Navigate The Private Credit Boom: 5 Key Do's & Don'ts

Table of Contents

Do's for Success in the Private Credit Market

Diversify Your Private Credit Portfolio

Diversification is paramount in any investment strategy, and private credit is no exception. A well-diversified private credit portfolio mitigates risk by spreading your investments across various asset classes, strategies, and managers. This approach reduces the impact of any single investment underperforming.

- Different Strategies: Invest in direct lending, mezzanine financing, and distressed debt strategies to balance risk and reward.

- Asset Classes: Diversify across real estate, infrastructure, and corporate debt to reduce concentration risk.

- Fund Managers: Spread your investments among several experienced private credit fund managers with diverse investment approaches.

- Geographic Diversification: Consider investments in different regions or countries to reduce exposure to localized economic downturns. This aspect of private credit portfolio diversification is often overlooked.

Successful private credit portfolio diversification requires a thorough understanding of your risk tolerance and investment objectives. By implementing these strategies, you can build a more resilient and potentially higher-yielding private credit portfolio.

Thoroughly Conduct Due Diligence Before Investing

Due diligence is the cornerstone of successful private credit investing. Before committing capital to any private credit opportunity, conduct a rigorous investigation to assess the risks and potential returns. This critical step can prevent costly mistakes and protect your investments.

- Management Team: Analyze the experience, track record, and reputation of the management team responsible for the investment.

- Financial Statements: Scrutinize the financial health of the borrower or underlying asset, paying close attention to cash flow, debt levels, and profitability.

- Legal Aspects: Ensure all legal documentation is thoroughly reviewed by qualified legal counsel to avoid any contractual ambiguities or potential legal issues.

- Investment Strategy & Terms: Clearly understand the investment strategy, terms, conditions, and exit strategy of each private credit investment.

Thorough private credit due diligence requires expertise and attention to detail. Neglecting this process can significantly impact your returns and investment security.

Seek Professional Advice

Navigating the complexities of private credit investments is best done with the guidance of experienced professionals. Consult a financial advisor specializing in private credit, who possesses the expertise and network to provide valuable insights and support.

- Expertise: Financial advisors bring in-depth knowledge of market trends, investment strategies, and risk management techniques specific to private credit.

- Network: They can connect you with potential investment opportunities you may otherwise miss.

- Objective Perspective: They provide an unbiased perspective, helping you make well-informed decisions based on your financial goals.

- Tax & Legal Planning: A crucial aspect of private credit investment involves efficient tax planning and compliance with relevant legal frameworks.

Engaging a private credit advisor significantly enhances your ability to make sound investment decisions and effectively manage the associated risks.

Don'ts to Avoid in the Private Credit Landscape

Avoid Overexposure to Single Investments

Concentrating your investments in a single private credit opportunity significantly amplifies risk. If that investment fails, it can have a devastating impact on your entire portfolio. Avoid this pitfall by following a diversified investment approach.

- Loss of Capital: Overexposure can lead to substantial capital loss if the single investment defaults or underperforms.

- Missed Opportunities: Focusing on a single investment can cause you to miss out on potentially better opportunities elsewhere.

Proper portfolio allocation is crucial for private credit risk management. Spreading your investments across various opportunities is essential to safeguard your capital.

Neglecting Liquidity Considerations

Many private credit investments are illiquid, meaning they cannot be easily converted to cash. Before investing, carefully consider your liquidity needs and choose investments that align with your investment horizon.

- Long-Term Investments: Private credit investments typically have longer lock-up periods and maturities, so ensure you won’t need ready access to the funds.

- Liquidity Strategies: Explore different liquidity strategies, such as incorporating more liquid assets in your overall portfolio to balance your private credit investments.

Careful consideration of your investment horizon is vital for managing private credit liquidity and preventing potential financial difficulties.

Ignoring Legal and Regulatory Compliance

Adherence to all applicable legal and regulatory requirements is non-negotiable in private credit investing. Non-compliance can result in significant penalties.

- Fines & Legal Action: Failing to comply with relevant regulations can lead to substantial fines, legal action, and reputational damage.

- Legal Counsel: If you are unsure about any legal aspects, consult qualified legal counsel to ensure compliance.

Understanding and complying with private credit regulations is vital for protecting your investments and avoiding legal repercussions.

