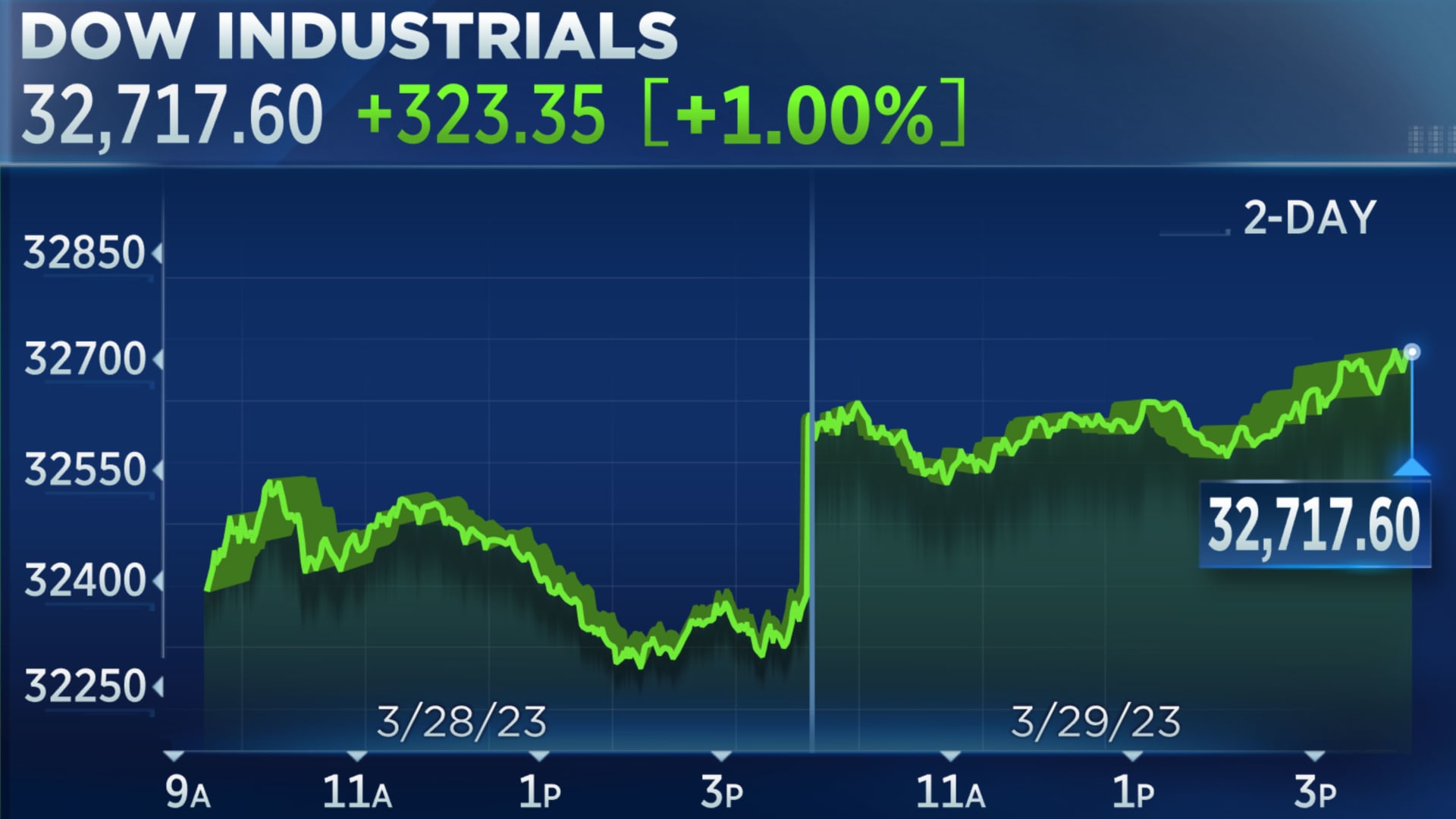

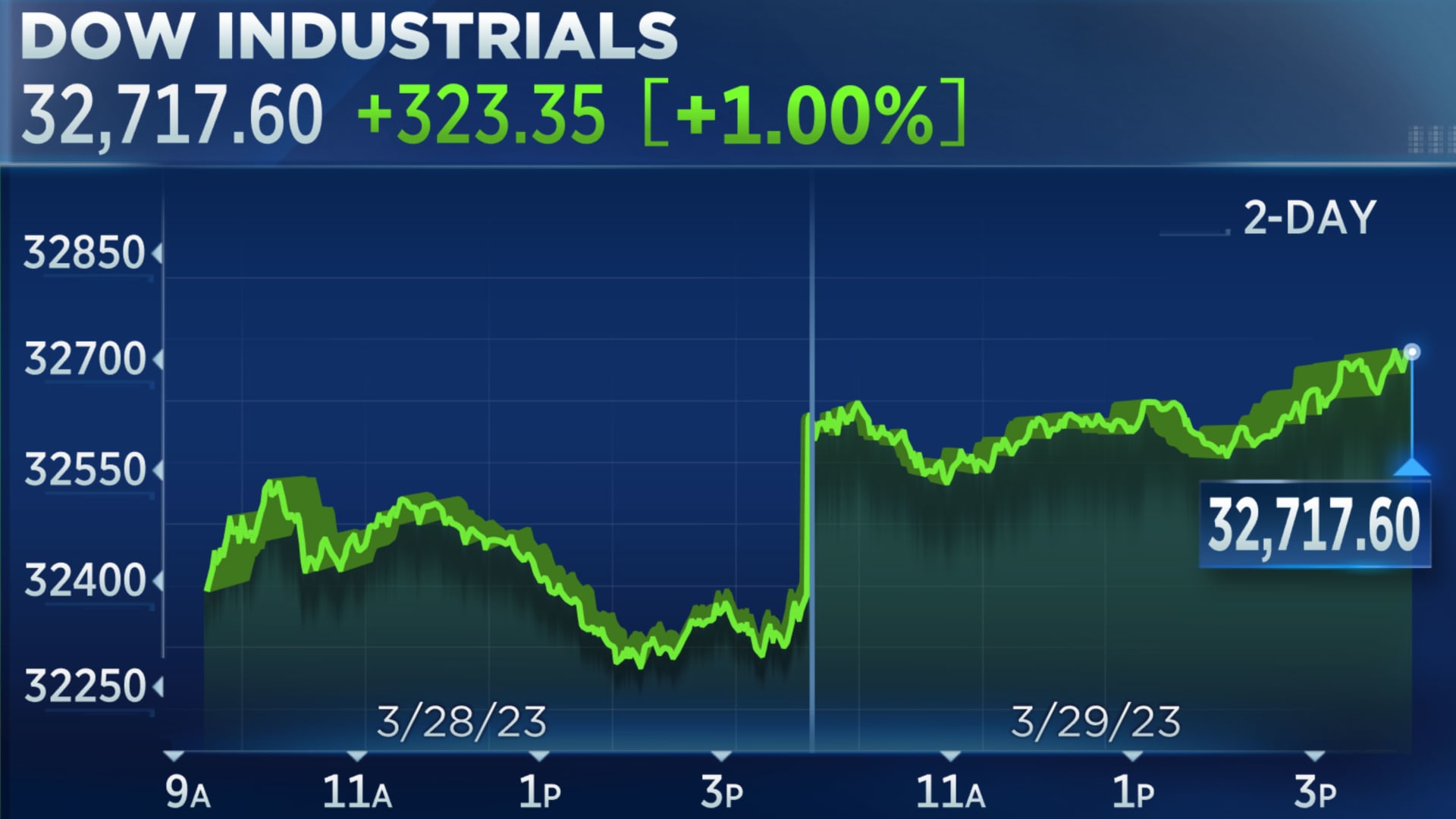

Dow Rallies 1000 Points: Stock Market Update And Analysis

Table of Contents

Understanding the 1000-Point Dow Rally

This remarkable 1000-point Dow rally wasn't a spontaneous event; it was the culmination of several converging factors impacting investor sentiment and market dynamics. While pinpointing a single cause is difficult, several key elements contributed to this significant increase.

- Easing Inflation Concerns: Recent economic data suggested a potential cooling of inflation, reducing fears of aggressive interest rate hikes by the Federal Reserve. This positive economic news significantly boosted investor confidence.

- Strong Corporate Earnings: Several major companies released unexpectedly strong earnings reports, exceeding market expectations and fueling optimism about corporate profitability. This positive news directly impacted stock prices, contributing to the overall market surge.

- Improved Investor Sentiment: A shift in investor psychology played a crucial role. After a period of uncertainty and market correction, a wave of optimism swept through the markets, leading to increased buying activity and driving up stock prices.

- Geopolitical Factors: While not the primary driver, positive developments in global geopolitical situations might have contributed to a calmer investor outlook and reduced risk aversion.

Key Sectors Driving the Dow Jones Rally

The 1000-point Dow rally wasn't uniform across all sectors. Certain industries significantly outperformed others, contributing disproportionately to the overall surge.

-

Technology Sector Dominance: The technology sector experienced a robust rally, driven by strong earnings reports from major tech companies and renewed investor confidence in the sector's long-term growth potential. Many tech stocks saw double-digit percentage increases.

-

Healthcare Sector Gains: The healthcare sector also performed exceptionally well, with pharmaceutical and biotechnology companies leading the charge. Positive clinical trial results and regulatory approvals contributed to this sector's strong performance.

-

Financial Sector Rebound: The financial sector witnessed a notable rebound, driven by increasing interest rates and improved economic forecasts. Banks and financial institutions benefited from the improving macroeconomic environment.

For example, the technology sector saw an average increase of 15%, while the healthcare sector experienced a 12% surge during the rally. These numbers highlight the uneven distribution of gains across different sectors.

