Stock Market Valuation Concerns? BofA Offers A Different Perspective

Table of Contents

BofA's Contrarian View on Stock Market Valuation

BofA maintains a cautiously optimistic stance on stock market valuations, diverging from the widespread pessimism. Their argument rests on a combination of factors, focusing less on short-term volatility and more on the long-term growth potential of the market. This perspective, while counterintuitive to some, provides valuable insight into a complex market environment.

Focus on Long-Term Growth Potential

BofA's bullishness stems from their projections for sustained corporate earnings growth. They highlight several key factors:

- Strong corporate earnings growth projections: BofA analysts predict robust earnings growth across various sectors, fueled by strong consumer spending and business investment.

- Positive outlook for specific sectors: They point to promising growth in technology, healthcare, and renewable energy, sectors expected to drive significant economic expansion.

- Emphasis on technological advancements and innovation driving growth: BofA highlights the transformative impact of technological innovation on productivity and efficiency, leading to increased profitability.

- Utilizing key metrics: BofA supports its claims by referencing metrics like forward P/E ratios, adjusted for interest rate environments and historical growth patterns, indicating potential upside.

Addressing the High Valuation Concerns

While acknowledging the high Price-to-Earnings (P/E) ratios in some sectors, BofA offers compelling counterarguments:

- Low interest rates justifying higher valuations: The persistently low interest rate environment allows companies to borrow at lower costs, supporting higher valuations.

- Strong balance sheets of many companies: Many corporations possess robust balance sheets, providing a buffer against economic downturns and supporting higher valuations.

- Potential for future inflation and its impact on valuations: BofA's analysis incorporates potential inflation, acknowledging its impact on valuation but arguing that current valuations are not entirely unjustified given growth prospects.

