Tesla Q1 Earnings: Net Income Down 71% Amidst Political Headwinds

Table of Contents

Significant Drop in Net Income: A Detailed Look at the Numbers

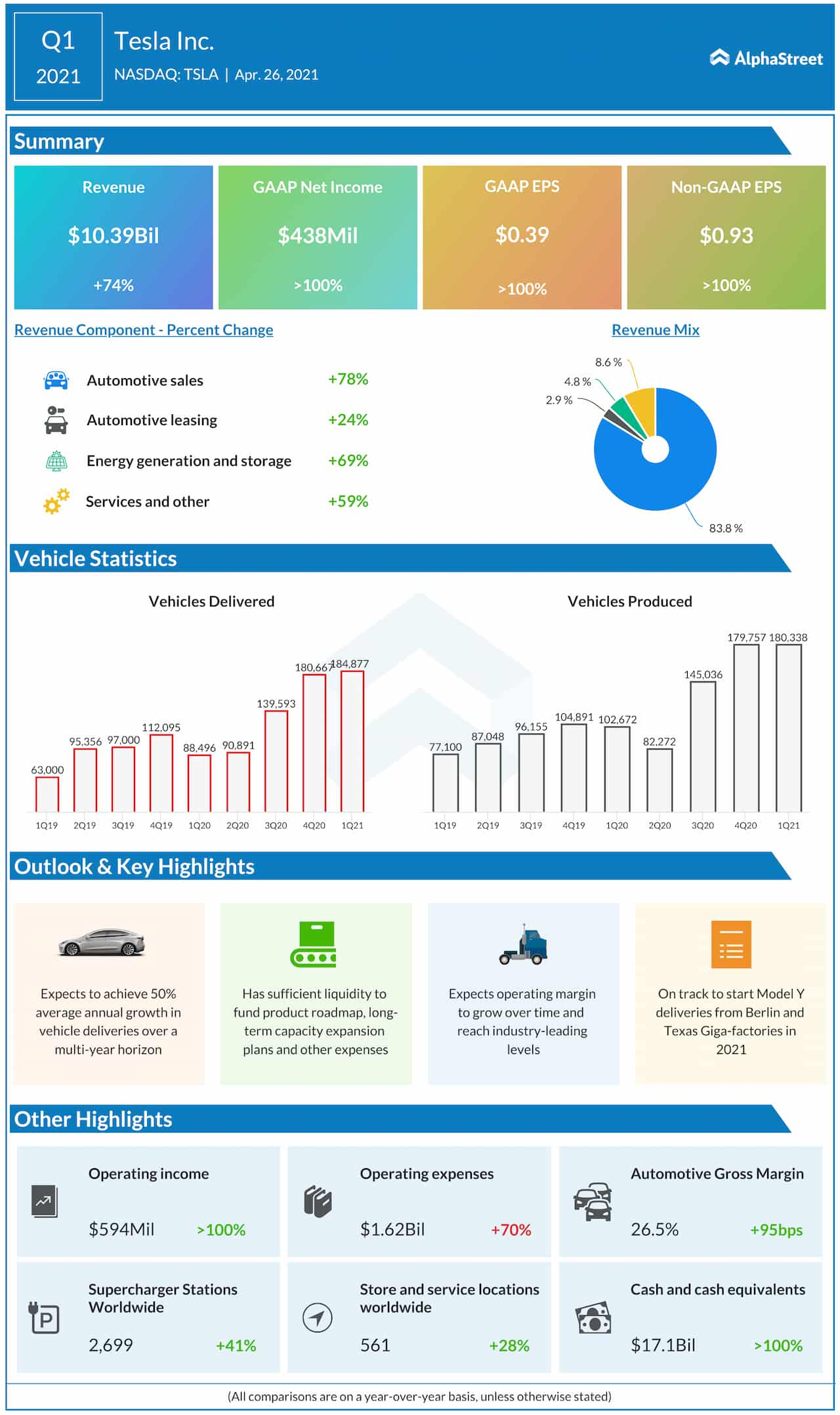

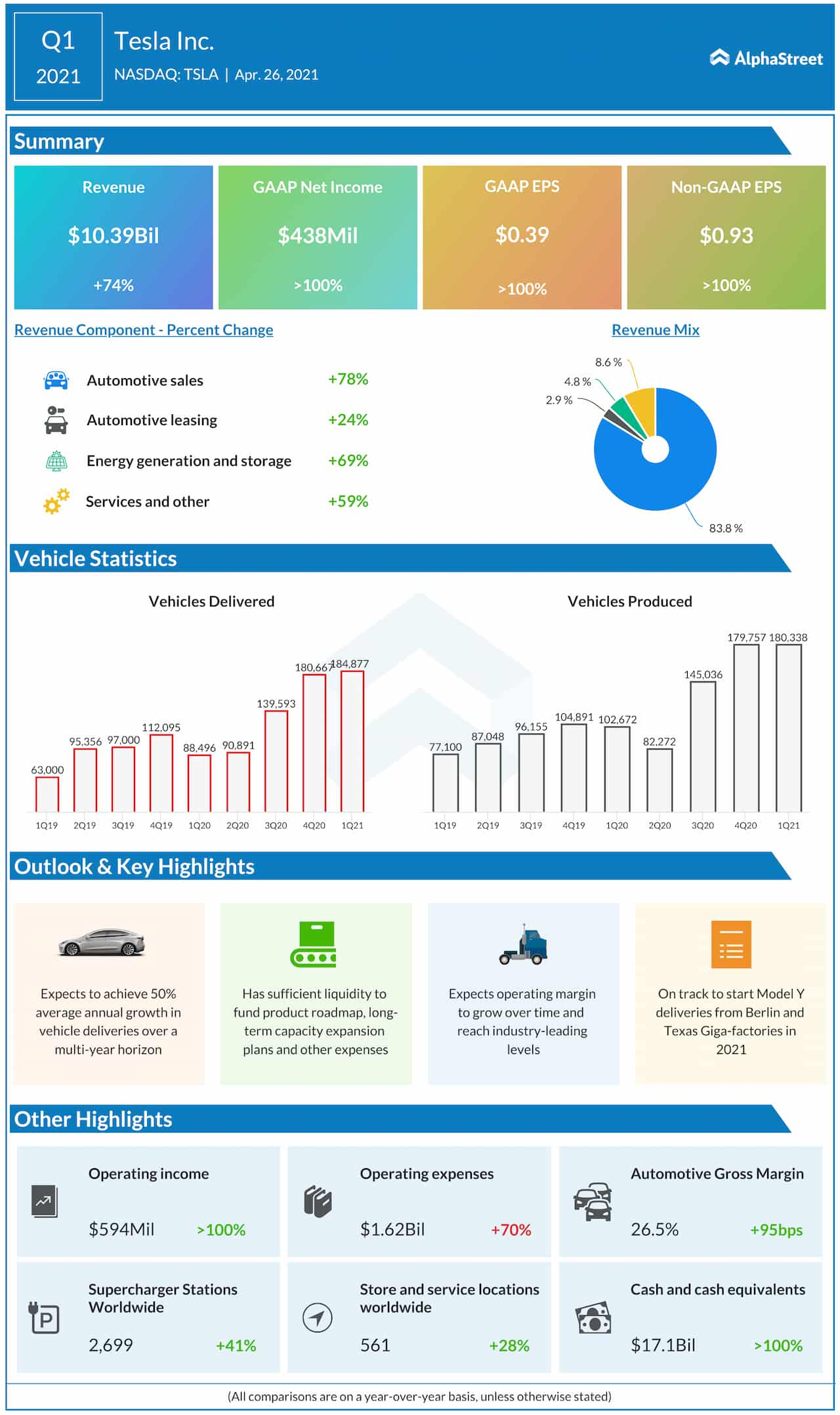

Tesla's Q1 2024 net income plummeted to [Insert Actual Figure], a stark contrast to [Insert Q1 2023 Net Income Figure] and significantly lower than previous quarters. This represents a 71% decrease year-over-year. Understanding this decline requires a closer look at the company's financials. Keywords: Tesla Q1 revenue, Tesla profit margin, operating expenses, cost-cutting measures

-

Revenue Breakdown: While Tesla's overall revenue reached [Insert Actual Revenue Figure], the breakdown reveals some concerning trends. Vehicle sales, typically the largest contributor, showed [Percentage Change] growth compared to Q1 2023. Energy generation and storage, and services revenue also experienced [Percentage Change] and [Percentage Change] respectively. This indicates a slowdown across multiple revenue streams.

-

Profit Margin Squeeze: Tesla's profit margins experienced a significant contraction. The gross margin fell to [Insert Actual Percentage], down from [Insert Previous Quarter/Year Percentage], primarily due to increased operating expenses and the impact of price cuts.

-

Rising Operating Expenses: A key driver of the decreased profitability was a surge in operating expenses, reaching [Insert Actual Figure]. This increase can be attributed to [Specific reasons for increased expenses, e.g., increased R&D spending, higher marketing costs].

-

Cost-Cutting Measures: In response to the shrinking margins, Tesla has reportedly implemented several cost-cutting measures, including [List specific cost-cutting measures, e.g., streamlining production processes, reducing workforce in certain areas]. The effectiveness of these measures remains to be seen in upcoming quarters.

