German DAX Index: Analyzing The Influence Of Politics And Economics

Table of Contents

Economic Factors Influencing the German DAX Index

The German DAX Index is heavily influenced by a variety of economic factors, both domestic and international. Understanding these factors is key to predicting DAX performance and making sound investment choices.

The Strength of the Euro

The Euro's value has a direct correlation with the DAX. A strong Euro makes German exports more expensive globally, potentially hindering economic growth and impacting the DAX negatively. Conversely, a weak Euro can boost exports, leading to increased company profits and a stronger DAX. This impact is particularly felt in export-oriented sectors like the automotive and manufacturing industries.

- Impact on export-oriented sectors like automotive and manufacturing: A strong Euro reduces competitiveness in global markets.

- Influence on foreign investment: A weak Euro can attract foreign investment seeking higher returns.

- Effect on inflation and interest rates: Currency fluctuations influence inflation and subsequently, interest rate decisions by the European Central Bank (ECB). These decisions, in turn, impact borrowing costs for businesses and consumer spending, influencing the DAX.

Historical examples abound; periods of Euro weakness have often coincided with stronger DAX performance, while periods of Euro strength have sometimes resulted in stagnation or decline. Analyzing historical currency fluctuations against DAX performance reveals a clear, albeit complex, relationship.

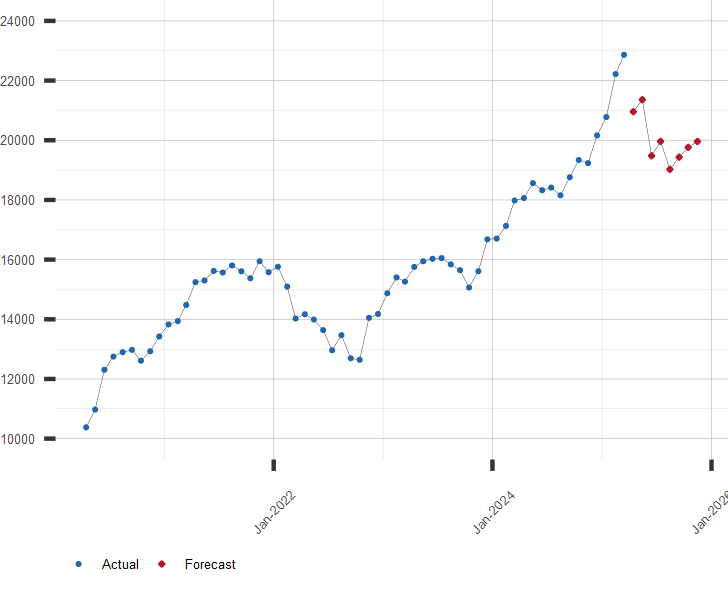

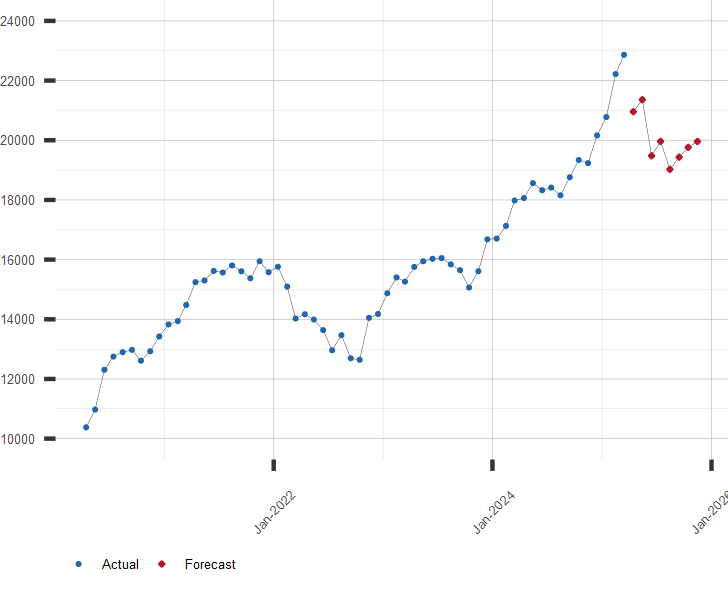

German GDP Growth and its Relation to the DAX

German GDP growth is fundamentally linked to the DAX. Strong GDP growth usually translates to increased company profits, higher investor confidence, and a rising DAX. Conversely, slow or negative GDP growth can lead to decreased profits, lower investor sentiment, and a falling DAX.

