Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

H2: BofA's Assessment of Current Stock Market Valuations

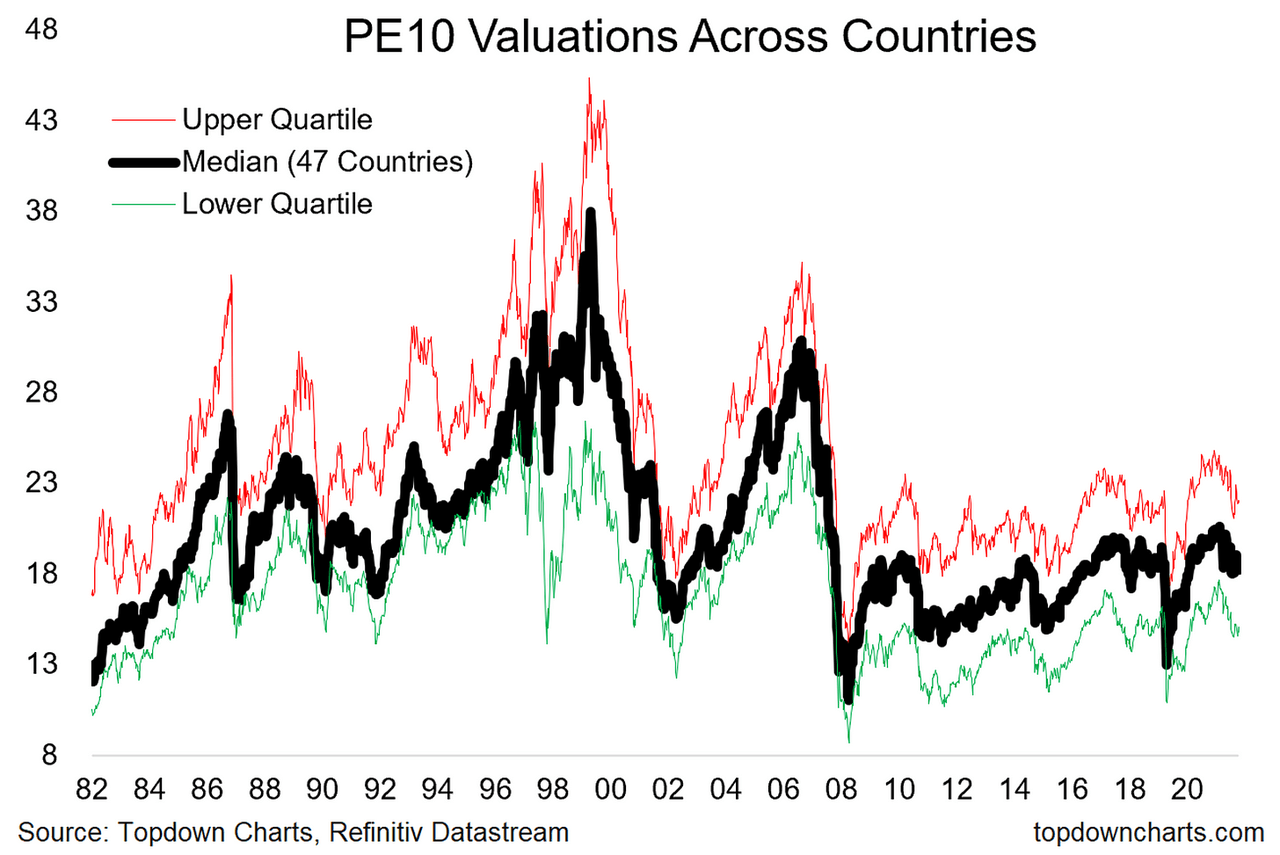

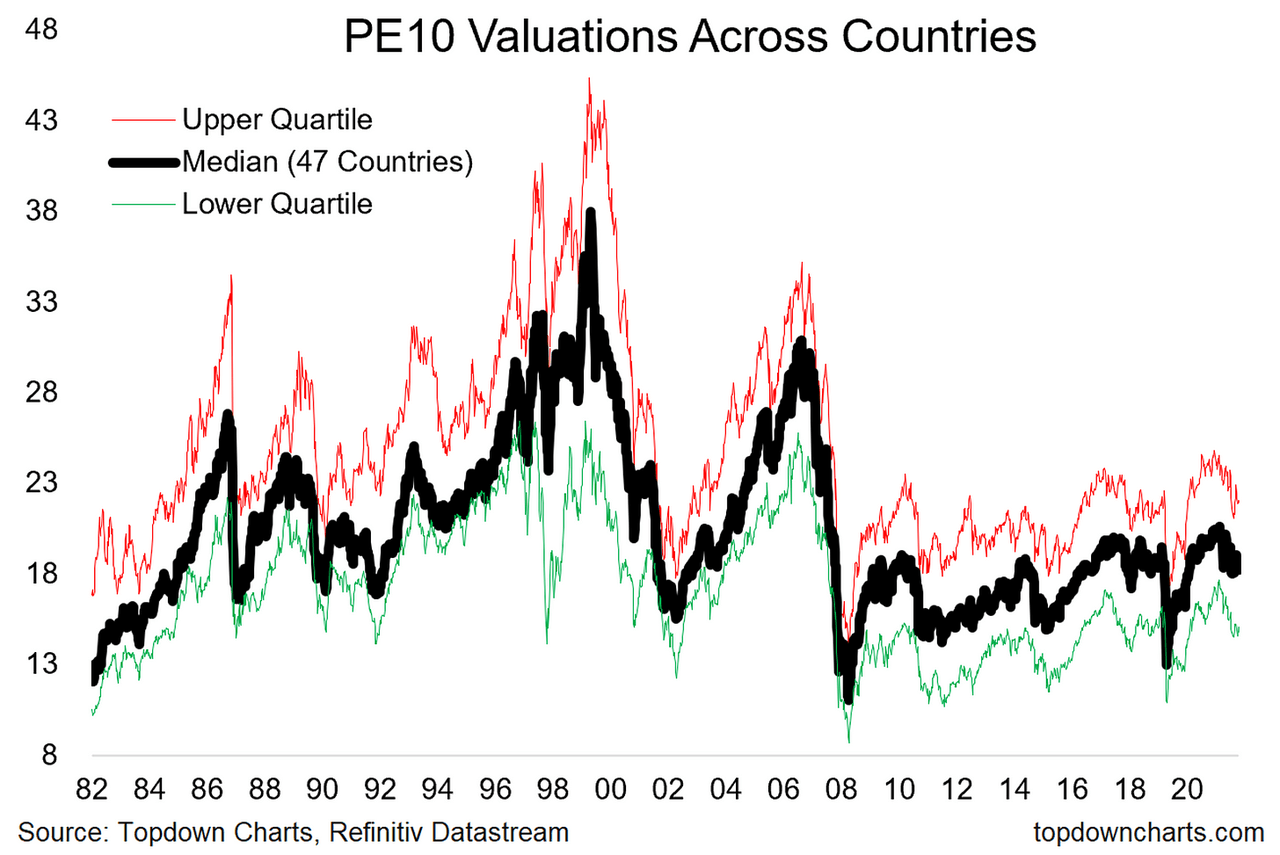

BofA's latest analysis suggests a nuanced view of current stock market valuations. While acknowledging the elevated levels of certain market segments, they don't necessarily deem the overall market as drastically overvalued. Their assessment incorporates several key metrics, including the widely-used Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), which considers inflation-adjusted earnings over a longer period.

- Key findings from BofA's report regarding valuation metrics: BofA's research likely points to a range of valuations across different sectors, with some sectors appearing more expensive than others. Their analysis probably incorporates forward-looking earnings estimates, which are crucial for assessing future potential.

- Comparison to historical valuations: The report likely compares current P/E ratios and Shiller PE ratios to historical averages, providing context to the current market environment. This historical comparison helps determine whether current valuations are significantly higher or lower than historical norms.

- Mention any specific sectors or market segments BofA highlighted: BofA might highlight specific sectors like technology or energy as being relatively more or less expensive based on their analysis. Understanding these sector-specific valuations is crucial for portfolio diversification.

