New X Financials: Debt Sale Impacts And Company Transformation

Table of Contents

Immediate Impacts of the Debt Sale on New X Financials' Financial Health

Improved Liquidity and Debt Reduction

The debt sale directly improves New X Financials' financial health by significantly reducing its debt burden and increasing short-term liquidity. This positive shift in the company's balance sheet has several key benefits:

- Improved Credit Rating: The reduced debt-to-equity ratio will likely lead to an upgrade in New X Financials' credit rating, making future borrowing cheaper and easier. This improved standing with credit agencies reflects positively on the company's overall financial health.

- Decreased Interest Payments: By reducing its overall debt, New X Financials will experience a substantial decrease in interest payments, freeing up capital for reinvestment in the business or returning value to shareholders. This improved cash flow is a critical element of New X Financials' improved financial health.

- Increased Cash Flow for Operational Improvements: The additional cash flow resulting from lower interest payments allows New X Financials to focus on operational improvements, such as upgrading technology or streamlining internal processes. This directly contributes to New X Financials' improved financial health and long-term sustainability. New X Financials' improved financial health is a direct result of the strategic debt sale.

Potential Impact on Stock Price and Investor Sentiment

The market reaction to the debt sale has been mixed, reflecting the complexities of such a transaction. While short-term volatility is expected, the long-term impact on New X Financials' stock price hinges heavily on investor confidence.

- Positive Investor Reactions: Many analysts view the debt sale as a positive step, signaling a proactive approach to financial management and improved long-term prospects for New X Financials' stock performance. This positive sentiment could lead to increased investment and higher stock valuation.

- Negative Investor Reactions: Some investors may harbor concerns about the potential impact of restructuring or the use of sale proceeds. These concerns could lead to short-term sell-offs and downward pressure on New X Financials stock performance. Careful communication with investors is vital to mitigate such concerns.

- Trading Volume Changes Post-Sale: Increased trading volume following the debt sale indicates heightened market interest in New X Financials. Analyzing these changes will provide insights into investor sentiment and the overall market assessment of the transaction's impact on New X Financials. Major financial news outlets are closely monitoring these changes.

Long-Term Strategic Implications for New X Financials' Business Model

Restructuring and Operational Efficiency

The proceeds from the debt sale are expected to be used strategically to transform New X Financials. This includes substantial investments in restructuring operations and improving overall efficiency:

- Investments in Technology: Modernizing outdated systems and implementing new technologies can significantly streamline operations and reduce costs. This aspect of New X Financials' business transformation is critical for long-term competitiveness.

- Streamlining Processes: Identifying and eliminating inefficiencies across various departments can improve productivity and reduce operational expenses. This is a key part of the strategic restructuring of New X Financials.

- Workforce Restructuring: While potentially sensitive, strategic workforce adjustments may be necessary to optimize the company's structure and improve overall efficiency. This aspect of New X Financials' business transformation requires careful planning and execution.

Expansion and Growth Opportunities

The improved financial position resulting from the debt sale opens doors for strategic expansion and growth opportunities for New X Financials:

- Mergers and Acquisitions: The available capital could be used to acquire complementary businesses, expanding New X Financials' market share and product offerings. This is a crucial aspect of New X Financials' growth strategy.

- Expansion into New Geographic Markets: The debt sale provides a financial foundation for expanding into new geographic markets, broadening the customer base and diversifying revenue streams. This expansion is part of New X Financials' future expansion plans.

- Investment in Research and Development: Investing in research and development will allow New X Financials to develop innovative new products and services, strengthening its competitive edge and driving future growth. This investment is crucial for New X Financials' long-term success.

Risks and Challenges Associated with the Debt Sale and Transformation

Potential Negative Impacts on Employee Morale and Retention

The restructuring process inherent in New X Financials' transformation carries potential risks to employee morale and retention:

- Concerns Related to Layoffs: Restructuring efforts may necessitate job losses, impacting employee morale and potentially leading to the loss of valuable expertise. Careful management of this sensitive aspect is crucial for maintaining a positive work environment.

- Changes in Employee Benefits: Adjustments to employee benefits packages could negatively impact morale and attract criticism from employees and labor unions. Open communication and transparency during the restructuring process are vital.

- Potential Impact on Company Culture: Large-scale changes can disrupt company culture and negatively impact employee engagement. It's critical that leadership actively works to preserve a positive and supportive atmosphere throughout the transition period. Protecting New X Financials' employee relations is paramount during this period.

Market Volatility and Economic Uncertainty

External factors can significantly impact the success of New X Financials' transformation:

- Impact of Interest Rate Changes: Fluctuations in interest rates can affect the cost of borrowing and potentially impact the overall financial health of New X Financials. Careful financial planning and risk management are essential in navigating this challenge.

- Global Economic Conditions: Recessions or economic downturns could negatively affect market demand and the overall success of New X Financials' transformation strategy. Monitoring economic indicators is important for proactive decision-making.

