The Impact Of US-China Trade Relations On Canada's Oil Exports

Table of Contents

US-China Trade War and its Direct Effects on Canadian Oil

The US-China trade war, characterized by escalating tariffs and trade restrictions, directly impacted the demand for Canadian oil. As the two economic giants engaged in tit-for-tat trade actions, global energy markets experienced significant volatility. This volatility, in turn, directly affected the price of Canadian oil and the overall volume of exports.

-

Tariffs and Reduced Demand: Tariffs imposed on various goods during the trade war led to reduced demand for energy-intensive products in both the US and China. This decreased demand translated into lower oil prices and reduced export volumes for Canadian producers. For instance, tariffs on steel and aluminum impacted the manufacturing sector in both countries, thereby lessening the demand for energy inputs.

-

Price Fluctuations and Export Volumes: Periods of heightened trade tension coincided with significant price swings in the oil market. When trade uncertainty was high, oil prices often fell, negatively impacting the profitability of Canadian oil exports. Conversely, periods of relative calm saw a slight rebound, albeit with lingering uncertainty.

-

Industry Response: Canadian oil companies reacted to these market shifts in various ways. Some focused on cost-cutting measures, while others diversified their export markets to reduce reliance on the US and China. Companies like Suncor Energy and Cenovus Energy, for example, adjusted their production levels and hedging strategies in response to price fluctuations.

Indirect Impacts: Shifting Global Energy Markets and Canadian Oil

The US-China trade relationship extends its influence beyond direct trade impacts. It significantly shapes the broader global energy landscape, creating indirect consequences for Canadian oil exports.

-

Renewable Energy Growth: The trade war, while disruptive, inadvertently accelerated the global push toward renewable energy sources. As countries sought to reduce dependence on energy imports from potentially unstable regions, investments in solar, wind, and other renewable technologies increased. This rise in competition from renewables further pressured Canadian oil prices.

-

Geopolitical Shifts and Trade Routes: The trade tensions also created geopolitical uncertainty, affecting trade routes and the transportation of Canadian oil. Concerns about supply chain disruptions and the reliability of traditional shipping lanes led to increased costs and logistical challenges for Canadian exporters. For example, potential disruptions to the Panama Canal could significantly impact the shipping of Canadian crude to Asian markets.

-

Global Energy Demand and Pricing: The trade war's effect on global economic growth significantly impacted overall energy demand. Slower economic growth in both the US and China, resulting from trade restrictions, naturally reduced the demand for oil, putting downward pressure on prices.

Canada's Diversification Strategies in Response to US-China Trade Dynamics

Faced with the uncertainties stemming from US-China trade relations, Canada has actively pursued diversification strategies to bolster its oil export sector's resilience.

-

Pipeline Projects: Investing in new pipeline infrastructure is crucial for accessing new markets and reducing reliance on existing routes. Projects like the Trans Mountain Expansion pipeline aim to increase Canada's access to Asian markets, lessening dependence on the US market.

-

Strengthening Trade Relationships: Canada has focused on forging stronger trade partnerships with countries beyond the US and China. Agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) offer access to diverse and growing markets in the Asia-Pacific region.

-

Effectiveness of Diversification: While Canada's diversification efforts are underway, their full impact remains to be seen. The success of these strategies depends on a combination of factors, including the completion of pipeline projects, the continued growth of alternative energy sources, and the evolving geopolitical landscape.

The Future Outlook: Predicting the Long-Term Impact on Canadian Oil Exports

Predicting the long-term impact of US-China trade relations on Canada's oil exports requires considering various scenarios.

-

Continued Trade Tension: If trade tensions persist, Canadian oil exports will likely face continued volatility and reduced demand, particularly in the US and China markets.

-

De-escalation and Cooperation: A de-escalation in trade tensions could lead to more stable markets, but the long-term effects of the trade war on global energy demand and supply chains will likely persist.

-

Shifting Energy Dynamics: The increasing adoption of renewable energy sources could eventually lead to a structural shift in global energy demand, requiring Canada to further diversify its energy portfolio and explore new markets. Technological advancements in oil extraction and refining could also play a significant role.

-

Long-Term Oil Price Predictions: The long-term outlook for oil prices remains uncertain, subject to various factors including global economic growth, technological advancements, and geopolitical events. The price of oil will significantly influence Canada's oil export revenue and overall economic prosperity.

Conclusion: Understanding the Impact of US-China Trade Relations on Canada's Oil Exports

In summary, the Impact of US-China Trade Relations on Canada's Oil Exports is multifaceted, encompassing both direct and indirect effects. Understanding these complex relationships is vital for effective Canadian economic planning and policy-making. The Canadian oil industry must adapt to a dynamic global energy landscape characterized by geopolitical uncertainty and increasing competition from renewable energy sources. To learn more about the intricacies of this relationship and its implications for Canada's future, explore resources from the Canadian Energy Information Agency, the International Energy Agency, and various academic studies on global energy markets. Continue researching the Impact of US-China Trade Relations on Canada's Oil Exports to gain a more comprehensive understanding of this critical issue.