- Correlation between GDP growth and DAX performance: A strong positive correlation is generally observed.

- Sector-specific analysis of GDP impact: Different sectors react differently to GDP changes. For example, consumer discretionary sectors are more sensitive than essential goods sectors.

- Long-term trends and their implications for the DAX: Analyzing long-term GDP trends helps predict potential DAX trajectories.

Key economic indicators like unemployment rates and consumer confidence provide further insight into the overall health of the German economy and offer valuable clues about potential future DAX performance. Monitoring these metrics alongside GDP growth provides a more holistic picture.

Global Economic Conditions and their Ripple Effect on the DAX

The German economy, and by extension the DAX, is deeply intertwined with the global economy. Global events and trends exert a significant influence.

- Impact of global supply chain disruptions: Disruptions can significantly impact German manufacturers and the DAX.

- Influence of international trade agreements: Trade wars or new agreements directly impact German exports and imports, affecting the DAX.

- The role of geopolitical risk: Geopolitical instability often leads to increased uncertainty and risk aversion, influencing investor behavior and affecting the DAX.

Recessions in major economies, trade wars, and volatile commodity prices (like oil, a crucial input for many German industries) all have ripple effects on the German economy and its flagship index.

Political Factors Shaping the German DAX Index

Political factors play a significant role in shaping the German DAX Index. Government policies, geopolitical events, and EU initiatives all contribute to the overall economic climate and investor sentiment.

Government Policies and Regulations

German government policies and regulations directly impact the DAX. Fiscal policies (tax cuts, government spending) influence business investment and consumer spending, directly affecting corporate profits and, subsequently, the DAX.

- Examples of pro-business policies and their effects on the DAX: Tax incentives for businesses often lead to increased investment and DAX growth.

- Impact of regulatory uncertainty: Uncertain regulatory environments can deter investment and negatively affect the DAX.

- Influence of political stability on investor confidence: Political stability is a key driver of investor confidence, directly impacting the DAX.

Regulatory changes (environmental regulations, labor laws) also influence corporate profitability and investment decisions, impacting the DAX's trajectory.

Geopolitical Events and their Impact on the DAX

International conflicts and political instability worldwide can significantly affect the German economy and investor sentiment, leading to fluctuations in the DAX.

- Examples of geopolitical events impacting the DAX: The 2014 Ukraine crisis and the ongoing war in Ukraine have demonstrably impacted the DAX.

- The importance of political risk assessment: Analyzing geopolitical risks is crucial for understanding potential DAX volatility.

- How investors react to geopolitical uncertainty: Geopolitical uncertainty often leads to risk aversion and capital flight, impacting the DAX negatively.

Political developments in other major European economies and global powers also have a knock-on effect on the German economy and the DAX.

European Union Policies and their Influence on the DAX

EU policies, monetary policy from the European Central Bank (ECB), and economic initiatives significantly impact the German economy and the DAX.

- Impact of EU regulations on German industries: EU regulations can both positively and negatively affect German businesses.

- Influence of the Eurozone on the DAX: The Eurozone's economic health is directly linked to the DAX's performance.

- The role of EU structural funds: EU funds can stimulate economic growth in specific regions of Germany, indirectly influencing the DAX.

The Eurozone's overall economic health and ECB monetary policies (interest rates, quantitative easing) directly affect the DAX. Understanding these factors is crucial for investors.

Conclusion

The German DAX Index is a complex reflection of both Germany's robust economic performance and the broader political and economic landscape. Understanding the interplay between these factors – the strength of the Euro, German GDP growth, global economic conditions, government policies, geopolitical events, and EU initiatives – is crucial for successfully navigating the German stock market. By carefully analyzing these influential aspects, investors can make more informed decisions regarding the German DAX Index and optimize their investment strategies. To stay updated on these dynamic influences and their impact on the German DAX Index, continue researching market trends and political developments. Thorough analysis of the DAX index and its influencing factors is key to successful long-term investing.

