Tesla's Reduced Q1 Profits: Analyzing The Fallout From Musk's Political Ties

Table of Contents

The Direct Impact of Musk's Political Activities on Tesla's Financial Performance

Musk's outspoken political views and actions frequently dominate headlines, creating a ripple effect that directly impacts Tesla's financial health. This influence manifests in two key ways: negative publicity and distraction from core business operations.

Negative Publicity and Brand Erosion

- Increased media scrutiny leading to negative news cycles: Musk's political forays often generate intense media coverage, much of it negative. This constant stream of controversy overshadows positive news about Tesla's technological advancements and business achievements.

- Potential alienation of environmentally conscious consumers: Tesla has cultivated a strong brand identity built around sustainability and environmental responsibility. However, some of Musk’s political positions clash with the values of environmentally conscious consumers, potentially alienating a key segment of their customer base.

- Impact on brand image and consumer trust: The constant barrage of negative publicity surrounding Musk's political activities inevitably erodes public trust in both Musk and, by extension, Tesla. This erosion of trust can lead to decreased sales and a weakened brand image.

- Examples of specific controversies and their resulting media coverage: Specific instances, such as Musk's controversial Twitter activity, his involvement in political debates, and his support of certain political figures, have all generated significant negative press, directly affecting Tesla’s stock price and public perception. Analyzing the correlation between these events and dips in sales figures would provide compelling data.

- Discussion of how this negative publicity affects sales and investor sentiment: Negative publicity can translate to decreased consumer confidence, resulting in lower sales figures. Furthermore, it can negatively influence investor sentiment, leading to stock price volatility and reduced investment opportunities for Tesla.

Distraction from Core Business Operations

- Musk's involvement in political debates diverting resources and attention away from Tesla's core business: Musk's considerable time and energy spent on political issues inevitably detract from his focus on Tesla's core business operations. This diversion of resources and attention can hinder efficient decision-making and strategic planning.

- Potential impact on the efficiency of the company's operations and product development: The internal focus required for efficient operations and timely product development can be compromised when the CEO is preoccupied with external political matters. This can lead to delays, increased costs, and missed opportunities.

- Examples of how political involvement might overshadow crucial business decisions: It is plausible that crucial strategic decisions regarding product development, manufacturing, or market expansion might be delayed or even altered due to Musk's political engagements, influencing the company's trajectory.

- Discussion of the opportunity cost of Musk's political engagement: The opportunity cost represents the potential benefits Tesla could have gained had Musk dedicated his full attention to managing the company. This loss of potential revenue, market share, and innovation presents a significant concern.

The Indirect Impact: Investor Sentiment and Stock Market Volatility

Beyond the direct impact on Tesla's operations, Musk's political ties significantly influence investor sentiment and stock market volatility.

Investor Concerns and Stock Price Fluctuations

- Analysis of Tesla's stock performance in relation to Musk's political controversies: A detailed analysis would show a clear correlation between periods of heightened controversy surrounding Musk's political actions and fluctuations in Tesla's stock price.

- Discussion of how investor confidence is affected by Musk's actions: Investors are inherently risk-averse. Musk's unpredictable political behavior introduces an element of uncertainty, impacting investor confidence and potentially leading to divestment from Tesla stock.

- Examination of potential long-term implications for investors: The continuous uncertainty surrounding Musk’s political actions poses long-term risks for Tesla investors, affecting their return on investment and overall portfolio stability.

- Comparison to other companies facing similar situations: Comparing Tesla's performance with other companies whose CEOs have faced similar controversies can provide valuable insights into the long-term impact of such situations on stock valuations and investor behavior.

Impact on Funding and Investment Opportunities

- Potential challenges in securing future investments due to reputational risks: Tesla's ability to secure future funding and investment might be hampered by the reputational risks associated with Musk's political controversies. Investors may be hesitant to commit capital to a company perceived as politically unstable or controversial.

- The impact of negative publicity on Tesla's ability to attract top talent: Negative publicity can also make it difficult for Tesla to attract and retain top-tier talent. Potential employees may be less inclined to work for a company whose CEO is constantly embroiled in political disputes.

- Analysis of the effects on partnerships and collaborations: Musk’s political actions could negatively impact Tesla's partnerships and collaborations. Other companies may be reluctant to associate with a brand perceived as politically controversial.

- Discussion of possible legal implications from these political ties: Depending on the nature of Musk’s political engagements, there could be potential legal ramifications affecting Tesla's financial stability.

Analyzing the Separation of Musk's Personal Brand from Tesla's Corporate Image

Perhaps the most significant challenge lies in disentangling Musk's personal brand from Tesla's corporate identity.

The Blurred Lines Between Musk and Tesla

- Discussion of the inseparable connection between Musk's persona and Tesla's brand: Musk's personality and public image are inextricably linked to Tesla's brand identity. This close association makes it exceptionally difficult to separate the two in the public's perception.

- How Musk's actions directly impact public perception of Tesla: Musk's actions, regardless of their relation to Tesla's operations, invariably shape public perception of the company. Negative publicity directed at Musk automatically spills over to Tesla.

- The difficulty in separating the two entities in the public eye: Despite attempts to delineate the CEO’s personal life from the company's operations, the public largely views them as inseparable.

- Strategies companies can use to manage such situations: Analyzing how other companies have successfully managed similar situations involving their CEOs' controversial actions can offer valuable strategies for mitigating the reputational damage.