- Potential Competition: Increased competition in the market could hinder the growth and profitability of New X Financials. Maintaining a strong competitive edge is crucial for success. Analyzing New X Financials' resilience in a volatile market will be a key indicator of future success.

Conclusion

The debt sale by New X Financials marks a pivotal moment in the company's history. While offering significant opportunities for improved financial health, strategic restructuring, and future growth, it also presents challenges. Careful management of these challenges, including maintaining employee morale and navigating economic uncertainty, will be crucial for successful transformation. Staying informed about New X Financials' progress and future announcements will be essential for investors and stakeholders alike. To stay updated on the ongoing transformation of New X Financials, continue to follow our analyses and insights. Understanding the impact of this debt sale on New X Financials' future is critical for informed decision-making.

Featured Posts

-

Florida Keys Road Trip The Ultimate Guide To Driving The Overseas Highway

Apr 28, 2025

Florida Keys Road Trip The Ultimate Guide To Driving The Overseas Highway

Apr 28, 2025 -

The Difficult Reality Laid Off Federal Workers Seeking State Local Positions

Apr 28, 2025

The Difficult Reality Laid Off Federal Workers Seeking State Local Positions

Apr 28, 2025 -

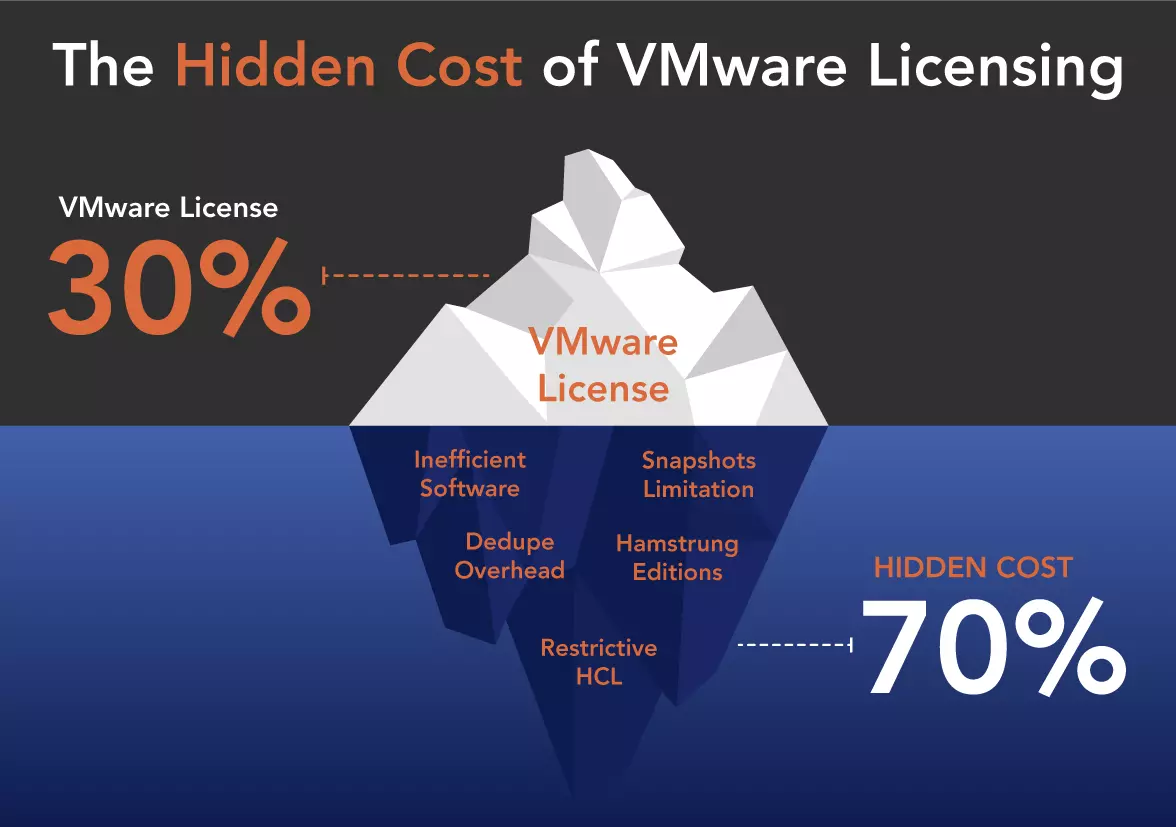

V Mware Costs To Skyrocket At And T Highlights 1050 Price Hike From Broadcom

Apr 28, 2025

V Mware Costs To Skyrocket At And T Highlights 1050 Price Hike From Broadcom

Apr 28, 2025 -

Is Your Marriage Ending Silently Recognizing The Warning Signs

Apr 28, 2025

Is Your Marriage Ending Silently Recognizing The Warning Signs

Apr 28, 2025 -

Americas Truck Bloat Finding A Solution

Apr 28, 2025

Americas Truck Bloat Finding A Solution

Apr 28, 2025