Should Investors Worry About Current Stock Market Valuations? BofA Weighs In

Table of Contents

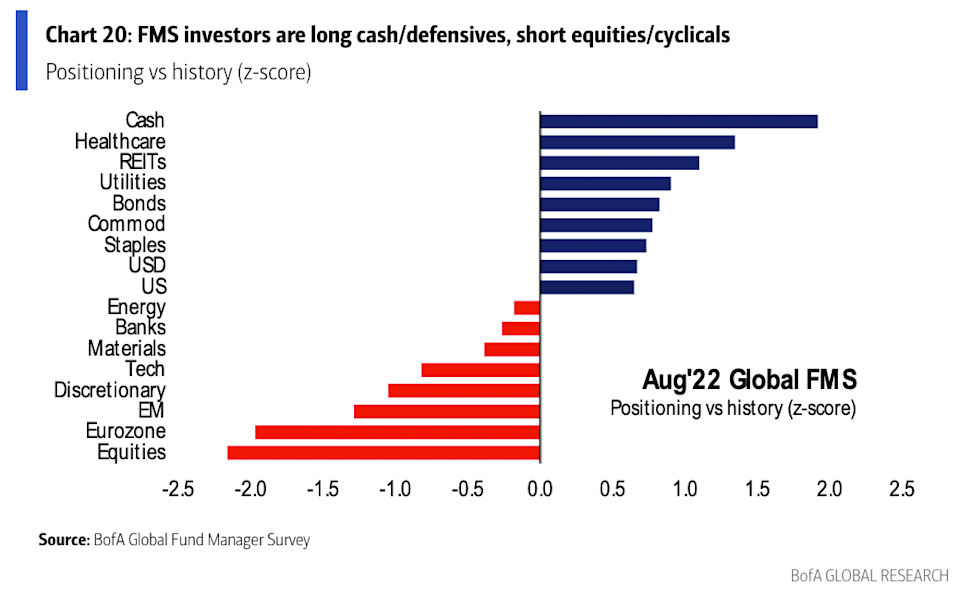

BofA's Assessment of Current Stock Market Valuations

BofA's recent reports present a nuanced perspective on current stock market valuations, neither purely bullish nor bearish, but rather cautiously optimistic. While acknowledging elevated valuations in certain sectors, they haven't issued a blanket warning of an imminent market crash. Their analysis often incorporates metrics like price-to-earnings ratios (P/E ratios) and forward earnings estimates to gauge the market's health. Specific data points from their reports vary depending on the timing and specific indices analyzed.

- Indices Analyzed: BofA typically assesses major indices such as the S&P 500, Nasdaq Composite, and sometimes international indices, comparing valuations across different markets.

- Key Metrics: Beyond P/E ratios, BofA's valuation analysis often includes metrics like the cyclically adjusted price-to-earnings ratio (CAPE ratio), dividend yields, and other measures of relative valuation compared to historical averages and alternative asset classes.

- Conclusions: While some sectors might show signs of overvaluation based on their analysis, the overall conclusion usually suggests that current valuations are not excessively high, considering the current economic environment and anticipated corporate earnings. However, they strongly caution against complacency and the need for continued monitoring.

Factors Influencing BofA's Valuation Analysis

BofA's valuation analysis isn't made in a vacuum. Numerous economic factors heavily influence their assessment. These include:

- Interest Rate Hikes: The Federal Reserve's interest rate hikes significantly impact stock valuations. Higher rates increase borrowing costs for companies, potentially slowing economic growth and reducing corporate profits, thereby impacting stock prices. This is a crucial consideration in any stock market valuation analysis.

- Inflation: Persistent inflation erodes purchasing power and impacts corporate earnings. High inflation can lead to reduced consumer spending and increased production costs, squeezing profit margins and impacting stock prices. Inflation's impact on future earnings is a key factor in BofA's valuation models.

