Tesla Earnings Plunge 71% In Q1: Impact Of Political Backlash Analyzed

Table of Contents

Keywords: Tesla earnings, Tesla Q1 earnings, Tesla stock, political backlash, Tesla, electric vehicle, EV, China market, US market, price cuts, competition, Elon Musk, financial performance.

Tesla's Q1 2024 earnings report sent shockwaves through the financial world, revealing a staggering 71% plunge. This dramatic downturn isn't solely attributable to market fluctuations; it's intricately linked to a growing wave of political backlash impacting the electric vehicle (EV) manufacturer's operations globally. This article delves into the key factors contributing to this significant decline and analyzes the potential long-term implications for Tesla stock and the broader EV market.

The Impact of Price Wars and Reduced Margins

Aggressive Price Cuts

Tesla's aggressive price cuts, implemented throughout Q1 2024, aimed to boost sales volume and maintain market share in a fiercely competitive EV landscape. While this strategy did increase sales, it significantly reduced profit margins.

- Increased sales volume vs. decreased profit per unit: The increased sales volume did not offset the dramatic decrease in profit per vehicle sold. This directly impacted the overall Tesla earnings report.

- Competition's response: Competitors, both established automakers and emerging EV startups, responded with their own price cuts, creating a price war that further squeezed margins for all players in the EV pricing strategy arena.

- Effect on brand perception: Some analysts argue that the aggressive price cuts might negatively impact Tesla's brand perception, potentially associating the brand with lower quality or value. Maintaining brand equity in the face of price wars is a critical challenge for Tesla.

Rising Production Costs

Simultaneously, Tesla faced rising production costs, further eroding profitability. Several factors contributed to this increase:

- Inflationary pressures: Global inflationary pressures impacted the cost of raw materials like lithium, cobalt, and nickel, essential components in EV battery production.

- Supply chain challenges: Persistent supply chain disruptions, exacerbated by geopolitical events, added to the production cost burden. Delays and shortages of crucial parts hampered manufacturing efficiency.

- Impact on manufacturing efficiency: These combined factors led to reduced manufacturing efficiency and increased costs per vehicle produced, directly impacting Tesla's overall financial performance.

Geopolitical Headwinds and Regulatory Challenges

China Market Volatility

Tesla's significant presence in the China market makes it highly vulnerable to the country's complex political and regulatory landscape.

- Government regulations: Shifting government regulations and policies in China, including those concerning data security and subsidies for domestic EV makers, created significant uncertainty.

- Competition from domestic Chinese EV makers: The rapidly growing domestic Chinese EV market, with innovative and competitive players, poses a significant challenge to Tesla's market share in the region.

- Impact on sales and production: These factors combined to negatively impact Tesla's sales and production in China, contributing significantly to the overall Tesla earnings decline.

US Political Scrutiny and Investigations

In the US, Tesla faced increasing political scrutiny and potential investigations.

- Regulatory investigations: Ongoing investigations into Tesla's autopilot system and other aspects of its operations created uncertainty and potential legal liabilities.

- Public perception: Negative media coverage surrounding these investigations potentially impacted public perception of the brand and consumer confidence.

- Impact on investor confidence: This uncertainty also affected investor confidence, leading to fluctuations in Tesla stock prices and contributing to the overall negative impact on Tesla earnings.

Intensifying Competition in the EV Market

Emerging Competitors

The electric vehicle market is becoming increasingly crowded, with both established automakers and new EV startups launching competitive models.

- Increased competition from legacy automakers: Traditional automakers are aggressively investing in EV technology and launching a wide range of competitive vehicles.

- Innovative startups: Innovative EV startups are challenging Tesla's dominance with cutting-edge technology and disruptive business models.

- Technological advancements from competitors: Competitors are making rapid strides in battery technology, charging infrastructure, and autonomous driving capabilities, further intensifying the competition.

Market Saturation and Consumer Demand

Several factors may be impacting consumer demand for electric vehicles, putting further pressure on Tesla's sales.

