ECB Rate Cut Outlook: Simkus Hints At Two More Reductions

Table of Contents

Šimkus's Statements and their Significance

The Context of the Comments

Šimkus's comments arrive against a backdrop of concerning economic indicators in the Eurozone. GDP growth has slowed significantly, falling below expectations in several key member states. Inflation remains stubbornly low, failing to reach the ECB's target of "below, but close to, 2%". Unemployment, while declining, is still higher than pre-crisis levels in many regions. These factors combine to create a challenging environment for the ECB, necessitating a proactive response.

- Direct quotes from Šimkus: While precise quotes may vary depending on the source, Šimkus's statements generally indicated a leaning towards further rate reductions to counter the economic slowdown. He may have used phrases suggesting a "high probability" or a "strong possibility" of additional cuts.

- Analysis of the language used: The language used by Šimkus was likely suggestive rather than definitive, reflecting the complexities and uncertainties inherent in economic forecasting and the need for consensus within the ECB Governing Council.

- Statements from other ECB officials: It's crucial to analyze statements from other key ECB officials to gauge the level of support for Šimkus's perspective. Agreement from other members would strengthen the likelihood of further rate cuts.

Further Detail: Gediminas Šimkus, as a member of the Governing Council, holds significant influence within the ECB. His statements, even if not entirely conclusive, carry considerable weight and significantly shape market expectations regarding future ECB monetary policy decisions and influence the ECB rate cut trajectory. Market participants closely scrutinize such statements to adjust their investment strategies accordingly.

Factors Influencing the ECB's Decision to Cut Rates

Weakening Economic Growth

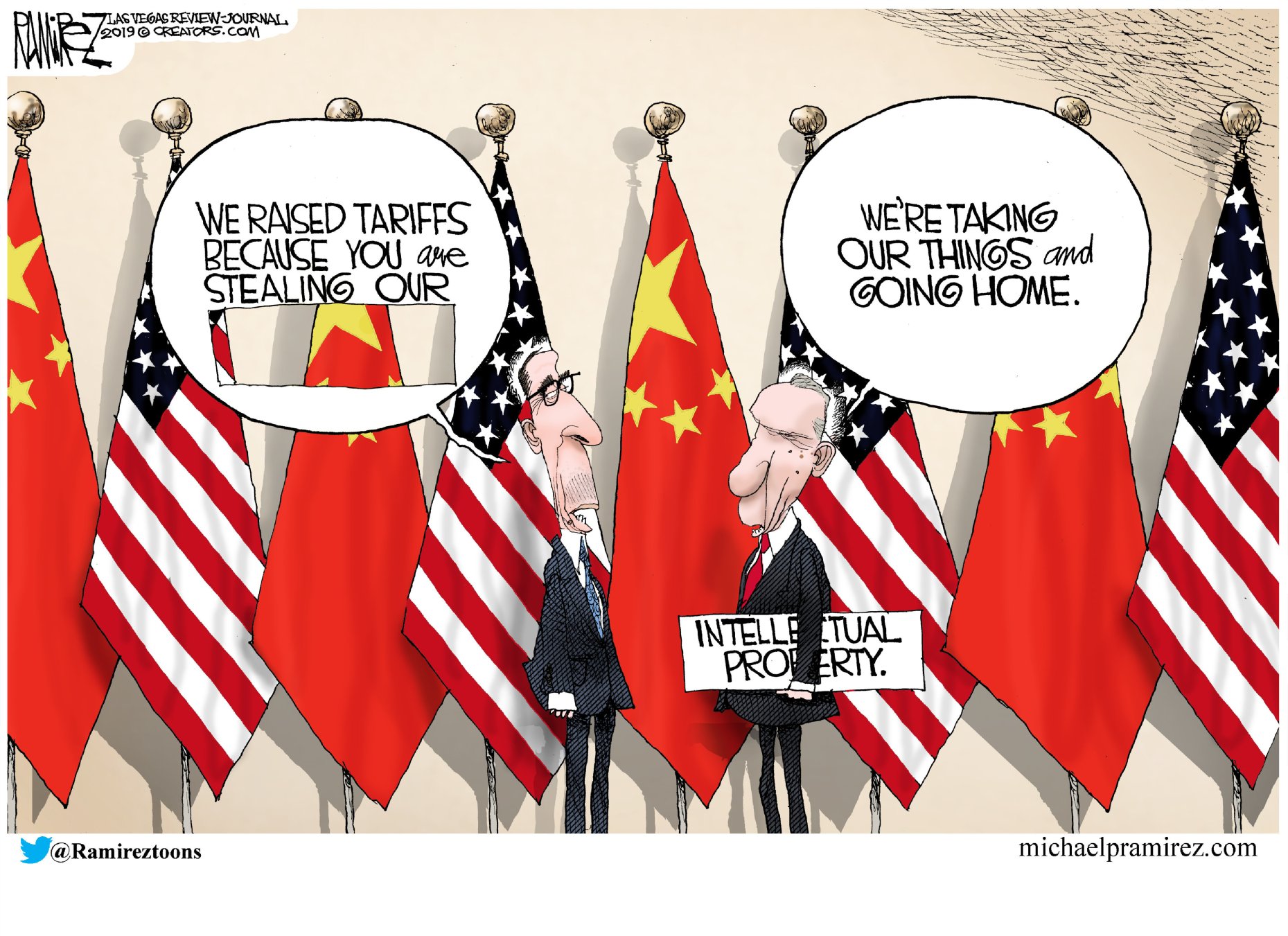

The Eurozone economy is facing multiple headwinds that contribute to its weakening growth trajectory. Global trade tensions, particularly the US-China trade war, have dampened export demand. Brexit uncertainty continues to cast a shadow over economic confidence and investment decisions. Furthermore, internal structural issues within some Eurozone economies are also playing a role.

