May Hearing To Determine Fate Of $500 Million Bread Price-Fixing Settlement

Table of Contents

The Allegations of Bread Price-Fixing

This monumental lawsuit centers around accusations of a coordinated effort to artificially inflate bread prices. The alleged bread price-fixing scheme involves some of the biggest names in the baking industry, impacting millions of consumers.

Companies Involved

Several major baking companies are implicated in the alleged price-fixing scheme. While specific names may not be publicly released until the May hearing, the investigation likely involves companies with significant market share and influence, contributing to the alleged bread price manipulation. The scale of their operations and market dominance made them key targets in the antitrust lawsuit. Understanding each company's role and their respective market influence is crucial to grasping the breadth of the alleged price-fixing conspiracy.

The Antitrust Lawsuit

The antitrust lawsuit alleges a conspiracy amongst these baking giants to collude on pricing strategies, resulting in artificially inflated bread prices. The plaintiffs, representing consumers and potentially retailers, claim this collusion violated antitrust laws designed to protect competition and prevent price gouging. The bread price manipulation allegedly deprived consumers of fair market pricing and negatively impacted their purchasing power.

- Specific examples of alleged price-fixing activities: The lawsuit likely points to specific instances of communication between companies, shared pricing strategies, and parallel price increases across different brands.

- Timeline of events leading to the lawsuit: The chronology of events, from initial suspicions of collusion to the filing of the lawsuit, is critical in establishing the case's timeline and the nature of the alleged conspiracy.

- Impact on consumer spending and market competition: The alleged bread price-fixing has significantly impacted consumers, resulting in increased household spending on bread and reduced purchasing power. The lack of fair competition has likely stifled innovation and reduced the availability of affordable options for consumers.

The Proposed $500 Million Settlement

The proposed $500 million settlement aims to resolve this complex bread price-fixing lawsuit without a protracted trial. However, the potential implications of its approval or rejection are substantial.

Breakdown of the Settlement

The $500 million settlement would likely be divided among several parties. A significant portion would go towards compensating consumers affected by the alleged price increases. A portion would cover legal fees for the plaintiffs and their lawyers, and some may go toward future consumer protection initiatives. The precise allocation of funds will likely be detailed in the upcoming hearing. The conditions attached to the settlement likely include measures to prevent future instances of price fixing.

Arguments for and Against the Settlement

Arguments in favor of the settlement highlight its potential benefits. It would bring a swift resolution to the lengthy and costly legal proceedings, providing quicker compensation to consumers. However, critics argue the settlement amount is insufficient and doesn't fully reflect the extent of the damage caused by the alleged bread price manipulation. Furthermore, opponents argue it lacks a clear admission of guilt from the baking companies involved.

- Details on the settlement structure: The hearing will delve into the specifics of how the $500 million will be distributed. This section will analyze the settlement structure.

- Key objections from different stakeholders: Various stakeholders including consumer groups, retailers, and even some competitors may have objections to the proposed settlement.

- Potential consequences of rejecting the settlement: Rejecting the settlement may lead to a long, drawn-out trial, potentially resulting in higher legal costs and a delay in consumer compensation.

The May Hearing and its Implications

The upcoming May hearing holds the key to the entire bread price-fixing case. Its outcome will significantly affect consumers, the bakery industry, and the future of antitrust litigation.

Key Players and Their Roles

The hearing will feature key players such as the presiding judge, lawyers representing both sides (plaintiffs and defendant companies), and potentially expert witnesses who will offer economic analyses of the alleged bread price-fixing scheme and the impact of the proposed settlement.

Potential Outcomes of the Hearing

Several outcomes are possible from the May hearing. The judge could fully approve the $500 million settlement. Alternatively, the judge might approve the settlement with modifications, such as adjustments to the distribution of funds or additional conditions imposed on the baking companies. The most extreme outcome would be the complete rejection of the settlement, leading to a full-scale trial. Each scenario has significant ramifications for all parties involved.

- Date, time, and location of the hearing: This information may be available through court records and announcements.

- Key issues to be debated during the hearing: Arguments will likely focus on the adequacy of the settlement amount, the evidence supporting the price-fixing claims, and the implications for future antitrust enforcement.

- Potential impact on future antitrust lawsuits in the food industry: The outcome of this case will set a significant precedent for future antitrust lawsuits, especially within the food industry, impacting the behavior of businesses and setting the stage for stricter regulation.

Conclusion

The $500 million bread price-fixing settlement represents a high-stakes legal battle with far-reaching consequences. The May hearing will determine whether this proposed resolution adequately addresses the alleged bread price manipulation and compensates consumers for potential overcharges. The judge's decision will not only impact the involved companies but also shape future antitrust litigation in the food industry and beyond. Stay tuned for updates on this crucial bread price-fixing settlement, and learn more about the impact of this bread price collusion case on reputable news sources and legal websites. Understanding the complexities of this case will help us advocate for fair pricing and robust consumer protection in the future.

Featured Posts

-

Exclusive Trump Administrations Plan To Defund Harvard By 1 Billion

Apr 22, 2025

Exclusive Trump Administrations Plan To Defund Harvard By 1 Billion

Apr 22, 2025 -

Activision Blizzard Acquisition Ftcs Appeal And Antitrust Concerns

Apr 22, 2025

Activision Blizzard Acquisition Ftcs Appeal And Antitrust Concerns

Apr 22, 2025 -

Resistance Grows Car Dealers Challenge Ev Mandate

Apr 22, 2025

Resistance Grows Car Dealers Challenge Ev Mandate

Apr 22, 2025 -

Are La Landlords Price Gouging After The Recent Fires

Apr 22, 2025

Are La Landlords Price Gouging After The Recent Fires

Apr 22, 2025 -

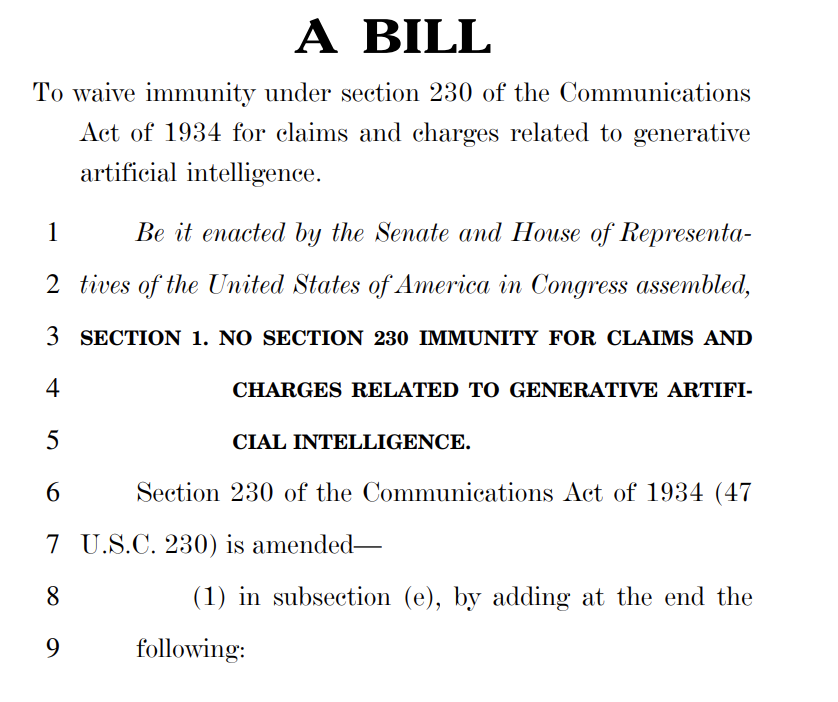

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025