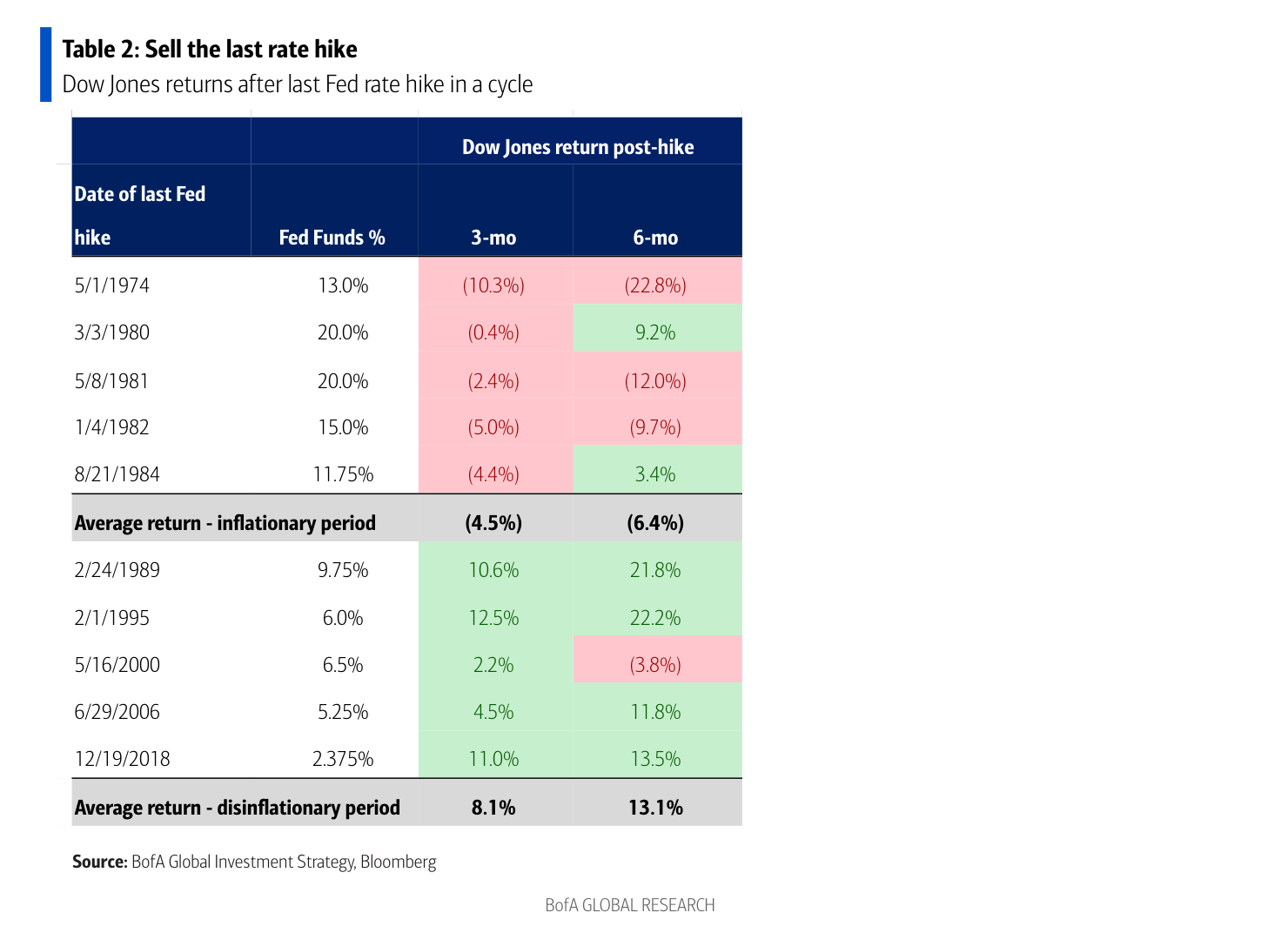

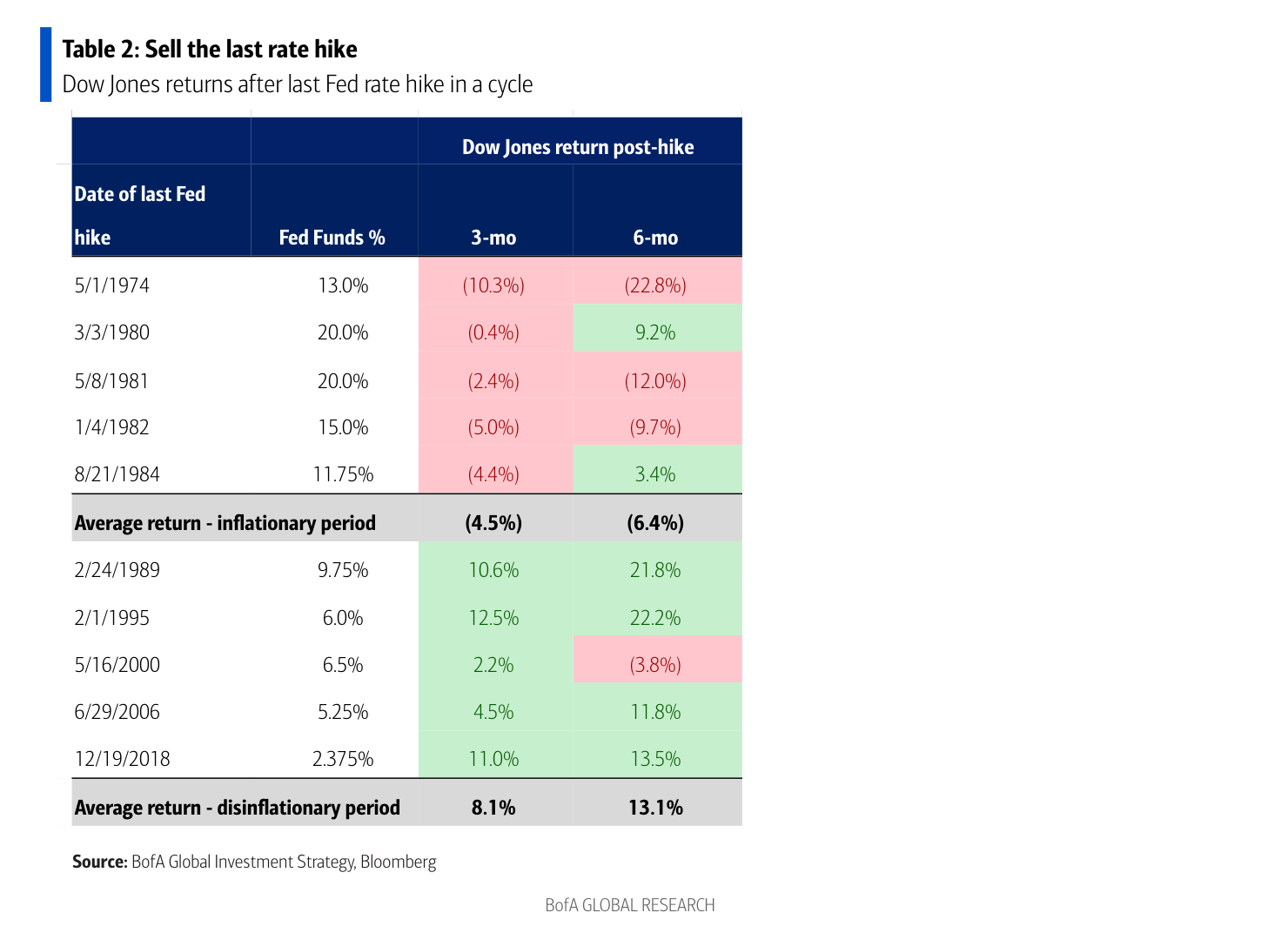

- Comparison to historical valuations in similar economic climates: BofA uses historical data to contextualize current valuations, demonstrating periods of similarly high valuations followed by sustained growth.

Key Factors Supporting BofA's Stock Market Valuation Analysis

BofA's analysis incorporates several crucial factors influencing their optimistic outlook on stock market valuation:

The Role of Interest Rates

BofA's perspective is heavily influenced by its interest rate predictions. They anticipate a gradual increase in interest rates, believing this will be manageable and won't significantly derail economic growth. They forecast a controlled rise, allowing the market to adjust gradually.

Impact of Geopolitical Events

BofA acknowledges the impact of geopolitical events, such as trade wars and global conflicts. Their analysis incorporates various scenarios and adjusts their valuations accordingly, demonstrating a sophisticated approach to risk assessment. They focus on long-term trends rather than short-term shocks.

Technological Disruption and its Influence

BofA recognizes the profound impact of technological disruption on various sectors. They see this not as a threat but as a catalyst for long-term growth and increased efficiency, bolstering their positive valuation outlook.

Divergent Opinions and Market Sentiment

It's crucial to acknowledge that not all analysts share BofA's optimistic view. Many remain cautious, citing concerns about overvaluation and potential market corrections. This highlights the importance of considering multiple perspectives before making investment decisions. The current market sentiment remains mixed, with investor behavior influenced by both optimism and apprehension regarding stock market valuations.

