The Private Credit Market Before The Storm: Credit Weekly's Observations

Table of Contents

Rising Interest Rates and Their Impact on Private Credit

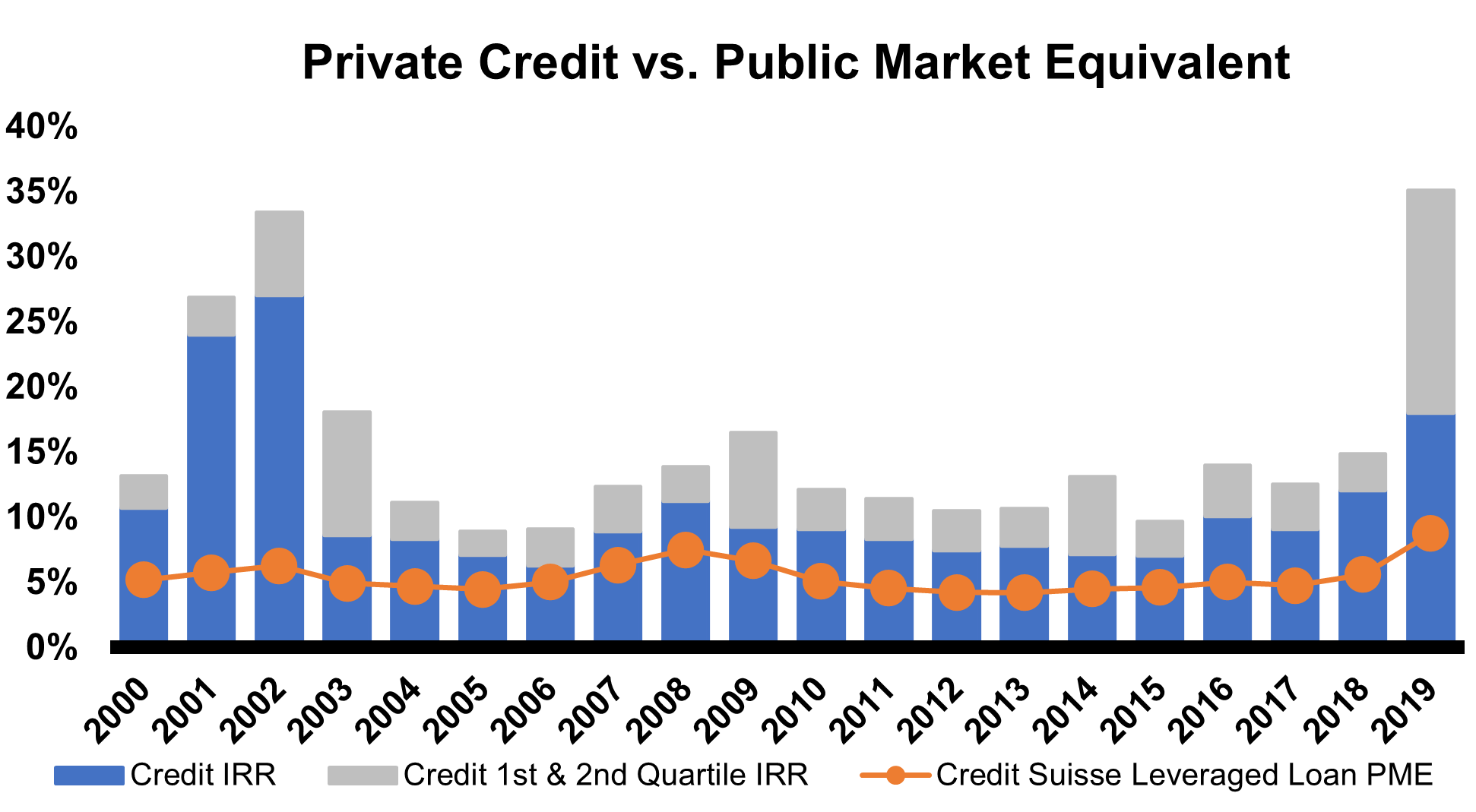

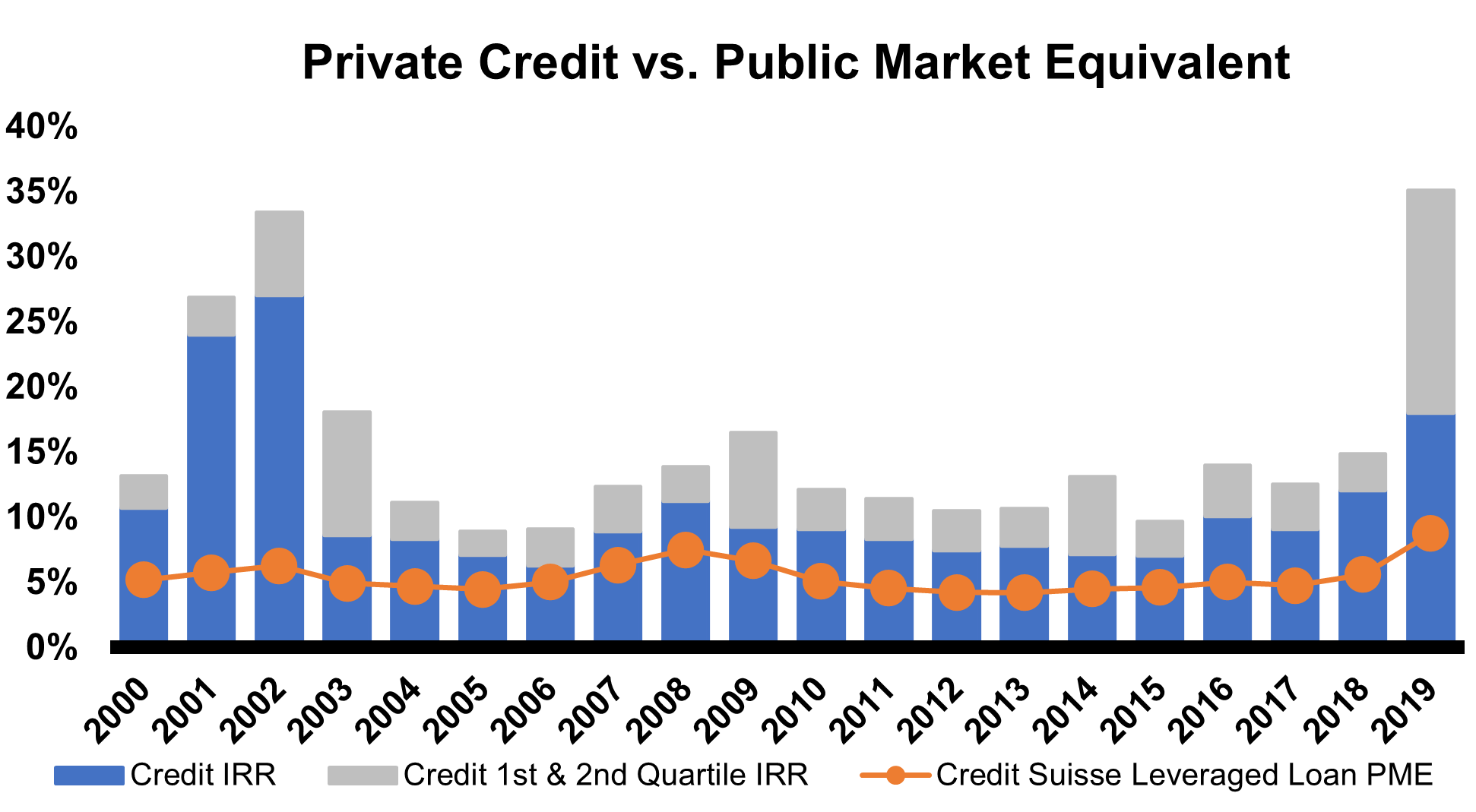

Interest rate hikes are significantly impacting the private credit market, increasing borrowing costs and altering the investment landscape. This affects profitability and risk profiles across the board, particularly impacting leveraged loans and collateralized loan obligations (CLOs).

-

Increased Borrowing Costs: Higher interest rates directly translate to reduced profitability for private credit investments. Borrowers face elevated debt servicing costs, potentially squeezing margins and affecting their ability to meet repayment obligations. This is especially true for companies with high leverage ratios.

-

Refinancing Challenges: The rising cost of borrowing makes refinancing existing debt significantly more expensive. Companies reliant on refinancing to manage their debt load may find themselves facing difficulties, increasing default risk. This is a key concern for those invested in the private debt space.

-

Impact on Leveraged Loans and CLOs: Leveraged loans and CLOs are particularly sensitive to interest rate changes. Their performance is directly linked to prevailing interest rates, and rising rates can lead to decreased valuations and increased credit risk. Sophisticated modeling of interest rate sensitivity is crucial for managing these investments.

-