The Impact of Price Cuts and Increased Competition

Tesla's aggressive price cuts across its vehicle lineup significantly impacted its Q1 2024 earnings. While boosting sales volume in a short term, it severely compressed profit margins. Keywords: Tesla price wars, EV competition, market share, sales volume, pricing strategy

-

Rationale Behind Price Cuts: Tesla justified the price reductions as a strategy to increase market share and stimulate demand amidst growing competition. However, this strategy, while potentially boosting sales volume in the short term, significantly eroded profit margins.

-

Intensifying Competition: The EV market is becoming increasingly crowded. Competitors like BYD, Rivian, and others are aggressively launching new models and expanding their market presence, putting pressure on Tesla's pricing strategy and market share.

-

Market Share Shift: Tesla's market share has seen [Insert Data on Market Share Change, if available]. This suggests that the price war is not fully securing a dominant market share for Tesla. The effectiveness of the pricing strategy in the long term needs further evaluation.

-

Maintaining Sales Volume: While the price cuts did result in increased sales volume, the extent to which this offsets the impact of reduced margins remains uncertain. This highlights a crucial challenge for Tesla: balancing volume and profitability.

Navigating Political Headwinds: Geopolitical Risks and Regulatory Challenges

Tesla's global operations are significantly impacted by geopolitical risks and evolving regulatory landscapes. The company faces challenges in several key markets, significantly impacting its overall financial performance. Keywords: Tesla China, geopolitical risks, regulatory hurdles, trade wars, government policies

-

Geopolitical Uncertainties: Global economic uncertainties, trade tensions, and political instability in various regions present ongoing risks for Tesla's supply chains and overall operations.

-

Regulatory Hurdles: Tesla faces varying regulatory environments across its global markets. Navigating differing safety standards, emissions regulations, and import/export restrictions adds significant complexity and cost.

-

Impact of Specific Events: [Mention specific political events or government policies that impacted Tesla's performance in Q1 2024, e.g., changes in Chinese government regulations, trade disputes, etc.]. These events demonstrate the significant vulnerability of Tesla's profitability to external political factors.

-

Long-Term Implications: The long-term implications of these political headwinds are significant. Tesla needs to proactively adapt its strategies and risk management processes to navigate these uncertain geopolitical landscapes.

The China Market: A Key Factor in Tesla's Performance

China remains a crucial market for Tesla, both for sales and manufacturing. The company's performance in China directly influences its overall financial results. Keywords: Tesla China sales, Chinese EV market, China manufacturing, local competition

-

Tesla's China Sales: Tesla's sales in China during Q1 2024 [Insert Data on China Sales]. This represents [Percentage Change] compared to the same period last year.

-

Competitive Landscape in China: The Chinese EV market is incredibly competitive, with several domestic brands posing a significant challenge to Tesla's dominance. This intense competition further intensifies pressure on pricing and profitability.

-

Role of Giga Shanghai: Tesla's Gigafactory in Shanghai plays a vital role in its global production strategy. Any disruptions to its operations in China have immediate and significant consequences for Tesla's overall output and profitability.

Conclusion

Tesla's Q1 2024 earnings report reveals a concerning decline in net income, largely attributed to price cuts, intensifying competition, and navigating complex political headwinds, especially within the crucial Chinese market. The company's future performance hinges on effectively addressing these challenges. The balance between maintaining sales volume through aggressive pricing and preserving profit margins remains a critical issue for Tesla.

Call to Action: Stay informed on the evolving landscape of the electric vehicle market and Tesla's strategic responses by following our updates on future Tesla Q2 earnings and analyses. Understanding the intricacies of Tesla's financial performance is crucial for informed investment decisions and a comprehensive view of the EV sector.

Featured Posts

-

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025 -

Newsom Calls On Oil Companies Amidst Californias Rising Gas Prices

Apr 24, 2025

Newsom Calls On Oil Companies Amidst Californias Rising Gas Prices

Apr 24, 2025 -

The Closure Of Anchor Brewing Company 127 Years Of Brewing History

Apr 24, 2025

The Closure Of Anchor Brewing Company 127 Years Of Brewing History

Apr 24, 2025 -

Ella Bleu Travolta Od Djevojcice Do Zrele Ljepotice

Apr 24, 2025

Ella Bleu Travolta Od Djevojcice Do Zrele Ljepotice

Apr 24, 2025 -

Nba All Star Weekend Herros 3 Point Show And Cavs Skills Challenge Success

Apr 24, 2025

Nba All Star Weekend Herros 3 Point Show And Cavs Skills Challenge Success

Apr 24, 2025