Tariff Hopes Fuel Stock Market Rally: Dow, Nasdaq, S&P 500 Gains

Table of Contents

Easing Trade Tensions: The Catalyst for the Rally

The recent positive shift in market sentiment is directly linked to easing trade tensions. Positive news regarding potential trade deal breakthroughs and delays in planned tariff implementations has injected much-needed confidence into the market. This newfound optimism has helped to alleviate concerns about a protracted trade war, which had previously weighed heavily on investor confidence and fueled market volatility.

- Specific examples: Reports suggest a potential agreement on key trade issues between major economic powers, leading to the postponement of several planned tariff increases on imported goods. This includes a delay in the implementation of tariffs on certain consumer electronics and a reduction in tariffs on agricultural products.

- Investor sentiment shift: The news triggered a significant shift in investor sentiment. Market analysts reported a surge in buying activity, with investors showing a renewed appetite for riskier assets. This is clearly indicated by the significant increase in trading volume across all major indices.

- Keywords: trade war, tariff reduction, trade deal, global trade, market volatility, trade negotiations

Dow, Nasdaq, and S&P 500 Performance Analysis

The market rally translated into substantial gains across major indices. The Dow Jones Industrial Average saw a [Insert Percentage]% increase, while the Nasdaq Composite surged by [Insert Percentage]%, and the S&P 500 experienced a [Insert Percentage]% jump. This demonstrates a broad-based market reaction to the easing tariff concerns.

