Targeting The Spot Market: EU's Plan For Russian Natural Gas Phaseout

Table of Contents

The Allure of the Spot Market

The EU's strategy hinges on leveraging the spot market for natural gas to reduce reliance on long-term contracts with Russia and enhance energy security. This shift offers several key advantages.

Reduced Dependency on Long-Term Contracts

Long-term contracts, while offering price stability in theory, often lock buyers into agreements with significant geopolitical risks. The spot market, however, provides greater flexibility.

- Reduced price volatility (in theory): While the spot market itself can experience price swings, it offers the potential to capitalize on lower prices when supply is abundant.

- Increased negotiation power: The ability to buy gas from multiple sources on the spot market increases the EU's bargaining power, reducing dependence on any single supplier.

- Ability to react quickly to market changes: The spot market allows for agile responses to geopolitical events or unexpected supply disruptions. This adaptability is crucial for ensuring a reliable gas supply.

Increased LNG Imports as a Spot Market Solution

A crucial aspect of the EU's spot market strategy is the dramatic increase in LNG (Liquefied Natural Gas) imports. This necessitates significant infrastructure upgrades.

- Investment in new LNG terminals: Across the EU, countries are investing heavily in new LNG import terminals to handle the increased volume of liquefied gas.

- Increased shipping capacity: The expansion of LNG shipping capacity is essential to transport gas from diverse sources globally to the EU.

- Partnerships with LNG-exporting countries: The EU is forging stronger partnerships with countries like the US, Qatar, and Australia, securing diverse LNG supply routes.

Challenges of the Spot Market Strategy

While the spot market offers advantages, it also presents significant challenges that the EU must address.

Price Volatility and Market Fluctuations

The inherent volatility of the spot market is a major concern. Global supply and demand imbalances can cause significant price swings, impacting both consumers and businesses.

- Potential for price spikes: Sudden disruptions to supply or unexpected surges in demand can lead to dramatic price increases in the spot market, creating energy affordability issues.

- Need for robust risk management strategies: The EU needs sophisticated risk management tools to mitigate the potential for price spikes and ensure energy security.

- Impact on consumers and businesses: Price volatility in the spot market can translate to higher energy bills for consumers and increased production costs for businesses.

Competition for Scarce Resources

The EU faces increased competition for limited natural gas supplies on the global spot market. This competition can drive up prices and potentially jeopardize the EU's energy security goals.

- Potential for bidding wars: The EU might find itself competing with other energy-hungry nations for available LNG supplies, leading to bidding wars that inflate prices.

- Securing sufficient supply: Ensuring a sufficient supply of natural gas to meet the EU's demand requires effective market strategies and diplomatic efforts.

- Ensuring equitable access: The EU must ensure that all member states have fair and equitable access to natural gas from diverse sources to avoid regional disparities.

Diversification of Gas Suppliers and Sources

To mitigate risks associated with relying on the spot market, the EU is actively diversifying its gas supply sources.

Exploring Alternative Gas Sources

The EU's strategy focuses on moving beyond its dependence on Russia by exploring and developing partnerships with other gas-producing nations.

- Increased cooperation with Norway, Algeria, and other gas-producing countries: The EU is strengthening ties with reliable alternative gas suppliers to ensure stable energy imports.

- Exploration of alternative energy sources such as renewables: Diversification goes beyond natural gas; the EU is heavily investing in renewable energy sources like solar, wind, and hydropower to reduce its reliance on fossil fuels.

Strengthening EU Energy Infrastructure

Upgrading and expanding the EU's energy infrastructure is crucial to handle the increased flow of gas from diverse sources, maximizing the efficiency of the spot market.

- Investments in pipelines: Modernizing and expanding existing pipelines and constructing new ones to improve connectivity within the EU and with neighboring countries.

- Storage facilities: Increasing the capacity of gas storage facilities across the EU to buffer against short-term supply disruptions.

- Interconnection projects: Improving cross-border interconnection projects to optimize gas flow and ensure regional balance.

- Smart grid technologies: Implementing smart grid technologies to improve the efficiency and resilience of the EU's energy network.

Conclusion

The EU's plan to phase out Russian natural gas by targeting the spot market is a complex and ambitious undertaking. While it offers potential for flexibility and reduced reliance on a single supplier, navigating price volatility and securing sufficient supplies in a competitive global market requires strategic planning and significant investment. Successfully managing this transition needs a multifaceted approach, including increased LNG imports, diversification of supply sources, and strategic investments in energy infrastructure. The effectiveness of this strategy will be critical to the EU's long-term energy security and independence. To stay abreast of developments in the EU's strategy and the dynamics of the spot market, continue following news and analysis on the topic. Understanding the complexities of the spot market will be crucial for businesses and policymakers as the EU strives towards its goal of energy independence.

