relationships and Supply Chains: The trade wars strained relationships with key trading partners and disrupted established supply chains, impacting businesses across various sectors.

H3: Renegotiation of Trade Agreements

The withdrawal from the Trans-Pacific Partnership (TPP) and the renegotiation of NAFTA into the USMCA represent significant shifts in US trade policy.

- Comparison of TPP and USMCA: The USMCA, while retaining aspects of NAFTA, incorporated changes in areas such as intellectual property protection, digital trade, and labor standards.

- Impact on Specific Industries: The impact of these changes varied across different industries, with some benefiting and others facing challenges.

- Geopolitical Implications: These shifts in trade policy had significant geopolitical implications, affecting alliances and relationships with countries around the world.

H2: Deregulation and its Economic Effects

The Trump administration pursued a policy of deregulation across various sectors, with significant implications for the environment and the financial sector.

H3: Environmental Deregulation

The rollback of environmental regulations sparked considerable controversy, raising concerns about long-term environmental costs and potential economic consequences.

- Examples of Deregulated Industries: The administration rolled back regulations in areas such as clean air and water, leading to increased pollution levels in some regions.

- Environmental Consequences: The long-term environmental consequences of these deregulations remain a subject of ongoing debate and scientific study.

H3: Financial Deregulation

Changes to financial regulations aimed at reducing the burden on financial institutions, though concerns persist regarding potential risks to financial stability.

- Potential Risks and Benefits: While some argue that deregulation fosters economic growth, others warn of increased systemic risk and potential for financial crises. The long-term effects on financial stability are still unfolding.

H2: Infrastructure Spending and its Economic Impact

Trump's administration promised significant investment in infrastructure, but the actual spending fell short of initial proposals.

- Scale of Investment: The level of infrastructure spending under Trump was relatively modest compared to many other developed countries.

- Effectiveness in Job Creation: While some job creation occurred, the overall impact on employment was limited given the scale of the investment.

- Long-Term Effects on Productivity and Infrastructure Quality: The long-term economic impact of this spending on productivity and infrastructure modernization will become clearer over time.

3. Conclusion:

A comprehensive cost-benefit analysis of Trump's economic policies reveals a mixed bag. While the tax cuts resulted in increased corporate profits, the promised job growth did not fully materialize. Trade policies, marked by tariffs and trade wars, had significant negative consequences for global trade relationships and increased costs for consumers. Deregulation efforts, particularly in environmental protection, raised concerns about long-term costs. Infrastructure investment, while positive, remained significantly below initial promises. The overall impact of Trump's economic legacy is complex and requires continued study and debate. The lasting impacts of these policies, both positive and negative, will continue to shape the American economy for years to come. To further your understanding of the impact of Trump's economic agenda, delve deeper into reports from the Congressional Budget Office, the Bureau of Labor Statistics, and other reputable sources. Continue researching and engaging with the topic of Trump's economic policies to develop a more nuanced and informed understanding of their long-term consequences and to form your own informed opinion on this complex and multifaceted subject.

Featured Posts

-

The Next Pope How Francis Papacy Will Shape The Conclave

Apr 22, 2025

The Next Pope How Francis Papacy Will Shape The Conclave

Apr 22, 2025 -

E Bay And Section 230 A Judges Ruling On Banned Chemical Listings

Apr 22, 2025

E Bay And Section 230 A Judges Ruling On Banned Chemical Listings

Apr 22, 2025 -

Bmw And Porsches China Challenges A Growing Trend

Apr 22, 2025

Bmw And Porsches China Challenges A Growing Trend

Apr 22, 2025 -

Deadly Russian Air Strikes On Ukraine Us Peace Efforts Intensify

Apr 22, 2025

Deadly Russian Air Strikes On Ukraine Us Peace Efforts Intensify

Apr 22, 2025 -

Why Automated Sneaker Production Isnt As Easy As It Seems Nike Example

Apr 22, 2025

Why Automated Sneaker Production Isnt As Easy As It Seems Nike Example

Apr 22, 2025