- Economic factors influencing consumer spending: A potential economic slowdown might reduce consumer spending on big-ticket items like electric vehicles, affecting overall market demand.

- Changing consumer preferences: Evolving consumer preferences, including a shift towards different vehicle types or features, could also impact demand for Tesla's specific models.

- Market saturation concerns: As the EV market matures, concerns about market saturation and slower growth rates may also be impacting investor sentiment and consumer demand.

Conclusion

Tesla's 71% earnings plunge in Q1 2024 underscores the complex interplay of internal strategies and external pressures affecting the company's financial performance. The aggressive price cuts, coupled with geopolitical headwinds, regulatory challenges, and intensifying competition, have significantly impacted profitability. While Tesla remains a major player in the EV market, navigating these challenges effectively will be crucial for its future success. Understanding the multifaceted factors contributing to this significant drop in Tesla earnings is essential for investors and industry observers alike. Stay informed about the ongoing developments and the potential implications for the future of Tesla stock and the electric vehicle market. To stay updated on the latest news and analysis of Tesla's financial performance, continue following our in-depth reporting.

Featured Posts

-

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Chinas Rare Earth Policies

Apr 24, 2025

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Chinas Rare Earth Policies

Apr 24, 2025 -

Oblivion Remastered Official Announcement And Release Date

Apr 24, 2025

Oblivion Remastered Official Announcement And Release Date

Apr 24, 2025 -

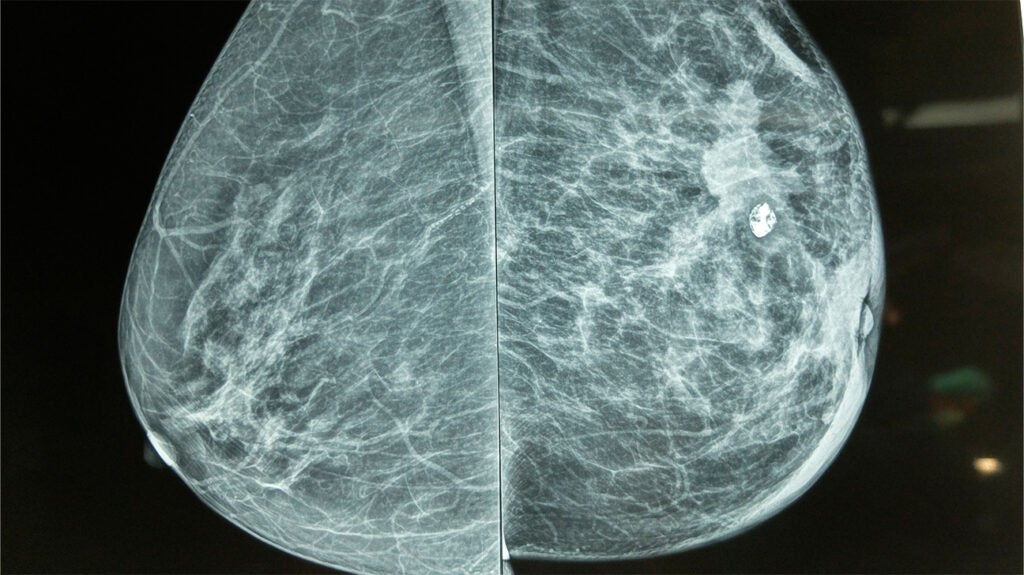

Breast Cancer Diagnosis After Missed Mammogram Lessons From Tina Knowles Experience

Apr 24, 2025

Breast Cancer Diagnosis After Missed Mammogram Lessons From Tina Knowles Experience

Apr 24, 2025 -

Execs Office365 Accounts Breached Crook Makes Millions Feds Say

Apr 24, 2025

Execs Office365 Accounts Breached Crook Makes Millions Feds Say

Apr 24, 2025 -

Ted Lassos Revival Brett Goldsteins Thought Dead Cat Analogy Explained

Apr 24, 2025

Ted Lassos Revival Brett Goldsteins Thought Dead Cat Analogy Explained

Apr 24, 2025