Minnesota Film Production: The Impact Of Tax Credits

Table of Contents

The Economic Impact of Minnesota Film Tax Credits

Minnesota film tax credits have a demonstrably positive effect on the state's economy. The direct economic benefits are significant, leading to job creation and increased spending within local communities. Film productions inject capital into various sectors, from hotels and restaurants to equipment rentals and local labor.

- Job Creation: Film productions create a diverse range of jobs, from highly skilled positions like directors and cinematographers to numerous crew members and support staff. (Insert hypothetical statistic here, e.g., "In 2022, 50 film productions utilized Minnesota tax credits, resulting in over 2,000 jobs and $50 million in local spending.") These jobs are not just temporary; many crew members find long-term employment within the growing Minnesota film industry.

- Increased Local Spending: Film productions spend money on various goods and services within the local economy. This includes accommodation for cast and crew, catering, transportation, and equipment rentals. This ripple effect stimulates economic activity across multiple sectors.

- Indirect Benefits: Beyond the direct economic impact, film productions contribute to increased tourism. The association of Minnesota with successful films and television shows enhances the state's image, attracting visitors interested in filming locations and related attractions. This, in turn, generates further revenue for the state. Furthermore, the presence of a thriving film industry attracts skilled workers, contributing to a more robust and diversified workforce. Keywords: economic benefits, job creation, film production spending, tourism revenue, state economy.

How Minnesota Film Tax Credits Work

The Minnesota film tax credit program offers financial incentives to qualifying film and television productions shot within the state. The application process generally involves submitting a detailed budget and demonstrating adherence to specific eligibility criteria.

- Eligible Productions: The program typically covers feature films, television series, commercials, and documentaries. Specific requirements may vary.

- Qualifying Expenses: The tax credits typically cover a percentage (check current percentage) of qualifying production expenses incurred within Minnesota. These expenses often include labor costs, location fees, and equipment rentals.

- Application Process: Applicants must submit a detailed application outlining their production plan, budget, and anticipated economic impact within Minnesota. (Include a link to the official application process if available.)

- Requirements and Limitations: There are specific requirements regarding in-state spending, hiring local crew, and meeting certain diversity standards. These requirements are intended to maximize the benefit to the Minnesota economy and its workforce. Keywords: tax credit application, eligibility criteria, qualifying expenses, film tax incentive program.

Success Stories: Productions Benefiting from Minnesota Film Tax Credits

Several successful film and television productions have leveraged Minnesota film tax credits, highlighting the positive impact of the program.

- (Example 1: Insert the name of a successful film or TV show produced in Minnesota. Describe its success and attribute a portion of it to the tax credits. E.g., "The Netflix series 'Lake Wobegon' filmed extensively in northern Minnesota, utilizing the state's tax credits to offset production costs. Its critical acclaim and global audience helped boost tourism in the region.")

- (Example 2: Insert another successful production and repeat the process. Mention specific details of the economic impact, if available.) These case studies demonstrate the effectiveness of the program in attracting high-quality productions and contributing to the state's economic prosperity. Keywords: case studies, successful productions, film incentives success stories, Minnesota film productions.

Challenges and Future of Minnesota Film Tax Credits

While the Minnesota film tax credit program has been successful, it faces ongoing challenges.

- Budget Constraints: The program’s budget may be limited, leading to competition for available funds among numerous applicants.

- Competition from Other States: Other states offer similar or even more generous film incentives, creating competition for attracting productions.

- Program Improvements: Regular evaluation and potential improvements to the program are essential to ensure its continued effectiveness and competitiveness. This might involve adjustments to eligibility criteria or increasing the percentage of qualifying expenses covered. Keywords: program challenges, budget constraints, future of film incentives, competition, program improvements.

Investing in Minnesota's Film Future Through Tax Credits

Minnesota film tax credits have proven to be a significant catalyst for economic growth and job creation within the state's film industry. The program's success lies in its ability to attract productions, generate revenue, and enhance Minnesota's reputation as a desirable filming location. The economic benefits extend beyond direct spending, fostering tourism and attracting skilled workers to the state. To further grow the Minnesota film industry, maintaining and potentially expanding this vital incentive program is crucial. Learn more about the Minnesota film tax credit program and consider utilizing these incentives for your next film project! (Include links to relevant websites, such as the Minnesota Department of Employment and Economic Development or the Minnesota Film Office.) Keywords: Minnesota film production, film tax credits, film incentives, movie production Minnesota, grow Minnesota film industry.