Stress Testing and Risk Management: Proactive stress testing of investment portfolios under various interest rate scenarios is crucial for robust risk management. Investors need to assess the resilience of their portfolios to withstand potential shocks stemming from further interest rate increases.

Assessing Credit Risk in a Deleveraging Environment

As the economy potentially slows, assessing credit risk in the private credit market becomes paramount. A thorough and rigorous approach to credit analysis and due diligence is no longer optional—it's essential.

-

Thorough Due Diligence: Rigorous credit analysis, including detailed financial modeling and sensitivity analysis, is crucial to identify potential weaknesses in borrowers’ profiles. This helps investors understand the true risk-reward profile of each investment.

-

Covenant Monitoring: Close monitoring of covenant compliance is essential. Any potential covenant breaches should trigger immediate action to mitigate potential losses. Proactive risk management necessitates consistent monitoring of financial metrics and covenants.

-

Portfolio Diversification: Diversification across various sectors and borrower types is a critical risk management strategy. Over-concentration in any single sector or borrower can amplify losses during an economic downturn.

-

Economic Shock Resilience: Careful consideration of borrowers' ability to withstand economic shocks is vital. Assessing their resilience to potential downturns in their respective industries is a key factor in underwriting standards. This includes evaluating the borrower’s liquidity position and access to additional capital.