Potential Strategies for Damage Control

- Strategies Tesla might employ to mitigate the negative impact of Musk’s political stances: Tesla could employ strategies such as issuing carefully worded statements clarifying the company's position on political issues, focusing communication efforts on highlighting Tesla's positive attributes, and strengthening its corporate social responsibility initiatives.

- The importance of clear corporate communications strategies: A clear and proactive corporate communication strategy is crucial in managing the fallout from Musk's political actions. Transparent and consistent messaging can help to counteract negative publicity and maintain investor confidence.

- How to address concerns from customers, investors, and employees: Open communication channels and transparent dialogues are essential to address concerns from various stakeholders, including customers, investors, and employees.

- Exploration of future actions that could mitigate risk: Proactive measures, such as establishing stricter guidelines for CEO communication and public engagement, could be implemented to minimize future reputational risks.

Conclusion

This analysis reveals a complex interplay between Elon Musk's political engagements and Tesla's Q1 profit reduction. While other market factors undoubtedly contribute, the negative publicity and potential erosion of investor confidence stemming from these controversies cannot be discounted. The blurred lines between Musk's personal brand and Tesla's corporate identity present a significant challenge for the company's long-term success.

To understand the full impact of Elon Musk's political ties on Tesla's future performance, continuous monitoring of market trends, news cycles, and investor sentiment is crucial. Stay informed about Tesla's financial performance and the evolving relationship between Elon Musk’s political actions and the company's success. Further research into the impact of CEO political activity on corporate profitability would be beneficial.

Featured Posts

-

La Fires Fuel Landlord Price Gouging Debate A Selling Sunset Star Speaks Out

Apr 24, 2025

La Fires Fuel Landlord Price Gouging Debate A Selling Sunset Star Speaks Out

Apr 24, 2025 -

Car Dealerships Continue To Oppose Mandatory Electric Vehicle Sales

Apr 24, 2025

Car Dealerships Continue To Oppose Mandatory Electric Vehicle Sales

Apr 24, 2025 -

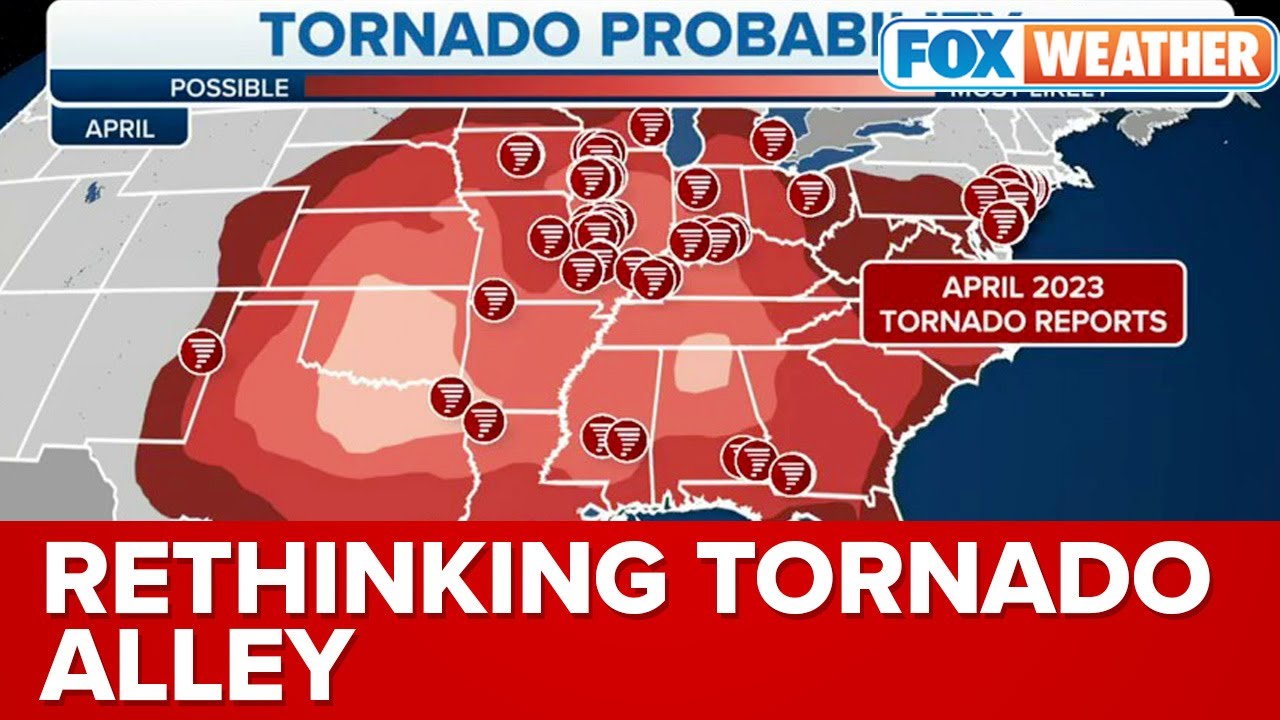

Tornado Season And Trumps Cuts A Dangerous Combination

Apr 24, 2025

Tornado Season And Trumps Cuts A Dangerous Combination

Apr 24, 2025 -

Fundraising Intensifies As Elite Universities Navigate Political Headwinds

Apr 24, 2025

Fundraising Intensifies As Elite Universities Navigate Political Headwinds

Apr 24, 2025 -

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 24, 2025

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 24, 2025