The Price Of Trump's Economic Policies: A Deep Dive

Table of Contents

H2: Tax Cuts and Their Impact

The cornerstone of Trump's economic platform was the 2017 Tax Cuts and Jobs Act (TCJA). This legislation significantly lowered the corporate tax rate from 35% to 21% and implemented various changes to individual income tax brackets.

H3: The 2017 Tax Cuts and Jobs Act:

-

Short-Term Stimulus: The TCJA initially spurred economic growth. Lower corporate taxes fueled investment, while individual tax cuts boosted consumer spending. GDP growth saw a temporary increase in the years immediately following the act's implementation. However, this growth was not evenly distributed.

-

Long-Term Debt and Inequality: The significant reduction in tax revenue, however, led to a substantial increase in the national debt. Furthermore, the tax cuts disproportionately benefited corporations and high-income earners, exacerbating income inequality. The Gini coefficient, a measure of income inequality, showed little improvement or even slight worsening during this period, depending on the metric used.

-

Criticisms and Distributional Effects: Critics argued that the tax cuts were designed to primarily benefit the wealthy and large corporations, at the expense of long-term fiscal sustainability. The lack of significant investment in infrastructure or social programs further fueled this criticism. Studies analyzing the TCJA's impact consistently revealed a widening gap between the wealthiest Americans and the rest of the population.

H2: Trade Wars and Their Consequences

Trump's administration implemented a protectionist trade policy, characterized by widespread imposition of tariffs on goods imported from various countries, notably China. The stated aim was to protect American jobs and combat unfair trade practices.

H3: Tariffs and Their Impact on Businesses and Consumers:

-

Increased Prices for Consumers: Tariffs resulted in increased prices for imported goods, impacting consumers' purchasing power. Industries heavily reliant on imported materials faced increased production costs, leading to price hikes and reduced competitiveness.

-

Retaliatory Tariffs and Economic Slowdown: Trump's tariffs provoked retaliatory measures from other countries, creating a trade war that disrupted global supply chains and negatively impacted US exports. This contributed to a slowdown in economic growth, particularly in sectors directly affected by the trade disputes.

-

Disruption to Global Trade Relations: The trade war significantly damaged international trade relations, undermining decades of efforts to build a rules-based global trading system. The uncertainty and instability created by the unpredictable tariff policies discouraged investment and hampered international cooperation.

H2: Deregulation and Its Economic Ramifications

Trump's administration pursued a policy of deregulation across various sectors, aiming to reduce the burden on businesses and stimulate economic growth. However, this approach carried significant risks.

H3: Environmental Deregulation: The rollback of environmental regulations, particularly those related to air and water quality, climate change mitigation, and protection of endangered species, had significant long-term economic and environmental consequences.

H3: Financial Deregulation: While less dramatic than environmental deregulation, changes to financial regulations raised concerns about increased systemic risk in the financial sector.

-

Arguments For and Against Deregulation: Proponents argued that deregulation reduces compliance costs for businesses, fostering innovation and economic growth. However, critics warned of increased environmental damage, financial instability, and potential long-term costs associated with mitigating the consequences of deregulation.

-

Examples and Consequences: Specific examples, such as the weakening of environmental protection rules, could be cited with evidence of increased pollution levels or the reduction of safety standards in the financial industry could be mentioned.

-

Long-Term Costs: The long-term costs of deregulation can be substantial, encompassing environmental cleanup, increased healthcare expenses related to pollution-induced illnesses, and the potential for future financial crises resulting from relaxed regulations.

3. Conclusion:

Trump's economic policies, while yielding some short-term economic gains, carried significant long-term risks. The substantial increase in the national debt, the exacerbation of income inequality, the disruption of global trade, and the potential for long-term environmental and financial damage raise serious concerns about the true "price" of his economic approach. The substantial increase in the national debt represents a considerable burden on future generations. Evaluating the price of Trump's economic legacy requires a comprehensive analysis of these factors, considering not only immediate economic indicators but also the distributional effects and potential for future instability. Understanding the true cost of Trump's economic policies is crucial for informed future economic planning. We must move beyond simple GDP figures to assess the broader societal and environmental implications of these decisions.