Conclusion: Mastering the Private Credit Market

Successfully navigating the private credit market requires a strategic approach, combining careful diversification with thorough due diligence. Remember the key do’s: diversify your private credit portfolio, conduct thorough due diligence, and seek professional advice. Equally crucial are the don’ts: avoid overexposure to single investments, neglect liquidity considerations, and ignore legal and regulatory compliance. The potential rewards of private credit investing are significant, but only with a well-informed and carefully managed approach can you effectively navigate the risks and reap the potential benefits. Take the next step towards mastering private credit investing by researching further, consulting a financial advisor specializing in private credit, and exploring suitable private credit investment opportunities.

Featured Posts

-

A Military Base In The Crosshairs Understanding The Us China Power Struggle

Apr 26, 2025

A Military Base In The Crosshairs Understanding The Us China Power Struggle

Apr 26, 2025 -

Analysis Of Trumps Comments On Congressional Stock Trading Ban The Time Interview

Apr 26, 2025

Analysis Of Trumps Comments On Congressional Stock Trading Ban The Time Interview

Apr 26, 2025 -

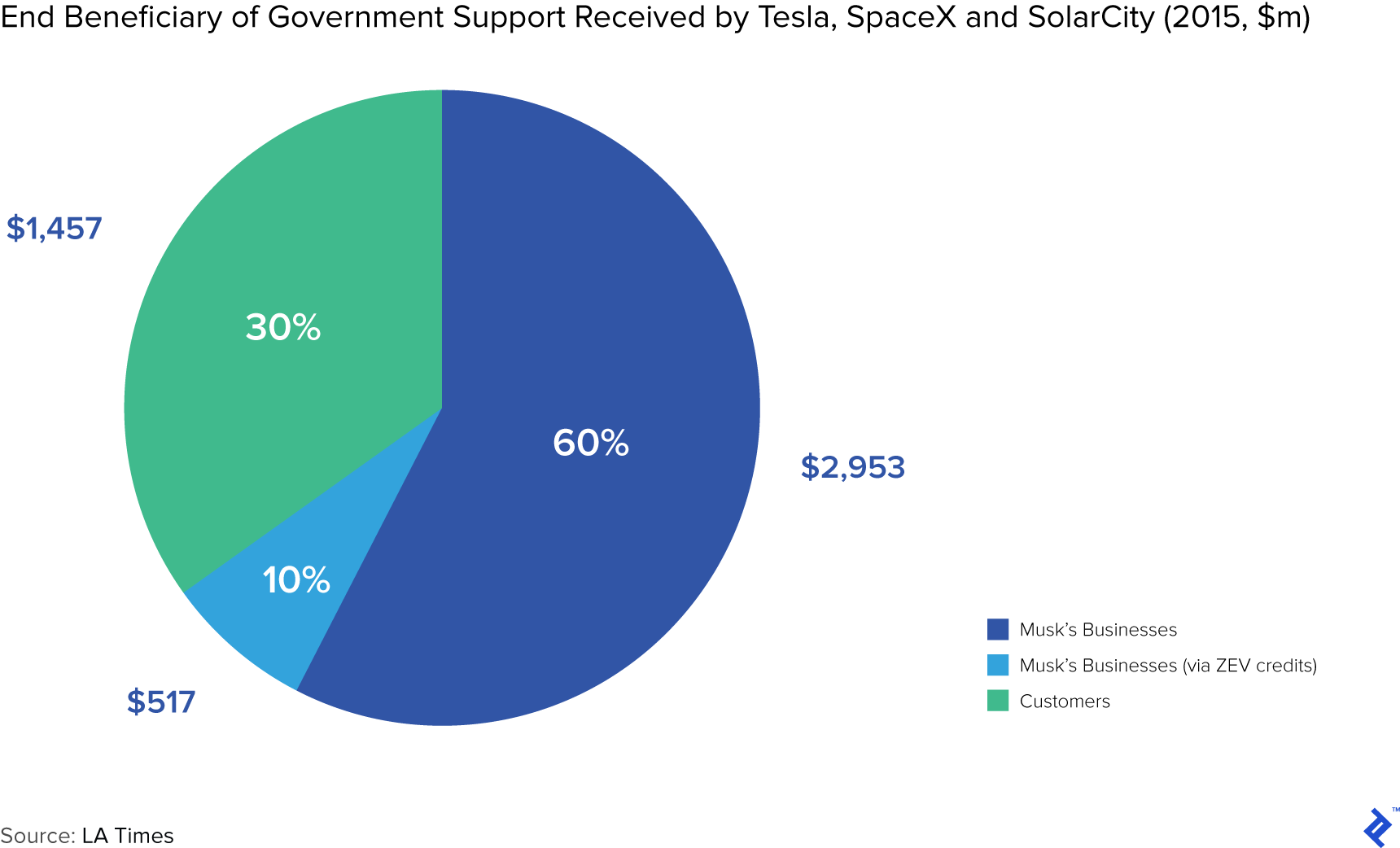

Gaining Access To Elon Musks Investments A Potential Side Hustle

Apr 26, 2025

Gaining Access To Elon Musks Investments A Potential Side Hustle

Apr 26, 2025 -

Floridas Charm A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Floridas Charm A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025 -

