Stock Market Valuation Concerns: BofA's Perspective For Investors

Table of Contents

BofA's Key Valuation Concerns

BofA's concerns regarding current market valuations stem from a confluence of factors, extending beyond specific sectors to encompass broader macroeconomic trends. Their analysis points to a potential overvaluation across significant portions of the market, necessitating a cautious approach from investors.

-

High Price-to-Earnings (P/E) ratios across various sectors: Many sectors are trading at P/E ratios significantly higher than historical averages, suggesting potential overvaluation relative to future earnings potential. This is particularly true in some growth-oriented sectors.

-

Concerns about future earnings growth potential: BofA analysts express concern that current earnings may not be sustainable, and future growth may fall short of market expectations. This could lead to a correction in stock prices.

-

Impact of rising interest rates on valuation multiples: The Federal Reserve's monetary policy tightening, including interest rate hikes, impacts valuation multiples. Higher interest rates increase the discount rate used in present value calculations, leading to lower valuations for equities.

-

Analysis of potential market corrections or bear markets: BofA's analysis suggests a significant risk of market corrections, or even a bear market, given the current valuation levels and macroeconomic headwinds.

-

Comparison to historical valuations and potential overvaluation: By comparing current market valuations to historical data, BofA highlights the potential for significant overvaluation in certain sectors and the market as a whole. This comparison provides a historical context to understand the current risk level.

BofA's Recommended Investment Strategies

In light of their valuation concerns, BofA recommends a more conservative and strategic approach to investing. This involves diversifying portfolios and focusing on fundamentally sound companies.

