The Impact Of Market Swings On Investor Behavior: Professionals And Individuals

Table of Contents

Professional Investors and Market Swings

Professional investors, such as fund managers, hedge fund managers, and institutional traders, approach market swings with a different mindset and toolkit compared to individual investors. Their actions are driven by sophisticated analysis and risk management strategies.

Risk Management Strategies Employed by Professionals

Professionals utilize a range of sophisticated techniques to mitigate risk during market swings. Their strategies are often far more complex than those employed by individual investors.

- Sophisticated Risk Models and Diversification: They employ advanced statistical models to assess risk and construct diversified portfolios across various asset classes (stocks, bonds, real estate, commodities, etc.), reducing exposure to any single market segment. This diversification helps to cushion the blow of market downturns.

- Hedging Strategies: Professionals frequently use hedging strategies to protect against potential losses. These strategies involve taking offsetting positions in related markets to minimize the impact of adverse price movements.

- Examples of Hedging Strategies: Options contracts, futures contracts, and swaps are commonly used hedging tools. For example, a fund manager might buy put options on a stock portfolio to protect against a potential market decline.

- Active Portfolio Adjustments: Professional investors actively monitor market conditions and adjust their portfolios based on market analysis and predictions. They may increase or decrease their exposure to certain assets depending on their outlook for the market.

- Quantitative Analysis and Algorithmic Trading: Many professionals rely heavily on quantitative analysis and algorithmic trading to make investment decisions. These techniques use complex mathematical models and computer algorithms to identify trading opportunities and manage risk.

The Impact of Market Swings on Professional Investment Decisions

Market swings create both challenges and opportunities for professional investors.

- Exploiting Volatility: Professionals often exploit opportunities created by volatility. For instance, value investors might look for undervalued stocks during market downturns, anticipating a price recovery in the future. This requires a deep understanding of fundamental analysis and market timing.

- Investment Timing and Asset Allocation: Market swings influence investment timing and asset allocation decisions. Professionals may shift their portfolios towards more conservative assets during periods of high volatility and increase their exposure to riskier assets when the market stabilizes.

- Market Sentiment Analysis: Professionals carefully analyze market sentiment—the overall feeling or attitude of investors towards the market—to gauge potential shifts in market direction. This involves monitoring news, social media, and other sources of information.

- Bull vs. Bear Market Reactions:

- Bull Market (rising prices): Professionals may increase exposure to equities, seeking higher returns.

- Bear Market (falling prices): Professionals might adjust their portfolios towards safer assets or employ hedging strategies to limit losses.

- Long-Term Investment Strategies: Despite short-term volatility, professionals typically maintain a long-term investment horizon, focusing on the overall trajectory of the market rather than short-term fluctuations.

Individual Investors and Market Swings

Individual investors often react differently to market swings than professionals. Their decisions are frequently influenced by emotions and behavioral biases.

Behavioral Biases and Emotional Reactions to Market Swings

Individual investors are susceptible to various behavioral biases that can negatively impact their investment decisions during market swings.

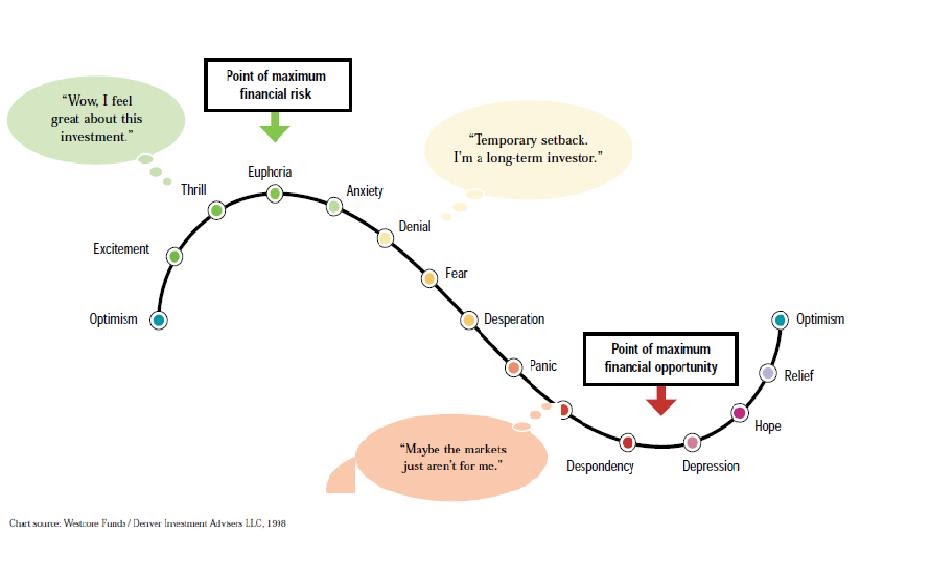

- Common Behavioral Biases: Herd behavior (following the crowd), fear (selling during downturns), and greed (buying during price increases) are common biases.

- Emotional Decision-Making: Emotions like fear and panic can lead to impulsive and irrational investment choices. During a market crash, fear can trigger panic selling, resulting in significant losses.

- Examples of Poor Investment Choices: Selling low (during a downturn) and buying high (during a peak) are classic examples of emotionally driven investment mistakes fueled by market swings.

- Specific Behavioral Biases:

- Confirmation bias (seeking information that confirms pre-existing beliefs)

- Overconfidence (overestimating one's ability to predict market movements)

- Influence of Media and Social Networks: The media and social networks can significantly influence individual investor behavior, often amplifying fear and uncertainty during market downturns.

