New Developments In US-China Trade: Targeted Tariff Exemptions

Table of Contents

Recent Changes in US Tariff Policies Towards China

The US-China trade war, marked by escalating tariffs, began in 2018, rooted in concerns over intellectual property theft, trade imbalances, and unfair trade practices by China. The initial imposition of tariffs targeted a wide range of goods, impacting numerous US industries and consumers. These tariffs, ranging from 10% to 25%, significantly increased the cost of imported Chinese goods, leading to price hikes for consumers and reduced competitiveness for some US businesses reliant on Chinese imports.

- Industries Significantly Affected: The technology sector, particularly concerning semiconductors and telecommunications equipment, faced significant challenges. The agricultural sector, with products like soybeans and pork, also experienced substantial losses. Manufacturing industries relying on intermediate goods from China saw production costs rise.

- Economic Impact: While tariff revenue generated billions for the US government, the overall economic impact remains a subject of debate. Studies have shown varying effects, including increased prices for consumers, reduced US exports, and shifts in global supply chains. Specific tariff rates and their application varied depending on the product category and the phase of the trade war.

The Mechanism of Targeted Tariff Exemptions

Targeted tariff exemptions offer a lifeline to businesses negatively affected by broad-based tariffs. These exemptions allow specific companies to import goods from China without paying the imposed tariffs. The process involves a formal application to the relevant US government agency, usually demonstrating a compelling case for exemption.

- Application Process: Businesses must submit detailed applications outlining the necessity of the exempted goods, the unavailability of comparable domestic alternatives, and the potential economic hardship caused by the tariffs.

- Criteria for Approval: Criteria for exemption approval include demonstrating that the goods are not readily available domestically, that the tariff imposes significant economic hardship, and in some cases, that national security interests are at stake.

- Timeline and Examples: The review process can be lengthy, often taking several months. Successful exemptions have been granted to companies in various sectors, often highlighting the importance of specific Chinese components or materials for crucial manufacturing processes.

Industries Benefiting from Targeted Tariff Exemptions

Several sectors have received, or are anticipated to receive, targeted tariff exemptions. These are frequently industries highly reliant on specific Chinese inputs or those producing goods deemed strategically important.

- Benefiting Sectors: The technology sector, specifically companies needing specialized components, has been a significant beneficiary. Certain segments of the agricultural sector, dependent on Chinese-sourced ingredients, have also secured exemptions. Manufacturing industries requiring specific intermediate goods have also benefited.

- Positive Effects: Exemptions have helped maintain production levels, prevent job losses, and mitigate price increases for consumers in some cases.

- Potential Negative Consequences: Critics argue that exemptions can create an uneven playing field, favoring some businesses over others, and potentially delaying broader trade negotiations.

Future Outlook and Potential Implications of Targeted Tariff Exemptions

The future direction of US-China trade policy remains uncertain. While the current administration has shown willingness to grant targeted tariff exemptions, the long-term implications for both countries are still unfolding.

- Future Tariff Adjustments: Predictions regarding future tariff adjustments vary greatly depending on the trajectory of US-China relations and any future trade agreements.

- Effectiveness of Exemptions: The effectiveness of the exemption policy itself is debatable. While it has offered some relief to specific businesses, it has also created complexities and inconsistencies in the overall tariff structure.

- Alternatives to Tariffs: Experts advocate for alternative approaches, such as focusing on addressing underlying trade imbalances and intellectual property concerns through negotiations and comprehensive trade agreements rather than relying heavily on tariff-based policies.

Understanding and Adapting to New Developments in US-China Trade: Targeted Tariff Exemptions

The recent changes in US-China trade relations, particularly concerning targeted tariff exemptions, highlight the need for businesses to actively monitor and adapt to evolving trade policies. Understanding the mechanism for securing exemptions, identifying potential benefits, and preparing for future adjustments are critical for navigating this complex landscape. Stay informed about US-China trade updates, develop robust tariff exemption strategies, and seek professional advice to effectively manage the impact of trade policy on your business. Ignoring these developments could have significant consequences for your company's competitiveness and profitability in the global marketplace.

Featured Posts

-

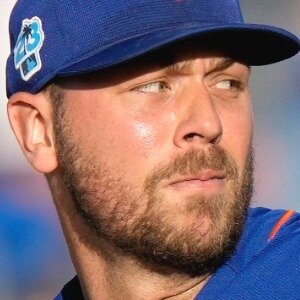

Key To Success Tylor Megills Impact On The Mets Winning Streak

Apr 28, 2025

Key To Success Tylor Megills Impact On The Mets Winning Streak

Apr 28, 2025 -

Red Sox Vs Blue Jays Game Preview Lineups Buehler And Player Returns

Apr 28, 2025

Red Sox Vs Blue Jays Game Preview Lineups Buehler And Player Returns

Apr 28, 2025 -

Andy Pettittes Gem A 2000 Yankees Diary Entry Featuring Joe Torre

Apr 28, 2025

Andy Pettittes Gem A 2000 Yankees Diary Entry Featuring Joe Torre

Apr 28, 2025 -

Michael Jordans Denny Hamlin Endorsement You Boo Him He Gets Better

Apr 28, 2025

Michael Jordans Denny Hamlin Endorsement You Boo Him He Gets Better

Apr 28, 2025 -

Jack Link 500 Talladega 2025 Prop Bets And Winning Strategies

Apr 28, 2025

Jack Link 500 Talladega 2025 Prop Bets And Winning Strategies

Apr 28, 2025