Conclusion

BofA's analysis provides a compelling counterpoint to the prevailing bearish sentiment. Their focus on long-term growth potential, coupled with a nuanced understanding of interest rates, geopolitical events, and technological disruption, leads them to a more optimistic outlook on stock market valuation. However, it’s critical to remember that this is just one perspective.

Remember to conduct thorough research, consider diverse viewpoints, and seek professional financial advice before making any investment decisions. Understanding the nuances of stock market valuation before making any investment decisions is paramount. Learn more about BofA's perspective and explore other viewpoints to form your own informed opinion.

Featured Posts

-

Analyzing Pitchers Name S Performance Mets Rotation Contender

Apr 28, 2025

Analyzing Pitchers Name S Performance Mets Rotation Contender

Apr 28, 2025 -

Isdarat Mwsyqyt Ealmyt Fy Mhrjan Abwzby Aldwly

Apr 28, 2025

Isdarat Mwsyqyt Ealmyt Fy Mhrjan Abwzby Aldwly

Apr 28, 2025 -

Hollywood Strike Actors Join Writers Bringing Industry To A Standstill

Apr 28, 2025

Hollywood Strike Actors Join Writers Bringing Industry To A Standstill

Apr 28, 2025 -

127 Years And Counting Anchor Brewing Company Announces Closure

Apr 28, 2025

127 Years And Counting Anchor Brewing Company Announces Closure

Apr 28, 2025 -

Thnyt Qayd Eam Shrtt Abwzby Llmnawbyn Wtfqdh Syr Aleml

Apr 28, 2025

Thnyt Qayd Eam Shrtt Abwzby Llmnawbyn Wtfqdh Syr Aleml

Apr 28, 2025