- Geopolitical Risks: Global events, such as geopolitical tensions and conflicts, introduce uncertainty into the market. These events can significantly influence investor sentiment and lead to increased market volatility, impacting stock valuations. Risk assessment is a key part of any sound stock market valuation approach.

- Potential Recessionary Scenarios: The possibility of a recession is always a significant factor in valuation assessments. BofA's analysis considers various recession scenarios and their potential impact on corporate earnings and stock prices, using different economic models and projections to gauge probabilities.

The Role of Corporate Earnings in Stock Market Valuations

Corporate earnings are fundamentally linked to stock market valuations. Strong earnings growth typically supports higher valuations, while weaker earnings often lead to lower valuations.

- Earnings Forecasts: Analysts' earnings forecasts play a crucial role. Positive revisions generally boost stock prices, while negative revisions often lead to price declines. These forecasts are incorporated into various valuation models used to determine fair market value.

- Earnings Revisions: Unexpected changes in earnings, both positive and negative, significantly impact stock prices. The speed and magnitude of revisions influence how investors perceive future profitability and thus adjust their valuation of a company's stock.

- Sector-Specific Growth: Different sectors exhibit varying growth rates. Strong earnings growth in specific sectors can disproportionately affect overall market valuations, especially if those sectors carry significant weight in major indices.

Alternative Investment Strategies in Light of Current Valuations

Investors concerned about current stock market valuations might consider diversifying their portfolios.

- Bonds: Bonds, offering fixed income, can provide stability during periods of stock market uncertainty. However, interest rate changes impact bond prices, hence careful selection is crucial.

- Real Estate: Real estate can act as a hedge against market volatility. However, liquidity can be a concern, and real estate valuations also depend on several factors, including local market conditions.

- Commodities and Alternative Investments: Other asset classes like commodities (gold, oil) and alternative investments (hedge funds, private equity) can offer diversification benefits but may involve higher risks and complexities.

Long-Term vs. Short-Term Perspectives on Stock Market Valuations

It's crucial to distinguish between short-term market fluctuations and long-term investment goals.

- Short-Term Market Timing: Trying to time the market is risky. Short-term market fluctuations can be unpredictable, making it difficult to consistently outperform the market.

- Buy-and-Hold Strategy: A long-term buy-and-hold strategy, focusing on fundamentally strong companies and regularly reinvesting dividends, has historically proven effective for wealth building.

- Long-Term Historical Performance: The stock market has historically delivered positive returns over the long term, despite short-term corrections and volatility.

Conclusion

BofA's analysis suggests that while current stock market valuations are not excessively high in their view, they are not necessarily undervalued either. The firm's assessment considers various economic factors, including interest rates, inflation, geopolitical risks, and the potential for a recession. While understanding stock market valuations is crucial for effective investment strategies, the importance of considering both short-term and long-term perspectives cannot be overstated. While BofA's analysis provides valuable insight, individual investors should conduct their own thorough research before making any investment decisions regarding stock market valuations. Consider consulting a financial advisor to determine the best strategy for your individual circumstances and risk tolerance. Remember, understanding stock market valuations is crucial for effective long-term investment planning.