Featured Posts

-

Back From Surgery Yelich Hits First Home Run

Apr 23, 2025

Back From Surgery Yelich Hits First Home Run

Apr 23, 2025 -

Analysis Of Keider Monteros Game In Tigers Loss To Brewers

Apr 23, 2025

Analysis Of Keider Monteros Game In Tigers Loss To Brewers

Apr 23, 2025 -

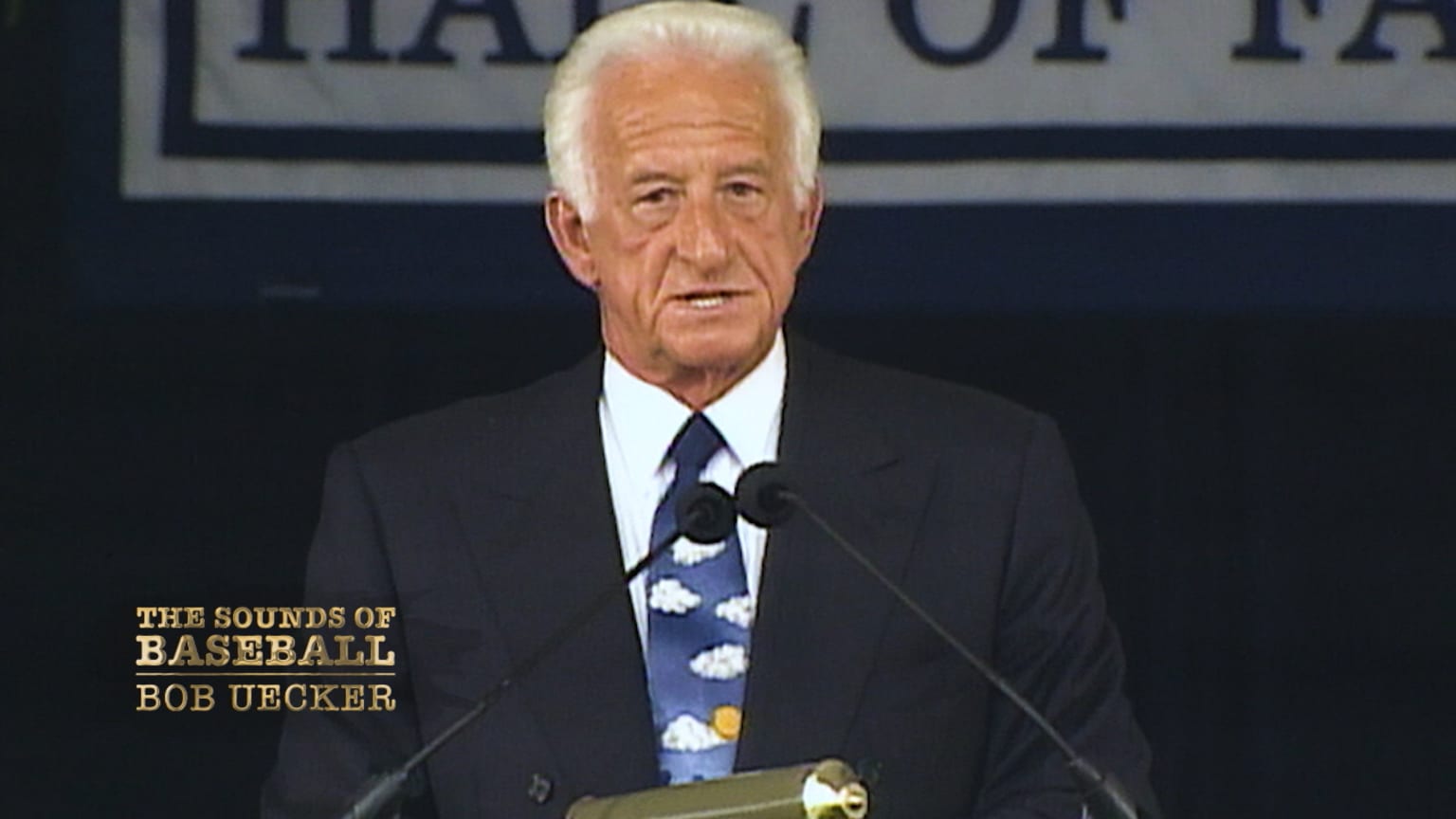

Provuss Heartfelt Tribute To Baseball Legend Bob Uecker

Apr 23, 2025

Provuss Heartfelt Tribute To Baseball Legend Bob Uecker

Apr 23, 2025 -

Giants Flores And Lee Deliver Again In Victory Over Brewers

Apr 23, 2025

Giants Flores And Lee Deliver Again In Victory Over Brewers

Apr 23, 2025 -

Is William Contreras The Key To Brewers Success

Apr 23, 2025

Is William Contreras The Key To Brewers Success

Apr 23, 2025