Featured Posts

-

Conclave 2023 Assessing Pope Francis Enduring Impact

Apr 22, 2025

Conclave 2023 Assessing Pope Francis Enduring Impact

Apr 22, 2025 -

Trumps Protectionist Policies Risks To Americas Global Financial Leadership

Apr 22, 2025

Trumps Protectionist Policies Risks To Americas Global Financial Leadership

Apr 22, 2025 -

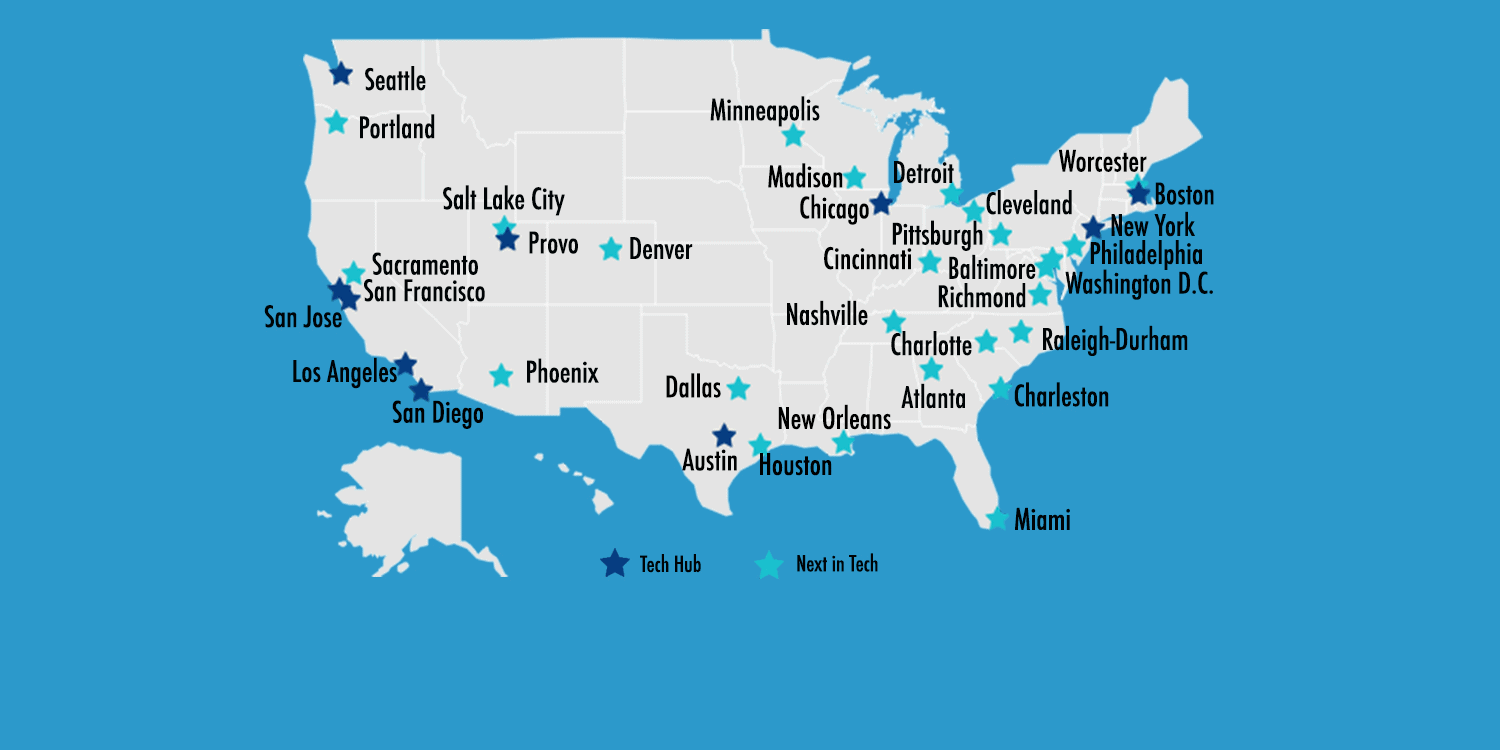

Mapping The Nations Hottest New Business Hubs

Apr 22, 2025

Mapping The Nations Hottest New Business Hubs

Apr 22, 2025 -

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 22, 2025

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 22, 2025 -

Covid 19 Pandemic Lab Owner Admits To Falsifying Test Results

Apr 22, 2025

Covid 19 Pandemic Lab Owner Admits To Falsifying Test Results

Apr 22, 2025