-

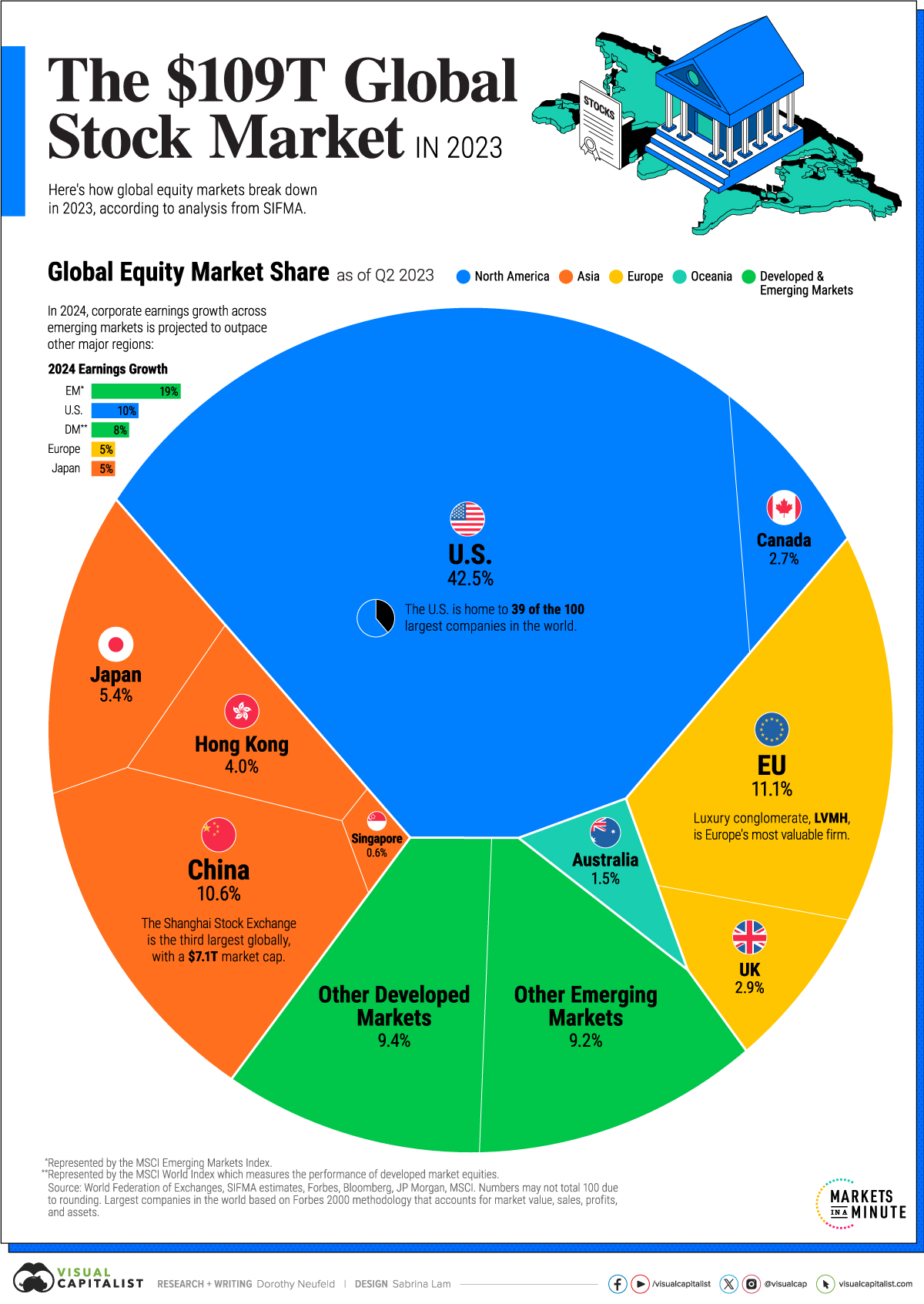

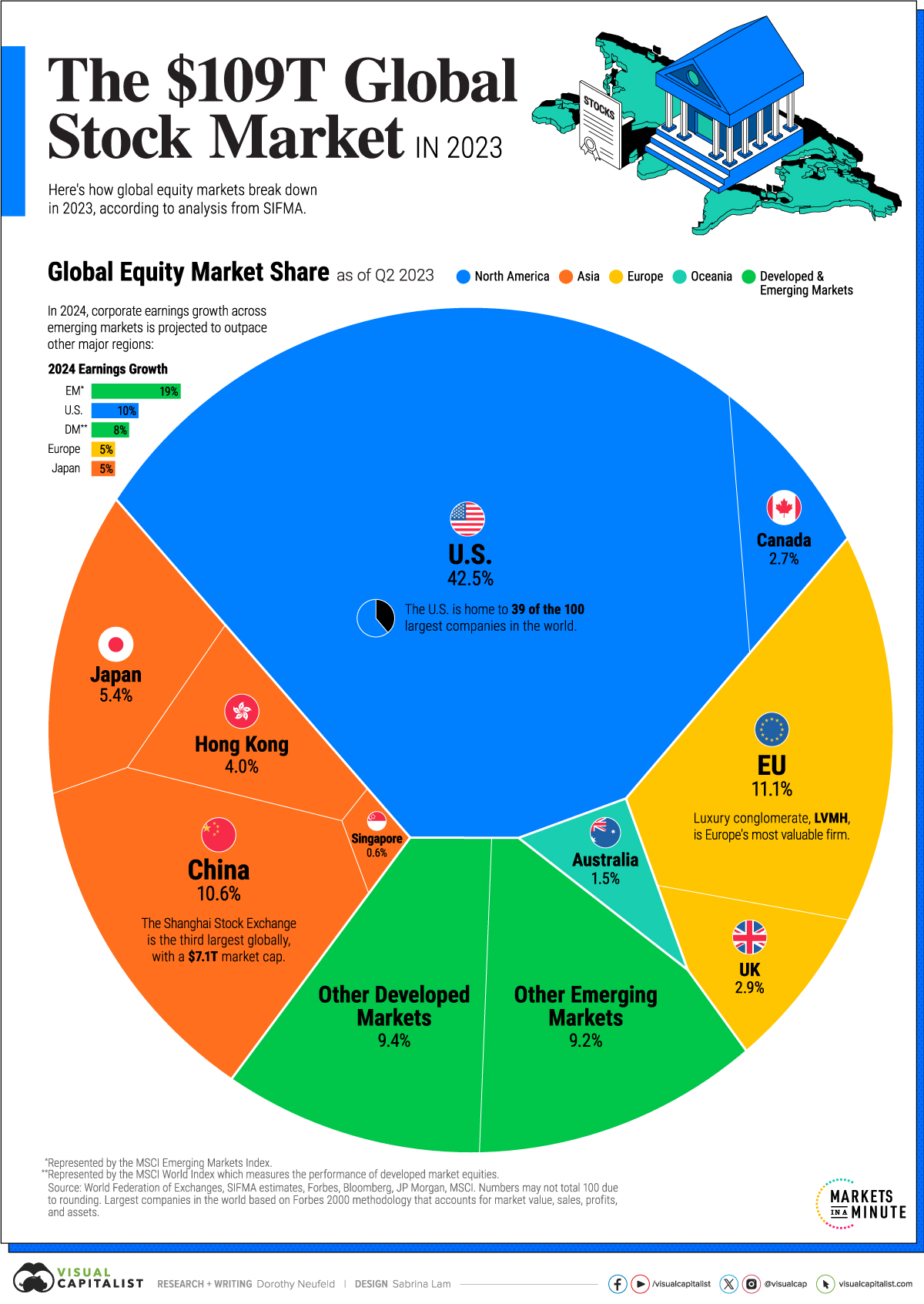

Diversification strategies to mitigate risk: BofA emphasizes the importance of diversifying across different asset classes, sectors, and geographies to reduce overall portfolio risk. This is crucial in a potentially volatile market.