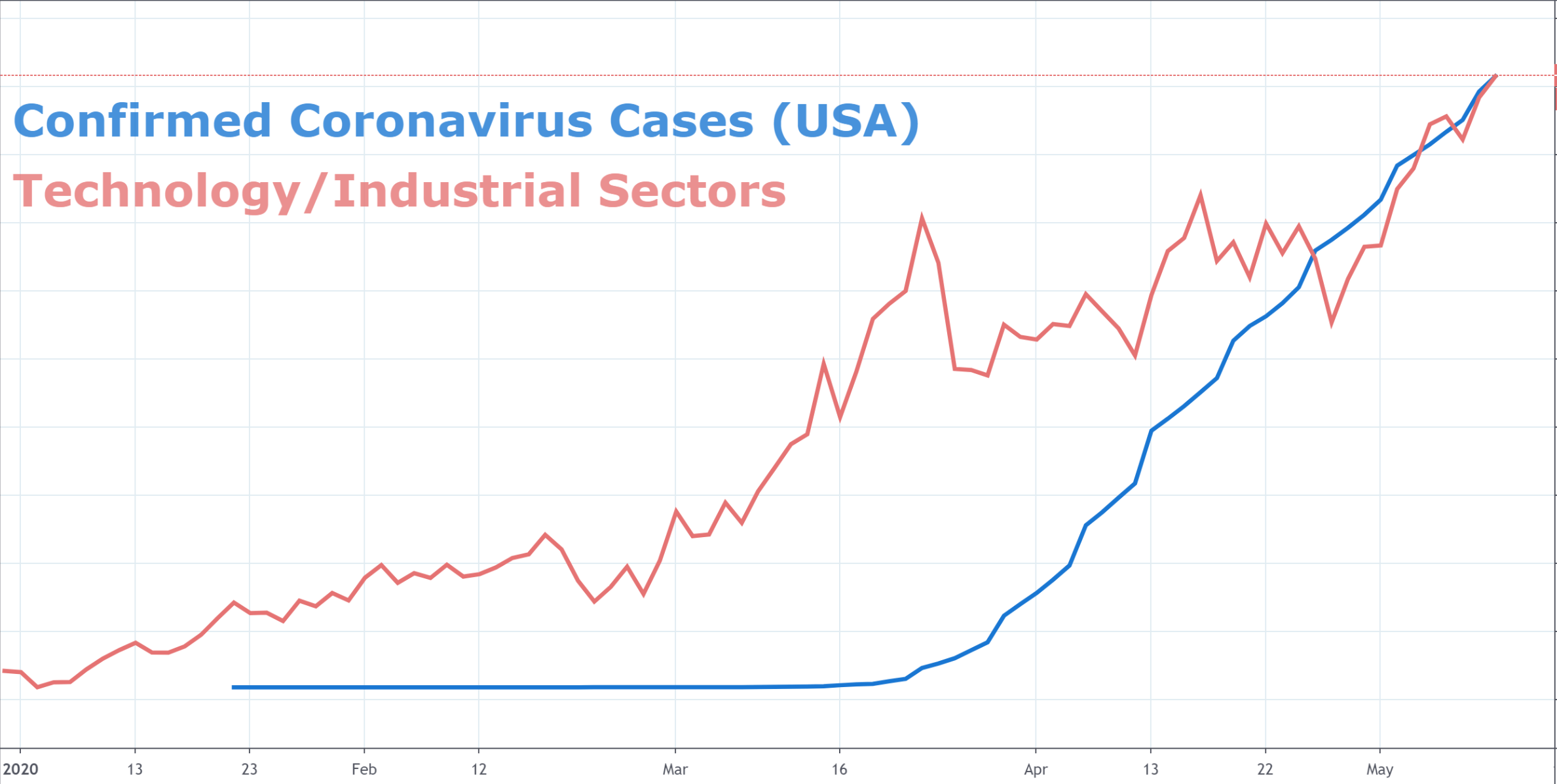

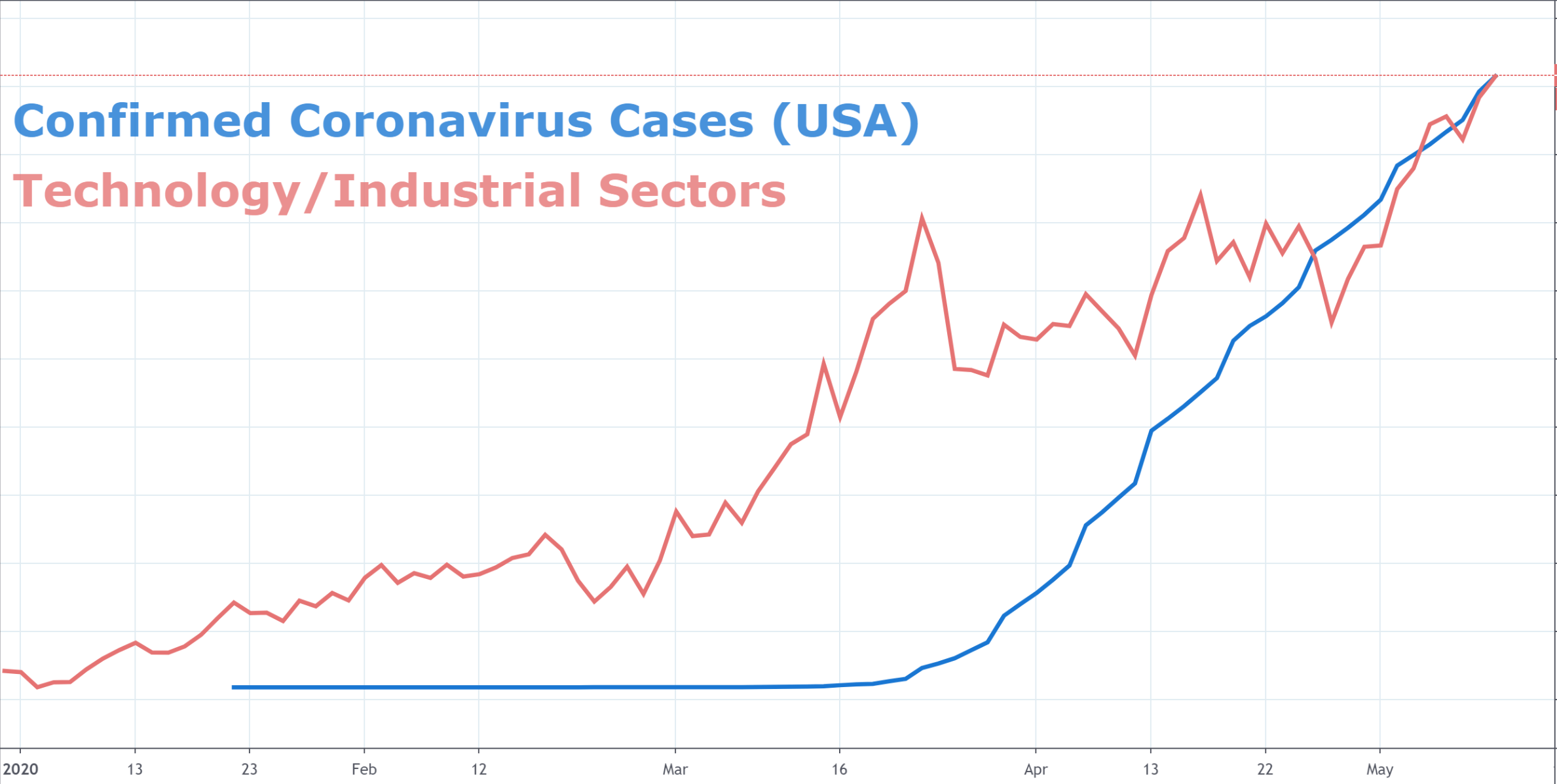

- Sector-specific performance: The technology sector, particularly sensitive to global trade dynamics, experienced disproportionately high gains. Manufacturing also saw a significant boost, reflecting the positive impact of potential tariff reductions on production costs. [Include specific examples if available, mentioning companies and their performance].

- Visual representation: [Insert a chart or graph illustrating the upward trend of the Dow, Nasdaq, and S&P 500 during the period in question]. This visual representation effectively highlights the magnitude of the gains.

- Keywords: Dow Jones, Nasdaq, S&P 500, stock market indices, market performance, index gains, sector performance

Investor Confidence and Future Market Outlook

The positive reaction to the easing trade tensions signals a renewed confidence in the market's ability to navigate global economic uncertainties. However, it's crucial to acknowledge that the situation remains fluid, and several factors could still impact the rally.

- Potential risks and uncertainties: While the current news is encouraging, the complete resolution of trade disputes is not yet guaranteed. Any unforeseen setbacks in trade negotiations could lead to renewed market volatility. Geopolitical risks and global economic slowdown remain potential headwinds.

- Expert opinions: [Include quotes or summaries of analyses from reputable financial experts on the future market outlook, considering both optimistic and cautious perspectives].

- Long-term implications: The long-term impact of the tariff changes will depend on several factors, including the extent of the trade deal, the pace of global economic growth, and the reactions of competing economies. A sustained reduction in tariffs could boost economic activity and long-term investor confidence.

