Dow's Canadian Project: Construction Delayed By Market Volatility

Table of Contents

Market Volatility: The Primary Culprit

The current economic landscape is characterized by significant market volatility, creating a perfect storm that's impacting the Dow Chemical Canada project. Several factors are contributing to this instability:

-

Rising Inflation: Soaring inflation is driving up the cost of construction materials, labor, and services, significantly impacting the project's budget. The unforeseen increases in material prices are forcing project managers to constantly re-evaluate cost projections.

-

Increased Interest Rates: Higher interest rates are making financing more expensive, adding to the financial strain on the project. Securing loans and maintaining sufficient capital to fund the construction becomes increasingly challenging in this environment.

-

Fluctuating Energy Prices: The volatility in global energy markets adds another layer of complexity, affecting both the project's operational costs and the overall feasibility of the venture. Energy price fluctuations directly impact the cost of manufacturing and transportation.

-

Supply Chain Disruptions: Ongoing supply chain bottlenecks are delaying the delivery of essential materials, creating further delays and pushing back the project completion date. The inability to secure necessary components on time directly impacts the construction schedule.

Impact on Project Timeline and Budget

The impact of market volatility on Dow's Canadian project is significant. Currently, the project is estimated to be delayed by [Insert timeframe, e.g., six to nine months], resulting in substantial cost overruns. Precise figures remain undisclosed, but industry analysts predict the final cost could exceed the initial budget by [Insert percentage or range, e.g., 15-20%]. The consequences extend beyond Dow itself:

-

Increased Project Costs: Inflation, delays, and supply chain disruptions are collectively driving up the overall project costs, potentially jeopardizing the project's financial viability.

-

Potential Loss of Revenue: The delayed completion translates to a loss of potential revenue from delayed production and a slower return on investment for Dow and its shareholders.

-

Impact on Job Creation: The project delays could negatively affect job creation in the local community, impacting economic growth in the region.

-

Risk of Project Cancellation: The cumulative effect of these challenges poses a significant risk of the project being scaled back or even canceled altogether, resulting in considerable economic losses.

Dow's Response to the Challenges

Faced with these unprecedented challenges, Dow is implementing a multi-pronged strategy to mitigate the impact of market volatility:

-

Renegotiating Contracts: Dow is actively renegotiating contracts with suppliers and subcontractors to secure more favorable pricing and delivery terms.

-

Seeking Alternative Financing: The company is exploring alternative financing options to secure the necessary capital despite the higher interest rate environment.

-

Adjusting Project Scope: To manage costs and timelines, Dow is evaluating potential adjustments to the project scope, prioritizing essential components and potentially delaying less critical elements.

-

Implementing Cost-Cutting Measures: The company is implementing rigorous cost-cutting measures across the project to optimize resource allocation and minimize unnecessary expenditures.

Future Outlook for Dow's Canadian Project

The long-term prospects of Dow's Canadian project remain uncertain. Several scenarios are possible:

-

Best-Case Scenario: The project is completed with manageable delays and cost increases, minimizing the overall negative impact.

-

Worst-Case Scenario: The project faces significant delays or is ultimately suspended due to escalating costs and persistent market volatility.

-

Realistic Scenario: The project is completed with substantial delays and cost overruns, requiring significant financial adjustments and potentially impacting profitability.

Dow remains committed to the project, but the success hinges on the company's ability to effectively navigate the ongoing market volatility and implement its mitigation strategies.

Conclusion: Navigating Market Volatility: The Future of Dow's Canadian Project

Market volatility is presenting significant challenges to Dow's Canadian petrochemical project, resulting in substantial delays and cost overruns. The impact extends beyond Dow, affecting job creation and the broader Canadian economy. Dow's response to these challenges will be crucial in determining the ultimate success of this significant undertaking. Stay tuned for further updates on Dow's Canadian project and how the company navigates future market volatility. Learn more about how economic uncertainty impacts large-scale construction endeavors.

Featured Posts

-

Wildfire Gambling A Look At The Los Angeles Betting Market

Apr 27, 2025

Wildfire Gambling A Look At The Los Angeles Betting Market

Apr 27, 2025 -

From Hair To Tattoos Ariana Grandes Style Overhaul And The Professionals Behind It

Apr 27, 2025

From Hair To Tattoos Ariana Grandes Style Overhaul And The Professionals Behind It

Apr 27, 2025 -

Get Professional Help Ariana Grandes Hair And Tattoo Transformation Inspires

Apr 27, 2025

Get Professional Help Ariana Grandes Hair And Tattoo Transformation Inspires

Apr 27, 2025 -

Grand National How Many Horses Have Died Before The 2025 Race

Apr 27, 2025

Grand National How Many Horses Have Died Before The 2025 Race

Apr 27, 2025 -

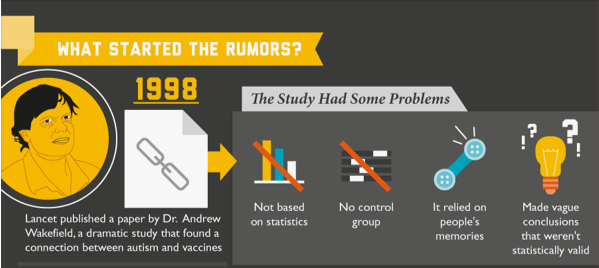

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Claims

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Claims

Apr 27, 2025