Stock Market Analysis: Impact Of Trade Tariffs On Dow Futures And Dollar

Table of Contents

How Trade Tariffs Affect Dow Futures Contracts

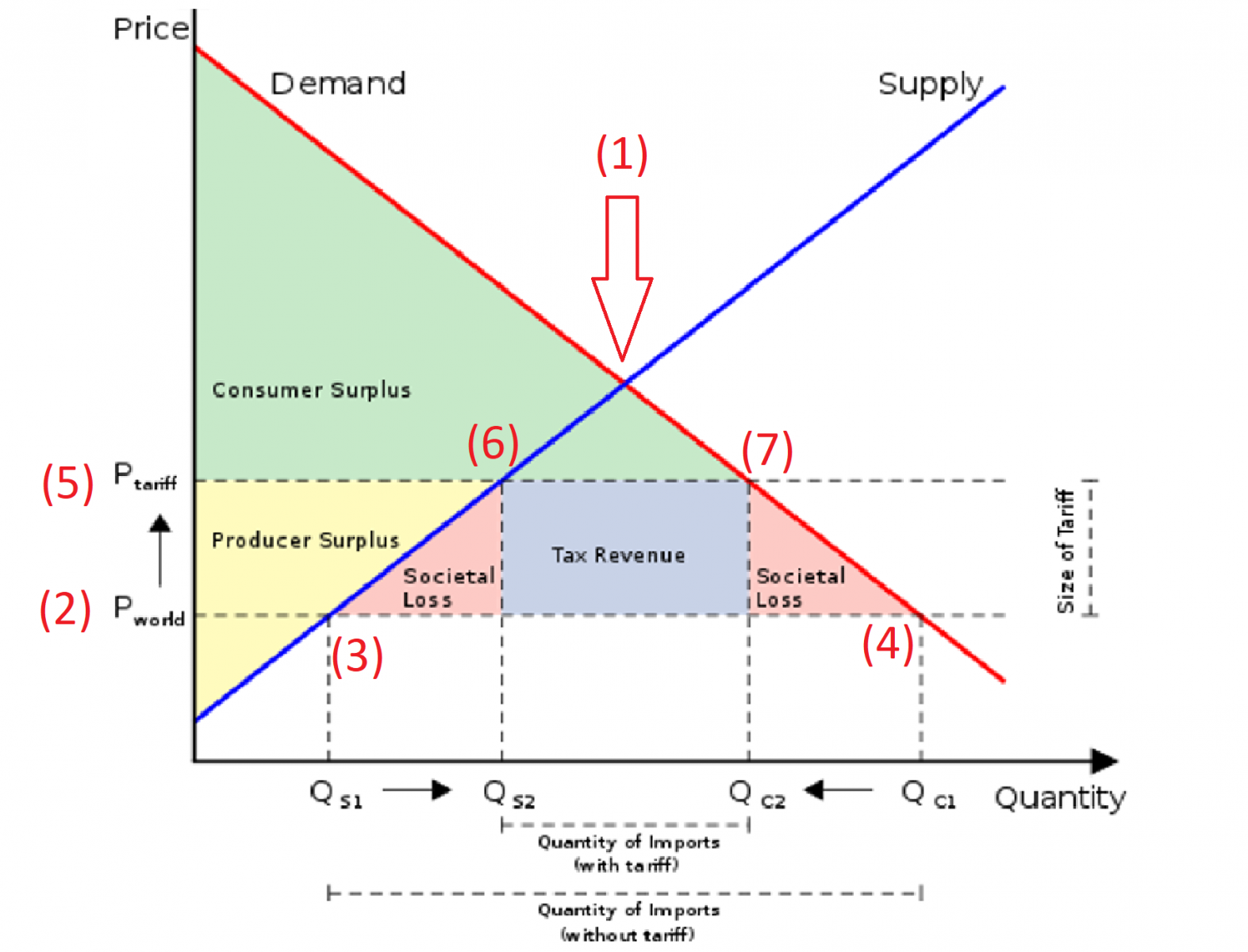

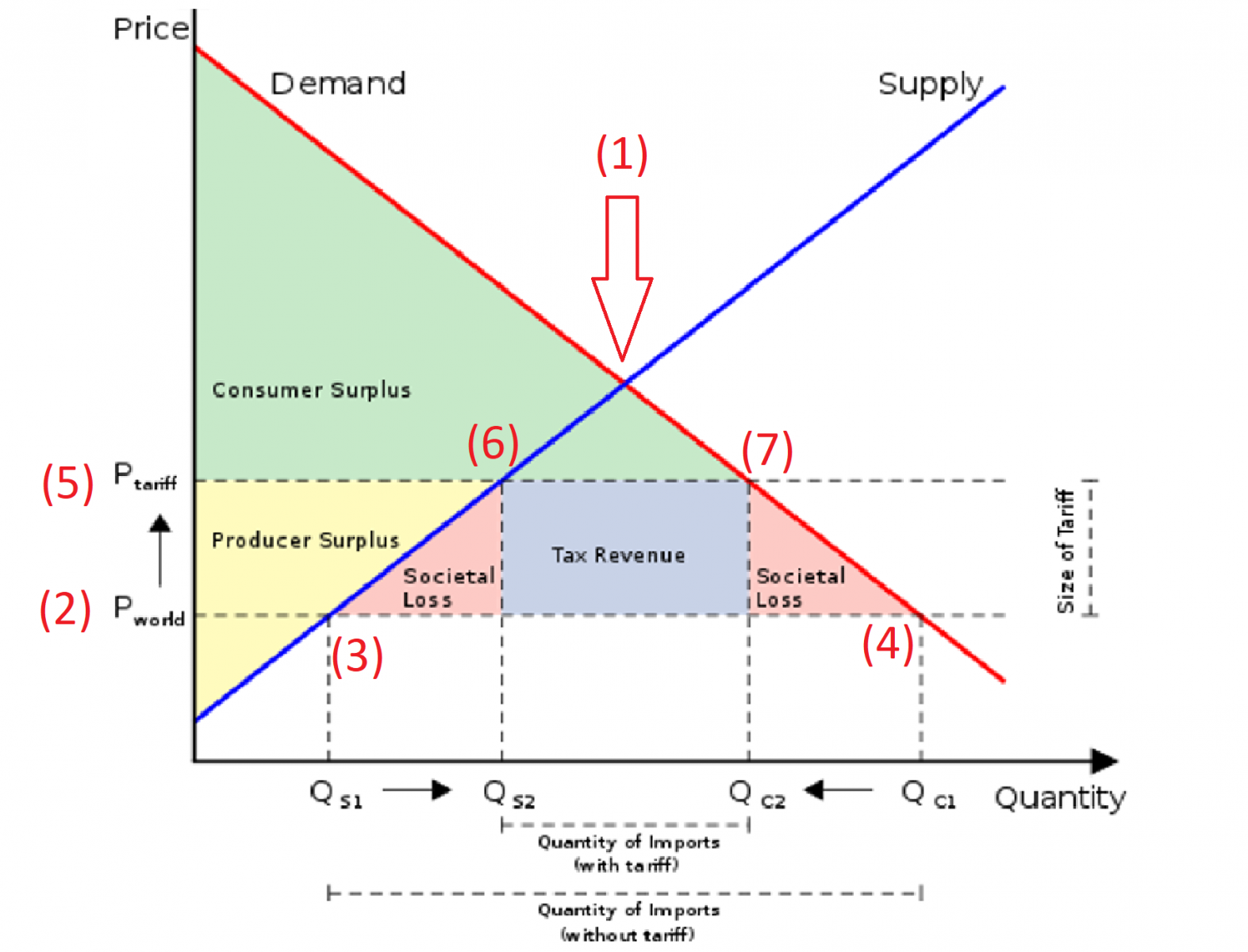

Trade policy uncertainty is a major driver of Dow Futures price fluctuations. The Dow Jones Industrial Average futures contract (Dow Futures) is a derivative that tracks the predicted performance of the Dow Jones Industrial Average, a leading indicator of US stock market performance. When trade tariffs are imposed or threatened, uncertainty ripples through the market, impacting corporate earnings and investor sentiment. This uncertainty directly influences the price of Dow Futures contracts.

- Impact on Corporate Earnings: Tariffs increase the cost of imported goods, impacting the profitability of businesses reliant on imported materials or exporting goods.

- Manufacturing sectors, particularly those reliant on global supply chains, are significantly impacted.

- Agricultural sectors face challenges due to retaliatory tariffs imposed by trading partners.

