Economists Predict Rate Cuts Following Weak Retail Sales Data

Table of Contents

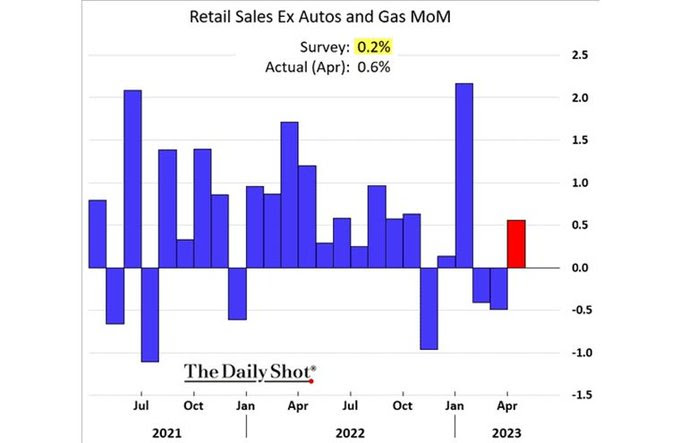

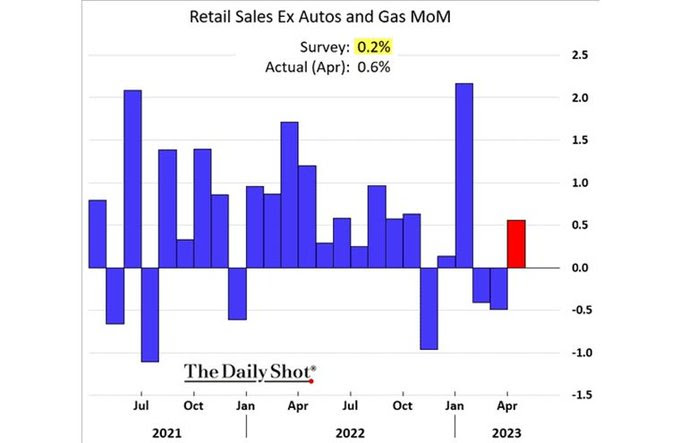

Weak Retail Sales Data: A Deeper Dive

The latest retail sales figures paint a concerning picture. A significant decline in consumer spending signals a weakening economy and has fueled predictions of rate cuts. Several key factors contribute to this worrying trend. High inflation continues to erode purchasing power, leaving consumers with less disposable income. Simultaneously, elevated interest rates, implemented to combat inflation, have increased borrowing costs, further dampening consumer confidence and reducing spending on big-ticket items.

- Significant drop in sales of durable goods: Sales of appliances, furniture, and other durable goods have experienced a sharp decline, indicating a pullback in major purchases. This suggests consumers are increasingly hesitant to take on debt and are prioritizing essential spending.

- Decreased spending on non-essential items: Consumers are cutting back on discretionary purchases, such as clothing, entertainment, and dining out. This shift towards essential spending reflects a cautious approach to personal finances in the face of economic uncertainty.

- Impact on various retail sectors: The retail sector is feeling the pinch across the board. Clothing retailers, electronics stores, and even grocery stores are reporting weaker-than-expected sales, demonstrating the widespread nature of the slowdown in consumer spending.

Economists' Predictions and Rationale

In response to the weak retail sales data and other indicators of economic slowdown, many economists are predicting that central banks will implement interest rate cuts. This proactive monetary policy aims to stimulate economic activity by making borrowing cheaper and encouraging investment and spending.

- Expert X predicts a 0.25% rate cut by October 2024: Leading economist Jane Doe from the prestigious Smith Institute forecasts a cautious approach, anticipating a small initial rate cut.

- Institution Y anticipates multiple rate cuts within the next six months: The renowned Jones & Co. financial institution anticipates a more aggressive response, predicting several rate cuts within the next half year to counter the economic downturn.

- The rationale behind the predicted cuts is to stimulate economic activity: By lowering interest rates, the central bank aims to reduce borrowing costs for businesses and consumers, encouraging investment and spending, and potentially boosting economic growth.

Potential Impacts of Rate Cuts

The potential impacts of these predicted rate cuts are multifaceted and potentially far-reaching. While intended to stimulate the economy, they also carry risks.

- Lower borrowing costs could incentivize businesses to invest: Reduced interest rates can make borrowing more attractive for businesses, potentially leading to increased investment in expansion and job creation.

- Increased consumer spending due to easier access to credit: Lower interest rates may encourage consumers to borrow more, leading to increased spending and potentially boosting economic activity.

- Potential risks of fueling inflation if implemented too aggressively: A rapid decrease in interest rates could reignite inflationary pressures if not carefully managed. This presents a delicate balancing act for central banks.

Alternative Economic Scenarios and Uncertainties

While economists are predicting rate cuts, it's crucial to acknowledge the uncertainties inherent in economic forecasting. Several alternative scenarios and factors could influence the accuracy of these predictions.

- Risk of a deeper recession if rate cuts are insufficient: If the rate cuts prove inadequate to stimulate sufficient economic activity, the economy could slide into a deeper recession than currently anticipated.

- Possibility of inflation remaining stubbornly high: Persistent inflation could necessitate a more cautious approach to rate cuts, potentially delaying or limiting their impact.

- Impact of global events (e.g., geopolitical tensions) on the economic outlook: Unforeseen global events could significantly alter the economic landscape, impacting the effectiveness of rate cuts and potentially leading to unexpected outcomes.

Conclusion

The weak retail sales data serves as a stark warning sign of an economic slowdown, prompting economists to predict imminent rate cuts. While these cuts aim to stimulate economic activity by lowering borrowing costs and encouraging spending, their effectiveness depends on various factors and carries inherent risks. The possibility of a deeper recession or stubbornly high inflation remains, highlighting the significant uncertainties facing the global economy. Staying informed about these developments is crucial. Stay updated on future interest rate cuts and their impact on the economy by following our publication and subscribing to our newsletter. Learn more about the impact of weak retail sales data on interest rates and future economic forecasts.

Featured Posts

-

The Proposed Broadcom V Mware Acquisition An Extreme Price Surge

Apr 28, 2025

The Proposed Broadcom V Mware Acquisition An Extreme Price Surge

Apr 28, 2025 -

Yankees Lose To Pirates On Walk Off Hit After Extra Innings

Apr 28, 2025

Yankees Lose To Pirates On Walk Off Hit After Extra Innings

Apr 28, 2025 -

Nfl Draft 2024 Shedeur Sanders Headed To Cleveland

Apr 28, 2025

Nfl Draft 2024 Shedeur Sanders Headed To Cleveland

Apr 28, 2025 -

Emotional Goodbye Espn Honors Cassidy Hubbarth

Apr 28, 2025

Emotional Goodbye Espn Honors Cassidy Hubbarth

Apr 28, 2025 -

Nascar Phoenix Race Bubba Wallace Hits Wall Due To Brake Issue

Apr 28, 2025

Nascar Phoenix Race Bubba Wallace Hits Wall Due To Brake Issue

Apr 28, 2025