Featured Posts

-

Is Google Facing Its Biggest Threat Yet A Potential Breakup

Apr 22, 2025

Is Google Facing Its Biggest Threat Yet A Potential Breakup

Apr 22, 2025 -

Navigating The Chinese Market Challenges For Automotive Giants

Apr 22, 2025

Navigating The Chinese Market Challenges For Automotive Giants

Apr 22, 2025 -

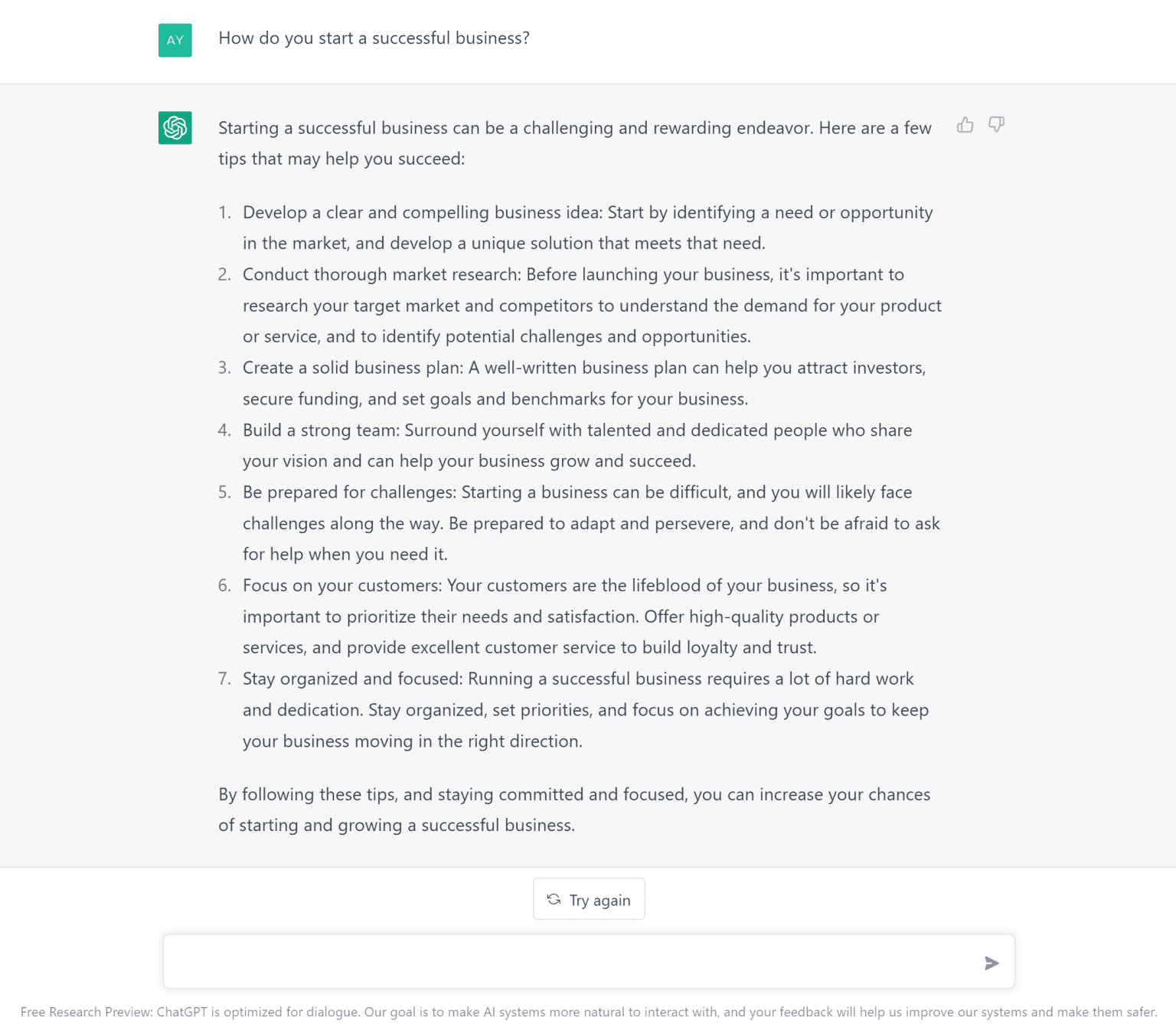

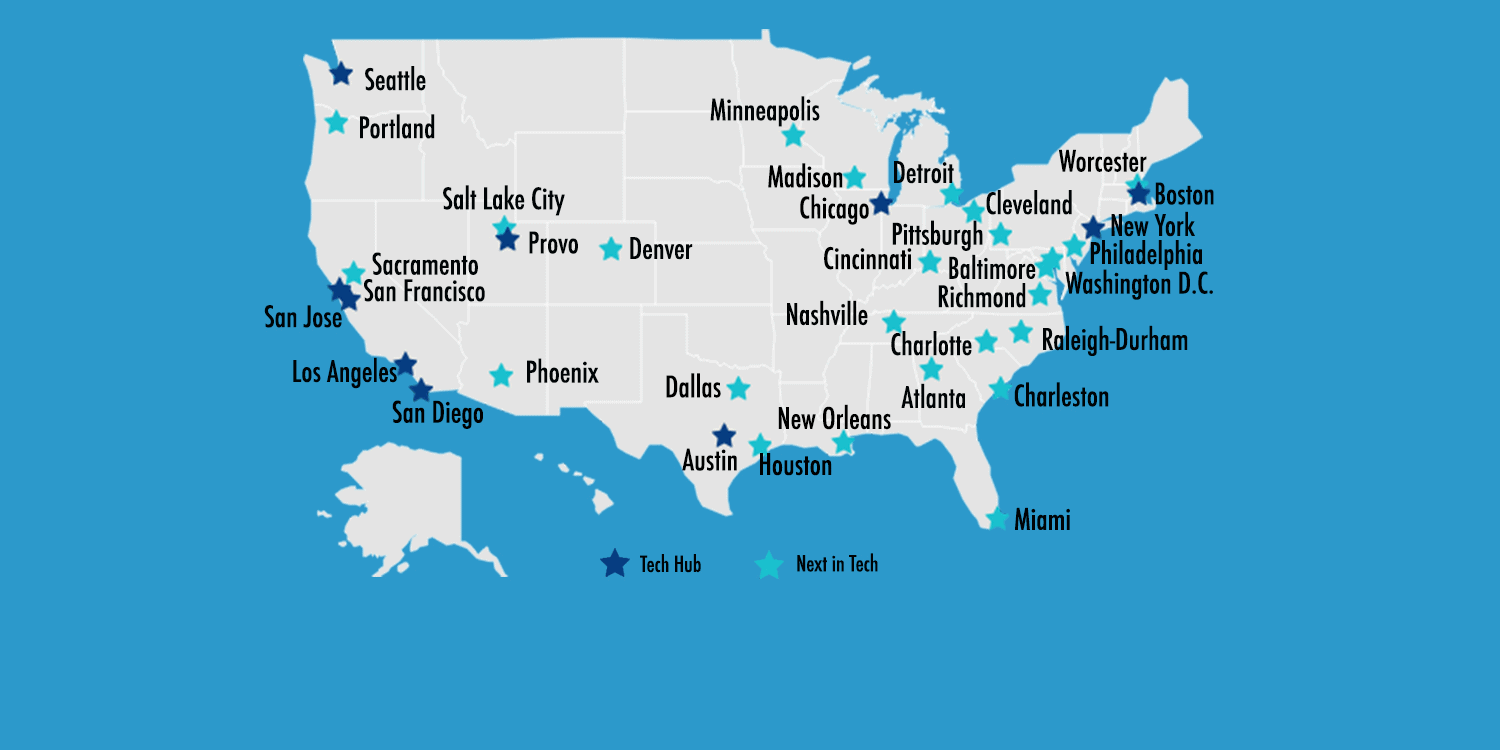

Mapping The Nations Hottest New Business Hubs

Apr 22, 2025

Mapping The Nations Hottest New Business Hubs

Apr 22, 2025 -

The Impact Of Failure Blue Origins Setbacks Compared To Katy Perrys

Apr 22, 2025

The Impact Of Failure Blue Origins Setbacks Compared To Katy Perrys

Apr 22, 2025 -

Analyzing Chinas Economic Exposure To Increased Tariffs

Apr 22, 2025

Analyzing Chinas Economic Exposure To Increased Tariffs

Apr 22, 2025