- Increased costs can lead to reduced consumer demand and overall reduced corporate earnings.

- Investor Sentiment: Negative news related to tariffs generally leads to a decline in investor confidence.

- Fear of reduced corporate profits and slower economic growth prompts investors to sell assets, driving down Dow Futures prices.

- Uncertainty surrounding future trade policies makes it difficult for investors to predict future earnings, increasing market volatility.

- Speculation and Hedging: Market participants engage in speculation and hedging activities to mitigate risks associated with trade tariff uncertainty.

- Speculators bet on future price movements of Dow Futures based on their assessment of tariff impacts.

- Companies utilize hedging strategies to protect themselves against potential losses from tariff-related disruptions. This can further impact Dow Futures prices.

(Insert chart here illustrating historical correlation between tariff announcements and Dow Futures movements)

The Impact of Tariffs on the US Dollar's Value

The US dollar often serves as a safe-haven currency during times of global economic uncertainty. However, trade wars and tariff imposition can significantly influence capital flows and, consequently, the dollar's value.

- Capital Flows and the Dollar: Tariffs can create both upward and downward pressures on the dollar.

- Increased demand for US assets (considered safer during uncertainty) can strengthen the dollar.

- A trade deficit resulting from tariffs (more expensive imports) can weaken the dollar.

- International Trade and US Competitiveness: A stronger dollar can make US exports more expensive and imports cheaper, potentially hurting US competitiveness. Conversely, a weaker dollar can boost exports but increase import costs.

- Impact on US Economy: Fluctuations in the dollar's value impact US imports and exports, influencing inflation, employment, and overall economic growth.

(Insert chart here illustrating the historical relationship between tariffs and the US dollar exchange rate)

Stock Market Analysis Techniques for Navigating Tariff Uncertainty

Effective stock market analysis during periods of tariff uncertainty requires a multifaceted approach that integrates both fundamental and technical analysis techniques.

- Fundamental Analysis: Focus on evaluating company-specific factors affected by tariffs.

- Analyze company earnings reports to assess the impact of tariffs on profitability and future projections.

- Evaluate industry trends to determine which sectors are most vulnerable or resilient to tariff changes.

- Identify companies that can effectively mitigate tariff impacts through diversification or cost-cutting measures.

- Technical Analysis: Use chart patterns and indicators to anticipate market reactions to tariff-related news.

- Identify support and resistance levels to gauge potential price movements.

- Monitor trading volume and momentum to confirm price trends.

- Utilize risk management strategies, such as stop-loss orders, to limit potential losses during periods of increased volatility.

- Diversification and Risk Management: Diversifying investments across different sectors and asset classes is crucial to mitigate the impact of trade-related uncertainty.

- Utilize External Resources: Stay informed by consulting economic forecasts, following expert opinions from financial analysts, and monitoring government announcements related to trade policy.

Conclusion: Mastering Stock Market Analysis in the Age of Trade Tariffs

Trade tariffs significantly influence Dow Futures prices and the value of the US dollar, creating a complex interplay that necessitates a nuanced approach to stock market analysis. Understanding the relationship between these market indicators and trade policies is paramount for effective investment strategies. By combining fundamental and technical analysis, employing robust risk management techniques, and staying informed about global trade developments, investors can navigate the uncertainties of tariff-induced market volatility. Continue learning about stock market analysis, focusing specifically on the implications of trade tariffs, Dow futures, and the dollar, to build more resilient and profitable investment portfolios. Explore further resources such as financial news websites, economic publications, and educational platforms to enhance your understanding and refine your trading strategies.

Featured Posts

-

La Fires Landlords Accused Of Price Gouging Amidst Crisis

Apr 22, 2025

La Fires Landlords Accused Of Price Gouging Amidst Crisis

Apr 22, 2025 -

Analyzing The Impact Of Trumps Trade Policies On Us Financial Primacy

Apr 22, 2025

Analyzing The Impact Of Trumps Trade Policies On Us Financial Primacy

Apr 22, 2025 -

The Aftermath Of La Fires Renters Face Price Gouging

Apr 22, 2025

The Aftermath Of La Fires Renters Face Price Gouging

Apr 22, 2025 -

Pope Francis Champion Of Compassion Passes Away At 88

Apr 22, 2025

Pope Francis Champion Of Compassion Passes Away At 88

Apr 22, 2025 -

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 22, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 22, 2025