Opportunities within the Private Credit Market Amidst Uncertainty

While the private credit market faces headwinds, opportunities exist for sophisticated investors who can identify and capitalize on distressed situations.

-

Distressed Debt Strategies: Distressed debt strategies can generate attractive returns for those with the expertise to navigate complex situations. These strategies involve investing in debt securities of financially troubled companies.

-

Value Investing and Special Situations: Focusing on companies with strong underlying fundamentals but facing temporary liquidity challenges can yield significant returns. These "special situations" often present opportunities for value investors.

-

Opportunistic Strategies: Identifying and capitalizing on unique opportunities in the market, such as undervalued assets or companies undergoing restructuring, can lead to substantial gains. This often necessitates a deep understanding of market dynamics and the ability to identify mispriced assets.

-

Yield Enhancement: Despite the risks, the private credit market can still offer opportunities for yield enhancement, especially for those with strong risk management capabilities.

The Role of Regulatory Scrutiny

Increased regulatory scrutiny is changing the private credit market. Understanding and adapting to these changes is vital for continued success.

-

Regulatory Landscape: The evolving regulatory landscape necessitates staying updated on all changes and ensuring complete compliance. Non-compliance can result in severe penalties.

-

Transparency and Reporting: Increased transparency and robust reporting are becoming mandatory. Investors are increasingly demanding higher levels of transparency in reporting.

Conclusion

The private credit market faces significant challenges due to rising interest rates and a potentially weakening economic outlook. However, opportunities exist for investors with a keen understanding of credit risk and a robust investment strategy. Successful navigation requires thorough due diligence, proactive risk management, and a deep understanding of the evolving regulatory landscape within the alternative lending space. Distressed debt and special situations present possibilities for savvy investors, but careful analysis and risk mitigation are non-negotiable.

Call to Action: Stay informed about the evolving dynamics of the private credit market by subscribing to Credit Weekly for insightful analysis and expert perspectives. Navigate the potential storm in the private credit market with confidence. Learn more about effective strategies for investing in the private credit market today!

Featured Posts

-

Crumbachs Resignation A Test Of The Spd Led Coalitions Strength

Apr 27, 2025

Crumbachs Resignation A Test Of The Spd Led Coalitions Strength

Apr 27, 2025 -

The Night Robert Pattinson Couldnt Sleep A Horror Movies Impact

Apr 27, 2025

The Night Robert Pattinson Couldnt Sleep A Horror Movies Impact

Apr 27, 2025 -

Join The Open Thread February 16 2025

Apr 27, 2025

Join The Open Thread February 16 2025

Apr 27, 2025 -

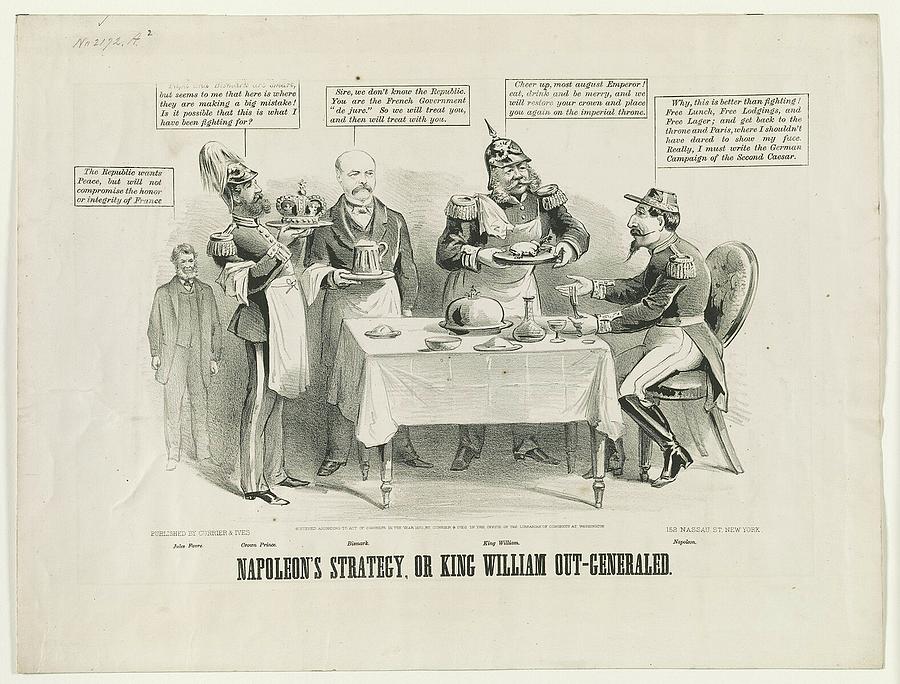

Canadian Manufacturing Central To Napoleons Strategy

Apr 27, 2025

Canadian Manufacturing Central To Napoleons Strategy

Apr 27, 2025 -

Couples Getaway Ariana Biermann In Alaska

Apr 27, 2025

Couples Getaway Ariana Biermann In Alaska

Apr 27, 2025