Extreme Price Increase: AT&T On Broadcom's VMware Acquisition Costs

Table of Contents

The VMware Acquisition: A Deep Dive

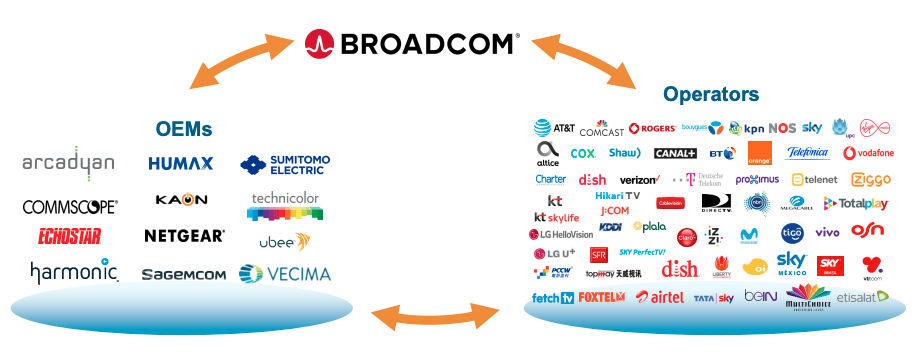

Broadcom's acquisition of VMware, finalized in late 2022, represents one of the largest technology mergers in history. This $61 billion deal brought together a leading infrastructure software provider (VMware) and a dominant semiconductor and infrastructure software company (Broadcom). Broadcom's strategic goal was to expand its software portfolio and strengthen its position in the enterprise software market, particularly in cloud computing and data center infrastructure. The initial market reaction was mixed, with some analysts expressing concerns about potential monopolies and increased pricing for enterprise customers. VMware plays a crucial role in many companies' IT infrastructure, including AT&T, providing virtualization and cloud management solutions. This integration into AT&T’s infrastructure now means they are directly impacted by Broadcom’s pricing decisions.

- Acquisition Size: $61 billion

- Completion Date: Late 2022

- Broadcom's Strategic Goals: Expansion of software portfolio, dominance in enterprise software market.

- Initial Market Reactions: Mixed, concerns about monopolies and pricing.

- VMware's Role in AT&T's Infrastructure: Provides crucial virtualization and cloud management solutions.

Analyzing the Price Increases for AT&T

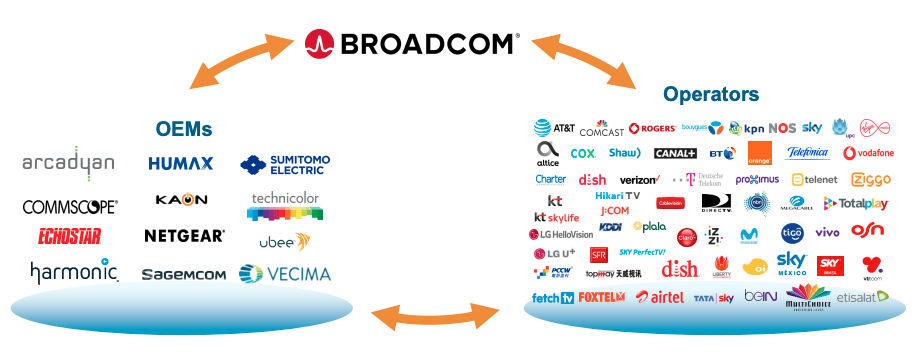

The Broadcom VMware acquisition cost increase has translated into substantial price hikes for AT&T. While specific figures remain largely undisclosed due to competitive sensitivity, reports suggest significant percentage increases across various VMware products and services. This directly impacts AT&T's operational costs, potentially squeezing profit margins and affecting its ability to invest in future network upgrades and innovation. The impact is far-reaching, affecting various services, including but not limited to cloud computing infrastructure, networking solutions, and data center management.

- Percentage Increase: Unconfirmed, but reports suggest substantial increases.

- Impact on Operational Costs: Significant increases in expenditure.

- Impact on Profitability: Potential for reduced profit margins.

- Affected Services: Cloud services, networking solutions, data center management.

AT&T's Response and Mitigation Strategies

Facing the Broadcom VMware acquisition cost increase, AT&T is likely exploring various mitigation strategies. Although official statements haven’t detailed specific actions, several potential responses are plausible. This could include cost-cutting measures within its IT infrastructure, negotiating directly with Broadcom for more favorable pricing, or exploring alternative vendors for specific VMware services. These strategic decisions may affect future investments in other areas of the business.

- Cost-Cutting Measures: Streamlining IT operations, optimizing resource allocation.

- Negotiations with Broadcom: Attempting to secure better pricing agreements.

- Alternative Solutions: Exploring competing products and vendors.

- Future Investments: Potential for reduced investment in other areas.

Long-Term Implications and Industry-Wide Effects

The Broadcom VMware acquisition cost increase has far-reaching implications beyond AT&T. Other telecommunication companies utilizing VMware solutions are likely experiencing similar price pressures. This could intensify competition as companies seek more cost-effective alternatives. The long-term impact on consumers remains uncertain, but it's possible that increased costs could be passed on in the form of higher service prices or reduced service quality. Regulatory scrutiny and potential antitrust concerns are also likely to increase in the coming months and years.

- Impact on Other Telecom Companies: Similar cost increases anticipated.

- Market Competition: Increased pressure to find cost-effective solutions.

- Long-Term Cost Implications for Consumers: Potential for higher prices or reduced service quality.

- Regulatory Scrutiny: Increased antitrust concerns.

Conclusion

The Broadcom VMware acquisition cost increase presents a significant challenge for AT&T and the broader telecommunications industry. The substantial price hikes, coupled with the potential for reduced profitability and increased consumer costs, highlight the complex ramifications of such large-scale mergers. AT&T's response, along with the actions of other telecom providers, will be crucial in shaping the future landscape of the industry. Stay updated on the evolving impact of the Broadcom VMware acquisition cost increase on AT&T and the telecom sector. Further research into regulatory filings and industry reports will provide a more comprehensive understanding of this developing situation.

Featured Posts

-

Boosting Canadian Energy Exports A Focus On Southeast Asia

Apr 28, 2025

Boosting Canadian Energy Exports A Focus On Southeast Asia

Apr 28, 2025 -

V Mware Costs To Skyrocket At And T Highlights 1050 Price Hike From Broadcom

Apr 28, 2025

V Mware Costs To Skyrocket At And T Highlights 1050 Price Hike From Broadcom

Apr 28, 2025 -

What A Young Mets Starter Needs To Do To Secure A Rotation Spot

Apr 28, 2025

What A Young Mets Starter Needs To Do To Secure A Rotation Spot

Apr 28, 2025 -

Is This Underrated Red Sox Player Ready For A Breakout Season

Apr 28, 2025

Is This Underrated Red Sox Player Ready For A Breakout Season

Apr 28, 2025 -

Is Kuxius Solid State Power Bank Worth The Premium A Cost Vs Longevity Analysis

Apr 28, 2025

Is Kuxius Solid State Power Bank Worth The Premium A Cost Vs Longevity Analysis

Apr 28, 2025