Featured Posts

-

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025 -

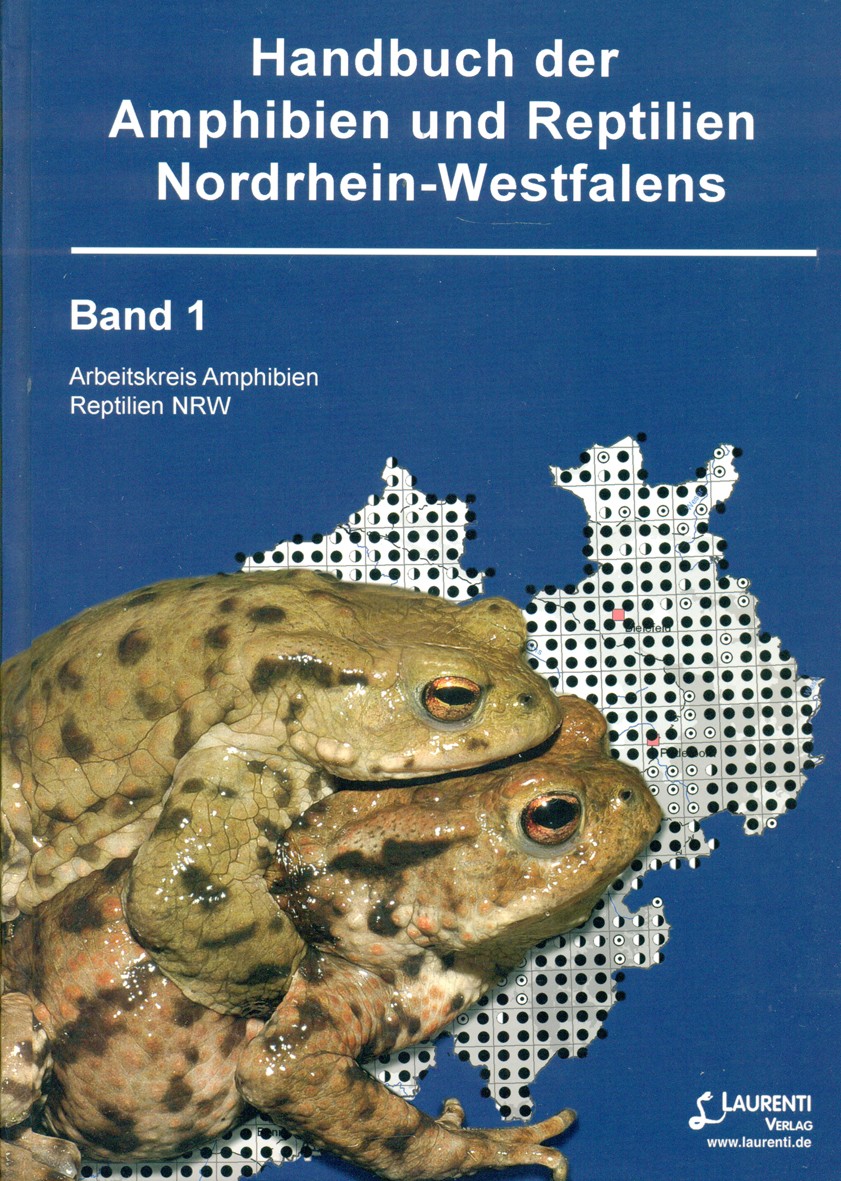

Thueringen Amphibien Und Reptilien Atlas Ein Umfassender Ueberblick

Apr 27, 2025

Thueringen Amphibien Und Reptilien Atlas Ein Umfassender Ueberblick

Apr 27, 2025 -

Is The Cdcs New Vaccine Study Hire Spreading Misinformation

Apr 27, 2025

Is The Cdcs New Vaccine Study Hire Spreading Misinformation

Apr 27, 2025 -

Thueringens Reptilien Und Amphibien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Reptilien Und Amphibien Der Neue Atlas Ist Da

Apr 27, 2025 -

Jannik Sinners Doping Case Concludes The Verdict

Apr 27, 2025

Jannik Sinners Doping Case Concludes The Verdict

Apr 27, 2025