-

Focus on value stocks or undervalued companies: The firm suggests looking for value stocks—companies trading below their intrinsic value—as a way to potentially generate returns even in a challenging market. Thorough fundamental analysis is key here.

-

Increased allocation to defensive sectors (e.g., consumer staples, healthcare): Defensive sectors, typically less sensitive to economic downturns, are suggested for increased allocation as they offer relative stability during periods of market uncertainty.

-

Potential for tactical asset allocation shifts: BofA advocates for the flexibility to adjust asset allocation based on market conditions. This may involve shifting to more conservative asset classes temporarily.

-

Importance of long-term investment horizons: Maintaining a long-term investment horizon is crucial for weathering short-term market volatility and realizing the benefits of compounding returns.

Analyzing Sector-Specific Valuations

BofA's analysis provides sector-specific insights into valuations.

-

Valuation analysis for technology stocks: The technology sector, having experienced substantial growth in recent years, is subject to intense scrutiny. BofA's analysis assesses whether current valuations are justified by future growth prospects.

-

Assessment of energy sector valuations: Energy sector valuations are influenced by global supply and demand dynamics and geopolitical factors. BofA's analysis examines the sustainability of current valuations in this sector.

-

Perspective on the financial services sector: The financial services sector's valuation is heavily tied to interest rate movements and economic growth. BofA assesses this relationship within its overall market outlook.

-

Evaluation of consumer discretionary stocks: Consumer discretionary spending is sensitive to economic conditions. BofA analyzes the valuations of companies in this sector based on consumer sentiment and economic forecasts.

Understanding the Macroeconomic Context

BofA's valuation concerns are deeply intertwined with the broader macroeconomic environment.

-

Impact of inflation on corporate earnings: High inflation erodes corporate profit margins, impacting future earnings growth and potentially justifying lower equity valuations.

-

Influence of rising interest rates on bond yields and equity valuations: Higher interest rates make bonds more attractive, potentially drawing investment away from equities and putting downward pressure on equity valuations.

-

Geopolitical risks and their potential market effects: Geopolitical events and uncertainties introduce significant volatility and uncertainty into the market, affecting investor sentiment and valuations.

-

Potential for recessionary pressures: The risk of a recession is a key factor in BofA's assessment, potentially leading to lower corporate earnings and decreased equity valuations.

Managing Risk in a Challenging Market

Given BofA’s assessment, effective risk management is paramount.

-

Importance of risk tolerance assessment: Investors should carefully assess their risk tolerance to ensure their investment strategy aligns with their comfort level.

-

Strategies for portfolio protection: This includes diversification, hedging strategies, and potentially shifting to more conservative asset classes.

-

Utilizing stop-loss orders: Stop-loss orders can help limit potential losses by automatically selling a security when it reaches a predetermined price.

-

Dollar-cost averaging as a risk mitigation tool: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This can help mitigate the risk of investing a lump sum at a market peak.

Conclusion

BofA's analysis highlights significant stock market valuation concerns, driven by high P/E ratios, concerns about future earnings growth, rising interest rates, and broader macroeconomic factors. Their recommended investment strategies emphasize diversification, a focus on value stocks, and increased allocation to defensive sectors. Managing risk through careful assessment of risk tolerance, portfolio protection strategies, and the use of tools like stop-loss orders and dollar-cost averaging is crucial. By understanding these stock market valuation concerns and implementing the suggested strategies, investors can navigate this challenging environment and make more informed decisions to protect their portfolios. Stay informed on market developments and regularly review your investment strategy in light of evolving stock market valuation concerns.

Featured Posts

-

Cybercriminal Nets Millions Through Executive Office365 Compromise

Apr 22, 2025

Cybercriminal Nets Millions Through Executive Office365 Compromise

Apr 22, 2025 -

A Closer Look At The Pan Nordic Military Alliance Strengths And Weaknesses

Apr 22, 2025

A Closer Look At The Pan Nordic Military Alliance Strengths And Weaknesses

Apr 22, 2025 -

Us South Sudan Collaboration On The Repatriation Of Deportees

Apr 22, 2025

Us South Sudan Collaboration On The Repatriation Of Deportees

Apr 22, 2025 -

Ukraine Conflict Kyiv Under Pressure To Respond To Trump Plan

Apr 22, 2025

Ukraine Conflict Kyiv Under Pressure To Respond To Trump Plan

Apr 22, 2025 -

Saudi Aramco Byd Collaboration A New Era In Electric Vehicle Technology

Apr 22, 2025

Saudi Aramco Byd Collaboration A New Era In Electric Vehicle Technology

Apr 22, 2025