High Stock Valuations: BofA's Argument For Investor Calm

Table of Contents

BofA's Core Argument: Strong Corporate Earnings Justify High Valuations

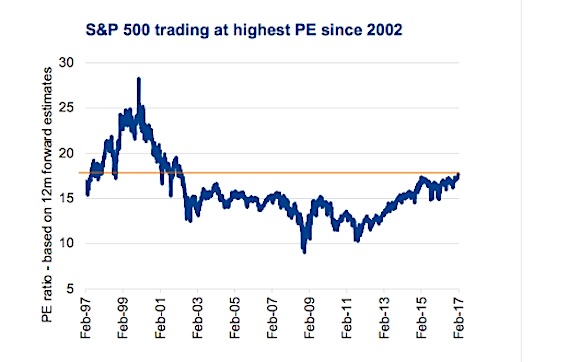

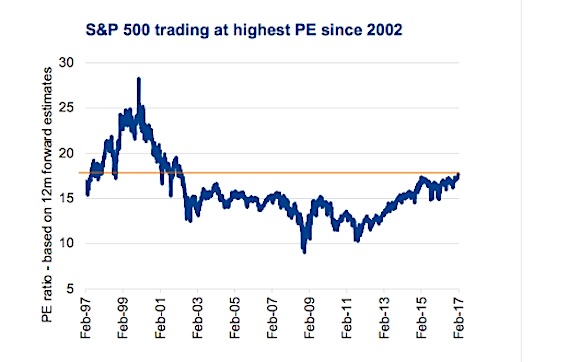

BofA's central thesis is that while Price-to-Earnings (P/E) ratios might appear elevated compared to historical averages, robust corporate earnings growth is effectively offsetting this, leading to valuations that are, in their view, sustainable. They argue that focusing solely on P/E ratios without considering the underlying earnings power provides an incomplete picture of market valuation.

- Strong Earnings Growth in Key Sectors: BofA points to specific sectors, such as technology, healthcare, and select consumer staples, as exhibiting exceptional earnings growth. These sectors are demonstrating resilience even amidst macroeconomic uncertainty.

- Projected Earnings Growth: BofA's analysts predict continued earnings growth in the coming quarters, although at potentially a slower pace than previously seen. Their forecasts often incorporate various economic scenarios and risk factors. For example, they might project a 7-10% earnings growth rate for the S&P 500 over the next year, depending on the prevailing economic conditions.

- Robust Profitability and Cash Flow: Supporting their argument, BofA highlights data demonstrating strong corporate profitability and healthy cash flows. This indicates that companies are not only growing their top lines (revenues) but also effectively managing their bottom lines (profits), a key indicator of financial health.

- Earnings Growth Justifies Valuations: BofA's analysis suggests that the current elevated valuations are justifiable, given the projected earnings growth and the strong fundamental performance of many companies. They argue that the market is correctly pricing in future earnings expectations.

Addressing the Inflation Concerns and Interest Rate Hikes

Inflation and the Federal Reserve's (Fed) response via interest rate hikes are major concerns for investors. BofA acknowledges these concerns but offers a nuanced perspective.

- BofA's Stance on Fed Policy: BofA generally anticipates that the Fed will continue to manage interest rate increases strategically, aiming to curb inflation without triggering a significant economic downturn. Their predictions are constantly evolving based on new economic data.

- Inflation Trajectory Predictions: BofA's economists predict a gradual decline in inflation over time, although the path to lower inflation might be uneven. They carefully weigh factors like supply chain disruptions, energy prices, and consumer spending habits in their projections.

- Inflation's Impact on Valuations: BofA's assessment incorporates the anticipated effects of inflation and interest rate adjustments on corporate earnings and stock valuations. They believe that while these factors introduce uncertainty, the underlying strength of corporate earnings will ultimately prove resilient.

- Navigating the Inflationary Environment: BofA doesn't necessarily advocate for drastic portfolio changes. They often suggest a measured approach, emphasizing the importance of portfolio diversification and a long-term investment horizon.

The Role of Long-Term Growth Prospects

BofA's valuation assessment extends beyond short-term market fluctuations. They consider the potential for long-term economic growth as a crucial factor.

- Sectors Poised for Long-Term Growth: BofA identifies sectors like renewable energy, artificial intelligence, and biotechnology as poised for substantial long-term growth, driven by technological advancements and evolving societal needs.

- Technological Advancements and Societal Shifts: These long-term growth predictions are based on ongoing technological innovations and shifts in consumer preferences and societal priorities. This provides a positive outlook even considering current market volatility.

- Mitigating Valuation Risks: BofA argues that the potential for long-term growth from these emerging sectors mitigates the risks associated with high current valuations. The expectation of future growth justifies, in their opinion, the premium investors are currently paying.

Diversification and Risk Management Strategies

In the context of high stock valuations, BofA underscores the critical importance of diversification and effective risk management.

- Diversification Strategies: BofA implicitly suggests diversification across different asset classes (stocks, bonds, real estate), sectors, and geographies to reduce overall portfolio risk. This is a standard recommendation for managing investment risk.

- Risk Management Tools: Risk management techniques include setting stop-loss orders, regularly rebalancing portfolios, and potentially incorporating hedging strategies to mitigate potential losses.

- Navigating Market Volatility: By implementing robust diversification and risk management strategies, investors can potentially navigate market volatility more effectively, even when stock valuations appear high. This helps in mitigating potential losses during market corrections.

Conclusion

BofA's core arguments for investor calm despite high stock valuations center on strong corporate earnings growth, a managed approach to inflation by the Federal Reserve, positive long-term growth prospects in key sectors, and the importance of diversification and risk management. While valuations might seem high compared to historical norms, BofA's analysis suggests that these factors justify, to a significant extent, the current market levels. They are not suggesting ignoring the risks but rather offering a perspective that balances these risks with the potential rewards.

While high stock valuations may seem daunting, understanding BofA's perspective and incorporating sound investment strategies can help you navigate the current market. Learn more about managing your portfolio in the face of high stock valuations and make informed decisions for your financial future. Consider consulting with a financial advisor for personalized guidance tailored to your risk tolerance and financial goals. Remember to conduct your own thorough research and seek professional financial advice before making any investment decisions.

Featured Posts

-

Andy Pettittes Gem A 2000 Yankees Diary Entry Featuring Joe Torre

Apr 28, 2025

Andy Pettittes Gem A 2000 Yankees Diary Entry Featuring Joe Torre

Apr 28, 2025 -

A Look Back The 2000 Yankees Joe Torre And Andy Pettittes Success

Apr 28, 2025

A Look Back The 2000 Yankees Joe Torre And Andy Pettittes Success

Apr 28, 2025 -

Merd Fn Abwzby Kl Ma Thtaj Merfth En Fealyat 19 Nwfmbr

Apr 28, 2025

Merd Fn Abwzby Kl Ma Thtaj Merfth En Fealyat 19 Nwfmbr

Apr 28, 2025 -

Trumps Time Interview Canada China And The Third Term Key Insights Revealed

Apr 28, 2025

Trumps Time Interview Canada China And The Third Term Key Insights Revealed

Apr 28, 2025 -

Planning For The Future Red Sox Solutions To Fill O Neills Role In 2025

Apr 28, 2025

Planning For The Future Red Sox Solutions To Fill O Neills Role In 2025

Apr 28, 2025