The Influence of Market Swings on Individual Investment Strategies

Market swings can significantly affect individual investment strategies and long-term goals.

- Panic Selling: During market downturns, many individual investors engage in panic selling, selling their assets at a loss to avoid further potential losses. This often leads to poor investment outcomes.

- Impact on Long-Term Goals: Market swings can derail long-term investment goals if not managed properly. Short-term market fluctuations should not dictate long-term investment strategies.

- Importance of Financial Education and Planning: Financial education and careful planning are crucial for individual investors to navigate market volatility effectively. Understanding investment basics, risk tolerance, and long-term goals is key.

- Strategies for Managing Emotions:

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of market price.

- Diversification: Spreading investments across various asset classes to reduce risk.

- Seeking Professional Financial Advice: For many individuals, seeking advice from a qualified financial advisor can prove beneficial in navigating market swings and developing a sound long-term investment strategy.

Comparing Professional and Individual Responses to Market Swings

A direct comparison reveals significant differences in how professionals and individuals respond to market swings:

- Risk Tolerance and Investment Horizons: Professionals generally have a higher risk tolerance and longer investment horizons than individual investors.

- Access to Information and Resources: Professionals have better access to information, analytical tools, and resources than individual investors.

- Analytical Approaches: Professionals typically employ more sophisticated analytical approaches, including quantitative analysis and advanced risk models.

- Key Differences in Behavior and Outcomes:

- Professionals: Tend to be more disciplined, less emotionally driven, and better equipped to manage risk.

- Individuals: More prone to emotional decision-making, leading to potentially poor investment outcomes.

- Understanding Your Investor Profile: It's crucial for individual investors to understand their own risk tolerance, investment goals, and time horizon before making investment decisions.

Conclusion

Understanding the impact of market swings on investor behavior, both for professionals and individuals, is crucial for making informed investment decisions. While professional investors generally employ sophisticated strategies to mitigate risk and capitalize on opportunities, individual investors are often more susceptible to emotional biases and impulsive actions. By acknowledging these differences and implementing appropriate strategies, investors can navigate market volatility more effectively and achieve their long-term financial goals. Learn more about how to manage your investments during periods of significant market swings and develop a robust investment strategy by researching effective techniques for navigating market volatility. Don't let unpredictable market swings derail your financial future; take control of your investments today!

Featured Posts

-

2000 Yankees Season Joe Torres Managerial Decisions And Pettittes Dominance

Apr 28, 2025

2000 Yankees Season Joe Torres Managerial Decisions And Pettittes Dominance

Apr 28, 2025 -

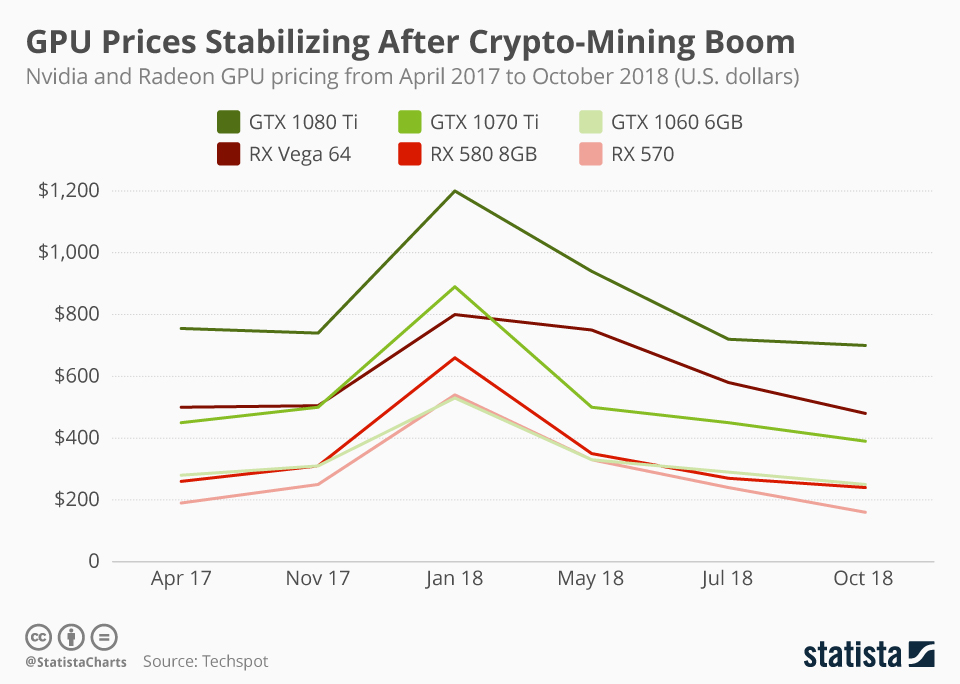

High Gpu Prices When Can We Expect Relief

Apr 28, 2025

High Gpu Prices When Can We Expect Relief

Apr 28, 2025 -

Ohio Train Disaster Investigation Into Lingering Toxic Chemical Contamination

Apr 28, 2025

Ohio Train Disaster Investigation Into Lingering Toxic Chemical Contamination

Apr 28, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 28, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 28, 2025 -

Red Sox Doubleheader Coras Strategic Lineup Changes

Apr 28, 2025

Red Sox Doubleheader Coras Strategic Lineup Changes

Apr 28, 2025