Featured Posts

-

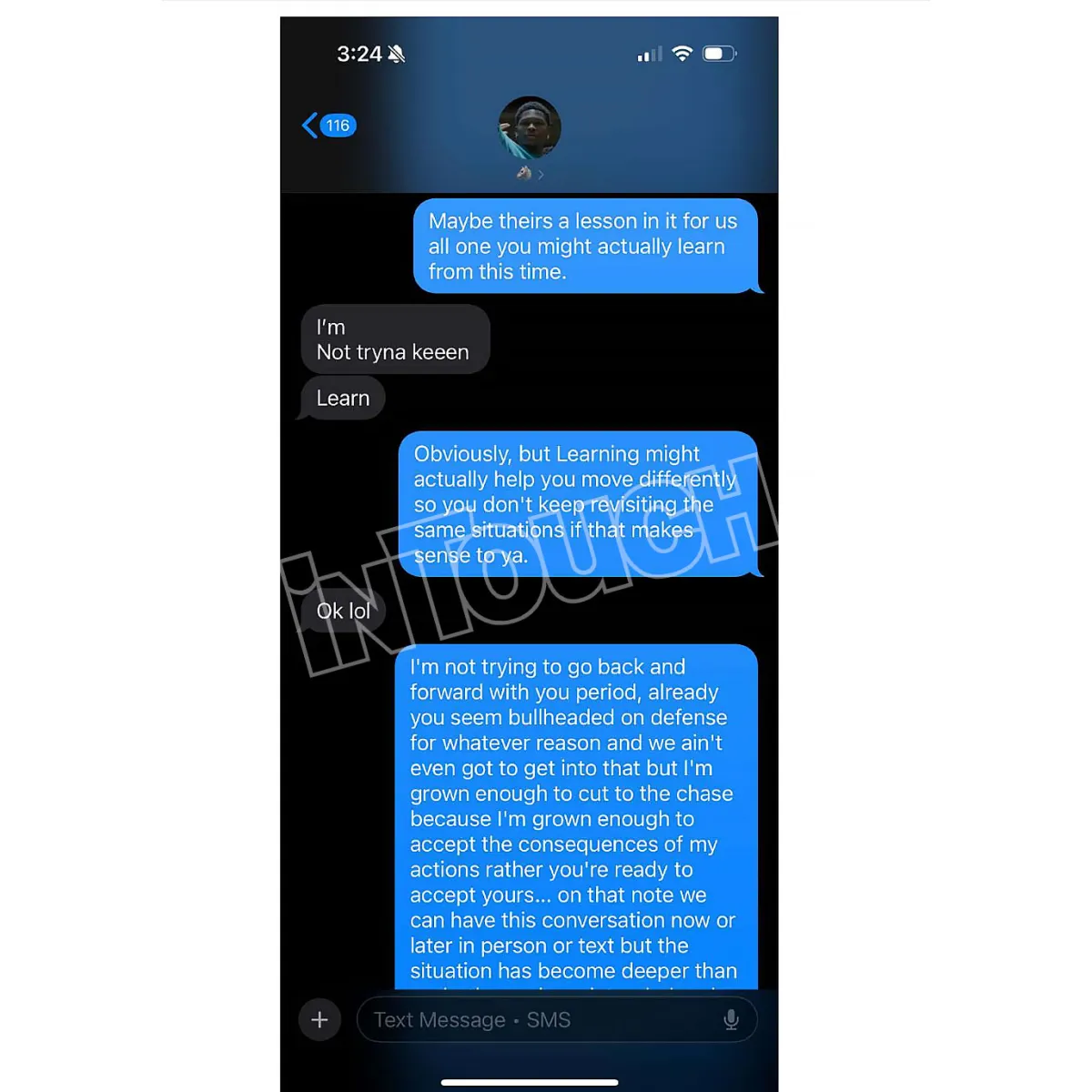

Anthony Edwards And Ayesha Howard Custody Battle Outcome

Apr 29, 2025

Anthony Edwards And Ayesha Howard Custody Battle Outcome

Apr 29, 2025 -

Anthony Edwards Fined 50 K By Nba Over Fan Interaction

Apr 29, 2025

Anthony Edwards Fined 50 K By Nba Over Fan Interaction

Apr 29, 2025 -

Fatal Wrong Way Crash Claims Life Of Texas Woman Near Border

Apr 29, 2025

Fatal Wrong Way Crash Claims Life Of Texas Woman Near Border

Apr 29, 2025 -

160km

Apr 29, 2025

160km

Apr 29, 2025 -

Winning Names Revealed Minnesotas Snow Plow Naming Contest Results

Apr 29, 2025

Winning Names Revealed Minnesotas Snow Plow Naming Contest Results

Apr 29, 2025