Analyzing Individual Stock Performances within the Dow

While the overall Dow Jones Industrial Average experienced a significant surge, individual stock performances varied.

- High-Performers: Companies with strong earnings reports, innovative product launches, or positive industry tailwinds significantly outperformed the market average. For example, [Insert example of a high-performing stock and the reasons for its success].

- Underperformers: Conversely, some stocks lagged behind the overall market rally. Factors like disappointing earnings, negative news impacting the company, or sector-specific headwinds contributed to underperformance. [Insert example of an underperforming stock and the reasons for its weaker performance]. Analyzing individual stock charts helps to understand the dynamics at play. [Include a chart or graph illustrating stock price movements].

Implications and Future Outlook for the Stock Market

The 1000-point Dow rally presents both opportunities and challenges for investors.

- Sustainability of the Rally: The long-term sustainability of this rally remains uncertain. While positive factors contributed to the surge, various economic and geopolitical risks could impact the market's trajectory.

- Potential Risks and Challenges: Factors such as persistent inflation, rising interest rates, geopolitical instability, and potential economic slowdowns could negatively influence market performance. Careful monitoring of these factors is crucial.

- Expert Predictions: Market analysts offer varied predictions regarding the market's future trajectory. Some anticipate continued growth, while others foresee a potential correction or consolidation. [Insert expert opinions or forecasts].

- Impact on Investment Strategies: This rally significantly impacts various investment strategies. Conservative investors might consider rebalancing their portfolios, while more aggressive investors could seek out new opportunities.

Strategies for Investors Following the Dow Jones Rally

Navigating the market after such a significant rally requires careful consideration.

- Risk Management: Diversification is crucial to mitigate risk. Investors should spread their investments across different asset classes and sectors to reduce exposure to any single market downturn. Utilizing stop-loss orders can help protect against significant losses.

- Investment Opportunities: The rally presents opportunities for investors to capitalize on potential market corrections or to identify undervalued stocks within sectors that lagged behind the overall surge.

- Buy, Sell, or Hold Decisions: The decision to buy, sell, or hold assets depends on individual risk tolerance, investment goals, and a thorough analysis of the market conditions.

- Consult a Financial Advisor: Seeking advice from a qualified financial advisor is essential before making any significant investment decisions.

Conclusion

The 1000-point Dow rally represents a significant market event, driven by a confluence of positive economic indicators, strong corporate earnings, and improved investor sentiment. While the rally presents opportunities, it's crucial to understand the potential risks and challenges that lie ahead. Investors should adopt a cautious and well-informed approach, prioritizing risk management and diversification. Staying informed about market trends and monitoring the Dow Jones Industrial Average, as well as other key market indicators, is essential for making sound investment decisions. To stay updated on Dow Jones rallies, stock market surges, and market volatility, continue to follow reputable financial news sources and consult with financial professionals. Remember to make informed investment decisions based on your risk tolerance and financial goals.

Featured Posts

-

Trumps Statement On Fed Chair Powell No Plans For Dismissal

Apr 24, 2025

Trumps Statement On Fed Chair Powell No Plans For Dismissal

Apr 24, 2025 -

The Bold And The Beautiful April 3 Recap Liams Collapse After Explosive Bill Confrontation

Apr 24, 2025

The Bold And The Beautiful April 3 Recap Liams Collapse After Explosive Bill Confrontation

Apr 24, 2025 -

Ohio Train Derailment The Long Term Impact Of Lingering Toxic Chemicals

Apr 24, 2025

Ohio Train Derailment The Long Term Impact Of Lingering Toxic Chemicals

Apr 24, 2025 -

Living With The Lg C3 77 Inch Oled A Practical Review

Apr 24, 2025

Living With The Lg C3 77 Inch Oled A Practical Review

Apr 24, 2025 -

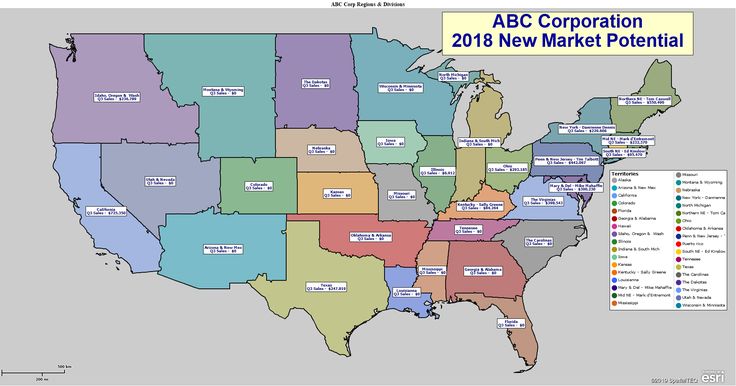

Mapping The Countrys Hottest New Business Locations

Apr 24, 2025

Mapping The Countrys Hottest New Business Locations

Apr 24, 2025