Private Credit Jobs: 5 Do's And Don'ts To Get Hired

Table of Contents

Do's to Get Hired in Private Credit

Do 1: Network Strategically

Building a strong network is paramount in the private credit industry. Don't underestimate the power of connections in securing a private credit career.

- Industry Events: Attend conferences, workshops, and networking events focused on private credit, private equity, or alternative investments. These events offer invaluable opportunities to meet professionals and learn about potential private credit jobs.

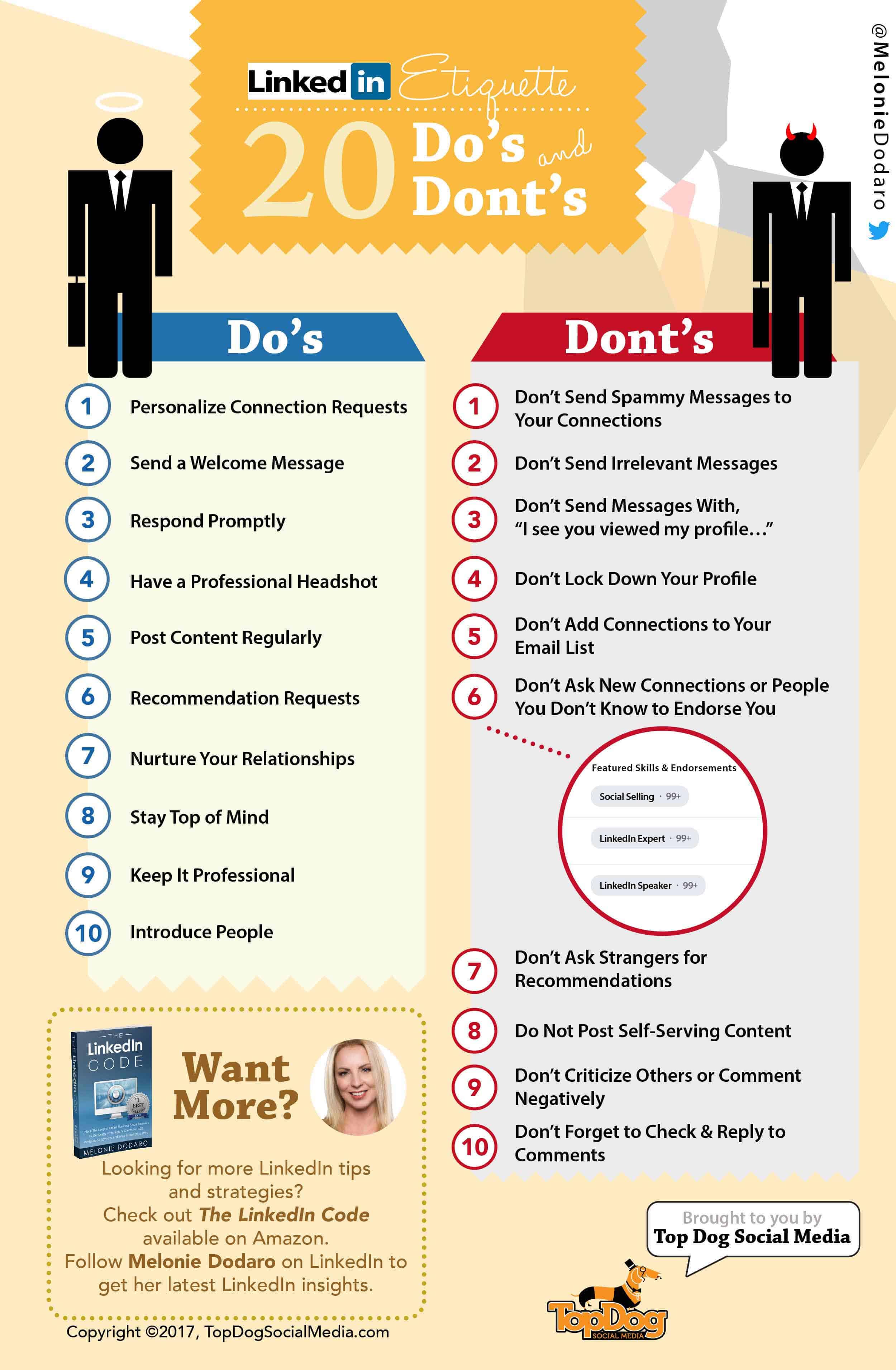

- Online Platforms: Leverage LinkedIn effectively. Connect with professionals working in private credit, join relevant groups, and participate in discussions. Tailor your profile to highlight your skills and experience relevant to private credit analyst jobs.

- Informational Interviews: Reach out to professionals for informational interviews. These conversations provide insights into the industry, specific firms, and potential career paths within private lending jobs. Target your efforts towards firms specializing in areas like distressed debt, mezzanine financing, or direct lending, depending on your interests.

- Stay Updated: Follow industry news and publications like Private Equity International, PEI Media, and AltCredit Intelligence to stay current on market trends and engage in relevant conversations.

- Cultivate Genuine Connections: Focus on building authentic relationships, not just collecting contacts. Genuine engagement leads to stronger referrals and long-term professional relationships.

Do 2: Showcase Specialized Skills

Private credit roles demand specific skills. Highlight your expertise to stand out from other candidates seeking private credit jobs.

- Analytical Skills: Emphasize your proficiency in financial analysis, credit underwriting, and valuation. Quantify your achievements whenever possible to demonstrate your impact (e.g., "Improved portfolio performance by 12% through enhanced credit risk assessment").

- Financial Modeling: Showcase your expertise in financial modeling using software such as Excel, Bloomberg Terminal, or Argus. Demonstrate your ability to build complex models and interpret results effectively. This is crucial for many private credit analyst jobs.