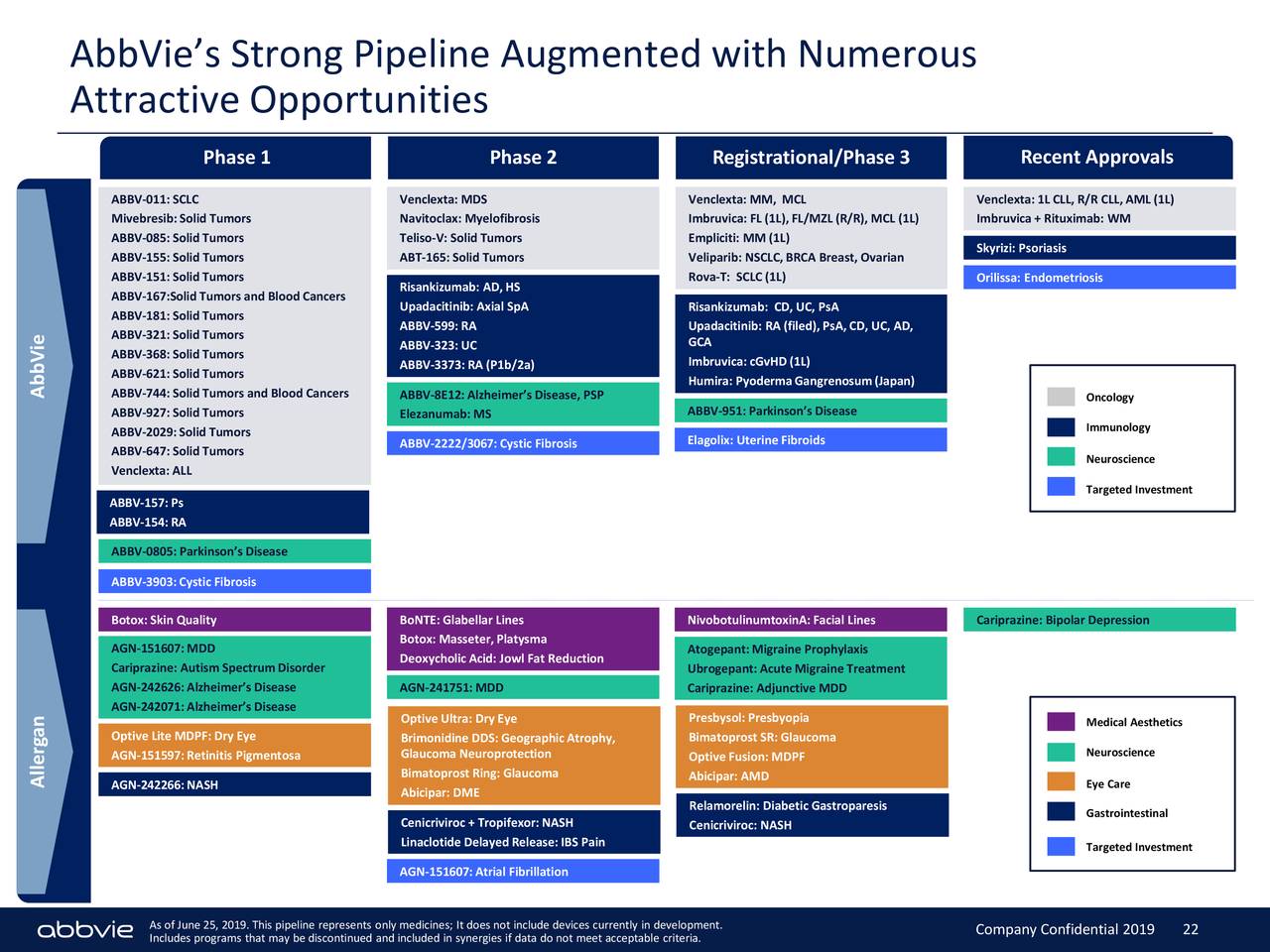

Strong Q Quarter Number Results For Abb Vie Abbv New Medications Drive Sales Beat And Increased Profit Forecast

Apr 26, 2025

Strong Q Quarter Number Results For Abb Vie Abbv New Medications Drive Sales Beat And Increased Profit Forecast

Apr 26, 2025