- Specific examples of weakening economic indicators: This could include declining industrial production figures, weakening consumer confidence indexes, and slowing retail sales.

- Impact on Eurozone businesses and consumers: Lower growth translates to reduced business investment, hiring freezes, and potentially job losses. Consumers may postpone major purchases, leading to further weakening of demand.

- Potential risks to the Eurozone economy: The risks include a potential recession, further deflationary pressures, and increased social and political instability within some member states.

Further Detail: The ECB's primary mandate is to maintain price stability and support economic growth within the Eurozone. The current low inflation and slowing growth necessitate a policy response aimed at stimulating the economy and pushing inflation back towards its target level. The ECB rate cut is a key tool in their arsenal to achieve this goal.

Potential Impact of Further ECB Rate Cuts

Effect on Borrowing Costs

Lower interest rates directly translate to lower borrowing costs for businesses and consumers. This can boost investment and consumption, stimulating economic activity.

- Impact on investment and economic activity: Businesses will find it cheaper to borrow money for investment in new equipment, expansion projects, and hiring. This should increase overall investment and stimulate growth.

- Potential consequences for the housing market: Lower interest rates often lead to increased demand for mortgages, potentially pushing up house prices in some areas.

- Effect on the Euro exchange rate: Lower interest rates can make the Euro less attractive to foreign investors, potentially leading to a depreciation of the currency.

Further Detail: While rate cuts can be stimulative, they also carry risks. Excessive rate cuts could fuel inflation in the longer term, potentially leading to asset bubbles and financial instability. The ECB needs to carefully balance the need for economic stimulus with the risk of unintended consequences.

Alternative Monetary Policy Options

Quantitative Easing (QE)

Should the ECB deem further interest rate cuts insufficient, they might consider restarting or expanding their quantitative easing (QE) program.

- Advantages and disadvantages of QE: QE can boost liquidity and lower long-term interest rates, but it also carries the risk of increasing inflation and creating asset bubbles.

- Potential impact of QE on bond yields and inflation: QE can put downward pressure on bond yields and potentially increase inflation, if effective.

- Comparison of QE with interest rate cuts: QE is a more powerful tool than interest rate cuts, but also carries greater risks. It’s a more significant intervention in the market.

Further Detail: The ECB may also explore other non-conventional monetary policy tools, such as negative interest rates on commercial bank reserves or targeted longer-term refinancing operations (TLTROs), to further support lending and credit conditions within the Eurozone.

Market Reaction and Investor Sentiment

Analysis of Market Response

Šimkus's comments likely caused immediate ripples in the financial markets.

- Changes in bond yields and stock prices: Bond yields might fall as investors anticipate lower interest rates, while stock prices could react positively or negatively depending on investors’ assessment of the overall economic outlook and the impact on corporate earnings.

- Assessment of investor confidence: Investor confidence could either rise (if the market views the rate cut as positive for economic growth) or fall (if it views it as a sign of weakness).

- Potential risks or opportunities for investors: Investors need to carefully assess the risks and opportunities presented by the potential for further ECB rate cuts.

Further Detail: The Euro's exchange rate is particularly sensitive to expectations about ECB monetary policy. Anticipation of further rate cuts can put downward pressure on the Euro, impacting businesses engaged in international trade and investors holding Euro-denominated assets.

Conclusion

Šimkus's comments suggesting two more ECB rate cuts highlight the challenges faced by the Eurozone economy. Slowing growth, low inflation, and external headwinds necessitate a proactive monetary policy response from the ECB. The potential impact of these cuts includes lower borrowing costs, but also carries risks of increased inflation and asset bubbles. Alternative options such as QE remain on the table. Financial markets will closely monitor further developments to assess the overall implications of these decisions.

Call to Action: Stay informed about further developments concerning the ECB's monetary policy and the ongoing ECB rate cut outlook. Follow our website for regular updates and expert analysis on the implications of future ECB decisions. Understanding the implications of the ECB rate cut is crucial for navigating the evolving economic landscape.

Featured Posts

-

Canadas Negotiating Power Awaiting A Favorable Us Trade Agreement

Apr 27, 2025

Canadas Negotiating Power Awaiting A Favorable Us Trade Agreement

Apr 27, 2025 -

Ohio Derailment The Lingering Threat Of Toxic Chemicals In Buildings

Apr 27, 2025

Ohio Derailment The Lingering Threat Of Toxic Chemicals In Buildings

Apr 27, 2025 -

Charleston Open Kalinskayas Stunning Victory Over Keys

Apr 27, 2025

Charleston Open Kalinskayas Stunning Victory Over Keys

Apr 27, 2025 -

Trump Predicts Trade Deal Conclusion In 3 4 Weeks

Apr 27, 2025

Trump Predicts Trade Deal Conclusion In 3 4 Weeks

Apr 27, 2025 -

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025