- Resume Tailoring: Customize your resume and cover letter for each application. Highlight the skills and experience most relevant to the specific job description and the firm's investment strategy.

- Software Proficiency: Emphasize your proficiency in relevant software and databases. This shows you are prepared to hit the ground running in your new private credit career.

Do 3: Master the Interview Process

The interview process is crucial for securing a private credit job. Preparation and confidence are key.

- Practice Answering Questions: Prepare for common interview questions, including behavioral questions ("Tell me about a time you failed") and technical questions related to financial modeling and credit analysis.

- Research the Firm: Thoroughly research the firm's investment strategy, portfolio companies, and recent transactions. Prepare insightful questions to demonstrate your interest and understanding.

- Professionalism and Confidence: Present yourself professionally and confidently. Enthusiasm for the role and the private credit industry is contagious.

- Problem-Solving Skills: Prepare examples illustrating your problem-solving skills and ability to work effectively under pressure.

Do 4: Highlight Relevant Experience (even if indirect)

Even if your experience isn't directly in private credit, transferable skills are valuable.

- Transferable Skills: Highlight skills from previous roles, such as financial analysis, portfolio management, or credit risk assessment, emphasizing how they apply to a private credit role.

- Internships and Volunteer Work: Include internships or volunteer experiences related to finance or investment to showcase your commitment to the field.

- Projects and Certifications: Showcase any relevant academic projects, coursework, or certifications like the CFA or CAIA charters. These credentials demonstrate your commitment to professional development.

- Volunteer Finance Experience: Even volunteer work involving financial management for a non-profit can be valuable, demonstrating responsibility and financial acumen.

Do 5: Follow Up After Interviews

Following up demonstrates your continued interest and professionalism.

- Thank-You Notes: Send personalized thank-you notes to each interviewer, expressing your gratitude and reiterating your interest in the specific private credit job.

- Follow-Up Communication: If you haven't heard back within a reasonable timeframe, a polite follow-up email shows your continued interest.

- Maintain Professionalism: Maintain professional communication and a positive attitude throughout the entire process.

- LinkedIn Connections: Use LinkedIn to reconnect with interviewers and strengthen your professional network within the private credit space.

Don'ts to Avoid When Seeking Private Credit Jobs

Don't 1: Overlook Networking

Networking is essential for uncovering unadvertised opportunities and building connections.

- Don't Rely Solely on Online Applications: Actively seek out connections within the industry. Networking events are crucial for finding hidden opportunities.

- Don't Be Afraid to Reach Out: Many professionals are happy to share advice and insights. Don't hesitate to initiate contact.

- Don't Limit Your Reach: Attend industry events and conferences to expand your network significantly.

Don't 2: Neglect Due Diligence

Thorough research is essential before applying or interviewing for private credit jobs.

- Don't Apply Blindly: Research the firm's investment strategy, recent transactions, and portfolio companies. Demonstrate your understanding during the interview.

- Don't Skip the Research: Preparing thoughtful questions for the interview shows initiative and genuine interest.

- Don't Appear Uninformed: A lack of knowledge about the firm or the private credit industry reflects poorly.

Don't 3: Underestimate the Importance of Technical Skills

Technical proficiency is crucial for success in private credit.

- Don't Rely on Soft Skills Alone: Mastering technical skills like financial modeling, valuation, and credit analysis is essential.

- Don't Neglect Skill Development: Continuously update your skills to stay current with industry trends and technological advancements.

- Don't Overlook Software Proficiency: Demonstrate proficiency in relevant software and tools (Excel, Bloomberg Terminal, etc.).

Don't 4: Ignore the Power of a Strong Resume and Cover Letter

Your resume and cover letter are your first impression.

- Don't Use Generic Applications: Tailor your resume and cover letter to each specific job description.

- Don't Neglect Proofreading: Errors in your application materials create a negative impression.

- Don't Undersell Your Achievements: Quantify your achievements and highlight your impact using concrete numbers. Use keywords relevant to the job description.

Don't 5: Be Passive in Your Job Search

A proactive approach is essential for landing a private credit job.

- Don't Wait for Opportunities: Actively seek out opportunities through networking, online applications, and direct outreach.

- Don't Let Rejection Discourage You: View rejection as a learning experience and continue to refine your approach.

- Don't Give Up Easily: Landing a private credit job requires perseverance. Use multiple job boards and professional networking platforms to expand your search.

Conclusion

Securing a coveted private credit job requires a strategic approach combining technical expertise, networking prowess, and a proactive job search strategy. By following these "do's" and avoiding the "don'ts," you can significantly increase your chances of success. Remember to network strategically, showcase your specialized skills, master the interview process, highlight relevant experience, and always follow up. Don't overlook the importance of due diligence, technical skills, a strong resume, and a proactive job search. Start applying these tips today and begin your journey towards a fulfilling career in private credit jobs!

Featured Posts

-

Us China Geopolitical Competition A Focus On A Key Military Base

Apr 26, 2025

Us China Geopolitical Competition A Focus On A Key Military Base

Apr 26, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 26, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 26, 2025 -

Ukraines Nato Future A Skeptical View From Trump

Apr 26, 2025

Ukraines Nato Future A Skeptical View From Trump

Apr 26, 2025 -

Trumps Time Interview Key Takeaways On Proposed Ban Of Congressional Stock Trading

Apr 26, 2025

Trumps Time Interview Key Takeaways On Proposed Ban Of Congressional Stock Trading

Apr 26, 2025 -

Congressional Stock Trading Ban Trumps Stance In Recent Time Interview

Apr 26, 2025

Congressional Stock Trading Ban Trumps Stance In Recent Time Interview

Apr 26, 2025