H2: Factors Influencing BofA's Valuation Analysis

BofA's valuation analysis is not conducted in a vacuum; it considers several crucial macroeconomic factors:

- Interest rate environment and its impact on valuations: Rising interest rates increase the cost of borrowing for companies, potentially impacting future earnings and thus stock valuations. BofA's analysis likely incorporates projections for future interest rate hikes and their influence on corporate profitability.

- Inflationary pressures and their effect on corporate earnings: High inflation erodes purchasing power and impacts corporate profit margins. BofA's analysis likely assesses the impact of inflation on various sectors and their earnings potential.

- Geopolitical risks and their influence on market sentiment: Global events like the war in Ukraine and rising geopolitical tensions can significantly affect market sentiment and investor risk appetite, thus impacting valuations. BofA likely incorporates a geopolitical risk assessment into their analysis.

- Potential impact of upcoming economic data releases: Key economic data releases (e.g., employment figures, inflation reports) can significantly influence market movements and stock valuations. BofA's outlook probably incorporates projections based on anticipated economic data releases.

H2: Implications for Investors: How to Interpret BofA's Reassurance

BofA's findings should inform, but not dictate, your investment strategy. The key is understanding your risk tolerance and aligning your investment approach accordingly.

- Advice for long-term investors based on BofA's assessment: Long-term investors should probably focus on the underlying fundamentals of companies and sectors, rather than short-term market fluctuations. BofA's reassurances might bolster a long-term buy-and-hold strategy for those with a high risk tolerance.

- Strategies for short-term investors given the current valuation landscape: Short-term investors might need a more cautious approach, potentially considering defensive sectors or strategies to mitigate risk, based on BofA's assessment of specific sectors.

- Importance of diversification in the current market climate: Diversification remains crucial regardless of market sentiment. Spreading investments across different asset classes and sectors helps mitigate the impact of any single sector's underperformance.

- Recommendations for specific asset classes based on BofA's analysis (if applicable): BofA might suggest specific asset classes (e.g., bonds, real estate) based on their assessment of current market conditions and the relative valuations within each asset class.

H2: Beyond BofA: Considering Other Expert Opinions on Stock Market Valuations

While BofA's perspective is valuable, it's essential to remember that it's just one viewpoint. Other financial institutions and analysts may hold different opinions on current stock market valuations.

- Briefly summarize contrasting viewpoints: Some analysts may be more bearish, highlighting potential risks and predicting a market correction, while others might share BofA's relatively optimistic outlook.

- Highlight the importance of independent research and due diligence: Investors should conduct their own thorough research and analysis before making any investment decisions.

- Explain how investors can synthesize multiple perspectives to inform their decisions: By considering multiple perspectives, investors can gain a more comprehensive understanding of the market and make more informed decisions.

Conclusion: Making Informed Decisions on Stock Market Valuations

BofA's analysis provides a valuable perspective on current stock market valuations, suggesting a nuanced view rather than a universally high or low assessment. However, it's crucial to remember that this is just one opinion. Thorough independent research and consideration of various perspectives are vital before making investment decisions. Understanding macroeconomic factors, your risk tolerance, and employing diversification strategies remain crucial for navigating the complexities of stock market valuations. Conduct further research on stock market valuations and consider seeking professional financial advice tailored to your individual circumstances and investment goals. Remember, successful long-term investing requires patience and a well-defined strategy to weather market volatility.

Featured Posts

-

The Mets Rotation Decision Pitchers Name S Prospects

Apr 28, 2025

The Mets Rotation Decision Pitchers Name S Prospects

Apr 28, 2025 -

World Leaders Attend Pope Francis Funeral Mass

Apr 28, 2025

World Leaders Attend Pope Francis Funeral Mass

Apr 28, 2025 -

When The Market Falls Professional Selling And The Retail Investor Response

Apr 28, 2025

When The Market Falls Professional Selling And The Retail Investor Response

Apr 28, 2025 -

Mets Manager Outlines Requirements For Final Rotation Spot

Apr 28, 2025

Mets Manager Outlines Requirements For Final Rotation Spot

Apr 28, 2025 -

Red Sox 2025 Season Espns Controversial Prediction

Apr 28, 2025

Red Sox 2025 Season Espns Controversial Prediction

Apr 28, 2025