Featured Posts

-

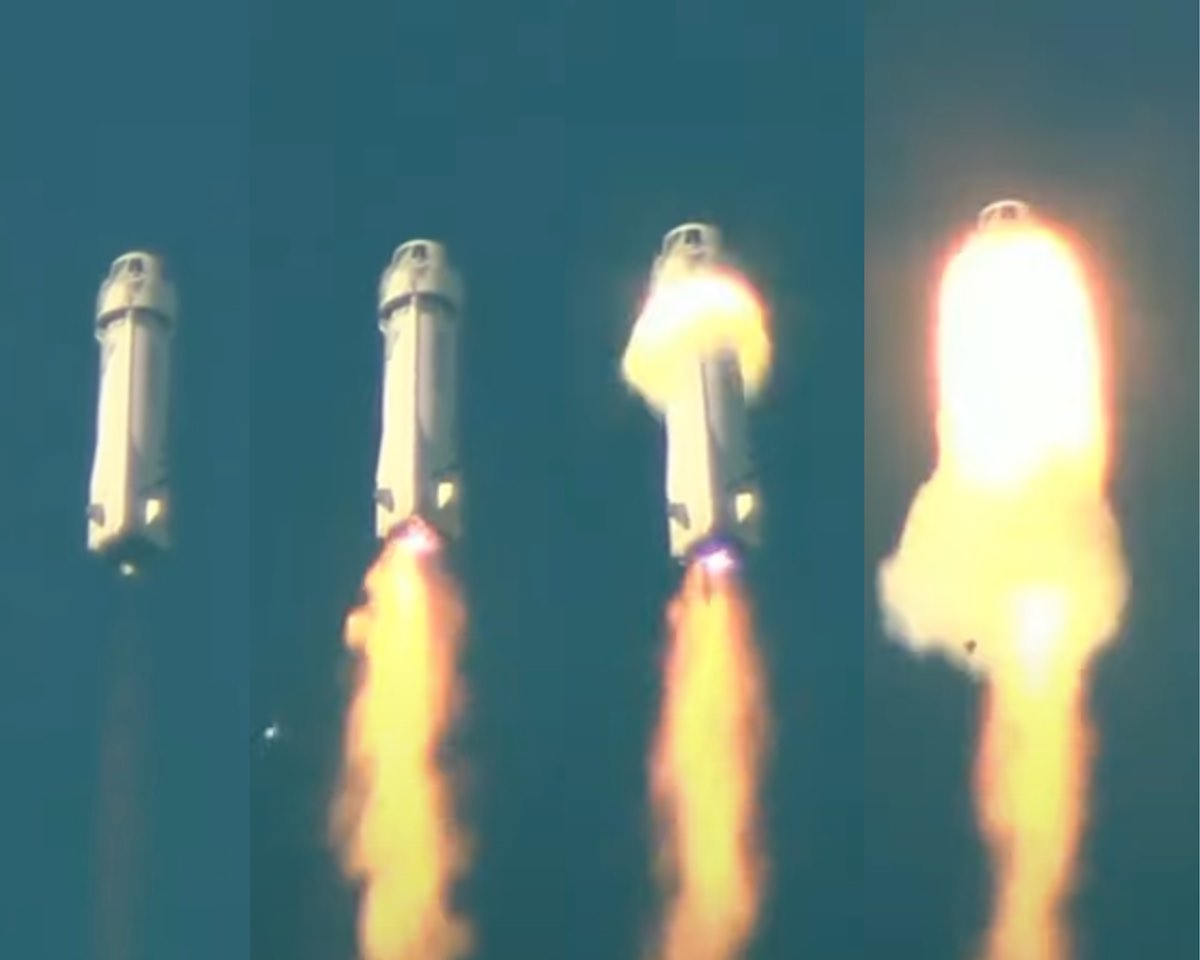

Blue Origin Scraps Launch Due To Vehicle Subsystem Problem

Apr 24, 2025

Blue Origin Scraps Launch Due To Vehicle Subsystem Problem

Apr 24, 2025 -

How Trumps Presidency Will Shape Zuckerbergs Next Move

Apr 24, 2025

How Trumps Presidency Will Shape Zuckerbergs Next Move

Apr 24, 2025 -

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 24, 2025

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 24, 2025 -

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025 -

Hisd Mariachis Whataburger Video A Ticket To The Uil State Competition

Apr 24, 2025

Hisd Mariachis Whataburger Video A Ticket To The Uil State Competition

Apr 24, 2025