- Keywords: investor sentiment, market outlook, economic growth, market prediction, risk assessment, future market trends, global economy

Conclusion: Navigating the Stock Market After the Tariff-Fueled Rally

The recent stock market rally, fueled by "Tariff Hopes," demonstrates the significant impact of trade policy on investor sentiment and market performance. The impressive gains in the Dow, Nasdaq, and S&P 500 underscore the market's positive reaction to the easing trade tensions. However, it’s crucial to remain vigilant and monitor developments concerning tariffs and their impact on global trade. Understanding the complexities surrounding tariffs and their effects on stock market performance is key to making informed investment decisions.

To stay ahead of the curve with tariff-related market analysis and understand the impacts on your portfolio, subscribe to our newsletter for regular updates, follow reputable financial news sources, and consider consulting with a qualified financial advisor. Staying informed about future developments related to tariffs and their effect on the stock market is crucial for navigating the evolving economic landscape. Understanding Tariff Impacts on Stock Market Performance is essential for successful long-term investing.

Featured Posts

-

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025 -

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 24, 2025

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 24, 2025 -

Why Pope Franciss Papal Ring Will Be Destroyed After His Death

Apr 24, 2025

Why Pope Franciss Papal Ring Will Be Destroyed After His Death

Apr 24, 2025 -

Trump Administration Open To Harvard Negotiations Following Lawsuit

Apr 24, 2025

Trump Administration Open To Harvard Negotiations Following Lawsuit

Apr 24, 2025 -

Minnesota Attorney General Files Lawsuit Against Trumps Transgender Athlete Ban

Apr 24, 2025

Minnesota Attorney General Files Lawsuit Against Trumps Transgender Athlete Ban

Apr 24, 2025